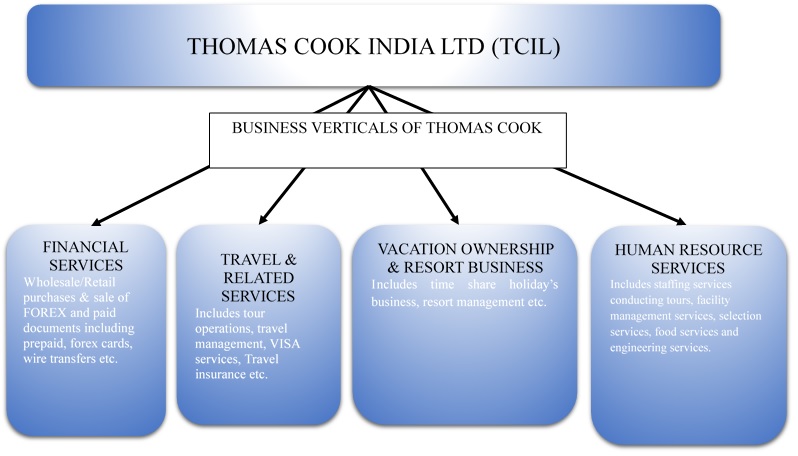

Thomas Cook (India) Ltd. (TCIL) is the leading integrated travel and travel related financial services company in the country offering a broad spectrum of services that include Foreign Exchange, Corporate Travel, MICE, Leisure Travel, Insurance, Visa & Passport services and E-Business. Thomas Cook is promoted by Fairfax Financial Holdings Limited through its wholly-owned subsidiary, Fairbridge Capital (Mauritius) Limited and its controlled affiliates which holds 67.61%.

Quess Corp Limited (Quess), established in 2007, is India’s leading integrated business services provider and is engaged in providing services in the fields of Industrial Asset Management, Integrated Facility Management, Human Resource Services, Global Technology Solutions and Internet Business. Based out of Bengaluru, Quess today has a presence in North America, the Middle East and South-East Asia.

Travel Corporation (India) Limited (TCI) is engaged in the business of handling inward foreign tourist activity in India including independent and conducted tours, safaris, expenditure, conferences and meeting etc. TCI is a wholly owned company of Thomas Cook.

TC Travel and Services Limited (TCTSL) is engaged in the business of travel and ticketing business and offers wide range of services including airline ticketing, booking hotel accommodation, visa and passport facilitation, travel insurance etc. TCTSL is a wholly owned subsidiary of Thomas Cook. TCTSL was acquired from Tata Capital Limited.

TC Forex Services Limited (TCF) is engaged in the business of travel-related foreign exchange products. TCF is a wholly owned subsidiary of Thomas Cook. TCF was acquired from Tata Capital Forex Limited last year.

SOTC Travel Management Private Limited (SOTC) is engaged in the business of travel agents and tour operator and booking and reserving accommodation. SOTC is a wholly owned subsidiary of Thomas Cook.

Fairfax Financial Holdings Limited (Fairfax) is a holding company which, through its subsidiaries, is engaged in property and casualty insurance and reinsurance and investment management. The company was founded in 1985 by the present Chairman and Chief Executive Officer, Prem Watsa. The company has been under the present management since 1985 and is headquartered in Toronto, Canada.

