Last month we covered the articles describing the commercial aspects of Facebook & other global leading Private Equity firm’s investment in Reliance Jio. In this article, we will try to evaluate how Reliance Industries Limited (RIL) built Jio (financially) and re-structuring it did before finally going for fundraise. We have tried to divide the article into three parts:

- How RIL financed all the Jio Operations

- Re-Structuring before stake dilution

- Value creation with minimal leakage

No introduction is required for Reliance Industries Limited (“RIL”). However, in brief, it is India’s largest private sector company. RIL’s activities span hydrocarbon exploration and production, petroleum refining and marketing, petrochemicals, retail and digital services.

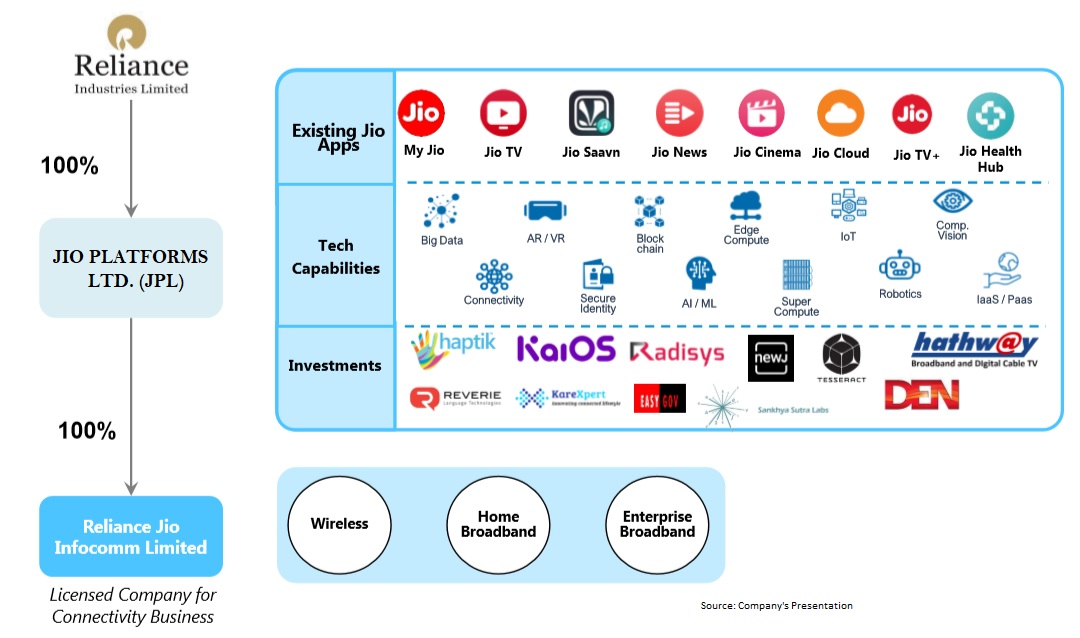

Reliance Jio Infocomm Limited (“RJIL”), a step-down subsidiary of RIL, has built a world-class all-IP data strong future proof network with latest 4G LTE technology.

Jio Platforms Limited (JPL), a WoS of RIL, created to transfer its investment in RJIL. JPL is currently a holding company for RJIL.

Current Structure:

Part A: Unfolding funding History of Jio

It was never a smooth ride for the Reliance Group to create a Telecom/digital behemoth of India. In this roller coaster ride, RIL as a group did multiple re-structuring/collaboration.

In 2013, RIL changed the name of its earlier acquired subsidiary Infotel Broadband Services Limited to Reliance Jio Infocomm Limited. During FY 2010-11, RIL acquired a 95% stake in the equity of Infotel Broadband Services Limited.

