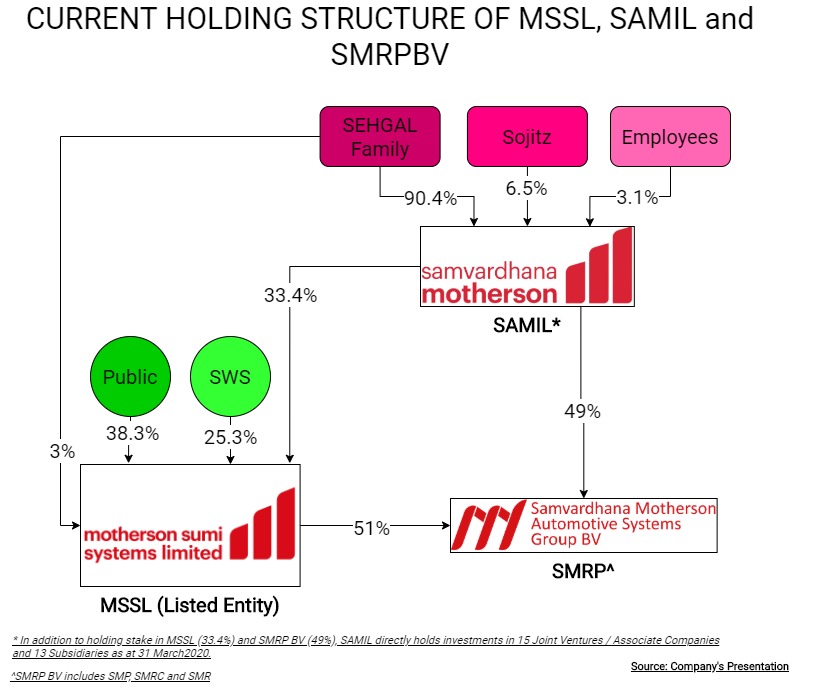

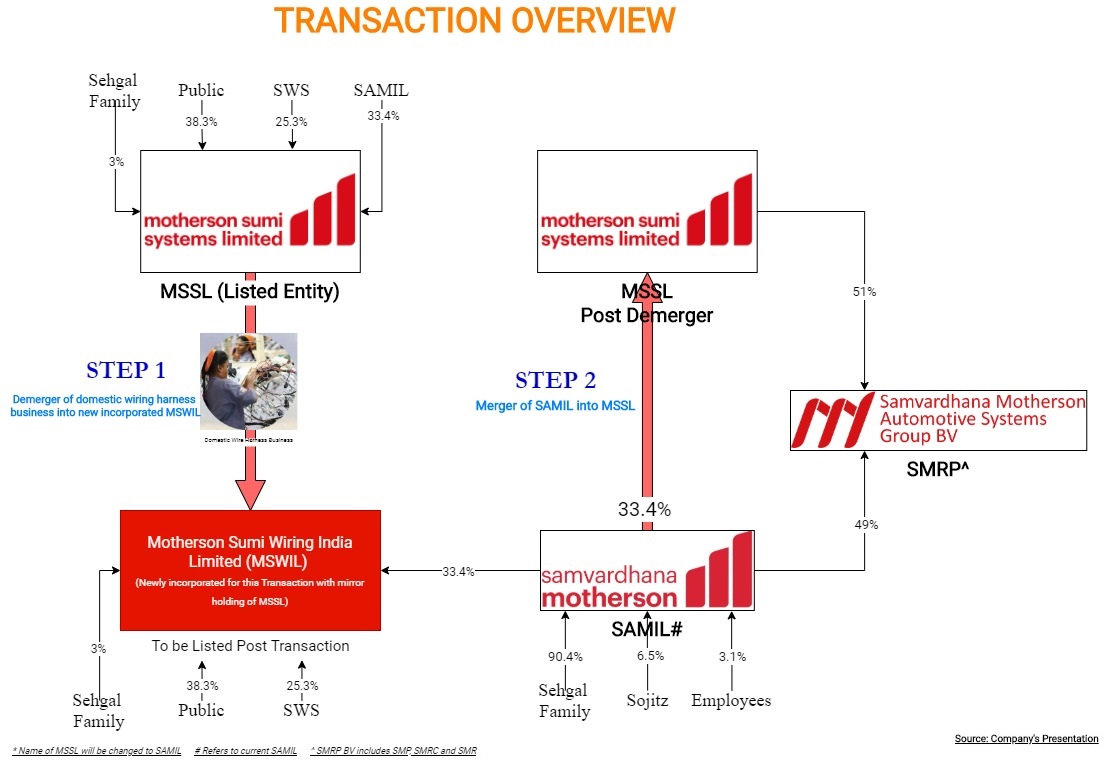

As a part of a long-standing demand of Sumitomo Wiring Systems, the joint venture partner of Motherson Sumi Systems Ltd (MSSL), the board of directors approved a new corporate structure. Under this, the domestic wiring harness business will be demerged into a separate entity, Motherson Sumi Wiring India Limited (MSWIL) a newly incorporated company incorporated for the purpose of the scheme, which will be subsequently listed on the stock exchanges. Also, Samvardhana Motherson International Limited (SAMIL), the holding company, will be merged with the existing organization, which will include the rest of the automotive component businesses.

Motherson Sumi Systems Limited (MSSL) is one of the world’s leading specialised automotive component manufacturing companies for OEMs. MSSL was established in 1986 as a joint venture with Sumitomo Wiring Systems and was listed in 1993 on BSE and NSE in India. With a diverse global customer base of nearly all leading automobile manufacturers globally, the company has a presence in 41 countries across five continents. MSSL is currently the largest auto ancillary in India MSSL is the flagship company of the Motherson Group.