Recent Transactions

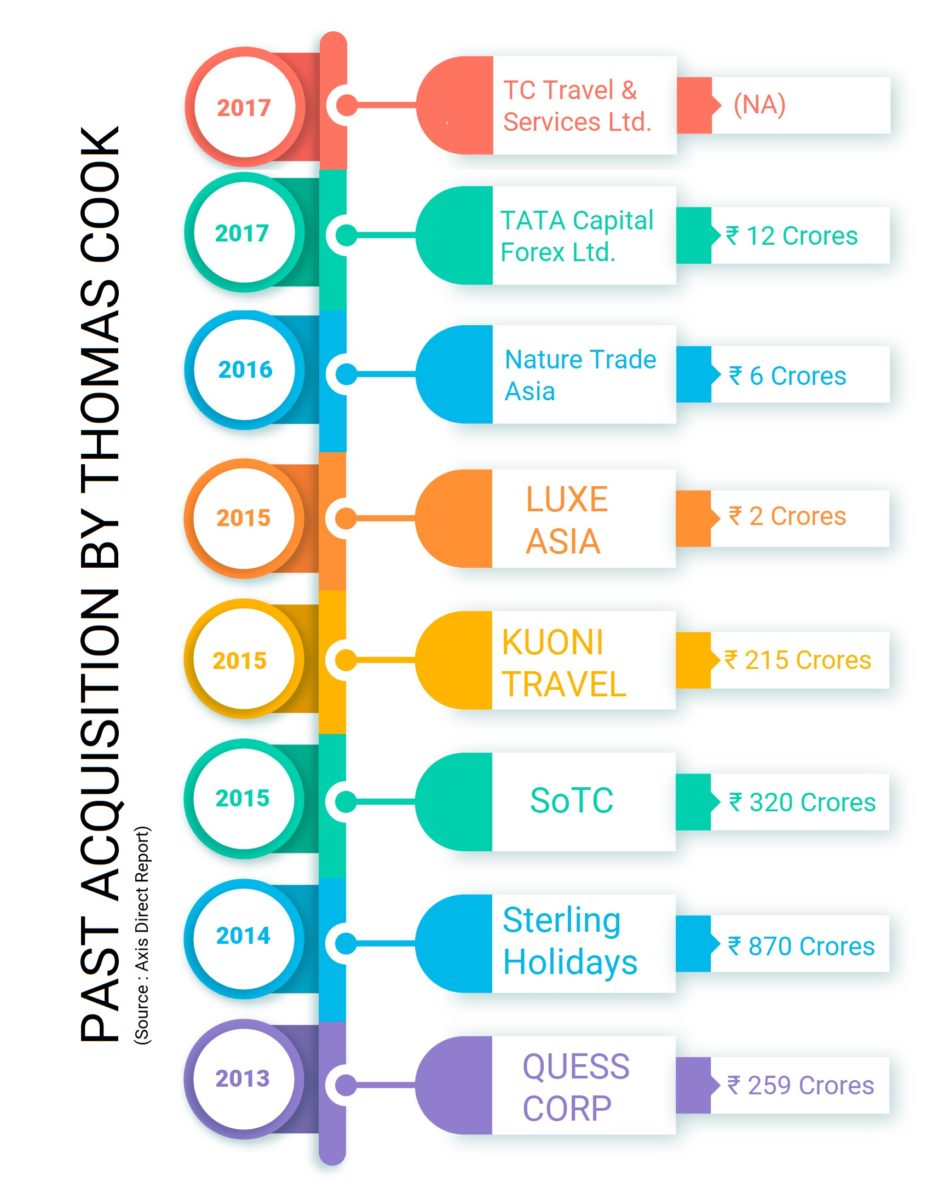

The last few years have seen Thomas Cook Group made many travel & non-travel related acquisitions from Quess to Sterling, SOTC, Kuoni Hong Kong, Kuoni’s multiple DMS entities across 21 countries and Tata Capital’s erstwhile Travel & Forex businesses – now renamed as TC Travel & TC Forex. Quess, meanwhile, also made several acquisitions both in India and abroad in line with its own areas of operation.

Quess went public during FY 2016-17, raising Rs 400 crore through a fully primary equity issuance. Immediately after listing of Quess, Thomas Cook was holding 62.58% stake in Quess. Last year, Thomas Cook has sold 5.42% equity stake in Quess through Offer for Sale for net consideration of Rs 628 crore. Thomas Cook realised a profit of Rs 535 crore on the same. During H1 FY18, Quess has done Institutional Placement at Rs 800 per share and raised a total capital of Rs 873 crore. Effectively, Thomas Cook took out all the money it invested in Quess with significant return while still holding 49% stake in it.

