Shree Digvijay Cement Co. Ltd. (SDCCL) is engaged in the manufacturing & selling of Cement. The company has one manufacturing facility at Sikka, Jamnagar, Gujarat with an installed capacity of 10.75 lacsMT per annum. The company caters mainly in the domestic market within India under the brand “Kamal”. The equity shares of the company are listed on BSE. The current promoter of the company is Votorantim Cimentos S.A.

The board of directors of the Shree Digvijay Cement Co. Ltd. at their meeting held on 12thNovember 2018, announced that the existing promoters have decided to sell their 75% holding in the company to a Private Equity Firm.

Votorantim Cimentos S.A is a joint stock corporation, incorporated on January 30,

The Transaction

Votorantim Cimentos S.A has entered into an agreement with True North Fund VI LLP (TrueNorth) to sell its entire shareholding in the company. True North (formerly known as India Value Fund Advisors – IVFA) was established in 1999 with a focus on investing in and transforming mid-sized profitable businesses into a world-class industry. True North has more than a decade-long experience with investments in the Indian construction and building materials space. It has owned and managed two prominent businesses in this space – RDC Concrete (“RDC”), a manufacturer of ready-mix concrete and Robo Silicon (“Robo”), a manufacturer of construction aggregates.

The said sale of the equity stake is proposed to be executed for a consideration aggregating up to INR 167.20 crores i.e. at a price of up to INR 15.77 per share. This acquisition will trigger the Open Offer requirement. True North will give an open offer to acquire equity shares representing 25.1% of the company at an offer price of INR 23.33 per share.

In the event, the acquirer’s total shareholding in the company after completion of the offer is likely to exceed the maximum permissible limit under SEBI and hence acquirer must sell some of its holdings to bring its stake 75% within a permissible time limit.

