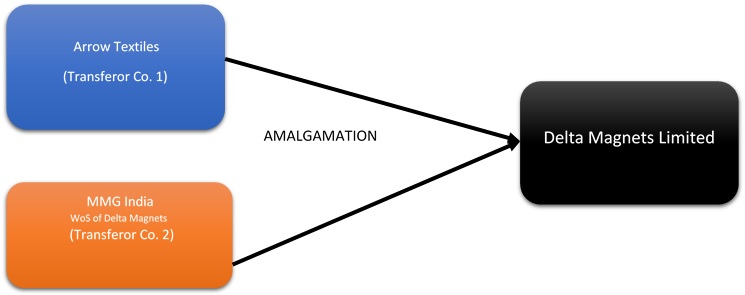

On 19th September Delta Magnets Ltd announced the merger of Arrow Textiles Ltd and MMG India Private Ltd with Delta Magnets Ltd. Post-merger the name of Delta Magnets Ltd will change to Delta Manufacturing Limited.

Delta Magnets Ltd (DML) started commercial production in 1986 and is one of the leaders in the hard ferrite industry, GPEL’s clientele includes Philips, BPL, Bush (in the audio electronics industry), Bajaj Auto and Lucas-TVS (in the automobile equipment industry). DML has two wholly-owned subsidiaries and one step-down wholly-owned subsidiary:

- MMG India Private Limited which is into manufacturing of Soft Ferrites

- Magdev Limited which is into Trading of Ferrites

- Pilamec Limited (Step-down Subsidiary) – Trading of Ferrites

MMG India Private Limited (MMG) is primarily engaged in the business of manufacturing of soft ferrites and coil winding.

Arrow Textiles Ltd (ATL) is the leading manufacturer of the specialty textiles in India. The company manufactures woven labels, fabric printed labels, elastic & non-elastic tapes (also known as garment trims). These products form a part of garment packaging products and are used for apparels and made-ups such as terry towels and home furnishings. The company has an installed capacity as on 31st March 2018, of 22 Nos. woven label looms, 22 Nos. printed label machines and 61 Nos. woven tapes looms.

Transaction Overview

Valuation

Appointed date is 1st October 2018. The valuation of equity shares of the company has been carried out using Income Approach- Discounted Cash Flow Method and Market Approach-Market Price Method.

Table 1: Valuation Methods for Arrow and DML (As per valuation report)

| Particulars | Arrow Textiles Ltd | Delta Magnets Ltd | ||||

| Method | Value per share (Rs) | Weight | Product | Value per share (Rs) | Weight | Product |

| Discounted Cash Flow Method (Income Approach) | 11.5 | 1 | 11.5 | 81.11 | 1 | 81.11 |

| Market Price Method (Market Approach) | 31.98 | 1 | 31.98 | 105.65 | 1 | 105.65 |

| Total | 2 | 43.48 | 2 | 186.76 | ||

| Fair Value per share | 21.74 | 93.38 | ||||

| Fair Share Exchange Ratio (Rounded off) | 0.23 | |||||

23 Equity shares of Rs 10 each fully paid up of DML shall be issued and allotted for every 100 Equity shares of Rs 10 each.

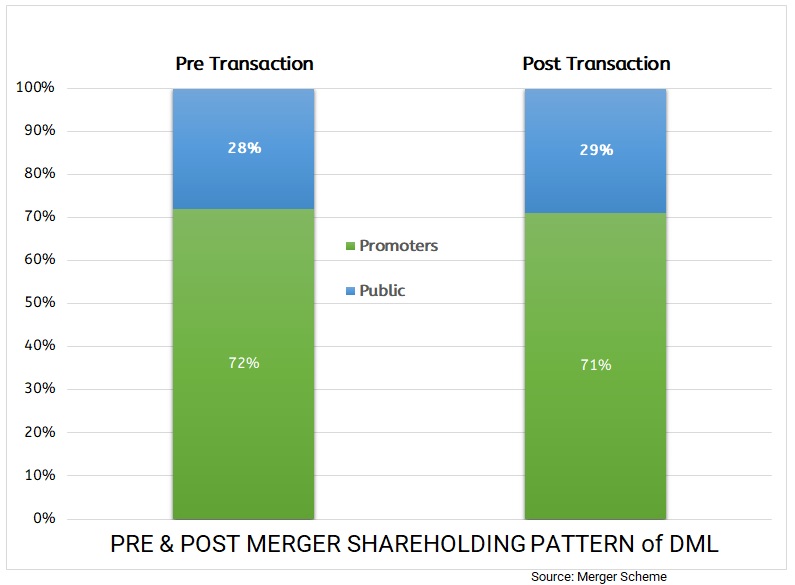

Shareholding Pattern

Note: Pre-shareholding in based on data available as on 30th Sep 2018.

Rationale

As per Scheme the proposed restructuring would:

- Provide an opportunity to leverage combined assets and enable optimum utilization of existing resources by pooling of resources to facilitate future expansion of business of Transferee Company and similar other general corporate level benefits

As per our observations:

- The above rationales seem insignificant as the same leads to only reduction of some expenditure and no real business or strategic benefits as there are no apparent synergies between two businesses

- DML, MMG, ATL are a part of Delta Group promoted by Jaydev Mody and family.

- DML is facing liquidity crunch and nearing bankruptcy which is substantiated by cash flow coverage ratio given below. Hence the merger will provide an opportunity to leverage combined assets.

- DML are having foreign subsidiaries and they may not want to disturb the operational management of these companies hence considered merging profit-making company ATL into nearly loss making DML.

Accounting Treatment

Financial Performance

Table 2: Standalone and Company Financials as on March 18 (All Figs in INR Crores)

| Particulars | DML (Standalone) | MMG | ATL | Combined |

| Networth | 29.5 | -0.62 | 35.3 | 58.6 |

| Revenue | 23.8 | 20.4 | 39.7 | 84 |

| EBIT Margin | 5% | -7% | 7% | 3% |

| PAT | 5.85 lacs | -0.53 | 1.6 | -0.36 |

| Market Cap* | 52 | NA | 46 | – |

| ROA | 0% | -15% | 4% | -3% |

| ROCE | 3% | -6% | 8% | 3% |

*As on 29th Nov, 2018.

Observations

- DML’s Long-Term debt is amounting to Rs 6.2 Crores which almost equal to its equity of Rs 6.4 Crores, which shows that since Delta Magnet is presently loss-making and there’s a question of sustainability of its current operations.

- Maintaining a high level of debt, while revenues are still below costs, can be dangerous as liquidity tends to dry up in unexpected downturns.

- It is seen that ATL is highly liquid whereas it is the opposite scenario for DML and its WoS MMG.

Conclusion

Considering the above analysis, the merger is in contemplation of saving DML from raising further funds for its survival and growth by increasing net worth through merger. It also looks like because of SEBI regulations and guidelines market price weightage has created ratio in favour of DML as last two-week average price was substantially higher i.e. 105.65 as against average of last 26 weeks of Rs 64.03 only. In case of ARL, both averages are almost same minority shareholders of both the companies are at loss though ARL minority shareholders are short charged even higher.