Facebook Inc. will invest $5.7 billion to pick up 9.99% stake in the digital business of Reliance Industries Ltd. The investment from Facebook values the Jio Platform close to $60 billion. What synergies the combined business will generate that propelled Facebook to pay this hefty amount?

Connected Ecosystem of the Combined Business

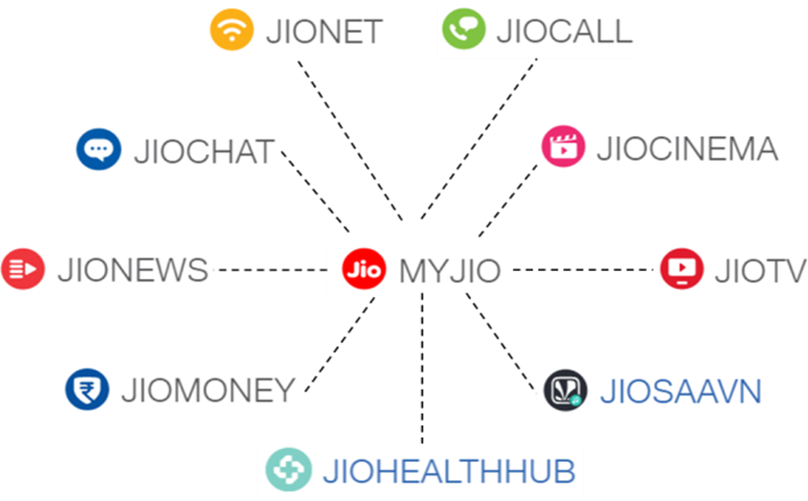

Jio Platform is the digital services entity that houses Reliance’s telecoms arm Jio Infocomm, as well as its news, movie and music apps, along with other businesses. The platform was launched to bring India’s No. 1 connectivity platform, leading digital app ecosystem, and the world’s best tech capabilities to create a digital society for each Indian. The platform was growing through mergers and acquisitions such as Saavn’s merger with Jio Music in 2018 and Haptick acquisition in 2019. The Jio Platform includes leading digital apps, digital ecosystem and India’s No. 1 high-speed connectivity platform under one umbrella.

