Last year, the Board of Directors of Pioneer Distilleries Limited & United Spirits Limited at its meeting, approved a scheme of amalgamation in relation to the proposed merger of the Company with its parent company United Spirits Limited under Sections 230 – 232 and other applicable provisions of the Companies Act, 2013 and the rules thereof.

Pioneer Distilleries Limited (PDL), a listed company is engaged in the business of manufacture and sale of extra neutral alcohol, malt spirits, Indian Made Foreign Liquor (IMFL) and other allied products, including bottling operations. PDL is a bulk spirit supplier & bottler to United Spirits Limited. PDL has undertaken capacity expansion during FY17 and FY18 in its plant in Dharmabad, Nanded. However, due to multiple stoppages in the utilities/plants and designing of plant and complexities involved, the plant is being operated at a lower capacity utilization of about 60%.

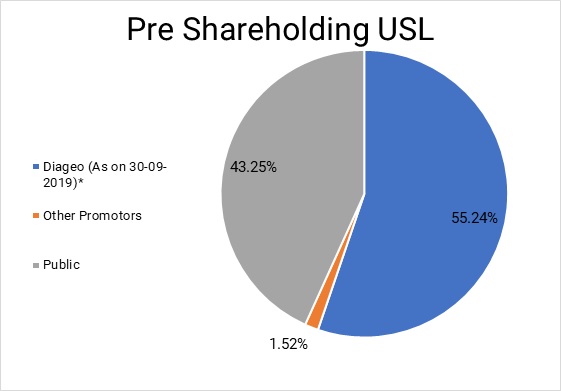

United Spirits Limited (USL), a listed company is engaged in the business of distilling, rectifying and blending of spirits, and production of ethyl alcohol from fermented material. USL, a 55.24% subsidiary of global spirits leader Diageo, manufactures, sells and distributes a portfolio of premium brands such as Johnnie Walker, Black Dog, Black & White, VAT 69, Antiquity, Signature, Royal Challenge, McDowell’s No.1, Smirnoff, Captain Morgan and Four Seasons. In 2011-12, USL acquired PDL and as on date, USL holds 75% stake in PDL.

The Transaction

Pioneer Distilleries Limited will get merged with its parent company United Spirits Limited under Sections 230 – 232 and other applicable provisions of the Companies Act, 2013 and the rules thereof.

The appointed date for the transaction is 1st April 2019.

Swap ratio for the transaction is 10 equity share of Rs. 10 of USL each for every 47 equity shares of PDL.

Rationale as given by the management:

- Simplification of corporate structure and consolidation of the group’s business.

- Integration of PDL’s operations with the Company resulting in benefits arising out of the synergies, especially since the Company is in the same line of business as PDL.

Due to operational challenges on account of intermittent breakdowns, closure of operations, delay in the stabilisation of operations resulting in underutilisation of capacity and change in terms of the government grant, PDL continued to report operational loss. These losses have resulted in negative net worth. In fact, if one considers adjustment regarding write back of government subsidy of Rs 26.86 crores, net worth was almost nil as on FY 18 also.

United Spirits currently holds 75% in Pioneer Distilleries post its acquisition in 2011-12.

In-spite of PDL continuously incurring operational losses (excluding government grant), PDL sustained its operation due to continuous support from its parent USL.

Last year, the registered office of the PDL has been shifted from Hyderabad to Bengaluru where USL registered office is located.

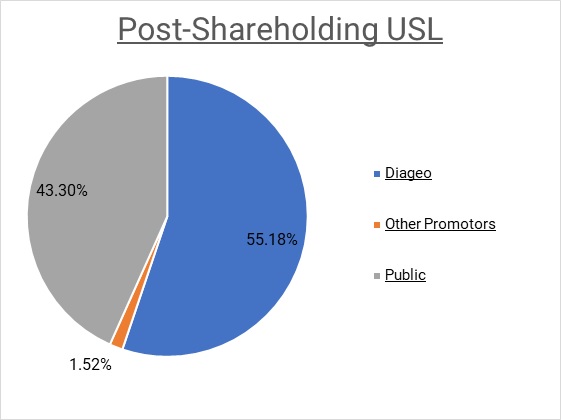

Shareholding Pattern:

*Post filing of the scheme Diageo buys 0.70% stake in USL, so the shareholding of Diageo increase to 55.94%. hence the Post approval of Scheme the shareholding of Diageo will be circa 55.88%.

Due to this restructuring, Diageo’s shareholding slightly decreases to 55.18% from 55.24%, while the shareholding of public is increased.

Taxation:

As on 31st March 2019 PDL having the following carried forward losses, unabsorbed depreciation and MAT credit.

Table 1: Carry Forward Losses (All Figs in INR Crores)

| Particulars | Amount* |

| Carried Forward Losses | 23.05 |

| Unabsorbed Depreciation | 164.48 |

| MAT Credit | 11.68 |

*Note: Above data taken from Annual Report of FY 2019.

According to section 72A (1) of Income Tax Act, 1961, the carry forward losses and Unabsorbed Depreciation of the amalgamating company will be allowed to set-off against the income of the amalgamated company.

Net saving in terms of income tax due to availability of the carry forward losses and unabsorbed depreciation is amounting to circa Rs. 61.60 crores. (Note: Assuming USL adopt for normal taxation provisions).

Related Party Transaction:

Since, acquisition of PDL, USL is continuously supporting PDL to grow or to minimize the losses. PDL is a bulk spirit supplier & bottler to United Spirits Limited. Most of the sales of PDL are to USL only.

Table 2: Related Party Transaction (All Figs in INR Crores)

| Particulars | 2014-15 | 2015-16 | 2016-17 | 2017-18 | 2018-19* |

| Sale of Goods to USL | NA | 47.07 | 51.92 | 61.39 | 79.67 |

| Loan from USL | 321.19 | 327.69 | 332.24 | 358.98 | 296.19 |

| -Non-Current Borrowings | 135.39 | 135.39 | 135.39 | 135.39 | 135.39 |

| -Interest accrued | 37.72 | 52.34 | 64.51 | 75.48 | 86.45 |

| -Trade Advance | 148.07 | 139.95 | 132.34 | 148.11 | 74.35 |

| Govt. Grant | 30.95 | 81.27 | 16.55 | 166.85 | (26.86)- |

Holding company charging interest on Loan at the rate of 12p.a.

Conclusion:

In a move to integrate its operations vertically, in 2012, USL acquired majority stake in then Maharashtra based PDL. USL bought PDL by paying hefty premium to its market value. By the acquisition, USL also expanded its control over prices of raw material. However, USL didn’t able to completely achieve the edge it wanted from the PDL. In any case the merger is an obvious way forward from all the angles. In fact the company shifted registered office of PDL to minimize stamp duty implications also.

Considering the size of PDL, it became imperative for USL to consolidate the operations and thereby reduce the administrative cost and withstand shocks arising out of changes in government policies . During the process, it will also help USL in reduction of some of the tax compliances such as Transfer pricing, GST and reap the benefits from the carry forward losses available with PDL.

Add comment