US software firm Ebix has acquired Nasdaq-listed Yatra Online Inc to boost its India travel ventures at an enterprise value of $336 million, or Rs 2,350 crore in an all stock deal. Once the transaction is complete — the deal marks Ebix’s biggest acquisition till date in India — it is expected to create India’s largest and most profitable travel services company.

The $2-billion Atlanta-based software company has set a $7 for each outstanding diluted share of Yatra, totalling 48 million shares. The $7 price a piece was 84% premium to Yatra Online’s closing share price of $3.8 as of March 8, 2019. However, Ebix has announced in the press note that it reserves the right to reduce its offer at its discretion if it does not receive a positive engagement response from the Yatra board in a timely manner or if any subsequent steps are taken by the company that could have an adverse impact on its future value.

The board of directors of both the company has approved the deal. Given the fact that Ebix, led by 51-year old Kashmiri Robin Raina, is a supplier of on-demand software and e-commerce services, the deal will be a strategic fit for both companies, with Ebix’s expertise in business-to-business segment. Through this deal, Ebix would be able to cater to every financial needs of consumers in the travel industry be it airlines, car rentals, or hotels and cross-sell products. In fact, after MakeMyTrip acquired rival GoIbibo, Yatra was facing a stiff challenge from the combined entity.

The deal is expected to close by 4Q2019. The deal remains subject to approval by Yatra shareholders, clearances by the US Securities and Exchange Commission and Nasdaq of the registration and listing of the Ebix convertible preferred stock and other customary closing conditions.

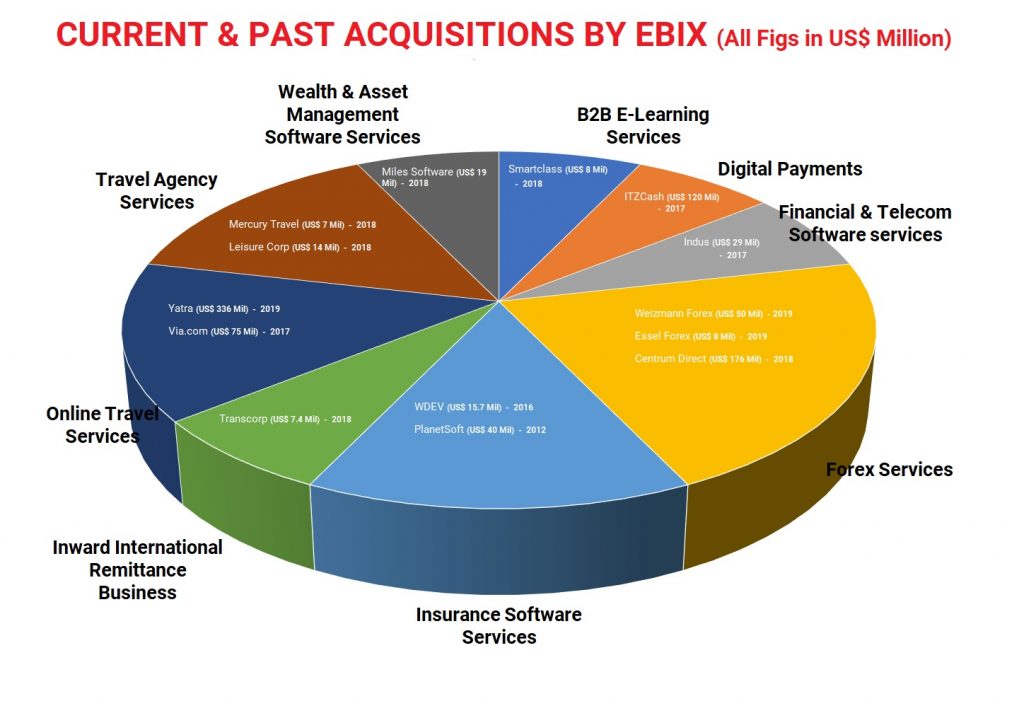

In the last two years, Ebix has acquired nearly 20 companies of various sizes to grow its footprint not only in India but the entire Southeast Asian Nations.

Deal synergy

The company has underlined few months ago that it is number two in business-to-business, consumer or retail markets and wanted to become number one by acquiring Yatra. As India’s travel business, especially online travel business is growing significantly, Ebix will position itself in an advantage position and ride the growth curve. Through the merger, the company expects to take its Gross Merchandise Volume (GMV) — total volume in dollars of sales over a given time period on an e-commerce site — up from $2.5 billion to $4 billion, which will catapult them into the number one position.

To be sure, under Ebix’s travel platform, the merged entity will leverage Yatra’s existing customer base, service offering and multi-channel platform to take advantage of the market opportunity in India. The combined company will have an international footprint with more than 11,000 employees and a travel expanse spanning the GCC, ASEAN and the rest of Asia Pacific. The transaction will also provide the necessary scale to extend its travel business to North America, Latin America and Europe.

