Poland’s sharp turn toward what its year-old government calls economic patriotism has activated the deal market.

Economic growth at more than twice the rate of the euro area, a nationalist government that wants to forge Polish giants and a handful of international bidders have combined to encourage foreign owners to sell out and create conditions ripe for deals.

Work has started on billions of dollars in mergers and acquisitions this year. The owner of Grupa Allegro Sp Zoo, Poland’s answer to EBay Inc., agreed to sell the company for $3.25 billion on Friday. Mid Europa Partners is weighing a sale of its Zabka Polska Sp Zoo supermarket chain for about 1 billion euros ($1.1 billion), people familiar with the plans had said. SABMiller Plc’s central and eastern European beer brands are also for sale as part of its tie-up with Anheuser-Busch InBev NV.

Foreign banks, such as Vienna-based Raiffeisen Bank International AG and Milan’s UniCredit SpA, are using this movement as an opportunity to sell Polish units. The firms are struggling to recover from the 2008 financial crash when cheap liquidity and high lending rates in Eastern Europe led to soured loans.

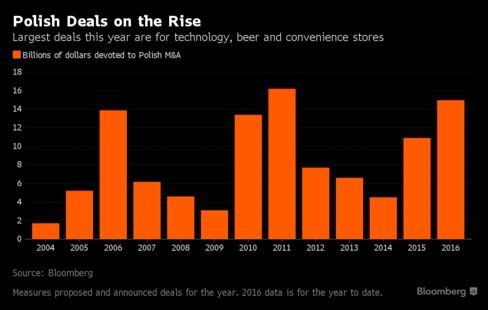

There’s been about $15 billion in deals for Polish companies announced or proposed so far this year, including SAB’s eastern European asset sale, according to data compiled by Bloomberg. That pace of spending puts 2016 on track to be the biggest year for M&A for the country in at least 12 years. The average volume over that period was about $7.8 billion.

Re-Polonization

French power companies Electricite de France SA and Engie SA are selling local assets. State-controlled utilities have placed a joint bid for EDF’s plants while Enea SA, Poland’s third-largest power company, has made an offer for Engie’s assets.

The flip side to the nationalist fervor is heightened state sensitivity to some deals. The Polish state railway has asked a Warsaw court to cancel last year’s 1.41 billion zloty ($359 million) sale of its power distribution unit to buyout firm CVC Capital Partners Ltd.

Global Attraction

Global investors are also drawn to Polish firms by the country’s cheap, highly qualified labor pool and an attractive exchange rate on the local currency. The zloty is the third worst-performing currency in developing Europe this year after Turkey’s lira and the Serbian dinar, according to data compiled by Bloomberg.

Poland’s economy is set to grow 3.3 percent next year, according to analysts surveyed by Bloomberg in August. That’s about twice the growth expected for the rest of Europe.

In June, China Everbright International Ltd. bought Polish waste processing company Novago Sp Zoo for about 123 million euros, one of the biggest Chinese investments in Poland ever, according to data compiled by Bloomberg. Finaccess Capital SA, a Mexican private equity fund, bought a controlling stake in restaurant and coffee chain operator AmRest Holdings SE last year. Finaccess offered to more than double its holding in July after the shares increased about 30 percent since the initial purchase was disclosed in August 2015.

Step Change

A surge in Polish consumers’ consumption has helped market valuations of mid-sized companies, and some of the beneficiaries are considering sales. Car parts maker Uniwheels AG, whose shares gained 63 percent in Warsaw this year, is weighing options including a sale, the company said in a regulatory filing this month.

“In Poland at the moment, we have come to one of those peaks where the size of companies and the development of certain sectors creates the environment for consolidation,” said Patrick Gahan, head of M&A for Central & Eastern Europe, Middle East, and Africa at Barclays Plc. Businesses are at a point where they “need to consider M&A as a solution to achieve the step change that moves companies to the next level.”