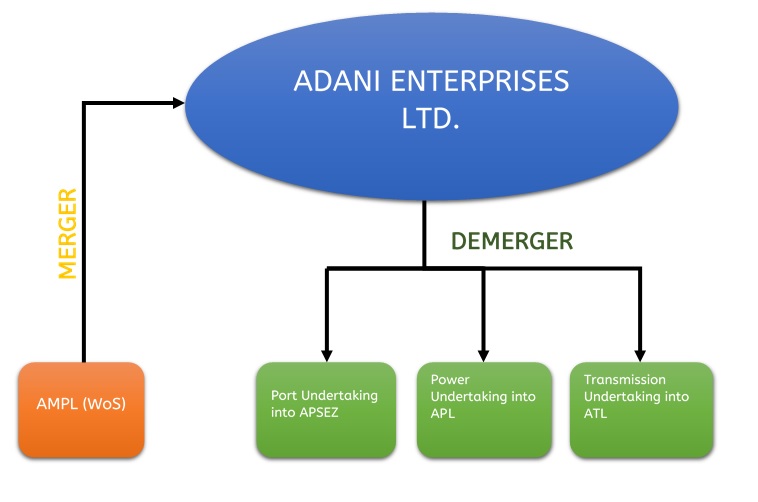

In order to build on its core strength, diversified industrial house Adani Group has restructured its business. Under the newly structured pattern, the group demerged its listed power generation and ports firm spliced out of the flagship company Adani Enterprises Ltd. It also involved listing Adani Transmission on the Bombay Stock Exchange as a separate company. As a part of the scheme, the Adani Group has cleared up the corporate structure to fully align with the specific areas of focus for each of the four distinct listed groups. The purpose of the Adani Enterprises restructuring was to consolidate and separate out the operations of Adani Ports and Adani Power as free standing listed groups.

The 400 MW Gujarat solar farm will be transferred from Adani Enterprises to Adani Power for 64 million Adani Power shares. The Balekeri Port was transferred from Adani Enterprises to Adani Ports and the transmission unit was transferred from Adani Power to Adani Enterprises in return for new Adani Power shares. The completion of the transactions will be completed by December 31, 2015, subject to all regulatory and statutory approvals. In April 2015, the Adani Group Board had approved the scheme and recommended it to shareholders, who voted overwhelmingly. The restructuring was done because of the growing opportunities in the power sector and also the company wants to take some big leap for growth.

Share Entitlement Ratios

Share Entitlement Ratios

- After the demerger of the Port Undertaking of AEL into APSEZ, APSEZ will issue and allot new equity shares to the equity shareholders of AEL in the ratio of 14,123 equity shares in APSEZ for every 10,000 equity shares held by the equity shareholder in AEL.

- APL will allot new equity shares to the equity shareholders of AEL in the ratio of 18,596 equity shares in APL for every 10,000 equity shares held by the equity shareholder in AEL.

- ATL will allot new equity shares to the equity shareholders of AEL in the ratio of 1 equity share in ATL for every 1 equity share held by the equity shareholder in AEL.

About Adani Group

Business icon Gautam Adani‐lead Adani group is one of India’s leading business houses with revenue of over $9.4 billion. Established in 1988, Adani has grown to become a global integrated infrastructure player with businesses in key industry verticals‐ Resources, Logistics and Energy. Each of the core businesses is successful in its own way. The holding company of the group i.e. Adani Enterprises Limited will demerge it’s direct and indirect interest in Logistics and Energy into listed entities involved in the said business.

Remaining undertaking with AEL Post Demerger

Resource by definition means obtaining coal from mines and trading of it. Adani group is the largest coal importer in India. After creating its mark in India, the company has expanded its operations and footprints in Indonesia and Australia by acquiring coal mines and ports. Two significantly large acquisitions in Australia are Galilee basin coal mine with reserves of 11.04 billion metric tonnes and Abbot Point Port with a capacity of 50 million metric tonnes. Globally, the company is gradually becoming a force to reckon with.

Adani Group has floated a Special Purpose Vehicle (SPV) called Adani Mining Private Limited (100% Subsidiary of Adani Enterprises Limited) with the purpose of undertaking activities related to development and operation of a domestic coal mine which is being merged with AEL to facilitate the consolidation of the core business of mining under one roof. The company undertakes coal trading business directly and through its subsidiaries, Adani Global FZE and Adani Global Pte. Ltd.