In its management commentary, Ebix has underlined that acquiring Yatra will boost its earnings and profitability and help in going public. In fact, Ebix has been planning to float an initial public offer (IPO) through its India subsidiary EbixCash for the past year. Both the companies will have the advantage on each other’s global outreach. In fact, EbixCash’s inward remittances business in India conducts around $5 billion gross annual remittances business, commanding a premium position. EbixCash, through its travel portfolio of Via and Mercury, is also one of Southeast Asia’s leading travel exchanges with over 2,200 employees, 212,450 agent network, 25 branches and over 9,800 corporate clients; processing an estimated $2.5 billion in gross merchandise value per year.

Past deals by Ebix

In May 2017, Ebix entered India after purchasing 80% stake in ItzCash for Rs 800 crore from Essel Group and other shareholders. Same year in November last year it acquired online travel portal via.com for $75 million. The acquisition helped Ebix grow its footprint not only in India but also in South-East Asian countries such as Indonesia, the Philippines and Singapore.

In the same month, it also acquired Mumbai-based Mercury Travels and Leisure Corp for $14.2 million to establish a travel division dedicated to luxury, events and sports-related travellers. Interestingly, Leisure Corp managed travel services for big sporting events such as Cricket World Cup and FIFA Football World Cup. Since then, the company has made several acquisitions across sectors such as travel, foreign exchange, remittances and education. In August last year, it acquired Centrum group’s forex business Centrum Direct for Rs 1,200 crore.

To increase its footprint further in India, Ebix acquired 80% stake in Indian Software-as-a-Service (SaaS) travel company Zillious Solutions, a market leader in corporate travel in the country. The founders of the company also joined the board. The management of Ebix has made it amply clear that it does not want to buy any offline player, but at the same time, already have 1,20,000 franchisee across the country. While the company has appointed travel agents across the country, it is fully digital.

About Ebix

The company was formed by Robin Raina, who pursued industrial engineering from Thapar University in Punjab and joined a company called Pertech Computers, which later entered into a joint venture with Dell Computers. He joined Ebix in the year 2000 as vice-president and led the country’s growth for close to two decades. Along with the company’s growth, he too moved up the ladder.

At present, Ebix has over 50 offices across six continents, providing on-demand software and e-commerce services to the insurance, financial, healthcare and e-learning industries. Called as “Phygital” strategy, the company combines 320,000 physical distribution outlets in many Southeast Asian Nations countries, to an omni-channel online digital platform. The company’s EbixCash Financial exchange portfolio encompasses leadership in areas of domestic and international money remittance, foreign exchange (Forex), travel, pre-paid & gift cards, utility payments, lending, wealth management, etc. in India and other markets.

EbixCash’s Forex operations have emerged as a leader in India’s airport foreign exchange business with operations in 32 international airports. Even in the insurance sector, the company’s focus is to develop and deploy a wide variety of insurance and reinsurance exchanges on an on-demand basis, while also, prove SaaS enterprise solutions in the area of CRM, front-end and back-end systems, outsourced administration and risk compliance services, around the world.

About Yatra

Yatra Online Inc a parent company of Gurugram-based Yatra Online Pvt. Ltd. It provides corporate travel services provider with over 800 corporate customers and one of India’s leading online travel companies by the name Yatra.com. The company provides information, pricing, availability, and booking facility for domestic and international air travel, domestic and international hotel bookings, holiday packages, buses, trains, in city activities, inter-city and point-to-point cabs, homestays and cruises.

Among the shareholders of Yatra are Reliance Industries-owned Network 18, Macquarie Group and Rotation Capital. It is one of the leading platforms for accommodation options by providing real-time bookings for more than one lakh hotels in India and over one crore hotels around the world. Launched in August 2006, Yatra was ranked the Most Trusted E-Commerce Travel Brand in India in the Economic Times Brand Equity Survey 2016 for the second successive year and has won the National Tourism Award for ‘Best Domestic Tour Operator (Rest of India)’ at the India Tourism Awards held in September 2017 for the third time in a row.

Conclusion

Ebix has been on a break-neck acquisition spree for few years and the company has taken substantial risks in the Indian business. It seems to see huge opportunity in the Indian market and Yatra acquisition is strategic and may be compelled due to MakeMyTrip acquisition of rival GoIbibo. It now needs to work on the transition and work out the synergies and grow in the business. Now how quickly and smoothly it carries our post-acquisition integration in terms of services, finances, marketing, customer acquisition and customer services is the key to its success and retaining number one brand in travel services. The past acquisitions will make it a dominant player in the industry and can gradually increase its market share.

Add comment