Videocon Industries Limited (VIL) was founded in the year 1986. Current director of Videocon claims that Videocon is the first company to bring colour TV’s in India.

Around 1990 Videocon was one of the most iconic consumer electronic brands in India. Promoters of the Videocon further diversified business of the company in Oil, Gas, Telecom Retail and DTH service. Diversified businesses of the company were capital intensive and for running the same Company borrowed huge amount of money from the financial institution. Though Company diversified into many businesses, consumer durables was the largest source of revenue, but the Company failed to build its brand royalty and other competitors like Samsung, LG, Sony overtook them.

In three consecutive financial years until September 2008, Videocon’s India business had registered standalone profits of over Rs. 800 crores with a focused approach in the consumer electronics business. Videocon’s debt surged because of its failed telecom services business – it lost about Rs. 7,000 crores in telecom – and the picture tube plant modernisation in Gujarat that cost Rs. 4,000 crores. Over time, the market value of the fridge-to-phone company tumbled way down to Rs. 600 crores. The decline started with Dena Bank classifying its Rs 520 crore loan to Videocon as an NPA in the quarter ending March 2017.

Admission for bankruptcy proceedings

Application for initiation of bankruptcy proceedings under Insolvency and Bankruptcy Code, 2016 (IBC) against the Videocon Industries Limited (VIL) was admitted by National Company Law Tribunal (NCLT) vide order dated June 06, 2018. The claim against the VIL and Videocon Telecommunications and other group companies by financial creditors added up to a whopping more than Rs.60,000 crore making it India’s one of the largest bankruptcy cases. The consortium of banks led by State bank of India filed multiple pleas in various courts against VIL and 14 other Companies after they defaulted on payments to a consortium of banks. Total amount claimed by financial creditors against Videocon Industries Limited is Rs. 59,451.87 Crores out which State Bank of India has claimed Rs.11,175.25 crores and claim accepted of SBI is Rs. 10,978.58 Crores.

Videocon group has mainly three kind of businesses viz. Consumer Home Appliances (CHA), Telecom and foreign Oil & Gas business.

Consolidation of Insolvency proceedings

Mr. Venugopal N. Dhoot, ex-director/promoter filed an application before the principal bench, NCLT New Delhi praying that all the CIRP proceedings pending against the Videocon Group Companies must be heard by one and the same court of Mumbai Bench of NCLT. Application asking for same relief i.e. consolidation of CIRPs of all the Corporate Debtors was also filed by the State Bank of India before the Principal Bench

It was submitted by the state bank of India that since the Corporate Debtors i.e Videocon Group Companies have been running their business, operations of all the business of the companies are interdependent on each other as if they were a single entity and a single economic unit and all the lending have been done on such basis, therefore, the entire line of credit by Banks and financial institutions to the Corporate Debtors was extended relying upon their unity in business and operations. So, the loans were extended with the understanding that the Corporate Debtors will be ‘jointly and severally’ liable for the obligation owed to the lenders.

The Hon’ble Principal Bench disposed of both the applications filed by Mr. Dhoot and State Bank of India vide a common order transferring all matters of CIRP commenced against the VIL and its other group companies to NCLT, Mumbai Bench as it will, inter alia, serve the basic purpose of tagging of all matters to avoid conflicting orders, if any, in the connected matters. Following the NCLT order, only one resolution plan for all Videocon units is required to be filed by the applicants. Total Amount claimed by Financial Creditors in case of Consolidated Insolvency Resolution Process is Rs. 63,649.11 Crores out of which claims of Rs. 61,740.58 has been accepted by the Resolution Professional. On the other side total consolidated claim of operational creditors is Rs.6,376.79 Crores out of which claims of Rs. 1,274.97 are admitted and claims of Rs. 1,679.52 are under verification as on December 2019.