The Transaction

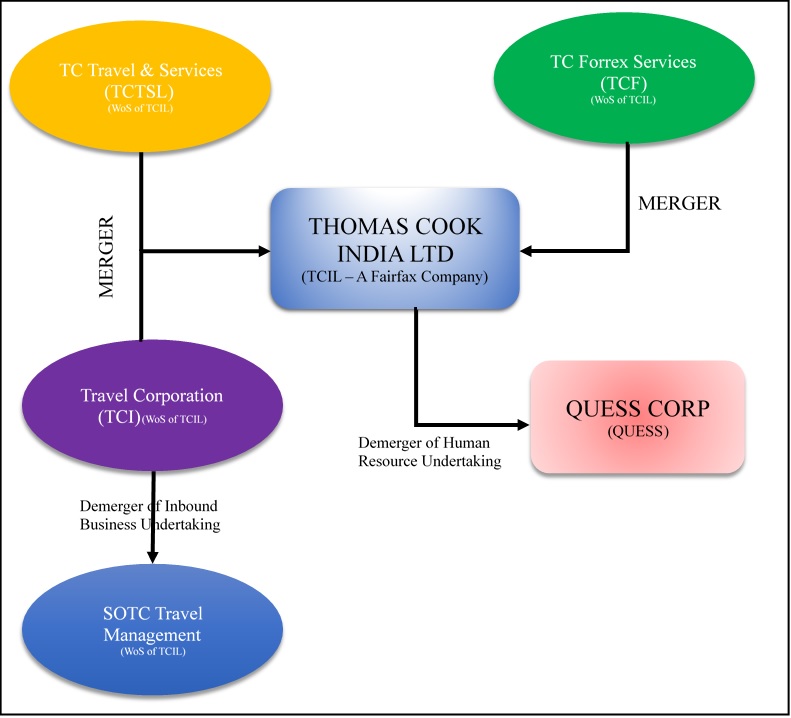

The Board of Directors of the companies approved scheme of Arrangement and Amalgamation between Thomas Cook, Quess Corp and Subsidiaries of the Thomas Cook whereby

- Demerger of “Inbound Business Undertaking” of TCI to SOTC.

- Amalgamation of TCI, TCF and TCTSL into Thomas Cook.

- Demerger of “Human Resource Undertaking” of Thomas Cook to Quess Corp.

“Inbound Business Undertaking” means all the inbound tour related business of TCI.

“Human Resource Business Undertaking” means all the assets & liabilities pertaining to the human resource business of Thomas Cook including investment in Quess.

Appointed date for the transaction is April 1, 2019.

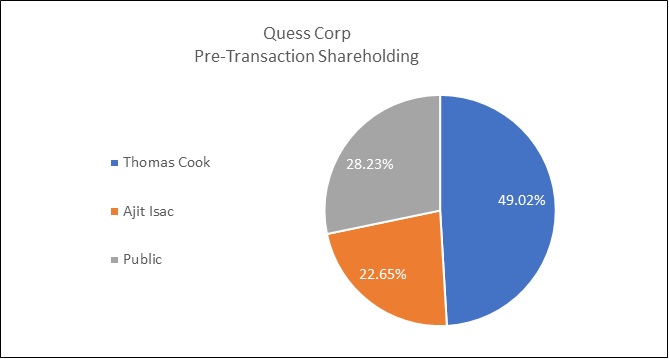

Shareholding Pattern

As on date promoters hold 67.03% stake in Thomas Cook and rest stake is held by public. The restructuring will not have any impact on the shareholding pattern of Thomas Cook.

Swap Ratio

Demerger of Inbound Business Undertaking

- 75 Non-Cumulative optionally convertible preference shares of SOTC of Rs 10 each for every 100 equity shares held in TCIL of Rs 10 each.

- 75 Non-Cumulative optionally convertible preference shares of SOTC of Rs 10 each for every 100 preference shares held in TCIL of Rs 10 each.

Demerger of Human Resource Undertaking

Thomas Cook Shareholders will receive 1,889 equity shares of Rs 10 each of Quess for every 10,000 equity shares of INR 1 each held in Thomas Cook.

Post transaction, TCIL name will be changed to TC Travel Services Limited and SOTC’s to Travel Corporation (India) Limited.

Steps taken by Thomas Cook: –

- The company completed the acquisition of 4.44% stake in TCIL from Sterling Holiday Resort Limited, a wholly owned subsidiary of the company.

