The Board of Directors of Century Textiles and Industries Limited (Century) had approved a Scheme of Arrangement between the Century, UltraTech Cement Limited (UltraTech), and their shareholders and creditors for the demerger of its cement division into UltraTech.

Ultratech, a part of Aditya Birla Group, is the largest manufacturer of grey cement, Ready Mix Concrete (RMC) and white cement in India. It is also one of the leading cement producers globally. UltraTech Cement has 19 integrated plants, one clinker plant, 25 grinding units and seven bulk terminals. Its operations span across India, UAE, Bahrain, Bangladesh and Sri Lanka. UltraTech Cement is also India’s largest exporter of cement reaching out to meet the demand in countries around the Indian Ocean and the Middle East.

Century incorporated in 1897 as a Public Limited Company the company operated only one cotton textile mill at Mumbai till 1951. Thereafter, it has expanded and diversified its activities. Currently, Century has four division i.e. cement, textiles, pulp and paper and real estate.

The Transaction

Ultratech Cement has been largest cement manufacturer and has been acquiring cement units like Gujarat units of Jaypee Cement, units of Jaiprakash Associates and JP cement in the past to maintain its leader position.

This transaction is of Century demerging its cement business undertaking to UltraTech Cement.

Swap Ratio

The consideration for the demerger will be by way of issuance of the equity shares to the shareholders of Century as on the record date by the issuance of one equity share of UltraTech each for eight equity shares held in Century.

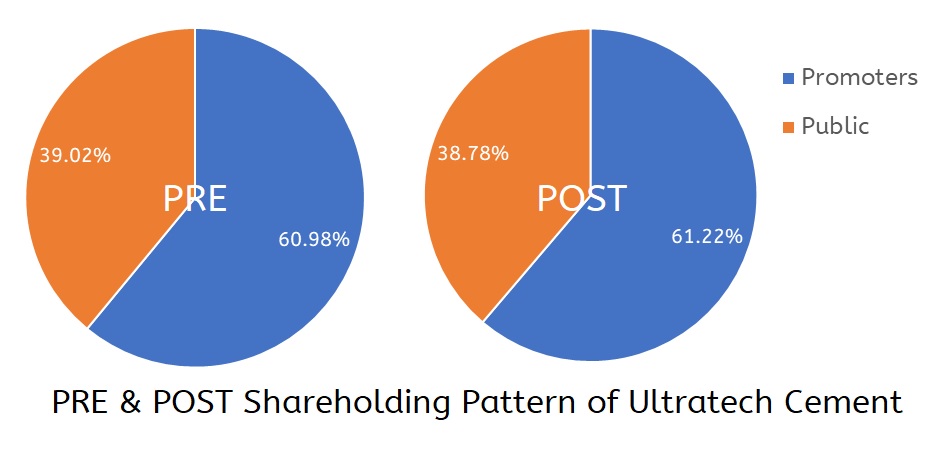

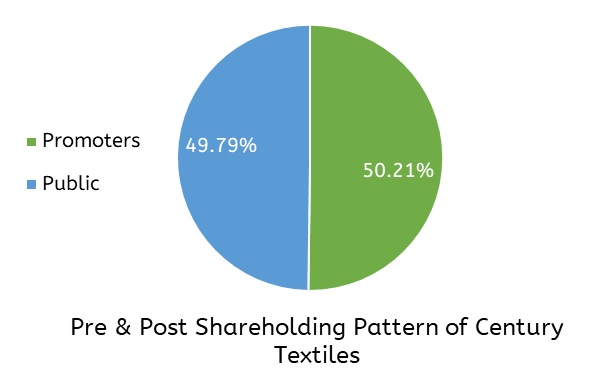

Shareholding Ratio

The transaction will result in marginal increase in promoter’s stake in UltraTech. However, post-transaction, effectively promoters stake in “Cement Business” of Century will increase from 50% to 61%.

Rationale

UltraTech Cement Expanding its footprint

Starting with one MTPA capacity in the mid 1980s, UltraTech has grown itself to the largest cement producer in India. Worldwide, it ranks fourth (excluding China). Century has a 13.4 MTPA Cement Capacity & clinker capacity of 8.5 MTPA. Post-transaction, UltraTech capacity will cross one lakh MTPA making it to around 1.06 lakh MTPA. As a result of this, the UltraTech will not only strengthen its numero-uno position in India but will become the third largest cement player globally (excluding China).

Strategic Location

Currently, UltraTech has a stronghold in India except for the East & North regions whereas Century has a stronghold in East region. The transaction will help UltraTech to strengthen its hold in the central region and a chance to become number one player in the East region in terms of sales.

Additional Cost Saving

Logistic cost is one of the most important factors in cement industry. Century’s plants are in the same cluster as that of the UltraTech’s which can save significant logistic cost. Further, the brand UltraTech has a premium on the pricing of Rs 10-15 per bag. With the operation efficiencies improvement with UltraTech experience, the deal can be immediately EPS accretive for UltraTech.