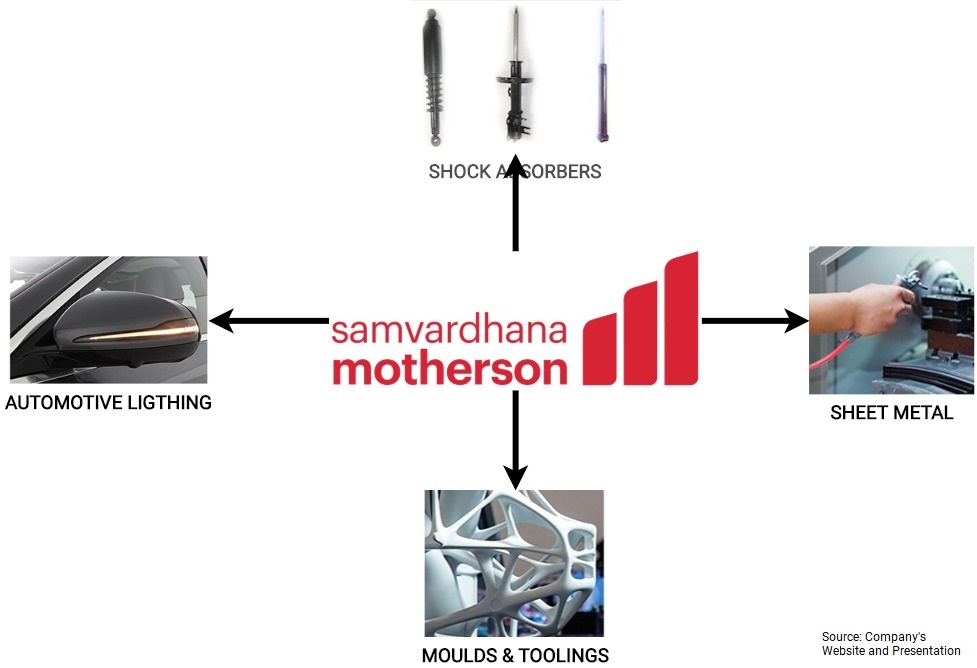

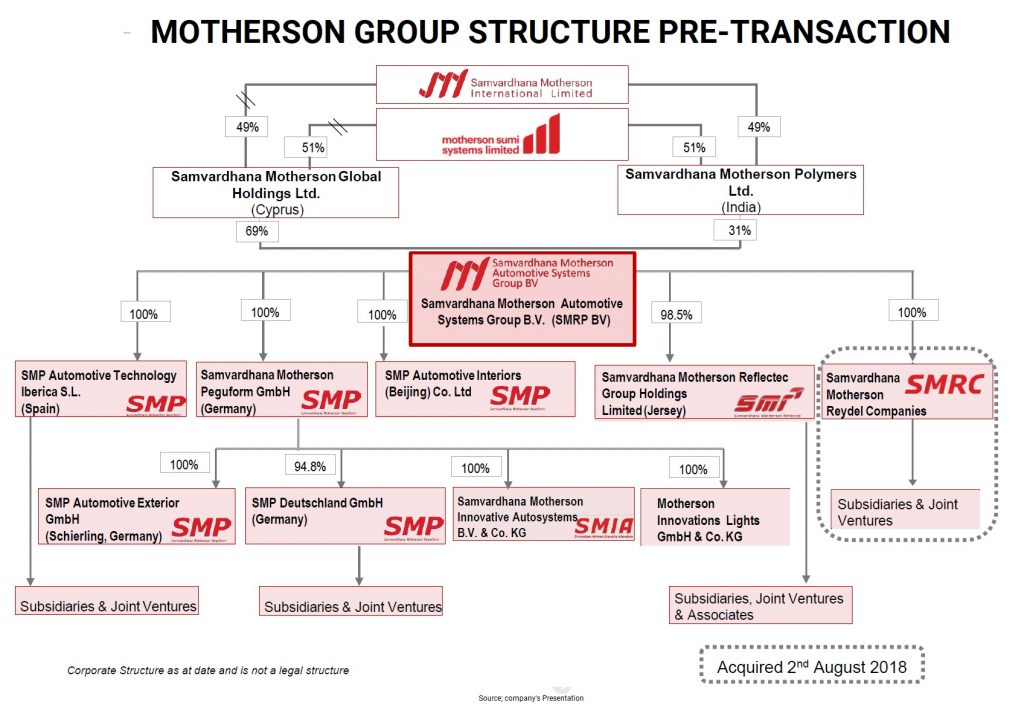

Samvardhana Motherson International Limited (SAMIL) is a non-deposit taking systemically important core investment company (CIC-ND-SI) registered with the Reserve Bank of India and is engaged in the business of holding and nurturing its investments in various subsidiaries and joint-venture companies in India. It is the principal holding company of Motherson Group. Excluding MSSL’s holding, SAMIL, through its subsidiaries and joint venture companies, is inter alia engaged in the business of manufacturing of automotive components and ancillaries, including automotive lighting systems, extruded and injection moulding tools and components, air intake manifolds, pedal box assemblies, heating ventilating