Adani has set up a gas distribution network by name of Adani Gas Ltd., a wholly owned subsidiary of AEL of approximately 5,700 kms comprising of steel and polyethylene pipeline network spread across Ahmedabad and Vadodara in Gujarat; Faridabad in Haryana and Khurja in Uttar Pradesh including 60 CNG stations at Ahmedabad and Vadodara in Gujarat and at Faridabad in Haryana.

The group also has an interest in agro-business through 50:50 joint venture with Wilmar of Singapore. Adani Wilmar owns a highly successful range of cooking and baking product including Fortune ‐ India’s largest selling edible oil. Adani also operates Agro‐storage facilities. Adani Agrifresh Limited is part of the Adani Group has forayed into the horticulture sector. Adani has a storage capacity of 21,000 MT applies across three locations in Himachal Pradesh. The company also has a facility of storing 6,00,000 MT wheat across 7 locations in India.

Undertaking to be Demerged

Logistics denotes a large network of ports, Special Economic Zone (SEZ) and multi‐modal logistics ‐ railways and ships. 95% of India’s International trade by volume is through its seaports. Adani group is the only pan India group having 6 operational ports and 2 under implementation ports across Indian coastline.

The scheme of arrangement, approved by the companies concerned, entails AEL transferring its businesses, activities, operations, assets and liabilities pertaining Belekeri port to APSEZL.

Consolidated cargo handled by the company was 108 MMT in 9MFY15, an increase of 29%, over the same period last year. Adani ports at Mundra handled 84 MMT cargo in 9MFY15 thereby continuing its leadership as the largest commercial port in India. Mundra port registered a 13% growth in 9MFY15 compared to 5% aggregate cargo growth at all major ports.

Dhamra Port is the only port in East with a deeper draft for larger vessels. Port is the gateway for Mining, Power and Steel Industry and Inland waterways connecting northeast. Adani Enterprises has also been named as the vehicle that will undertake the two new proposed expansions into solar.

Adani has also developed 120kms railway line on the west coast resulting in saving both cost and time compared to competing Mumbai Ports and 63 kms railway line at Dhamra on the east.

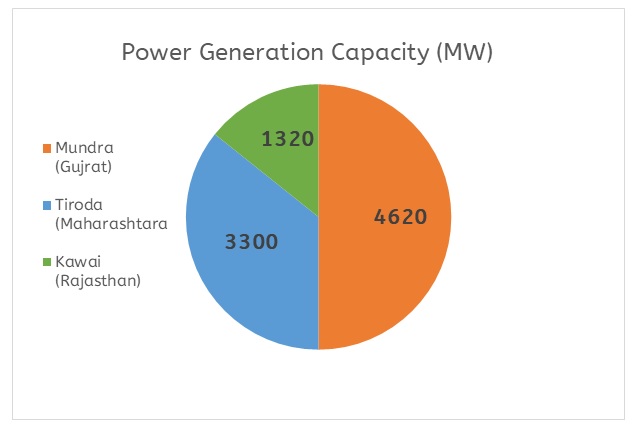

Energy involves power generation and transmission. Adani is the largest private thermal power producer in India with an installed capacity of 9,280 MW. Adani has three p+ower projects are spread out across the state of Gujrat, Maharashtra & Rajasthan.

Sources:‐ Company Data, hu Research

AEL will demerge its Power Undertaking comprising the undertaking, businesses, activities, operations, assets and liabilities pertaining to the 40MW Bitta solar power project into APL. Adani’s mining and logistics operations place Adani Power business in commanding position.

Adani also has operational Transmission asset portfolio of 5051 ckt kms. The power transmission firm would be spun off as a separate listed company, the fourth under the Adani Group. AEL will demerger its Transmission Undertaking comprising the undertaking, businesses, activities, operations, assets and liabilities related to the Mundra‐Zedra transmission line.

ATL is currently in the process of acquiring 100 percent of the outstanding equity share capital of Adani Transmission (India) Limited (ATIL) from APL and Adani Power Maharashtra Limited (APML, a wholly owned subsidiary of APL). ATL is also in the process of acquiring 100% of the outstanding equity share capital of Maharashtra Eastern Grid Power Transmission Company Ltd (MEGPTCL) from AEL.

