Skipper Limited (Skipper), incorporated in 1981, is the largest manufacturer of Transmission & Distribution Structures in India with engineering and manufacturing facilities in Eastern India. The company takes advantage of the available power and steel supply, the cost-effective labour, and proximity to ports. It has four state-of-the-art manufacturing plants in this region, two in Jangalpur; one in Uluberia near Kolkata, West Bengal; and one in Palasbari, near Guwahati). The Guwahati plant commenced operations in March 2017 and aims to tap the growing demand for T&D products in the North East region. The total installed capacity of Engineering products now stands at 265,000 MT.

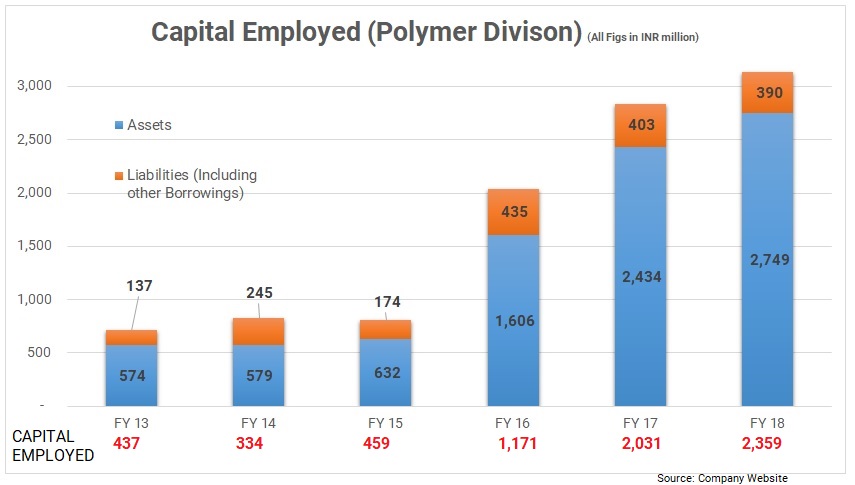

The company’s Polymer Product Segment has a manufacturing capacity of 51,000 MTPA. Over 70% of the gross block is less than six years old, and Skipper is one of the very few companies in India to be assured of CPVC for the manufacture of state-of-the-art pipes. Skipper is the only Company in the sector to undertake an asset-light route for expansion, setting up satellite manufacturing units to cater to the different zones of the country.

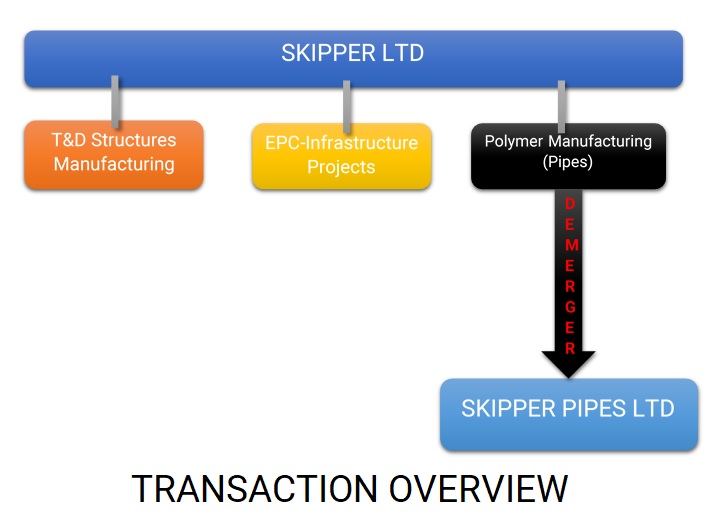

TRANSACTION

Demerger of Polymer products division/undertaking of Skipper Limited in Skipper Pipes Limited (SPL) except palasbari unit situated at Guwahati Assam with Appointed Date as 1St April 2018 Swap Ratio is 1:1 as Mirror Image of Skipper Limited.

Please Note:

- Skipper Pipes is currently owned by the promoters with no business. As part of scheme of merger, the shares held by promoters in SPL will be cancelled which will maintain mirror image shareholding post demerger.

- Demerger include joint venture entity with Israel based Metzerplas for drip irrigations solutions in India

RATIONALE

- Polymer products has significant growth potential and require management separate to focus

- Attracting different set of investor, strategic partners, Lenders, and other stakeholders

- Develop their own network of alliances and talent models that critical to success

- High Degree of independence as well as accountability with autonomy for each business segment

- Current Shareholders the ability to continue to remain invested in both or either of the two companies giving them greater flexibility in managing and/or dealing with their investments

VALUATION

Since the shareholders of Sipper shall have the same percentage of stake, ownership, control, and voting rights in Skipper and SPL and accordingly valuation of the companies has not been arrived. However, the post-demerger is to unlock the value for Engineering and manufacture of transmission and distribution structure and to attract investors which are focused on initial phase of business for Polymer products business.