and air conditioning (HVAC) systems for vehicles, cabins for off-highway vehicles, machined metal products, cutting tools, etc. SAMIL helps build the group’s diverse product portfolio in auto and not auto product segments and fosters deep manufacturing and design capabilities across the operating companies, to support a wide spectrum of ever-evolving customer requirements.

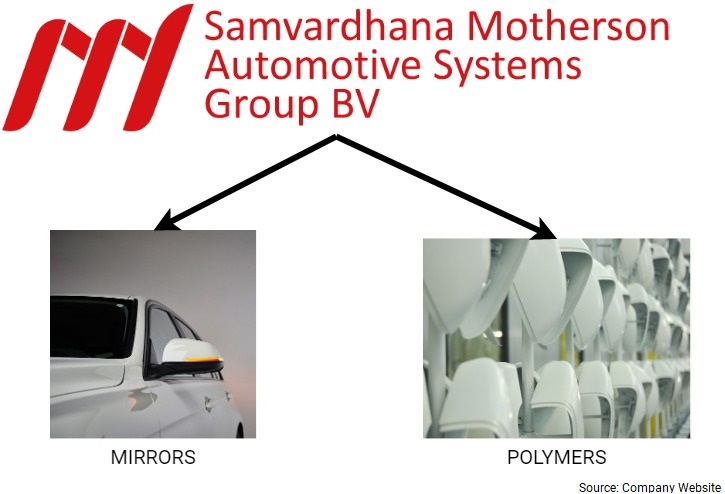

Samvardhana Motherson Automotive Systems Group BV (SMRP BV) is a joint venture between Motherson Sumi Systems Ltd. (MSSL) and Samvardhana Motherson International Ltd (SAMIL). SMRPBV operations include supplies to the global automotive industry as a Tier 1 supplier through its subsidiaries.

Current structure of the group

*SWS: Sumitomo Wiring Systems Limited.

