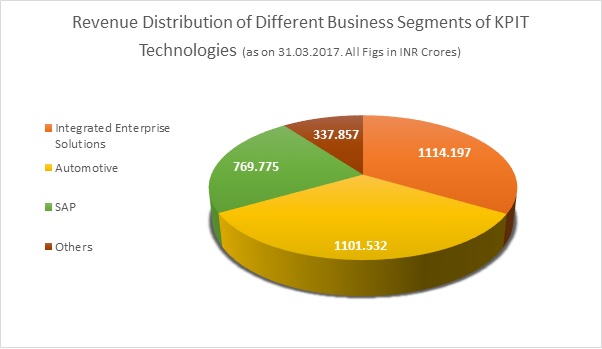

KPIT Technologies Ltd (KPIT), is a global technology company specialised in providing IT consulting and product engineering solutions and services to automotive, manufacturing, energy and utilities and life sciences companies. They currently partner with over 200 global corporations and has filed more than 60 patents in various domains such as Automotive, Very Large-Scale Integration (VLSI), High Performance Computing, Manufacturing, Energy, Model Based Design (MBD), among others. The equity shares of KPIT are listed on NSE and BSE. The market cap of KPIT on BSE is around Rs 4,000 crore.

KPIT Engineering Ltd (KEL) is a recently incorporated company (incorporated on 8th January 2018) and does not have any business operation as of now. The equity shares of KEL are not listed on any stock exchange.

Transaction

Background of transaction

- KPIT has two business divisions which are:

- IT

- Engineering

- Under IT Division, KPIT provides the enterprise resource planning business of Oracle and SAP, digital business (as comprised under digital technology strategic business unit) along with infrastructure management services and extended product lifecycle management business.

- Under Engineering Division, KPIT offers solutions of electronic or mechanical engineering and usage of this data for diagnostics, maintenance and tracking of assets and related connectivity solutions including data and analytics beyond embedded or mechanical engineering and their connectivity and integration with back-end IT Systems and platforms.

Structure of the Scheme of Arrangement

| What business will remain? | What business will be demerged? |

| Information technology business of the KPIT Technologies (including the business of the Birlasoft (India) Ltd acquired pursuant to amalgamation as per the Scheme) together with all its assets and liabilities shall form part of its Remaining Business; | The engineering business of the Company includes solutions of electronic or mechanical engineering and usage of this data for diagnostics, maintenance and tracking of assets and related connectivity solutions including data and analytics beyond embedded or mechanical engineering and their connectivity and integration with back-end IT systems and platforms. (“Engineering Business” or “Demerged Division”). |

| Post amalgamation the name of KPIT Technologies will change to Birlasoft (India) Ltd, and this company will focus on Enterprise Digital Business IT Services. | Post Demerger, the name of the company KEL will be changed to KPIT Technologies. The new KPIT (Earlier KEL) will focus on Automotive Engineering and Mobility Solutions |

| Post this scheme, the new ‘Birlasoft’ will be a USD 500 million Digital Business IT Services company creating a new leader in the mid-tier IT services space which will also be called Birlasoft. | Post this scheme, the new ‘KPIT Technologies’ will be a USD 200+ million focused Engineering Services company to create a global leader in Automotive Engineering and Mobility Solutions. |

Valuation

As per the Scheme of Arrangement, the Appointed Date is same as Effective Date.

Amalgamation

- Market Price Method: For arriving at the valuation of the share price of KPIT, the valuer has complied with SEBI Circular No. CFD/DIL3/CIR/2017/21 dated March 10, 2017, Circular No. CFD/DIL3/CIR/2017/26 dated March 23, 2017 and SEBI (Issue of Capital and Disclosure Requirements) Regulations, which prescribes method of determining the prices of shares of KPIT. Hence the fair value per equity share of KPIT is Rs 202.

- Comparable Companies’ Multiple (CCM): The valuer has identified listed companies that are comparable to BIL in terms of business profile and growth and have considered their EV/EBITDA multiple to compute the enterprise value of BIL. They have considered the sustainable EBITDA of BIL (adjusted for onetime expenses, exceptional items and excluding EBITDA from a particular client account that is not now being serviced by BIL as provided to them by the management) to compute the enterprise value of BIL under CCM method. Hence the fair value per equity share of BIL is Rs 492.