Table 1: Top 10 Financial Creditors in case of Consolidated CIRP of 13 Videocon Companies as on Dec 2019

| Sr No. | Claimant | Total Claimed (Amnt. In ₹ Crores) | Admitted Amount (Amnt. In ₹ Crores) |

| 1 | State Bank of India | 11,487.10 | 11,151.85 |

| 2 | IDBI Bank | 9,921.64 | 9,920.55 |

| 3 | Central Bank of India | 5,278.26 | 5,207.28 |

| 4 | ICICI Bank | 3,380.85 | 3,379.99 |

| 5 | Union Bank of India | 2,623.23 | 2,609.84 |

| 6 | Corporation Bank | 2,527.23 | 2,527.23 |

| 7 | EXIM Bank | 2,365.42 | 2,365.42 |

| 8 | Bank of Baroda | 2,413.67 | 2,362.49 |

| 9 | Punjab National Bank | 2,348.76 | 2,336.68 |

| 10 | Bank of India | 2,322.94 | 2,322.94 |

While issuing order on consolidation of CIRP NCLT has directed to compute the timeline of 180 days as given under section 12 of IBC from the date of such order i.e 08.08.2019. Accordingly, the timeline of 180 days finished on 4th February 2020. Upon filing an application for extension of time for further 90 days, the extended time limit will come to an end on 4th May 2020.

Inclusion of Overseas assets in the ongoing insolvency process

NCLT has directed vide order dated 12th February 2020 for the inclusion of Videocon Industries’ overseas oil and gas business in the ongoing insolvency process.

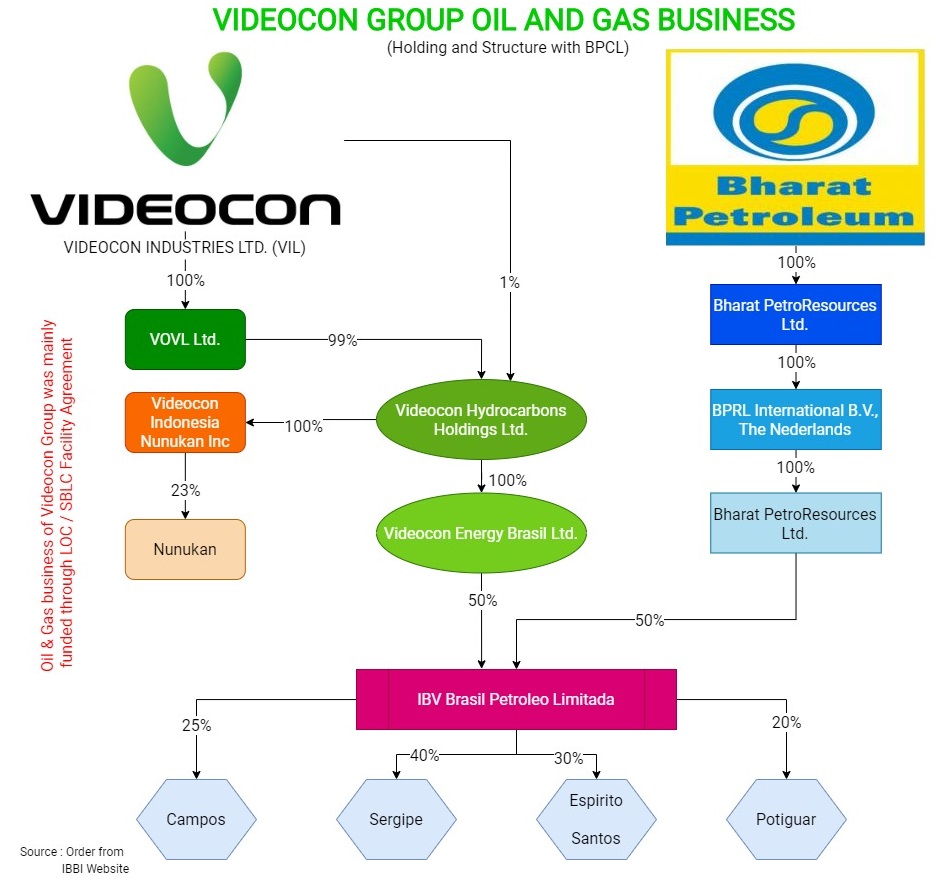

Mr. Venugopal Dhoot filed a miscellaneous application under section 60(5)(c) of IBC praying that moratorium to be declared as per the provisions of the IBC on foreign oil and gas assets and on all other rights, tangible and intangible assets, benefits held by VIL and VOVL Ltd, Videocon Hydrocarbon Holdings Limited, Videocon Energy Brasil Limited and Videocon Indonesia Nunukan Inc. [Collectively known as Special Purpose Vehicles (SPV)]