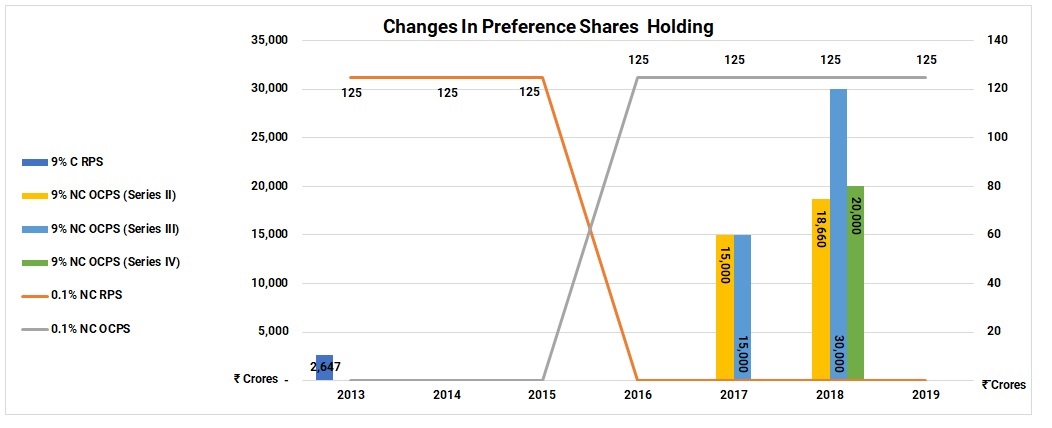

In 2013, RIL infused INR 2647 crore in RJIL in the form of 9% Cumulative Non-redeemable Preference Shares.

In 2013-14

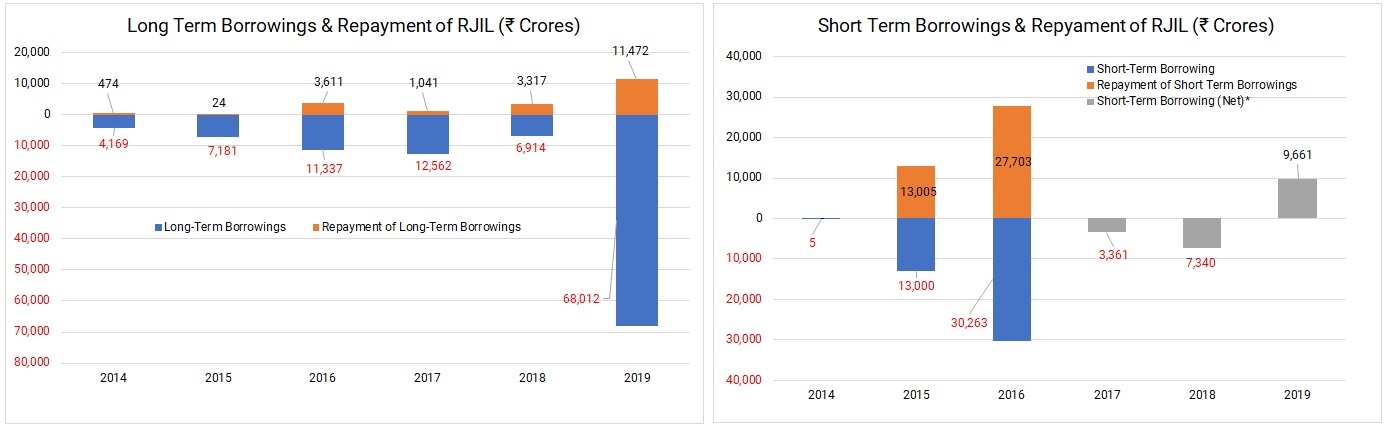

During the years 2013-14, Reliance Jio Infocomm Limited raised financing from banks and other institutions to part finance the capital expenditure.

During the year, RIL’s investment in equity shares of RJIL increased by INR ~17,900 crore while investment in 9% Cumulative Preference Shares became nil as all 9% Cumulative Preference Shares including new issue made during the year were redeemed by the RJIL. However, 0.1% Non-Cumulative Redeemable Preference Shares held by Reliance Industrial Investments and Holdings Limited (RIIHL), a wholly-owned subsidiary of RIL amounting to INR 125 crore remained unchanged.

RJIL also merged Infotel Telecom Limited, Rancore Technologies Private Limited with RJIL.

In 2014-15

The equity stake in the company increased to 99.16%. It subscribed to the additional shares to the tune of INR ~7000 crore.

In 2015-16

The equity stake in the company increased to 99.44%. It also changed terms of 0.1% Non-Cumulative Redeemable Preference Shares held by Reliance Industrial Investments and Holdings Limited to 0.1% Optionally Convertible Preference Shares.