The Transaction

To give effect to the proposed reorganization from Appointed Date 1st April 2021, the following transactions have been approved:

Step 1: Demerger of Domestic Wiring Harness business of MSSL into MSWIL

Step 2: Merger of SAMIL into MSSL

The domestic wire harness business will consist of wiring harness business related to a domestic passenger vehicle, Commercial vehicle, 2wheeler and others. MSSL will continue to hold wiring harness business related to export & international business. Post-transaction, MSWIL will be listed on the national bourses. Further, as a part of the scheme, MSSL will be renamed as SAMIL.

Swap Ratio:

- For the demerger of Domestic Wiring Harness Business into MSWIL, 1 equity share of MSWIL will be issued for every 1 share held in MSSL.

- For the merger of SAMIL into MSSL, 51 equity shares of MSSL will be issued for every 10 shares held in SAMIL.

Paid-up Capital of MSSL after re-structuring:

Table 1: Paid-up Capital of MSSL

| Particular | Shares (In million) |

| Outstanding shares of MSSL of face value Re. 1 each | 3157.9 |

| New shares to be issued by MSWIL of face value Re. 1 each | 3157.9 |

| Outstanding shares of SAMIL of face value Rs. 10 each | 473.6 |

| New Shares to be issued by MSSL to the shareholders of SAMIL of face value Re. 1 each | 2415.4 |

| Shares held by SAMIL of MSSL | 1055.8 |

| Resultant Equity Shares of MSSL | 4517.6 |

As a result of restructuring, the total promoter group shareholding in MSSL will increase from the current 61.73% to 68.15%. SWS shareholding in MSSL will be down to 17.7% from 25.3% however, they will continue to hold 25.3% in Domestic Wiring Harness business. The other shareholders of SAMIL will be classified as public shareholders in the merged MSSL.

The proposed transaction is structured in a way to achieve:

- Simplification of group structure and enable MSSL shareholders to benefit through 100% stake in Samvardhana Motherson Automotive Systems Group BV (“SMRP BV”)

- Create a separate independent entity which will house Domestic Wiring Harness business

- Bringing group’s all auto component and allied business in SAMIL under-listed entity.

Valuation:

According to the exchange ratio as evaluated by the valuers, the other business/ investment has given value of circa INR 1,38,000 million.

Table 2: Valuation of MSSL & SAMIL

| Particular | MSSL | SAMIL |

| Circa Average Value Per Share | 101.16 | 516.04 |

| No. of Shares (in million) | 3157.9 | 473.6 |

| Circa Value (in million) | 3,20,000 | 2,44,400 |

The EBITDA for DWH for FY 2020 is INR 5239 million & PAT is INR 2860 million. Assuming it will get PE multiple of ~15, the valuation of DWH will likely to be around INR 42000 million.

Financials

Table 3: Financials of Group Companies for FY 19-20 (Figs in INR Millions)

| Particular | DWH (MSWIL) | MSSL-Ex DWH Standalone | MSSL-Ex DWH Consolidate | SAMIL | Combined |

| Revenue | 39,439 | 40,888 | 6,07,529 | 12,863 | 6,16,248 |

| EBITDA % | 13.4% | 16.9% | 8.1% | 9.8% | 8.2% |

| PAT % | 7.3% | 14.5% | 1.6% | 21.8% | 1.4% |

| Gross Debt | 333 | 13,861 | 1,17,368 | 22,381 | 1,37,533 |

Table 4: Financials of Domestic Wire Harness Business (All Figs in INR Millions)

| Particulars | 2019 | 2020 |

| Revenue | 44,838 | 39,439 |

| EBITDA % | 16.5% | 13.4% |

| PAT % | 8.7% | 7.3% |

| Gross Debt | 63 | 333 |

| RoCE | 64% | 55% |

Conclusion

The announcement of consolidations of SAMIL into MSSL brings all auto component and allied businesses of Samvardhana group under listed entity. It was a long-time demand to merge the SAMIL into MSSL.

The move to demerge the Domestic wire harness is a result of SWS’s desire to focused participation in the Domestic wire harness business. The re-structuring steps was designed in such a way so that SWS will maintain its current stake in DWH business. In future, the reorganisation will give flexibility to SWS to increase its stake in DWH business and take exit from other businesses i.e. MSSL (Post-restructuring).

While the merger of SAMIL will take care of the much-awaited demand of investors by putting whole of SMRPBV in a listed entity, the valuation assigned to the SAMIL looks expensive and minority shareholders have already started expressing their concern over the valuation. No doubt, the move will increase the corporate governance for the group and could create value for the stakeholders.

Add comment