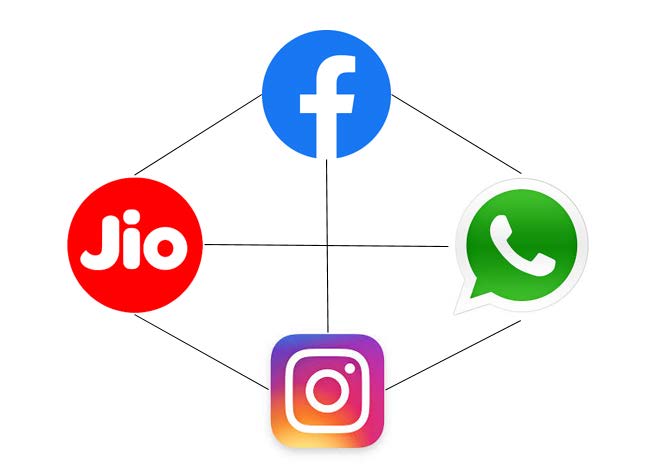

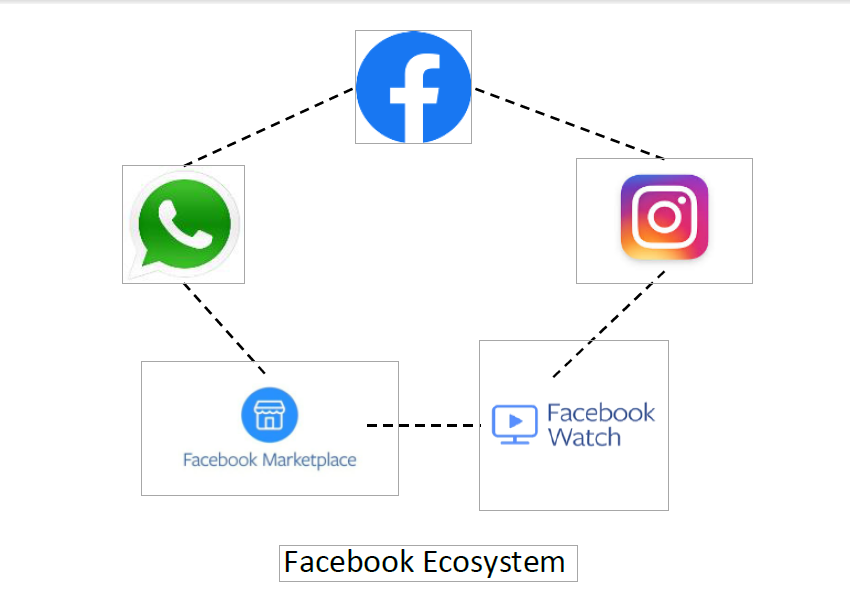

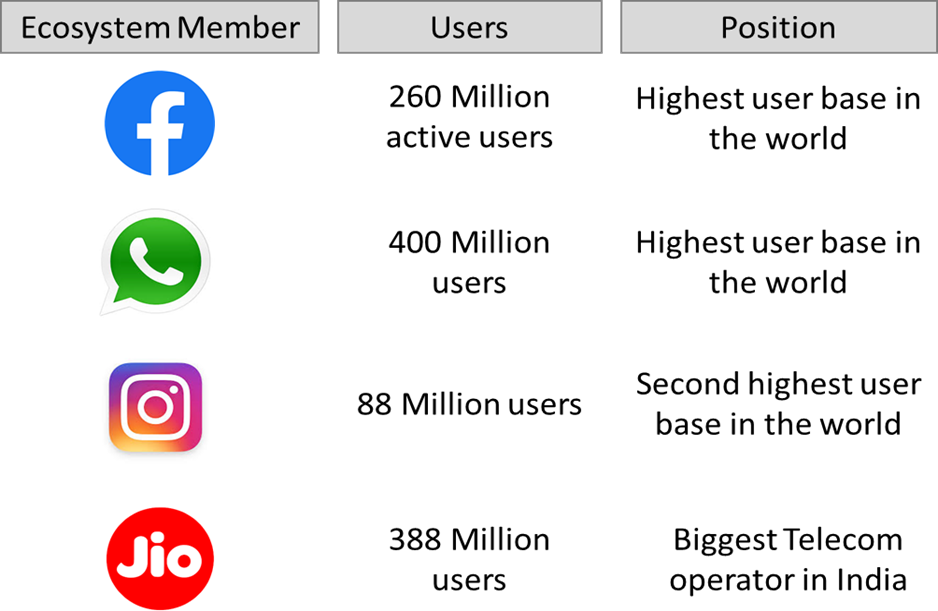

With more than 300 million Facebook users and 400 million WhatsApp users in the country, India is home to Facebook‘s largest user base on the planet. In 2017, it launched a commercial Wi-Fi program called Express Wifi, which allows mom-and-pop stores to provide internet access to shoppers via hotspots at a nominal rate. It currently has 500 local retailers signed up, and more than 10,000 hotspots across India. In 2019, it has also invested in Indian startup Meesho, an e-commerce company that leverages social media to connect customers with resellers.

The focus of the deal is to come up with digital-based solutions for 60 million micro, small and medium businesses, 120 million farmers, 30 million small merchants and millions of small and medium enterprises in the informal sector. Given the reach and scale of the digital ecosystem, Facebook has invested in the platform to create and unlock meaningful value through Network Synergy. The deal will unlock a huge network effect with the combined power of Facebook and Jio’s subscribers across plays in commerce and payments. On one hand, it gives Facebook a wider audience with Jio’s 388 million client, on the other hand it helps Reliance Jio leverage the reach of Whatsapp, Facebook Chat’s service. Facebook can help Jio move to the next level as they have the expertise, technology and global talent.

The two companies could leverage each other’s strengths to build a Connected Ecosystem comprising of digital payments, telecom and offline and online commerce.

What is Network Effect?

Network effects are the incremental benefit gained by an existing user for each new user that joins the network. There are two types of network effects: direct and indirect network effects.

Direct network effects are also known as the same-side effects. The value of service simply goes up as the number of users goes up. If we take the example of telephone, it is only useful if the people that we need to reach also have telephones. The more people there are who have phones, the more useful it is to have one yourself.

Indirect network effect, also known as cross-side effects. With indirect network effects, the value of the service increases for one user group when a new user of a different user group joins the network. Two or more user groups are needed to achieve indirect network effects. Platforms business have two or more user groups exchanging value with one another. In most platforms, there are two user groups: producers and consumers. The more consumers on the network, the more valuable that network is to producers, and vice versa. Taking e-commerce as an example, as more buyers (i.e. consumers) join the platform, the more useful and valuable it is to sellers (i.e. producers), because they have more business opportunities. The reverse is also true.

Network Synergy for the Connected Ecosystem

The deal will jointly create an ecosystem that take advantage of Facebook’s high daily active users and engaged customer base and Jio’s platform assets. For Facebook, this deal presents an opportunity to leverage the partner’s significant reach in India and explore the next-billion-user landscape. It also means the social media giant has a better partner in India’s complex policy lobby, where Reliance has a strong hand. For Reliance Jio, the business will not be dependent solely on how successful the next generation is, as it will continue to grow with the strategic partner. A partner with the ability to build capable and desirable technologies, like Facebook, could certainly help turn the tide for the enterprising carrier.