In 2016-17

During FY 2016-17, Reliance Jio Infocomm Limited (RJIL) raised financing from its shareholders, banks and other institutions to finance its ongoing capital expenditure. RJIL issued secured long-term INR non-convertible debentures aggregating to INR 5000 crores. RJIL was the first issuer outside the financial services industry in India to raise funds digitally through the EBP (Electronic Debt Bidding Platform) route in June 2016.

Apart from tying up debt financing from multiple financial institutions, RJIL has the approval to raise up to INR 45,000 crore by way of issuance of Non-Cumulative Optionally Convertible Preference Shares (OCPS) to its existing equity shareholders on rights basis in order to strengthen its capital structure and fund ongoing capital expenditure. RJIL has raised INR 15,000 crore out of OCPS Series II and INR 18,660 crore out of OCPS Series III. The equity stake in the company remained unchanged.

In 2018-19

During FY 2018-19, Reliance Jio Infocomm Limited (RJIL) successfully tied up JPY 53.5 billion – the largest Samurai loan for an Asian corporate and also for a telecom company. Additionally, RJIL tied up US$825 million and EUR 150 million K-Sure-supported Export Credit Agency (ECA) financing with the door-to-door tenor of over 10 years – the largest financing transaction globally in the telecom sector supported by K-Sure.

Reliance Jio Infocomm Limited (RJIL) approved the demerger of its passive infrastructure, tower and fiber assets into two separate SPVs.

Investments by RIL/its Subsidiary in RJIL

*Note: Decrease in cost due to the demerger.

In 2016, the 0.1% Non-Cumulative Redeemable Pref. Shares were converted into 0.1% Non-Cumulative Optionally Convertible Pref. Shares.

Table 1: Financials of RJIL (All Figs in INR Crores)

| Particulars | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 |

| Share Capital | 23,072 | 30,125 | 45,125 | 45,000 | 45,000 | 45,000 |

| A. Equity Share Capital | 22,947 | 30,000 | 45,000 | 45,000 | 45,000 | 45,000 |

| B. Preference Shares | 125 | 125 | 125 | 6,857 | 13,125 | 125 |

| Reserve | -27 | -51 | -74 | 25,864 | 57,933 | -4,600 |

| Borrowings | 14,290 | 18,691 | 32,852 | 47,462 | 58,392 | 75,912 |

| Total Assets | 41,910 | 82,015 | 1,35,726 | 2,00,888 | 2,53,731 | 1,95,780 |

| Non-Current Investments | 37 | 524 | 815 | 873 | 1,016 | 1,108 |

| Turnover | – | – | – | – | 20,154 | 38,838 |

| PAT | -10 | -23 | -24 | -31 | 723 | 2,964 |

Note: The company changed its accounting methods as per Ind-As from 2017.

