MORGANITE CRUCIBLE (INDIA) LIMITED (MCIL) is engaged in business of manufacturing and selling of silicon carbide and clay graphite and its accessories. Silicon carbide and clay graphite crucibles are used primarily as consumables in the manufacture of non-ferroalloys industries. Crucible is manufactured at Aurangabad in Maharashtra. The Aurangabad plant is certified under ISO 9001:2008. MCIL was a joint venture between Cotton Greaves and Morgan group. However, in 2006 it was acquired by Morgan group. In the same year Morganite had made investment in Diamond Crucible company Limited (DCCL) of Rs 4.96 crore for 51% and, in July 2017 had acquired the remaining stake for Rs 16 crore.

DIAMOND CRUCIBLE COMPANY LIMITED (DCCL) is primarily engaged in manufacture and sale of crucibles and allied refractory products for industrial use having its manufacturing facility at Mehsana in Gujarat. DCCL is currently WoS of the MCIL. DCCL was incorporated on June 23, 1981. The company’s sales are mostly generated from dealers and from few direct customers and primarily services the automobiles industry in India.

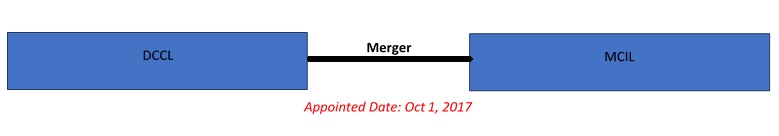

TRANSACTION:

Merger of DCCL into MCIL with appointed date October 1, 2017 since it is WoS merger there is no consideration.

RATIONALE:

- Both the companies are engaged in the same line of business and share common corporate values and culture.

- Simplify the corporate structure and eliminate duplicate corporate procedures.

- Achieve economy of scales, reduction in overheads

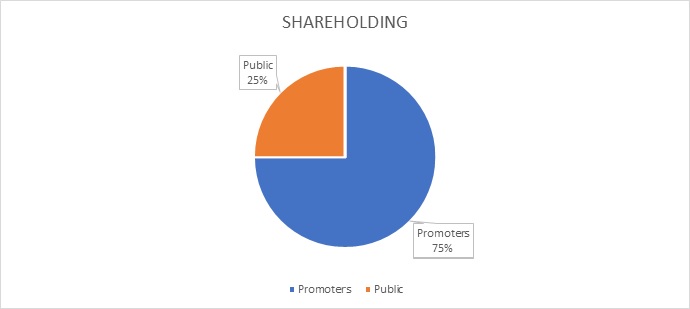

SHAREHOLDING:

Since it is WoS merger there is no consideration, therefore, there is no change in shareholding of the company post-merger.

BEFORE THE MERGER

DCCL was subsidiary of the company, however, MCIL acquired remaining stake 49% from Terrassen Holdings Limited in July 2017 for Rs 16.75 crore. The details of investment by MCIL in DCCL is as follows:

Table 1: Investment by MCIL

| Investment | FY17 | FY06 |

| Amount | 16,75,00,000 | 4,96,98,740 |

| No. of Shares | 17,150 | 17,850 |

| Price Per Share (Rs) | 9,767 | 2,784 |

| Stake | 49% | 51% |

Please note that MCIL with Terrassen Holding has done investment in 2006. Post-acquisition, DCCL entered into an agreement with Morganite Crucible Ltd UK for providing management services in the areas of planning, sales, accounts and HR policies and various other commercial aspects. And also the agreement for use of trademark logo and GBU charges and technical know-how support from the promoters. In 2017 MCIL generate operating cash flow of Rs 21 crore. Therefore, out of its cash surplus it has acquired remaining stake for Rs 16 crore. Terrassen will be liable to taxation as acquisition of 49% stake was for Rs 4.77 crore and sale value is Rs 16.75 crore.

FINANCIALS:

Table 2: Financials of Diamond Crucible for FY06 and FY17.

| Particulars | DCCL | |

| FY06 | FY17 | |

| Net worth | 2,01,40,516 | 17,31,67,130 |

| Turnover | 7,64,18,091 | 26,50,00,773 |

| Net Profit | 37,56,091 | 3,35,83,615 |

| No. of Share | 35,000 | 35,000 |

| EPS | 107 | 960 |

Since the acquisition by Morgan Group, the company has been able to grow its revenue approx. Four times and whereas net profit 10 times and became debt free company by repaying debt of Rs 2.50 crore. Based on FY17 financials, DCCL was valued at approx. Rs 34 crore ignoring controlling premium. The Details of Valuation is as follows:

Table 3: Valuation of DCCL Current and Past.

| Particulars | 2006 | 2017 |

| Valuation including/excluding Control Premium * | 9,75,00,000 | 34,19,00,000 |

| Sale Multiple | 1.28 | 1.29 |

| PE Multiple | 25.96 | 10.18 |

*Please Note FY06 valuation is including control premium whereas for FY17 it is excluding Control Premium

Table 4: Merger Effect on MCIL Networth

| Particulars | Amount |

| Investment in DCCL | 21,71,98,740 |

| Net worth of DCCL as on 31.03.2017 | 17,31,67,130 |

| Effect on networth of MCIL | -4,40,31,610 |

* Net worth is subject to financial as on Appointed Date October 1, 2017.

Table 5: Financials of MCIL Post-Merger

| Particulars | MCIL | on merger of DCCL | Post merger |

| Net Worth as on 31.03.2017 | 82,85,33,921 | -4,40,31,610 | 78,45,02,311 |

| Turnover | 85,84,34,997 | * 23,21,36,046 | 1,09,05,71,043 |

| Net Profit | 13,16,55,939 | 3,35,83,615 | 16,10,74,599 |

| No. of Shares | 28,00,000 | – | 28,00,000 |

| EPS | 47.02 | – | 59.01 |

| Book Value Per share | 295.90 | – | 280.18 |

Please note the figures on merger are after adjusting for related party transaction approx. Net Sale of Rs. 3.28 crore.

MARKET PRICE:

The upward movement in market price post announcement of acquisition and subsequent merger is almost 50%.

CONCLUSION:

The acquisition of remaining stake from Terrassen is done from cash surplus which the company is able to generate on year on year and consolidation by merger will simplify the structure for the holding company. Exit given to the promoters’ holding company is at the same sales multiple and PE multiple is around 10 which seems fair for the minority shareholders. However, the management has an option to merge DCCL with MCIL without acquisition of stake from Terrassen and sale shares of listed company to remain compliant of listing regulations of having minimum 25% public shareholding and have lower or nil capital gain tax. The consolidation has resulted into improved EPS which will benefit the company and it generates free cash flow year after year and management wants to look for non-traditional businesses for expansion.