TAXATION

Since it is compliant demerger there will be no tax implication in the hands of the shareholders and the company.

DEMERGED UNDERTAKING

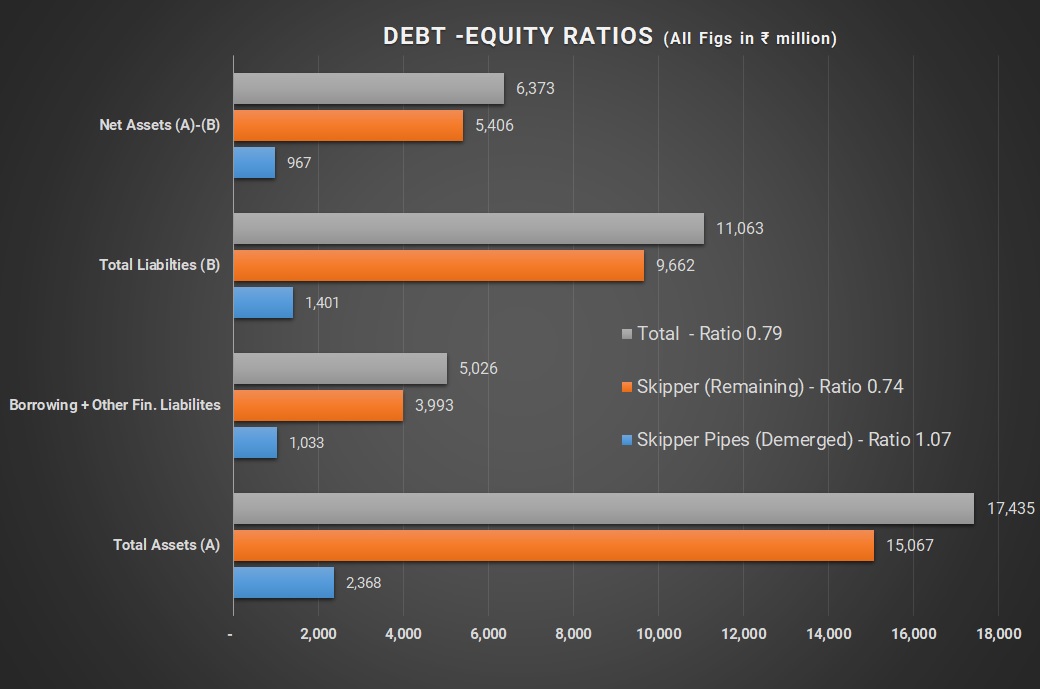

The Net assets of the Undertaking as on appointed date is as mentioned below. However, the debt-equity ratio of demerged undertaking is higher as major expansion is done in last 5 years.

The net worth of the demerged undertaking as on 31.03.2018 is Rs. 967.08Mn. However, the company has infused in the last 6 years approx. Rs. 1921.64 Mn in Demerged Undertaking. The management is positive for expansion to increase capacity to 1,00,000 MTPA.

Currently the Demerged Undertaking is at break even for cash positive. However, for remaining undertaking post demerger it will reflect improved profit margin.

Table 1: Financials of Skipper and Skipper Pipes (All Figs in ₹ Millions)

| Particulars | Demerged Undertaking | Remaining Undertaking | Total(FY 2018) |

| Revenue | 2,148.93 | 18,927 | 21,076.18 |

| Profit before Depreciation, Interest & Unallocated Exp. | 224.43 | 3,141 | 3365.93 |

| Depreciation | -73.50 | -386 | -459.06 |

| Interest Expenses | -161 | -623 | -784.45 |

| Unallocated | -34 | -298 | -331.98 |

| Interest Income | – | 13 | 13.45 |

| PBT | -44.16 | 1,848.05 | 1,803.89 |

| Tax | – | 628 | 626.27 |

| PAT | -44 | 1,220 | 1177.62 |

| Cash Profit | 29.35 | 1,605.27 | 1,636.68 |

| PAT Margin | -2.05% | 6.44% | 5.59% |

| No. of Shares | 102.67 | 102.67 | 102.67 |

| EPS | -0.43 | 11.88 | 11.47 |

STRATEGY

The company’s strategy being polymer business, started as a sustainable business. Now polymer business is matured enough to generate its own cashflow and/or the management may want to invite strategic partner for future expansion. The consolidated entity had much benefits in terms of taxation as polymer was not profit making and it will have ceased to exist. However, the equity capital for polymer business might be higher as it will not be able to in the initial phase of expansion, so the management thought of lower swap ratio to maintain lower capital.

CONCLUSION

The transaction of demerger is to unlock the value for transmission and distribution structure business which is cash positive and profit division whereas to create another listed company to attract difference set of investors or strategic partner for polymer products business which is in initial phase of growth.

Add comment