PART-B: Scheme of Arrangement

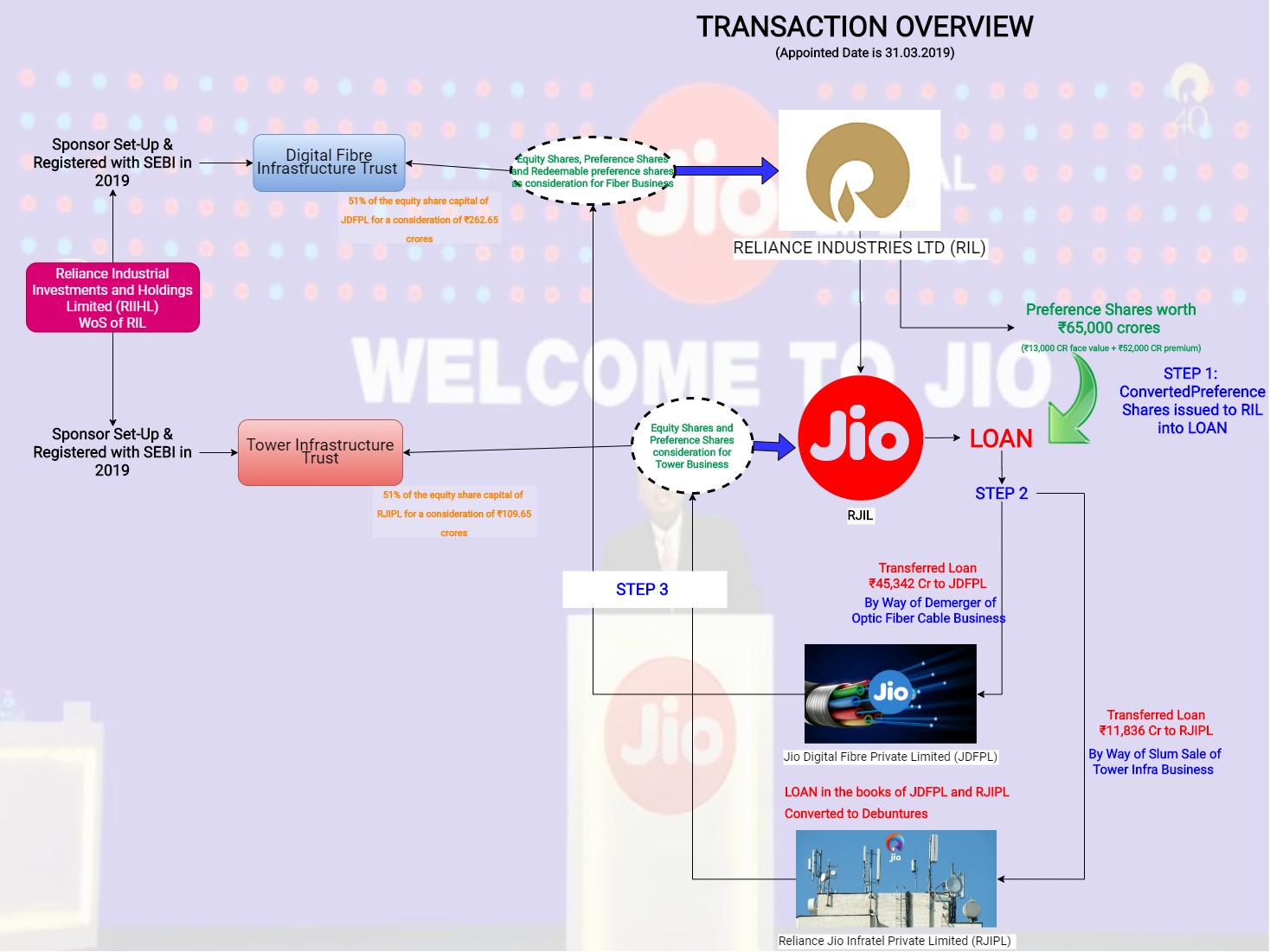

The Board of Directors of the Company at their meeting held on December 11, 2018 approved a Composite Scheme of Arrangement between Reliance Jio Infocomm Ltd (RJIL) and Jio Digital Fibre Private Limited (JDFPL) and Reliance Jio Infratel Private Limited (RJIPL) and their respective Shareholders and Creditors, inter-alia, for:

- a) Reduction of Preference Share Capital and Securities Premium of RJIL (Conversion into Loan);

- b) Demerger of the Optic Fiber Cable undertaking (Demerged Undertaking) of RJIL and its transfer to and vesting into JDFPL; and

- c) Transfer and vesting of the Tower Infrastructure undertaking (Transferred Undertaking) of RJIL to RJIPL for a lump sum consideration, with effect from the Appointed Date of March 31, 2019.

A. Reduction of Preference Shares

The cancellation of 13,00,00,00,000 preference shares, in the books of account of the Company, has the consequence of, the issued, subscribed and paid-up preference share capital being debited with ` INR 13,000 crore for the aggregate face value of preference shares cancelled and the securities premium account being reduced by INR 52,000 crore (Total INR 65,000), by way of constructive payment to such preference shareholders. Correspondingly, equivalent amounts have been credited to loan accounts in the books of account of RJIL, by way of constructive receipt of amount towards loans.

The preference shares (converted into loan) of INR ~57178 crore (out of INR 65,000 crore) were formed part of the demerged/transferred undertaking & transferred to JDFPL & RJIPL. Subsequently, loan amounting INR 57,178 crore was settled by issue of 9% Non-convertible debentures by Jio Digital Fibre Private Limited and Reliance Jio Infratel Private Limited amounting INR 45,342 crore and INR 11,836 crore, respectively consequent to a Composite Scheme of Arrangement.

