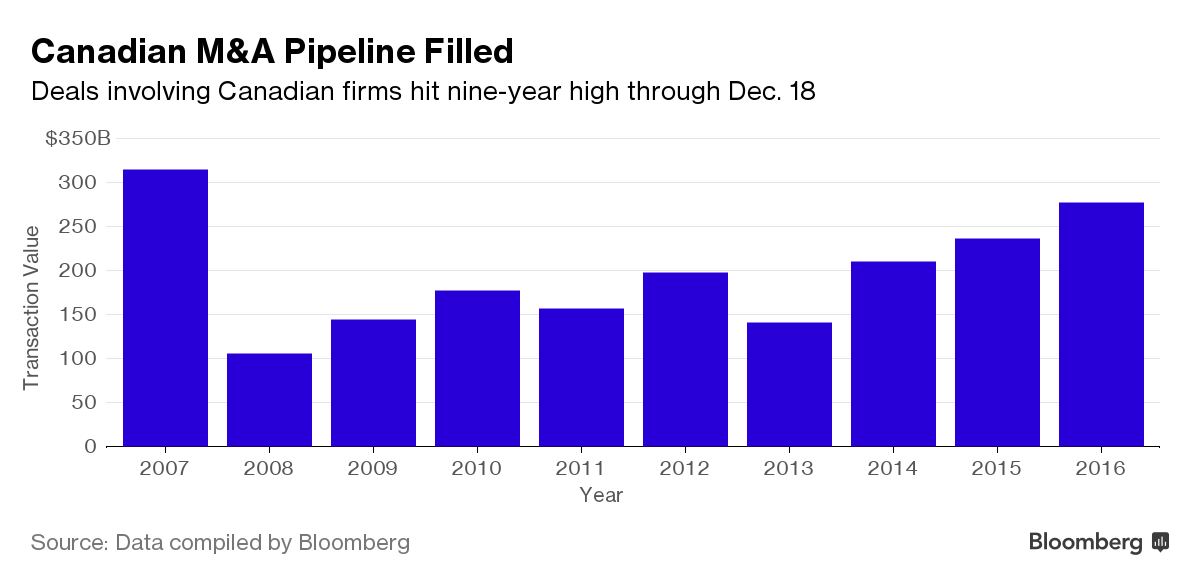

Mergers and acquisitions involving Canadian companies soared to a nine-year high in 2016, driven by a record string of pipeline deals by energy firms frustrated at home.

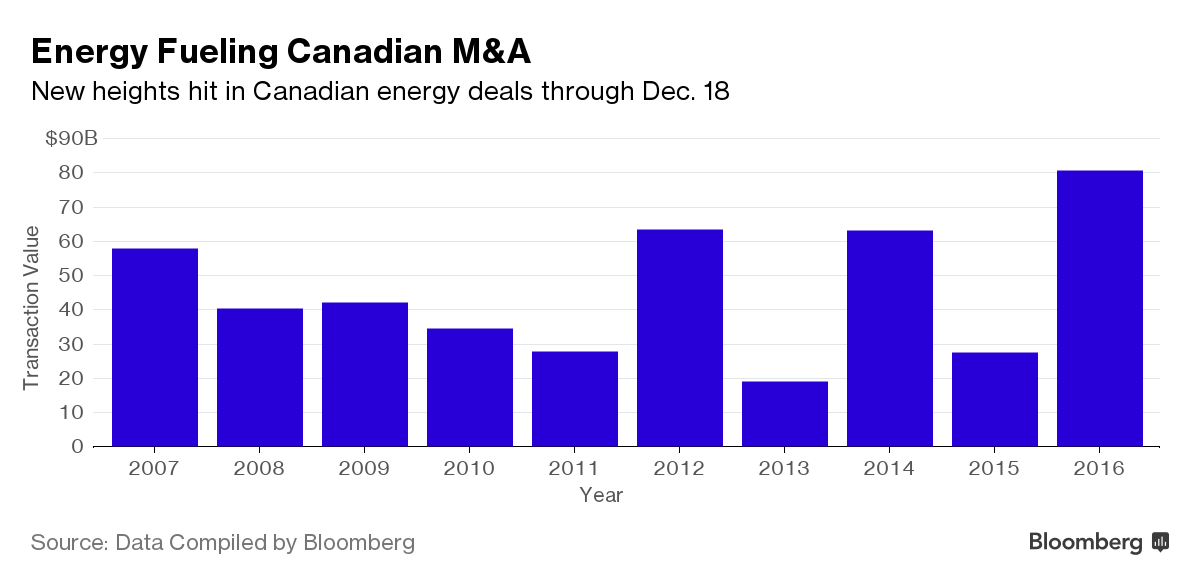

Pipeline deals — including Enbridge Inc.’s blockbuster acquisition of Spectra Energy Corp. for $42.8 billion including debt — made up more than 70 percent of the $81 billion in Canadian energy deals announced through Dec. 18, according to data compiled by Bloomberg.

That deal was also the largest of the year in the country and the priciest ever acquisition of a foreign target by a Canadian company, the data show. It followed TransCanada Corp.’s agreement to buy Columbia Pipeline Group Inc. for $12 billion.

Overall, deals involving Canadian firms reached nearly $277.6 billion through Dec. 18, the second-highest point on record, and 18 percent higher than 2015’s total. The previous peak was in 2007 when Canadian M&A hit $314.7 billion, the data show.

Canadian pipeline companies have been frustrated by delays building several planned projects, from Keystone XL to the Northern Gateway. The slowdown has prompted several to seek growth through acquisitions elsewhere, particularly in the U.S., according to Dougal Macdonald, President of Morgan Stanley Canada.