- Therefore, the exchange ratio is 2.44 (Rs 492/Rs 202) i.e 22 Equity shares of Rs 2 of KPIT for every 9 Equity shares of Rs 10 held in BIL.

| BIL | Audited for the half year ended 30th September 2017 (Rs in crore) |

| Networth | 373.46 |

| Equity shares FV Rs 10 | 3.14 |

| Book Value per share | 119.13 |

| Fair Value per equity share of BIL as per Valuation Report | 492.00 |

| BIL’s fair value per equity share is valued at 4 times the book value. | 4.13 |

Demerger

As per the valuation report, once the Scheme is implemented, all the shareholders of KPIT (including the shareholders of BIL being allotted shares pursuant to the merger with KPIT) would also become the shareholders of KEL, and their shareholding in KEL would mirror their shareholding in KPIT. Hence it is being understood the reason for first taking up amalgamation and then demerger. The effect of the demerger is that each shareholder of KPIT (post-merger of BIL) becomes the owner of shares in two companies instead of one.

- The consideration fixed for demerger is 1 Equity share of Rs 10 of KEL for every 1 Equity Share of Rs 2 held in KPIT.

- The Equity shares of KEL are proposed to be listed post demerger.

Shareholding Pattern

Step I – Amalgamation

Table 1: Share Holding Pattern of KPIT Technologies Pre-Amalgamation & Combined-KPIT Post Amalgamation (as on 31.03.2017)

| Particulars | Pre-amalgamation | Post-amalgamation | ||

| Nos of Shares | % | Nos of Shares | % | |

| Promoters | 3,73,91,122 | 19% | 12,95,09,452 | 54% |

| Public | 15,16,22,640 | 77% | 10,02,72,967 | 42% |

| Others | 84,84,980 | 4% | 84,84,980 | 4% |

| Total | 19,74,98,742 | 100% | 23,82,67,399 | 100% |

Note: The shareholding pattern post amalgamation may vary based on the number of shares tendered by public in the open offer to be launched by Birlasoft’s promoters and KPIT’s promoters. The above numbers are calculated based on full acceptance under the open offer, and exclude shares which may be issued in lieu of stock options held in Birlasoft. That means the Promoters Shareholding post amalgamation includes 5,13,49,673 Equity Shares, fully tendered by public shareholders in open offer.

Step II – Demerger

Table 2: Shareholding Pattern Post Demerger for KPIT Technologies

| Particulars | Nos of Shares | % |

| Promoters | 12,95,09,452 | 54% |

| Public | 10,02,72,967 | 42% |

| Others | 84,84,980 | 4% |

| Total | 23,82,67,399 | 100% |

Financial Performance

Table 3: Financials of KPIT Standalone and combined & Birlasoft as on 31.03.2017 (All Figs in INR Crores)

| Particulars | KPIT (Consolidated Financials) | Birlasoft (Standalone Financials) | Combined-KPIT |

| Networth | 1,584 | 295 | 1,879 |

| Income from Operations | 3,323 | 489 | 3,812 |

| EBT | 299 | 116 | 415 |

| PAT | 239 | 76 | 315 |

| PAT Margin | 7% | 16% | 8% |

| Weighted Average number of Equity shares | 19 | 3 | 24 |

| EPS | 12 | 24 | 13 |

| Book Value Per Share based on Weighted Average number of Equity shares | 83 | 94 | 79 |

Demerger

Following are the list of assets that pertains to the engineering business, will be transferred to the resulting company- new KPIT (KEL):

| Sr no: | Name of the company | Country |

| Direct Subsidiaries | Impact Automotive Solutions Limited | India |

| KPIT (Shanghai) Software Technology Co. Limited | China | |

| KPIT Technologies Netherlands B.V | Netherlands | |

| New US Co. | United States of America | |

| KPIT Technologies (UK) Limited | United Kingdom | |

| MicroFuzzy KPIT Tecnologia Ltda | Brazil | |

| New Japan Co. | Japan | |

| Step-Down Subsidiaries | KPIT Technologies Gmbh | Germany |

| MicroFuzzyIndustrie-Elektronic GmbH | Germany | |

| New US LLC | United States of America |

Branches

| Sr no: | Name of the Company | Country | Head Office |

| 1 | New Korea Branch | Korea | New Japan Co. |

| 2 | Sweden Branch | Sweden | KPIT Technologies (UK) Limited |

| 3 | Italy Branch | Italy | KPITTechnologies (UK) Limited |

- A list of 7 immovable properties which related to the engineering business.