Table 2: Loan Transfer (All Figs in INR Crores)

| Particulars | JDFPL | RJIPL |

| Loan (Pref. Capital) Transferred | 45,342 | 11,836 |

B. Assets & Liabilities of the Transferred Undertaking

Table 3: Assets & Liabilities of JDFPL & RJIPL (All Fig in ₹ Crores)

| Particulars | JDFPL | RJIPL |

| Total Assets | 91,371 | 36,796 |

| Total Liabilities | 90,870 | 36,546 |

| Net Assets | 501 | 250 |

C. Consideration for the Scheme of Arrangement

Under the Scheme, Shareholders of RJIL/RJIL were having multiple options (Equity Shares of Class A and B, Preference Shares of Class A & B) for consideration for the demerger/transfer of undertaking through Slump Sale. As per 2019 RJIL’s Annual Report, upon selection by the Shareholder of RJIL/RJIL, following consideration has been discharged:

- The Board of Directors of JDFPL allotted:

- 5,00,00,00,000 equity shares of JDFPL of Re 1 each fully paid up, to the shareholders of RJIL in the ratio of one equity share for every nine equity shares held in RJIL.

- 78,13,96,66,092 preference shares of JDFPL of Rs 10 each fully paid up to the shareholders of RJIL for the difference between the value of the assets recorded in the books of JDFPL and book value of the assets of RJIL transferred to JDFPL.

- 12,50,000 redeemable preference shares of Rs 10 each fully paid up to the preference shareholders of RJIL in the ratio of 1 preference share for every 100 preference shares held in RJIL.

- RJIPL has discharged the lump sum consideration to RJIL by the issuance of:

- 2,00,00,00,000 Class A equity shares of Re 1 each fully paid up.

- 5,00,00,000 preference shares of Rs 10 each fully paid up.

D. Setting of a Trust & Divestment

Reliance Industrial Investments and Holdings Limited (“RIIHL”), a wholly-owned subsidiary of RIL as sponsor set up Infrastructure Investment Trust (a) Digital Fibre Infrastructure Trust and (b)Tower Infrastructure Trust and registered them with SEBI. Later, on 31st March 2019,

- Digital Fibre Infrastructure Trust has acquired control of JDFPL by purchasing 51% of the equity share capital of JDFPL for a consideration of Rs. 262.65 crore; and

- Tower Infrastructure Trust has acquired control of RJIPL by purchasing 51% of the equity share capital of RJIPL for a consideration of Rs. 109.65 crore.

During FY2020, RIL has signed a binding agreement with Brookfield Infrastructure Partners LP and its institutional partners for investment in the units to be issued by the Tower InvIT. Brookfield and affiliates will invest INR 25,215 crore in Tower InvIT.

E. Rights Re-alignment

As an integral part of the Scheme, the rights of the existing Capital of JDFPL & RJIPL has been re-aligned.

F. Accounting in RIL’s Book

As per the RIL 2019 Annual Report, RIL, being a shareholder of RJIL, has received Equity Shares and Optionally Convertible Preference Shares with surplus rights (‘OCPS’) of JDFPL. Pursuant to receipt of these Equity Shares and OCPS, the Company has allocated its cost of investments in RJIL into RJIL and JDFPL and elected to value its investment in OCPS at Fair value through Other Comprehensive Income (FVTOCI) and accordingly fair value gain of INR 77,158 crore on OCPS has been accounted in Other Comprehensive Income.

Subsequently, RIL sold its controlling equity stake in JDFPL to Digital Fibre Infrastructure Trust resulting into a total gain of INR 494 crore recognised in the statement of profit& loss. The remaining Equity investment in JDFPL has been measured at FVTPL and OCPS continued to be measured at FVTOCI.