- The company completed the acquisition of 100% stake in TCTSL from TC Tours Limited, a wholly owned subsidiary of the company.The scheme of arrangement is a decisive step towards unlocking the potential value of Thomas Cook group companies

- The Board of Directors of the company at its meeting held in April 2018 ratified the management decision to re-classify the company’s investment in Quess from Subsidiary to Associate company with effect from March 1, 2018, consequently Thomas Cook has recognised fair value gain of Rs 5903 crore. In this context, the board also recognised certain participative rights of Ajit Isaac in day-to-day management and operations of Quess.

Financials & Valuations

Table 1: Consolidated Financials of Thomas Cook as on 31.03.2018 (All Figs in INR Crores)

| Particulars | Thomas Cook | Quess | Other |

| Networth | 8,671 | 2,461 | 6,210 |

| Borrowings | 296 | 965 | |

| Cash & Cash Equivalents | 1,092 | 836 | 256 |

| Total Assets | 12,204 | 4,899 | 7,306 |

| Revenue | 11,248 | 6,167 | 5,081 |

| EBIT | 398 | 336 | 62 |

| PBT(Before Exceptional items) | 248 | 261 | -13 |

| Adjusted PAT(Excluding Exceptional item) | 289 | 309 | -20 |

Segment-wise- Thomas Cook

Table 2: Business Verticals for FY 17-18 (All Figs in INR Crores)

| Particulars | Financial Services | Travel | Human Resource | Vacation Ownership |

| Total Income | 265 | 5,077 | 5,634 | 272 |

| EBIT | 70 | 136 | 295 | -18 |

| Total Assets | 969 | 2,439 | 7,031 | 694 |

| Total liabilities | 522 | 2,156 | 5 | 544 |

Human Resource segment mainly represents Quess.

Assigned valuation

Table 3: Valuation TCIL and Business to be Demerged (All Figs in INR Crores)

| Particulars | Amount |

| Inbound Undertaking | 198.5 |

| TCIL (After De-merger) | 429 |

| Human Resource undertaking | 7770 |

| *Fair value of investment | 7765 |

As per the valuation report, the human resource undertaking significantly consists of investment of Thomas Cook in Quess.

Table 4: Pre & Post Transaction Valuation of Quess and TCIL (All Figs in INR Crores)

| Particulars | Amount |

| MCAP of Thomas Cook | 9,942 |

| MCAP of Quess | 16,894 |

| Thomas Cook’s Share | 8,283 |

| Effective value to remaining business | 1,659 |

Our View

The scheme of arrangement is a decisive step towards unlocking the potential value of Thomas Cook group companies. In recent past, Quess has grown exceptionally well by acquiring various business. It seems now onwards Quess can grow on its own without any financial support from the holding company. The management team is different for both companies. Post-restructuring, there will be no interventions by Tomas Cook’s management in decision making of Quess. The risk and return for both Thomas Cook & Quess are different. to sell out or stay invested, based on the performance of the companies.

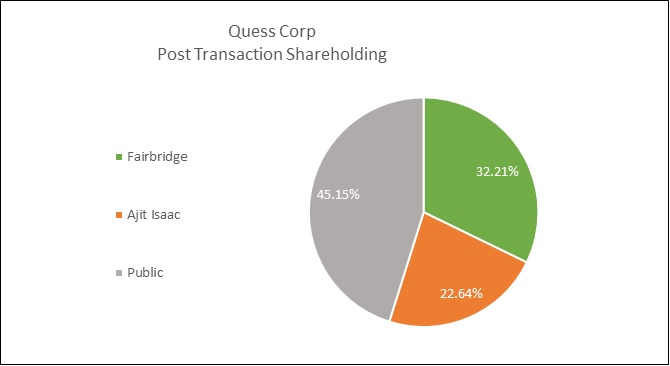

The other intention for the restructuring can be to give Fairfax a direct holding into Quess. Recently, IIFL Holdings Limited announced the group re-structuring for unlocking the value for its shareholder. Interestingly, Fairfax is one of the major investor in IIFL. Is it Fairfax compelling the companies for unlocking its value as it will improve the worth of their holdings by eliminating the holding company discount and will be benefited from such structure if they sell shares in Quess in future.