- A List of 3 Trademarks and

- A list 53 Patents

(Please note: The consolidated financials of KPIT shows statement of segment revenue geography wise and not business segment wise, hence Segment Results, assets and liabilities related to engineering business cannot be shown)

Accounting Treatment

Amalgamation

As per the scheme of arrangement, the amalgamation of Birlasoft with KPIT will be considered as a joint venture and KPIT shall account for the same in its books as per the applicable accounting principles prescribed under relevant Indian Accounting Standards (“lnd AS”). It would inter alia include the following:

- Assets, liabilities and reserves and surplus of the Transferor Company transferred to and vested in the Transferee Company shall be recorded at their book values and in accordance with requirements of applicable Ind AS.

- KPIT shall credit its share capital account with the face value of ‘New Equity Shares – Merger’ issued pursuant to the consideration to the shareholders of the Birlasoft.

- Subsequent to the transfer, the shares of KPIT held by Birlasoft shall be cancelled (as per Part II and Part IV of the Scheme) and appropriately adjusted with share capital/share premium or capital reserves if any, then to general reserves account and then to the retained earnings of the Transferee Company (pursuant to provisions of sections 230 to 232 read with section 52 and section 66 and other applicable provisions, if any, of the Companies Act, 2013). Such cancellation shall be effected as an integral part of the Scheme. The order of NCLT sanctioning the Scheme shall be deemed to be an order under Section 66 of the Act confirming the reduction of share capital and no further act, deed or thing as required under the provisions of the Act would be required.

Demerger

| Sr no: | In the books of the Demerged Company | In the books of the Resulting Company |

| 1. | The carrying values of the assets and liabilities of the Demerged Undertaking transferred to the Resulting Company shall be adjusted with capital reserves, if any, then to general reserve account and then to retained earnings of the Demerged Company. (pursuant to provisions of sections 230 to 232 read with section 52 and section 66 and other applicable provisions, if any, of the Act); | Assets and Liabilities of the Demerged Undertaking transferred to and vested in the Resulting Company shall be recorded at their carrying value as appearing in the books of the Demerged Company at the time of the demerger effective date and in accordance with requirements of relevant IndAS; |

| 2. | The carrying value of the investments in equity shares of the Resulting Company to the extent held by the Demerged Company, shall stand cancelled.

|

The Resulting Company shall credit its share capital account in its books of account with the New Equity Shares – Demerger issued to the shareholders of the Demerged Company; |

Subsequent to the demerger, the pre-demerger shares of Resulting Company held by the Demerged Company shall be cancelled (as per Part V of the Scheme) and appropriately adjusted with share capital/share premium or capital reserves of the Resulting Company (pursuant to provisions of sections 230 to 232 read with section 52 and section 66 and other applicable provisions, if any, of the Companies Act, 2013). Such cancellation shall be effected as an integral part of the Scheme. The order of NCLT sanctioning the Scheme shall be deemed to be an order under Section 66 of the Act confirming the reduction of share capital and no further act, deed or thing as required under the provisions of the Act would be required;

Rationale for Arrangement

- Post amalgamation the Birlasoft will transfer to KPIT all the brand/ trademark/ patent and any other intellectual property right acquired/ created by it till the Appointed Date.

- As per the scheme, Birlasoft has 10 Trademarks, which will be enjoyed by the amalgamated company.

- The combined KPIT will deal with the Business IT and consulting with strong expertise into enterprise resource planning, digital solutions and consulting with wider industry coverage.

- The New KPIT Technology (KEL) will have deep domain expertise in auto engineering and mobility solutions

This will enable both companies to have sharp focus, retain and attract best talent, bring better value to customers and make necessary investments in building technologies and solutions. This will accelerate profitable growth and industry recognition in respective areas.

Open Offer

Open Offer means when offering an exit opportunity to the public/minority shareholders of a company in the event of any substantial change in shareholding or change in control of the company. It is only fair and equitable that the public stakeholders who have invested in the company, relying on the management or the promoters of the company are given an opportunity to withdraw their investments when there is a change in the management or promoter shareholding.

In this case, Birlasoft and Birlasoft Promoters are desirous of becoming promoters of the Combined-KPIT along with the Company’s existing promoters subject to an open offer in accordance with the requirements prescribed under the Securities Exchange Board of India (Substantial Acquisition of Shares and Takeover Regulations, 2011). Hence a mandatory Open Offer is triggered.