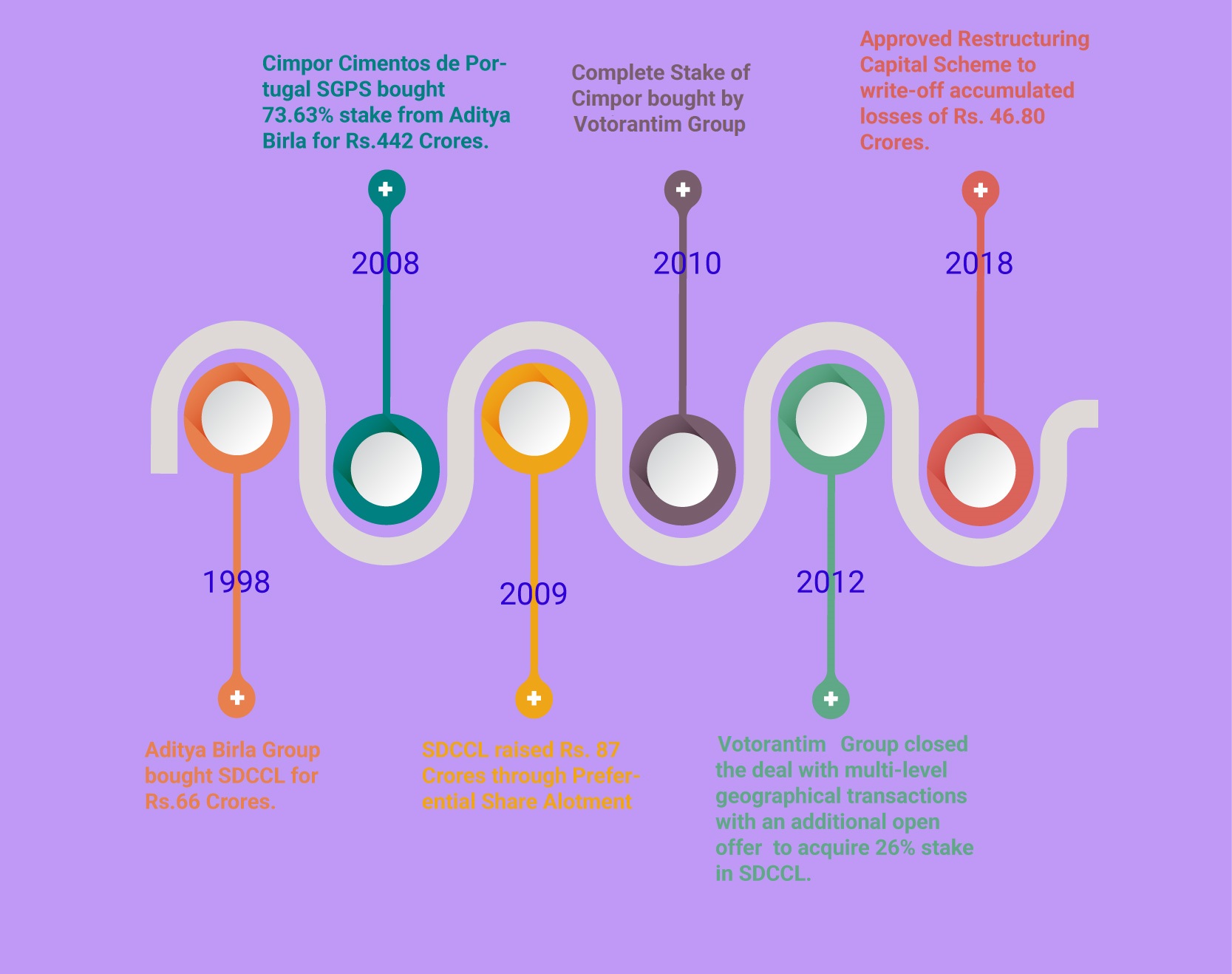

The Roller-Coaster Journey of SDCCL

1998

Kumar Mangalam Birla, the chairman, Aditya Birla Group, had bought SDCC from the Kolkata-based Bangur family in 1998 for INR 66 crore.

2008

To enter into the Indian Markets, Portuguese cement maker Cimpor Cimentos de Portugal SGPS SA has bought a controlling 73.63 per cent stake in SDCCL for the consideration of approximately INR 441 crores from Grasim Industries Limited.

2009

SDCCL raised INR 87 Crores through Preferential allotment of Compulsory Convertible Preference Shares of Rs. 100/- each to Cimpor Inversiones S.A. the Promoters of the Company. The capital was raised to strengthen the Capital base of the Company, so as to bring it out of BIFR.

2010

Brazilian major Camargo & Votorantim group buys the stake in Cimpor.

2012

Pursuant to the restructuring agreement between Votorantim Cimentos S.A., InterCement AustriaHolding GmbH and Camargo Correa Cementos Luxembourg Sarl, 73.63 % of the shares of the SDCCL has been transferred indirectly from Cimpor to a non-resident holding entity i.e. Votorantim through another non-resident holding entity i.e., Cementos EAA Inversiones, S.L. as part of a bundle of multi-jurisdictional assets by way of transfer of shares and two swaps of shares outside India. In a complex set of multi-level transactions spanning four continents, Votorantimtook control of the SDCCL. In pursuant to this, Votorantim initiated an open offer to acquire up to 26% of the equity share capital of the SDCCL at a price of INR 10.94 per share.

2018

The Board of Directors, at their meeting held on 27th March 2018, approved the “Scheme of Arrangement for Restructuring of Capital & Other Reserve”, wherein it was proposed to utilize Capital Redemption Reserve, Securities Premium account and Capital Reserve to writing off the accumulated losses of INR 46.80 crore as on31st

The Financials

Financial Highlight from Last 10 Years (All Figs in ₹ Crores)

Valuation

The Company has one manufacturing facility at Sikka (Jamnagar) with an installed capacity of10.75 lacs MT per annum. Considering the price paid by the True North, the enterprise value per ton comes out to be around INR 2250per tonne. The value seems to be too low considering the transaction happened in a similar space.

Table 1: Transactions in past (All Figs in ₹/Tonne)

| Year | Particular | Consideration(Per Tonne) |

| 2014 | Ultratech acquires two plants from Jaiprakash Associates | 8400 |

| 2016 | Birla Corp acquires Cement business of Reliance Infra | 8700 |

| 2018 | Ultratech acquires Cement Business of Century textile | 7102 |

The reason for such a huge difference could be because the SDCCL has only one manufacturing unit. Further, its power cost is too high compared with the industry average. There is no capacity addition for more than a decade.

Return Game

Cimpor Cimentos de Portugal SGPS SA had bought a controlling stake in the company in 2008. During 2009, Cimpor infused around INR 87crore through preferential allotment in the form of Compulsory ConvertiblePreference Shares. However, later these convertible preference shares didn’t get converted into equity. During 2012, Votorantim group acquired 1.64% stake in the company through open offer for INR 2.53 crores. Now, the group is selling its stake for INR 167 crores.

Table 2: Return on Investment for Votarantim Group (All Figs in ₹ Crores)

| Particulars | Amount |

| Amount paid to acquire 73% stake in SDCCL | 441 |

| Preferential Allotment | 87 |

| Acquisition in 2012 | 3 |

| Total Investment | 531 |

| Exit amount | 167 |

| Gain / (loss) | -69% |

In terms of Enterprise Value per ton, Cimpor acquired SDCCL at ~₹5,620/- and now Votorantim selling it for ₹2,257/-.

Conclusion

Decade ago, despite being a leading Cement Company, Grasim (The holding company of Ultratech Cement) sold its stake in Digvijay Cement to a foreign player. Votorantim Cimentos S.A, being a global player in Cement Sector was not able to turn around the company. TrueNorth has more than a decade-long experience with investments in the Indian construction and building materials space. This acquisition can give them entry into the Cement space.

Indian Cement sector is going through consolidation where all the big players are acquiring small units to strengthen their position. It will be interesting to see how True North will able to change the fortune of the company and can create value for the minority shareholders and fund holders which has only one plant.

Add comment