AEL

Table 1: Segment-wise breakdown of AEL Consolidated (All Figs. in INR Crores)

| Segment | Quarter Ended on | For year ended on 31st March 14 | |

| 31.12.14 | 30.09.14 | ||

| Consolidated Revenue | |||

| Coal Trading | 7,313.67 | 4,954.90 | 20,470.46 |

| Port | 1,110.37 | 1,186.47 | 3,582.59 |

| Power Generation | 5,665.20 | 4,314.24 | 15,922.22 |

| Agro | 2,469.95 | 2,134.31 | 9,311.81 |

| Consolidated EBIT | |||

| Coal Trading | 291.51 | 253.36 | 526.31 |

| Port | 656.35 | 791.83 | 2443.44 |

| Power Generation | 1,119.76 | 645.05 | 2867.39 |

| Agro | 8.01 | 27.74 | 136.46 |

| Consolidated Capital Employed | |||

| Coal Trading | 7,637.72 | 7,167.68 | 6,835.26 |

| Port | 23,127.41 | 22,347.65 | 17,445.59 |

| Power Generation | 62,070.73 | 61,228.95 | 58,491.74 |

| Agro | 2,045.29 | 1,736.20 | 1698.65 |

| AEL | 108,637.95 | 1,05,618.67 | 96,834.97 |

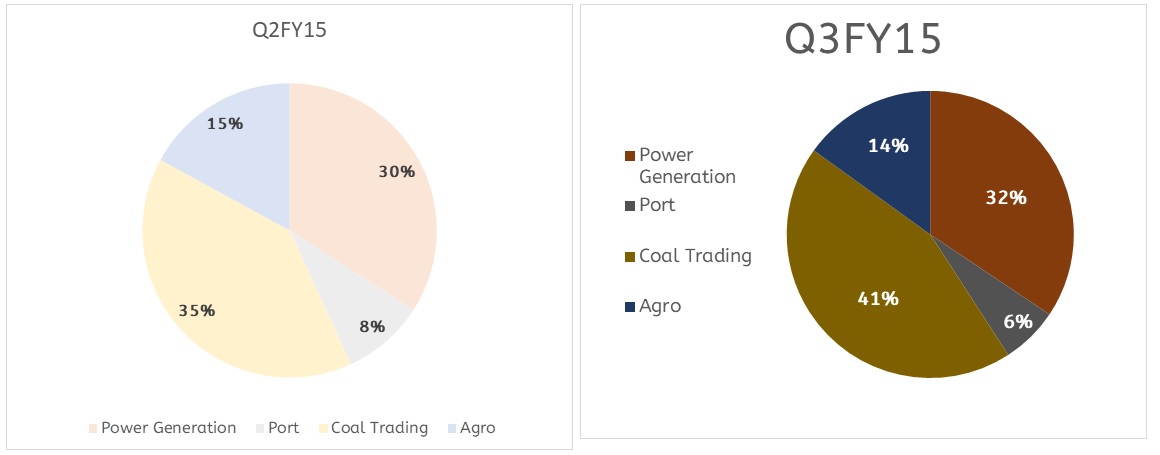

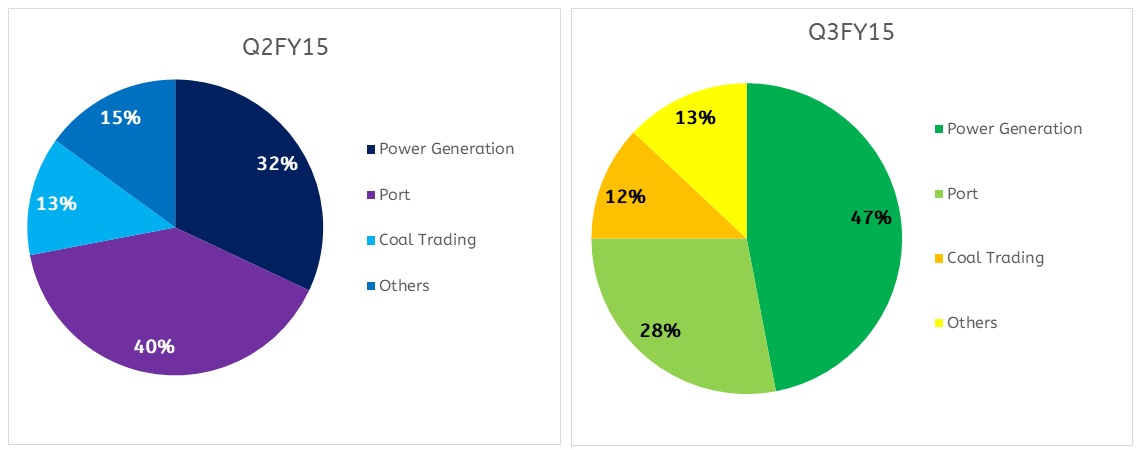

Above EBIT breakdown is presented in pie chart below

Sources: ‐ Company Data, hu Research

Sources: ‐ Company Data, hu Research

Above EBIT breakdown is presented in pie chart below

Sources:‐ Company Data, hu Research

Sources:‐ Company Data, hu Research

In the case of EBIT, Power generation, and Port business accounts for more than 70% revenue of AEL as a whole. Though Port segment’s contribution in the top line of AEL is a single digit, it contributes significantly in EBIT of AEL. However same is exactly reverse in case of Agro Segment. Agro segment’s contribution in top line of AEL is around 13% but in EBIT of AEL, it has contributed less than 1% in Q3FY15.