Formation of Holding Company Structure for Jio Platform

To benchmark the global peers, In October 2019, RIL announced that its Board of Directors has approved the formation of a Reliance Jio Platform Limited, wholly-owned subsidiary (“WOS”) for Digital Platform initiatives. After its formation, RIL infused money into it by subscribing to the equity shares and through which it acquired RIL’s equity investment of Rs. 64,450 crores in RJIL. Effectively, RJIL became a wholly-owned subsidiary of the JPL.

| Particulars | Amount (in Crores) |

| Investment in JPL: Equity Shares | 4961 |

| Investment in JPL: OCPS | 177,025 |

| Total | 181,986 |

| Transfer of investment in RJIL from RIL to JPL at cost | 64,450 |

Scheme of Arrangement-Transfer of Creditors

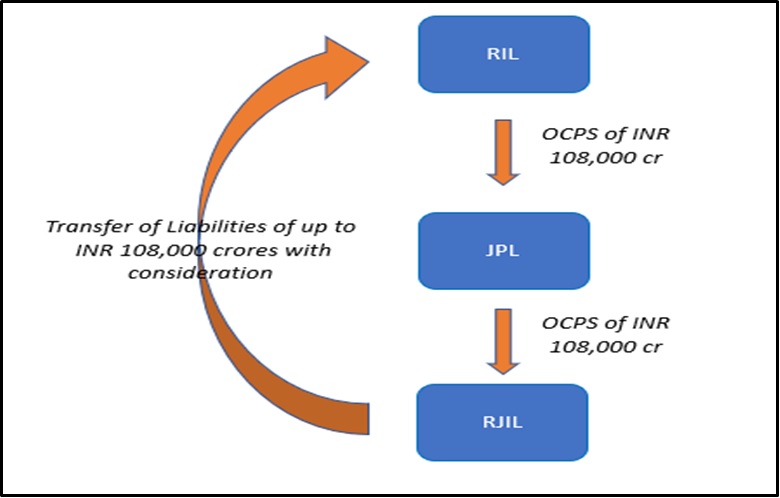

In a move to deleverage RJIL balance sheet, In October 2019, RJIL announced the scheme of arrangement between RJIL and certain classes of its creditors including debenture holders for transfer of identified liabilities of up to Rs 1,08,000 crore to RIL. To pay consideration, RJIL issued OCPS to its holding company i.e. JPL which in turn issued OCPS for the same amount to RIL. The Scheme resulted in the transfer of liabilities from RJIL books to standalone RIL’s book.

PART C: Value Creation through minimal leakage

RIL has had spent tremendous resources in becoming the leading Digital platform company. Entering all together a different league from existing Oil to Chemical (O2C) company, was never easy for RIL. With the help of all free cash flow available from its O2C business, they funded a major part of its inorganic growth strategy of its telecom business. Their strategy of Bolt-on acquisition pawed the way for offering offer a complete digital solution for its customer.

All its strategy was so well planned to create suitable special purpose vehicle for inviting strategic & financial partners. All the capital expenditure done to take the company to a certain mark was financed out of loan and guarantees from parent and minimal equity infusion and Preference shares with an option of converting into equity if needed. They nourished all the telecom business and once all the major expansion was done, they hived-off the asset-heavy telecom business (Optic Fiber & Tower Infra) into a separate company & gave up the control to the trust. At the same time, to participate in the future growth of those businesses, RIL will continue to hold 49% equity. The trust is planning to fundraise through InvIT. After the fund raised, all the significant funding which was in the form of a loan (Preference shares) by RIL will be redeemed. Hive-off of Asset heavy businesses resulted in significant value creation for its digital platform businesses and a perfect candidate for investment for large private equity players, so much that RIL announced/announcing new investments from the world over almost on daily basis.

Later, they created a structure which will allow flexibility to the RIL & its strategic partner by creating a separate holding company for asset light digital company. Immediately before the stake sale, RIL funded RJIL to make its debt-free and in the process savings in tax and enhanced valuation. Of course, after proposed investment by various funds/companies, RIL investments will be insignificant as compared to the enterprise value of the business as funds received on fresh investments will be enough to repay the full funding by RIL.

The whole exercise of funding and restructuring was planned so well that it will result in minimal outflow for the group and value creation for all stakeholders by leveraging RIL balance sheet and innovative tax-efficient structures.

In all the journeys, one thing they assured was returning all the capital expenditure done by RIL and at the same time keeping control over the future business. No doubt, in this process, they created enormous wealth for its stakeholders and earn reputation for the country.

Add comment