It may be time for a baby boom in U.S. oil.

Rising crude prices and a deregulatory push in Washington may spur as many as 40 companies to hold initial public offerings over the next two years, potentially tripling 2016’s activity, according to Maynard Holt, chief executive officer at Houston-based investment bank Tudor Pickering Holt & Co.

After a year in which explorers in the Permian shale basin straddling Texas and New Mexico dominated the business, interest in new oil industry offerings is likely to spread wider. It could include pipeline operators and regions like the Bakken in North Dakota and Wyoming’s Powder River basin, Holt said in a telephone interview Wednesday. Mergers and acquisitions should pick up as well.

“The number of companies expressing interest in going into this window is really high, and the number of investors saying we’d like to see something different is really high,” the CEO said.

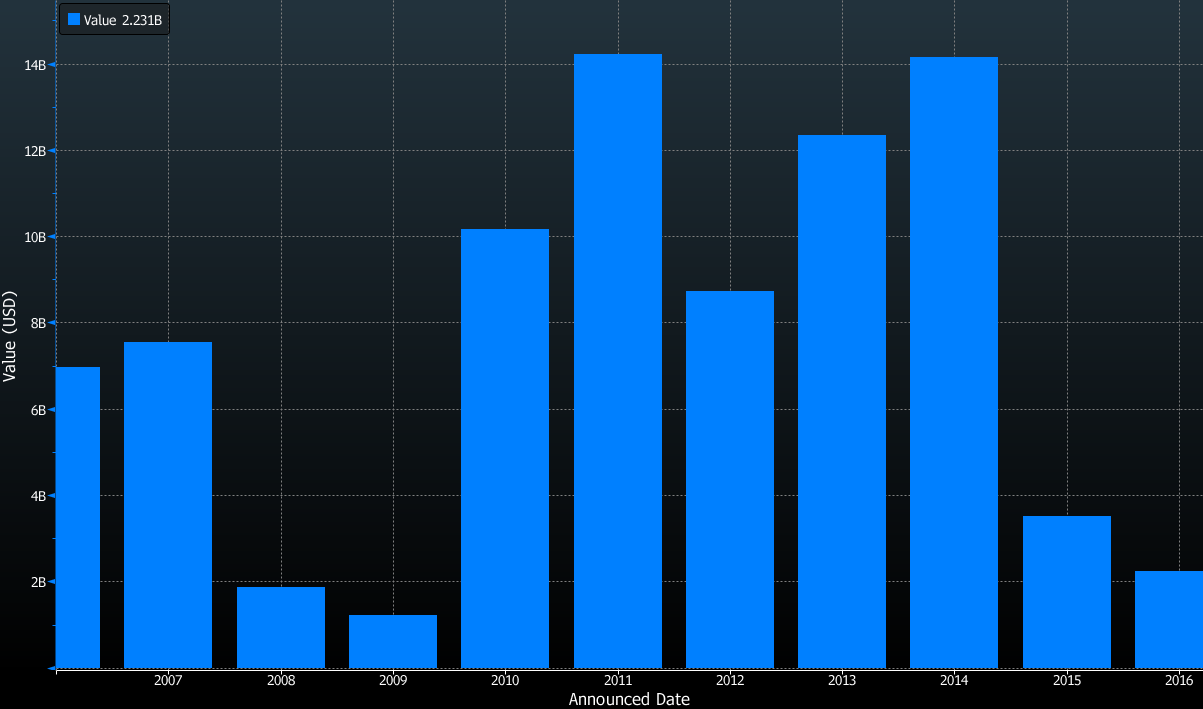

After two years of crashing crude prices, the number of North American IPOs for oil and natural gas companies fell to 13 this year, worth a collective $2.23 billion, according to data compiled by Bloomberg. That was down from 44 announced offerings, worth $14.15 billion, in 2014, when oil topped $100 a barrel.

The environment has become more welcoming after the Organization of Petroleum Exporting Countries agreed last month to cut output, paving the way for higher prices. President-elect Donald Trump’s promise to ease regulations on the sector is helping as well, Holt said. Investors are especially hungry for new opportunities among “midsize” companies — those valued between $2 billion and $4 billion — with relatively little debt and exposure beyond the Permian, he said.

Oilfield service companies are still struggling financially, but that could lead to more deals as well, according to Holt.

“It feels like we’ve entered a good window where OPEC is now being cooperative, the regulatory talk feels positive and the financing markets feel open,” he said. “You could see a lot of capital raising in that window.”

Tudor Pickering ranked 13th among advisers this year on oil IPOs, assisting on four offerings, according to Bloomberg data. The bank, which focuses on energy deals, was bought in November by New York-based Perella Weinberg Partners LP.

Recent Articles on M&A

Source: Bloomberg.com