The various driver of the network synergies are:

1. Phygital (Physical + Digital) Commerce Strategy

At its core, the deal will create an ecosystem by combining both offline and online retail. WhatsApp will empower nearly 30 million small Indian Kirana (grocery) shops to digitally transact with every customer in their neighbourhood through JioMart, the e-commerce venture of Reliance’s retail arm, which will offer customers free express grocery deliveries from neighbourhood mom-and-pop stores. Facebook, through its investment in Meesho, is already evaluating the SME space for e-commerce in India. Shopping in India could transform into a giant, end-to-end network of services with buyers connecting with retailers and placing orders through WhatsApp. The company can also create an ‘e-commerce monopoly’ and an upturn e-commerce ecosystem.

2. 360 Degree Data Monetizing

Facebook constellation is sitting on a huge pile of data which they weren’t able to monetize. The vast quantities of data generated by users of online services can now be processed into valuable information for commercial and strategic gains by leveraging Jio Mart’s reach.

In reverse data sharing, WhatsApp, through its commercial agreement with JioMart, could end up providing deeper and richer data to Facebook which will provide more intense and localized insight into the consumption patterns of Indian customers. This new perspective on Indian consumers will add to Facebook’s already formidable advertising revenue stream.

3. Digital Payment Reach

WhatsApp could leverage Jio’s Payments Bank as a sponsor bank to power its UPI-based payments. The deal will open up Whatsapp’s entire user base for Reliance Jio, including the customers on rival telecom partners.

Jio’s plan to pull all Kirana stores and combine it with the payments mechanism will be an amazing partnership on the payment side. Between Whatsapp, Instagram and Facebook, all commerce can be done through Whatsapp Pay. Having a local partner could help Whatsapp Pay in navigating various regulatory issues, including those related to privacy and local storage.

The power of content, commerce, and community supported by the mobile network can be unleashed for these services at scale, making the impact widespread from e-commerce to telecom to mobile payments and potentially even healthcare and education. Through this deal, JioMart could become a one stop shop for e-commerce, social media consumption, instant messaging and digital payments. The network effect also helps in creating an ecosystem that disincentives users from leaving.

Financial Returns of the Network Effects (Synergies)

The joint value created by a platform stems from its group based advantages. These advantages depend on the platform’s effectiveness in competing with rival platforms.

Just as a firm’s competitive advantages are shaped by the strategy and resources of the firm, so it goes with platform-based advantages. When the platform yields synergy, each member can be thought of as adding something to the network-based advantages.

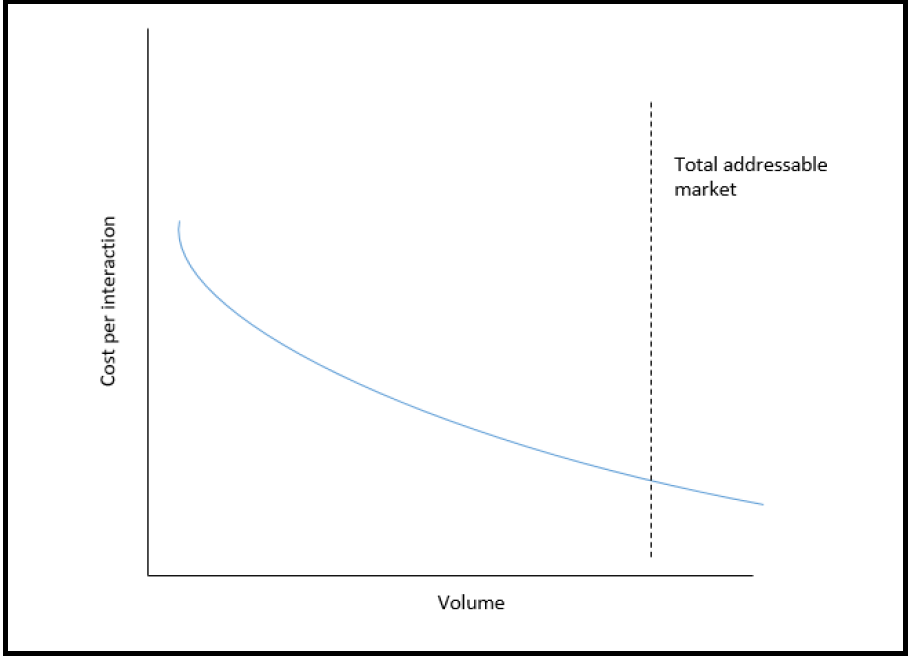

As a platform scales, its costs per unit sold decrease logarithmically in comparison to linear business. A platform grows not by buying more assets, but by acquiring more users, which has a near-zero cost. This costs the platform next to nothing.

Platforms boast higher profit margins and higher price-to-revenue multiples. Perhaps this explains some of the high valuations we see in platform businesses today including the recent Facebook – Reliance Jio deal.

The article is written by Debasish Sarkar – IT Mergers & Acquisition – Associate Director – Deloitte India in his personal capacity and doesn’t reflect the views of his employer.