Coal trading segment’s revenue increased by almost 48% however its EBIT increased by only 15%.This is mainly because of high volatility of price involved in this segment. Power generation’s revenue grew by 31% however its EBIT jumped up by almost 74% also Power generation EBIT for Q3FY15 was almost 40% of the whole EBIT for the year ended on 31st March 14.

Capital employed in all the segments got increased on QoQ basis. RoCE of Coal Trading, Port, Power, and Agro Segment for a year ended on 31st March 14 was 7.70%, 14%, 4.90% and 8% respectively. Each of the businesses carried by AEL is different in terms of growth, potential and investment. In order to enable distinct focus of investors to invest in some of the key businesses and to have greater focused operations, AEL proposed to segregate its Power, Port, and Transmission business.

APSEZL

Table 2: APSEZL Financials (All Figs. in INR Crores)

| Particulars | Quarter Ended on | For year ended on 31st March 14 | |

| As on 31.12.14 | As on 30.09.14 | ||

| Consolidated Revenue | 1546.33 | 1655.12 | 4823.99 |

| Consolidated EBIT | 834.62 | 1028.18 | 2954.50 |

| Capital Employed | 24,675.50 | 23,232.11 | 18,747.86 |

APSEZL consolidated revenue for Q3FY15 down by 6.5% against the last quarter. It’s EBIT for the same period declined by19%. Capital Employed in APSEZL was increased by almost 32% in 9MFY15. Company’s RoCE declined to 3.38% in Q3FY15 from 4.42% for Q2FY15.

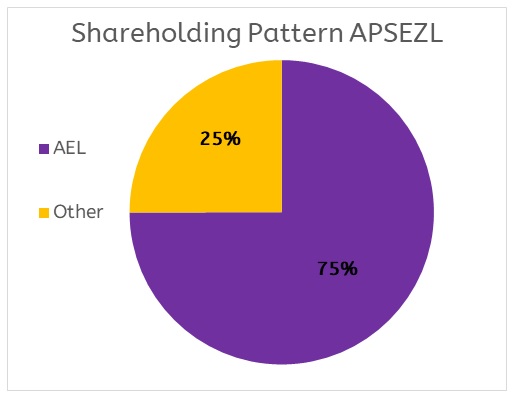

Shareholding Pattern of APSEZL

Source:‐ Company data

Demerger will results in a distribution of the APSEZ’s current shares held by AEL and also APSEZ will issue 0.9mn new shares (worth INR 306mn) for the transfer of Belekeri port from AEL, leading to a marginal dilution (0.04%) in shareholding pattern. Distribution of APSEZ stock to AEL minorities would reduce the promoter’s shareholding in APSEZL to 56% from the current 75% and expand the free float of the company by 75% (from the current 25% to 44%).