In the application submitted to NCLT, Mr. Dhoot stated that, foreign oil and gas assets were initially acquired by the VIL and SPV created only to hold such assets. Such SPV are acting like extended branch of the VIL and had no separate control and management and decision-making power on its own.

It was further stated in the application that under the provisions of the Foreign Exchange Management Act, the foreign subsidiaries could easily get the finance in the foreign countries in the foreign currency under the automatic route on the basis of the guarantee of the Indian holding company i.e. the present Corporate Debtor/VIL. Whereas, the substantial time was being wasted to send money of cash call from India to abroad as it required specific permission from Reserve Bank of India under the approval route and therefore just for the convenience purpose the SPVs were created. However, the said SPVs companies never did any other business except holding the participating interests for and on behalf of present Corporate Debtor i.e. VIL.

In response to the application filed by Mr. Dhoot, State bank of India contended that the Adjudicating Authority i.e. NCLT do not enjoy any jurisdiction over the foreign companies so no order of restraining the sale of such assets can be passed by the NCLT. The subsidiary and its assets are not the assets of the holding company and that the subsidiary and its assets are separate and independent. Section 18 (1)(f) of the IBC mandates the Resolution Professional to take control and custody of any assets over which the Corporate Debtor has ownership right as recorded in the balance sheet of the Corporate Debtor. In the present case, the balance sheet of the present VIL does not reflect the foreign oil and gas assets as assets of the Corporate Debtor. Hence such assets cannot be treated as assets of the VIL.

Post Application from Videocon’s MD, Mr. Dhoot, NCLT has directed to consider all the 13 companies under one Insolvency Proceedings to be held at the NCLT, Mumbai Bench.

The effect of such order is that Financial creditors of the VIL cannot sell such assets directly to recover their dues.

What’s Next?

The process to find a buyer for Videocon Group was started in August 2019. Due to NCLT’s order for consolidation of insolvency proceedings, all potential bidders are expected to submit a comprehensive resolution plan and not to bid for assets or businesses separately.

Haldiram’s, Vedanta and Indonesian billionaire Robert Haronto are among the prospective resolution applicant competing to acquire the Videocon Industries. According to banking sources, other suitors in competition to acquire the Videocon industries are strategic and financial investor and state-run oil and gas company. VIL has informed the BSE and NSE that pursuant to the approval of the committee of creditors vide its meeting held January 31st, 2020 and in light of order of the NCLT, Mumbai Bench to maximize the value of corporate debtor the last date for submission of Resolution Plan has been extended to March 16, 2020.

Conclusion

Videocon’s insolvency has been mired in litigation ever since SBI first dragged the company to the NCLT for Insolvency Proceedings. To avoid conflict of order NCLT passed an order for consolidation of CIRP proceedings of Videocon group companies. Due to such order passed by the NCLT resolution, applicants will have to submit comprehensive resolution plan for all the units of the Videocon which may cause delay in recovering the pending dues. Though some buyers may be interested in purchasing specific business/assets such buyers cannot do the same. NCLT further restrained the financial institutions from selling the foreign oil and gas assets and passed an order for the inclusion of those assets into the Insolvency proceedings. Foreign assets were purchased by Videocon after entering into an agreement with state-run Bharat Petroleum Corporation Limited. The two partners reportedly invested over $2 Billion in development of assets in last six to eight years. Considering the complexity of the case and orders passed by the Adjudicating authorities it will take more time to find a solid solution to recover the pending dues.

Add comment