Details of the Open Offer

| Offer Shares: Equity Shares of KPIT | 5,13,49,673 |

| Equity Share Capital of KPIT as on 29th January 2018 | 19,74,98,742 |

| Offer size is 26% of the total equity share capital of KPIT as per Detailed Public Statement | 26% |

| Offer price @ Rs 182 | 9,34,56,40,486 |

Inter-se promoter

What are the inter-se obligations of the Acquirer and Persons Acting in Concert?

After the receipt of the CCI Approval and subject to the provisions of the SEBI (SAST) Regulations and the terms of the Inter-se Agreement:

Significant Terms with respect to Amalgamation

Pre-Amalgamation and Post Open Offer

- Birlasoft shall have the right to nominate 1 (one) director and the Birlasoft Promoters shall collectively have the right to nominate 1 (one) director, for appointment on the KPIT’s board of directors.

- Birlasoft and the Birlasoft Promoters shall have the affirmative voting rights with respect to certain matters relating to the Target Company including acquisition of any new line of business, any sale or

- divestment of the KPIT’s information technology business, capital expenditure above a mutually agreed limit, transactions with customers above a mutually agreed contract value and initiation, discontinuation and settlement of litigations above a mutually agreed claim threshold.

- Further, under the Inter-se Agreement, the KPIT Promoter Group, Birlasoft and the Birlasoft Promoters have agreed to co-operate with each other with respect to various matters relating to the management of the Target Company such as re-appointment of independent directors, appointment of non-independent directors, approval of the Composite Scheme, etc.

Post-Amalgamation and Post Open Offer

- After the Effective Date, KPIT Promoter Group shall collectively have the right to nominate 1 (one) director for appointment on the board of directors of Combined KPIT (as defined below) and affirmative voting rights with respect to certain matters relating to Combined KPIT until the KPIT Promoter Group’s shareholding falls below a specified threshold.

Significant Terms with respect to Demerger

KEL and KPIT shall enter into a trademark license agreement which shall allow KPIT to use the “KPIT” brand name in a manner mutually agreed between the parties for a specified period post the Effective Date.

KPIT Option Agreement

Under the KPIT Option Agreement, the KPIT Promoter Group has a put option against the Birlasoft Promoters pursuant to which the KPIT Promoter Group is entitled to sell up to 15% of Combined KPIT’s share capital as on the date of allotment of Combined KPIT’s shares to the Birlasoft Promoters in accordance with the Composite Scheme and the Implementation Agreement.

The KPIT Promoter Group and Birlasoft Promoters have entered into an investment agreement on January 29, 2018 (“KEL Investment Agreement”), which records the terms and conditions in relation to:

- The sale by the Birlasoft Promoters to the KPIT Promoter Group of all shares held by the Birlasoft Promoters in KEL as on the date of allotment of shares of KEL to the shareholders of Combined KPIT (“Demerger Allotment Date”) except for such number of KEL’s shares held by the Birlasoft Promoters which constitute 3% of KEL’s share capital as on the Demerger Allotment Date (“Residual KEL Shares”),

- a simultaneous put-call arrangement between the KPIT Promoter Group and the Birlasoft Promoters in relation to the Residual KEL Shares, on and from the date of completion of the sale and purchase of the second tranche of 5% of Combined KPIT’s share capital as on the Merger Allotment Date (as contemplated in paragraph 2.3 above); and

- The inter-se rights and obligations of the KPIT Promoter Group and the Birlasoft Promoters as shareholders of KEL after the Proposed Demerger.

After the Proposed Demerger, KEL will obtain listing and trading approvals in relation to its shares. The KPIT Promoter Group will make a mandatory open offer by the KPIT Promoter Group to the public shareholders of KEL in compliance with the requirements under the SEBI (SAST) Regulations pursuant to the KEL Investment Agreement

Conclusion

In fact, it is a simple transaction of KPIT selling its IT business to Birlasoft and in the process Birlasoft getting listed. It could have been achieved a straight demerger of IT business into Birlasoft. And now somehow it seems KPIT’s promoters stake is pledged and KPIT promoters wants to swap its holding into IT business into Engineering Business in such a complex structure with additional liabilities under indirect tax like stamp duty and three times the compliance and approval cost because of two open offers.