ABOUT APL

Table 3: APL Financials (All Figs. in INR Crores)

| Particulars | Quarter Ended on | Year ended on 31st March 14 | |

| 31.12.14 | 30.09.14 | ||

| Consolidated Revenue | 5504.05 | 4147.93 | 15,768.08 |

| Consolidated EBIT | 1052.35 | 558.96 | 2992.41 |

| Finance Cost | 1458.65 | 1340.52 | 4007.49 |

APL’s revenue grew by about 33% on QoQ basis while its EBIT almost got double in the same period. Finance cost for Q3FY15 grew by almost 9% on QoQ basis, resulted in the posting of loss of INR 428.68 crore in Q3FY15.

Adani Power has acquired 1.2GW Udupi & 600MW Korba west power plant during 2015.The Company has acquired these projects at an Enterprise Value of INR 99 bn.

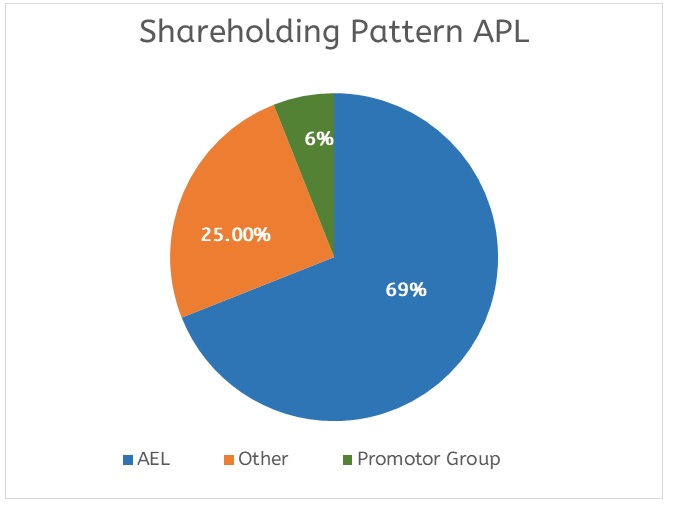

Shareholding Pattern of APL

Source:‐ Company Data

Demerger will result in a distribution of the current shares held by AEL and also Adani Power will also issue 64mn new shares (worth INR 3.3bn) for the transfer of a 40MW power plant from AEL, leading to a 2.2% dilution. The promoter’s holding in Adani Power could drop from 75% to 58%.

Why Demerger

The restructuring was done to give AEL shareholders direct ownership of operational businesses; improve the worth of their holdings by eliminating the holding company discount; facilitate the listing of AEL’s power transmission business; and improve the liquidity of already listed firms like Adani Power (APL) and Adani Ports and SEZ (APSEZ) by increasing their free float.

The scheme of arrangement is a decisive step towards unlocking the potential value of Adani Group companies. The demerger will drive the next level of value creation, competency, decision making and would be able to accelerate business growth,” Adani Group chairman Gautam Adani said in a statement.

The demerger is a win‐win situation for all shareholders, as it generally leads to an increase in a valuation of a separate business entity.Shareholders enjoy the ownership of both Demerged as well as Resulting Company. This restructuring will help to increase the valuations of the holding company and respective demerged companies. For instance, the port business with Adani Enterprises would not fetch a better valuation compared to a situation when it is with ‘Adani Ports’. The Adani’s scheme of arrangement will simplify the corporate structure providing shareholders of Adani Enterprise’s direct shareholding in the respective operating companies. Thus Post‐restructuring, shareholders will be having the flexibility to sell out or stay put, based on the performance of the companies.

Conclusion

- Adani Group’s restructuring is largely in line with a corporate trend in which large corporations are realigning their businesses to unlock latent shareholder value. The restructuring is part of the group’s effort to simplify its corporate structure. In the past, Larsen and Toubro Ltd, Aditya Birla group and Vedanta Plc have carried out similar restructuring exercises, which have yielded positive response from all stakeholders.

- As a result of demerger shareholding of promoter group will come down from existing level however promoters will get an opportunity to inject fresh equity by taking up their shareholding to the applicable limit of 75% if they so choose.

- Some of the profitable ventures of the Adani Group that were controlled by the holding company weren’t enjoying the kind of valuation that they would have otherwise. Spin off of various businesses will sharpen focus which is likely to give a cutting edge to each of the businesses in future and will be a win‐win situation in the long run.