Table 1: Cost Savings for Ultratech

| Zone | Ultratech Capacity | Ultratech Share | Addition | Total |

| North | 17.6 | 17% | 0 | 17.6 |

| East | 11.7 | 13% | 4.4 | 16.1 |

| Central | 21.1 | 35% | 4.2 | 25.3 |

| West | 21.7 | 35% | 4.8 | 26.5 |

| South | 20.5 | 13% | 0 | 20.5 |

| All India | 92.6 | 20% | 13.4 | 106.00 |

| Figures are in MTPA. | ||||

Focus

With an exit of cement business, Century will remain with three business verticals. One is paper & pulp, real estate and other i.e. textile & chemical. Last year, with an incorporation of Birla Estate Private Limited, Century entered real estate business. It has further signed an MoU to develop one million sq.ft residential project in Gurgaon. Further, the company is planning to monetise its land parcels at Worli, Kalyan and Pune.

Its pulp & paper business has performed well in past couple of years. The company is planning to modernise its existing capacity and expand its tissue capacity.

Some of the cement plants of Century are old and require significant capex to modernise and enhance product quality. The company has acquired additional mines during an auction for which it will require a land costing around Rs 150 crore. With demerger, Century can use such saved cash for its other business verticals to expand and UltraTech can use its existing plants capacity /surplus land for expansion as Century’s plant are located less than 100kms from the UltraTech’s existing plant.

Consolidation: For the group as a whole, the de-merger will result in consolidation of its cement business and effectively increasing its stake in the group’s flagship business.

Financials

Table 2: Financials Consolidated of Century Textiles (All Figs. in INR Crores)

| Particulars | Sales | EBIT | EBIT % | Segment Net-Assets | |||||

| 2018 | 2017 | 2018 | 2017 | 2018 | 2017 | 2018 | 2017 | ||

| Cement | 4,306 | 4,323 | 408 | 165 | 9.48% | 3.82% | 2,841 | 2,892 | |

| Textile | 1,396 | 1,540 | 151 | 176 | 10.82% | 11.43% | 80 | 835 | |

| Paper | 2,228 | 2,171 | 372 | 306 | 16.70% | 14.09% | 2,600 | 2,802 | |

| Real Estate | 135 | 97 | 132 | 18 | 97.78% | 18.56% | 1,335 | 1,324 | |

| 8,065 | 8,131 | 1,063 | 665 | 6,696 | 7,853 | ||||

Table 3: Other Financials for Century & Ultratech

| Partculars | Century | UltraTech |

| Turnover | 4,306 | 32,304 |

| EBITDA | 492 | 6,478 |

| EBITDA % | 11.43% | 20.05% |

| Capacity | 13.4 | 96.5 |

| Capacity Utilisation | 75% | 71% |

| EBITDA Per ton | 367 | 671 |

| MCAP | – | 1,01,000 |

| Assigned Equity Value | 5,138 | – |

| Debt | 3,000 | 18,626 |

| MCAP/Per MTon | 3,834 | 10,466 |

| EV/Per ton | 6,073 | 12,396 |

| Share prices as on 25.05.2018. Including clinker capacity. |

||

Strategy going ahead

UltraTech

Started with one MTPA in 1983-85, the company has paved its way to cross one lakh MTPA with the transaction. The group’s acquisition saga which started in 2003 with the landmark deal of acquiring L&T cement division having a capacity of 17 MTPA is continuing. The company amassing its capacity whenever it gets an opportunity.

| Particular (Target) | Year | Capacity (MTPA) | Value (EV) |

| L&T Cement Division | 2003 | 31 | NA |

| Star Cement | 2011 | 3 | 1754 |

| Gujarat Unit of Jaypee Group | 2013 | 4.8 | 3800 |

| Jaiprakash Associates Limited | 2016 | 21.20 | 16,189 |

Further, UltraTech is also trying to acquire Binani Cement Limited. The strategy of becoming India’s largest cement company by greenfield and brownfield expansion has worked well for UltraTech. The next growth phase for the company is to strengthen its position in India and to become one of the largest player in the world. The transaction is definitely a step towards it.

Century

In October 2015, B.K. Birla appointed his grandson and Aditya Birla Group chairman Kumar Mangalam Birla as vice-chairman of CTIL as part of a succession plan. Since then, Century is trying to realign its businesses with those of the Aditya Birla Group. Few of the decisions taken by the century since then: –

- Sold Yarn & Denim Division (Court decision is pending).

- Leased Viscose Filament Yarn to Grasim for 15 years for the royalty of Rs 600 crore and Rs 200 crore interest-free deposit

- Formed Birla Estate Private Limited, to focus on its real estate business.

Post-transaction, the company is left with small textile business (Fabric & Tyre Yarn), Pulp & Paper, Real Estate and small salt works & chemicals business. The company is trying to sale its Pulp & Paper business since along and news regarding the same had come several times. The company might hive-off its small textile and chemical business to other group entities to consolidate the group’s activity. What will remain with the company in the long run will be real estate business. The company is already started to develop its own land parcel’s and signed an MoU to develop a residential project.

Conclusion

Clearly, the deal comes because of consolidating and realigning the group’s businesses in the process improve ROCE on cement business. Though the deal is an obvious decision for the group, CCI’s clearance will be the most crucial part for deal to go through.

Post implementation of RERA, the real estate business has become very lucrative for big players. Most of the companies having a history of more than 50 years are shifting their factories from the heart of the city because of environmental issues. Instead of keeping the city land idle, they prefer to monetize it. The same strategy worked extremely well for Godrej, Supreme Industries, Glaxo, Burroughs Wellcome, RIL etc. The strategy seems to be to make Century as a real estate arm of Aditya Birla group and be the part of emerging lucrative business where huge consolidation must happen.