“If you look at the pipeline companies, there’s very little they can do domestically that would make sense for them,” Macdonald said in an interview. “When they’re looking for growth opportunities through M&A, they generally have to look outside of Canada.”

Utilities companies have been on a similar track, with deals in the industry hitting their highest point on record at $30 billion through Dec. 18, according to the data. Fortis Inc.’s $11.1 billion takeovers of ITC Holdings Corp. led the pack.

Like pipeline companies, utilities are also looking for large-scale opportunities outside of Canada, Macdonald said. While the heightened activity is unlikely to continue at such a pace in 2017, a sustained rally in oil prices could prompt an uptick in mergers and acquisitions involving Canadian oil and gas producers next year, he said.

“Some of the stronger names may want to take advantage of the still relatively low price of oil to see if they can get something done before oil rises further,” Macdonald said.

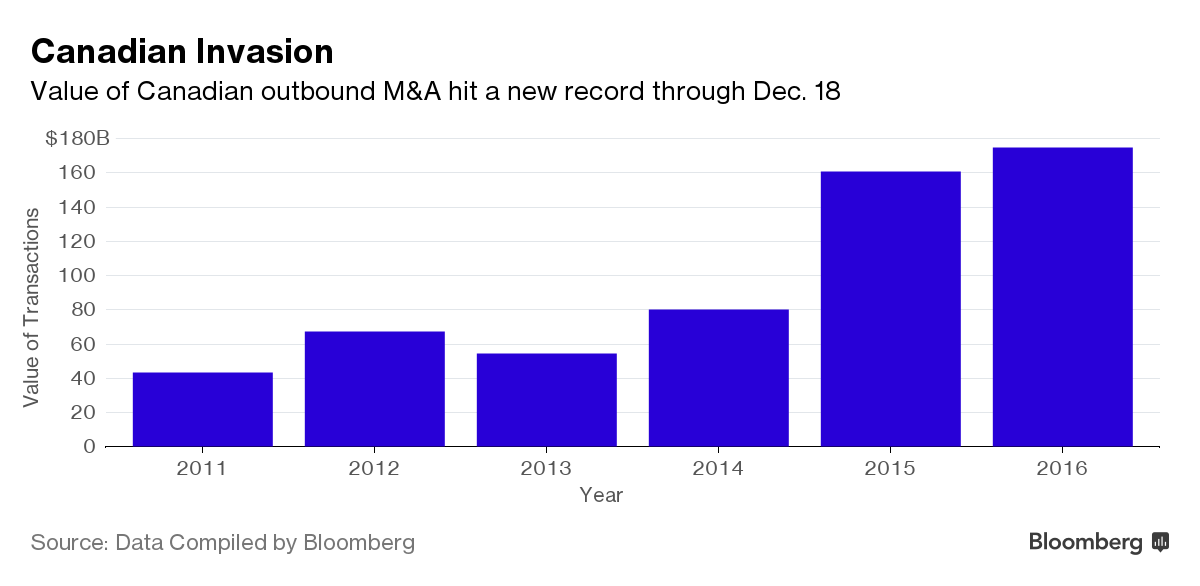

A record $174.5 billion worth of Canadian deals involved targets based outside of the country year to date in 2016, up 9 percent year over year from the previous peak in 2015 of $160.8 billion. Those outbound deals included Fairfax Financial Holdings Ltd.’s $4.9 billion acquisition of Allied World Assurance Co., announced Sunday, and Onex Corp.’s $1.69 billion deal for of Parkdean Resorts Friday.

Canadian outbound activity has typically been dominated by Canadian pension funds and money managers that have stockpiles of cash and few opportunities in Canada to deploy it, said Peter Buzzi, co-head of M&A at the Royal Bank of Canada. In 2016, though, Canadian corporations — from Canadian Imperial Bank of Commerce to Alimentation Couche-Tard Inc. — joined the trend by making acquisitions in the U.S. and elsewhere as they sought growth.

He sees that trend continuing in 2017.

“If you go back 10 years ago, the talk was all about the hollowing out of Canada. Nobody really talks about that anymore,” Buzzi said.

The nature of outbound transactions tends to favor the big global banks, which can find their way on either side of the deal.

Morgan Stanley was the top financial adviser for Canadian M&A year to date, followed by JPMorgan Chase & Co., Goldman Sachs Group Inc., Barclays Plc, and Bank of America, the data show. Royal Bank of Canada was the top Canadian bank in sixth place. The totals and rankings may change as new deals are announced.

Coming off the back of a rush of large-scale deals in the past two years, the overall value of outbound transactions will likely fall in 2017, David Rawlings, Canada senior country officer for JPMorgan said. The average value of outbound transactions in Canada in the five years prior to 2015 was roughly $67 billion compared to an average of about $168 billion in the past two years, the data show.

“The types of companies that could do big deals are going to be busy digesting big deals they’ve just done,” Rawlings said in an interview. “If you look at top 10 deals in 2017 on a size basis and you compare that to the top 10 deals in 2016, my guess is the average steps down and it goes to that point of capacity.”

Bruce Rothney, Chief Executive Officer of Barclays in Canada, said there is a chance that mining M&A could pick up again in 2017 after years of relative inaction. The rise in commodity prices has created renewed confidence in the boardrooms, he said.

“There will be more deals where cost structure and height quality resources can be combined for strategic heft and global competitiveness,” he said. “As conditions improve, you start thinking about how to create a bit more shareholder value”.

Recent Articles on M&A

Source: Bloomberg.com