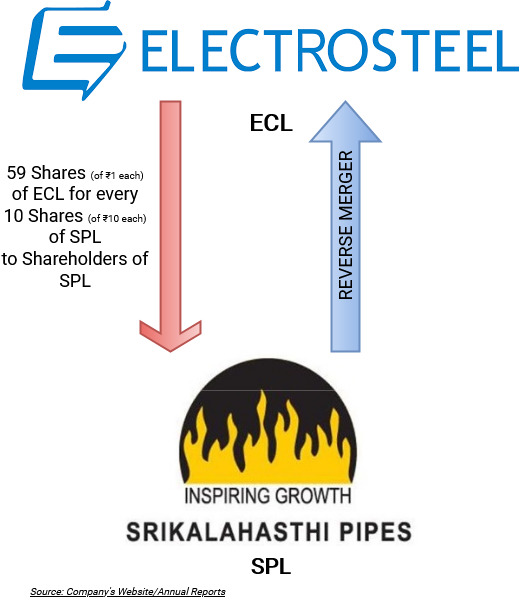

In order to consolidate its position in the ductile iron (DI) pipe industry, the boards of Kolkata-based Electrosteel Castings (ECL) and its associate company Srikalahasthi Pipes (SPL) approved a scheme of amalgamation, proposing that shareholders of SPL receive 59 equity shares of ECL for every 10 equity shares held in SPL. The scheme would be subject to stakeholders’ and regulatory authorities’ approval and the merger process is likely to be completed by the end of this fiscal’s third quarter. Both ECL and SPL are listed with the BSE and NSE.

Electrosteel Castings Limited (ECL) is a listed company and is engaged in the manufacture and supply of Ductile Iron (DI) Pipes, Ductile Iron Fittings (DIF) and Cast iron (CI) Pipes as its core business and produces and supplies Pig Iron, in the process. It also produces Metallurgic Coke, Sinter and Power for captive consumption.

Srikalahasthi Pipes Limited (SPL) is a listed company and is engaged in the manufacture and supply of Ductile Iron Pipe as its core business and in the process produces and supplies Pig Iron and Cement. It also produces Low Ash Metallurgical Coke, Sinter and Power for captive consumption in its integrated complex. SPL is an associate company of ECL.

The Transaction

SPL is proposed to be merged with ECL through a scheme of merger. Appointed Date for the same is 01st October 2020.

Exchange ratio: 59 shares of ECL of Rs 1 each for Every 10 Shares of SPL of Rs 10 each.

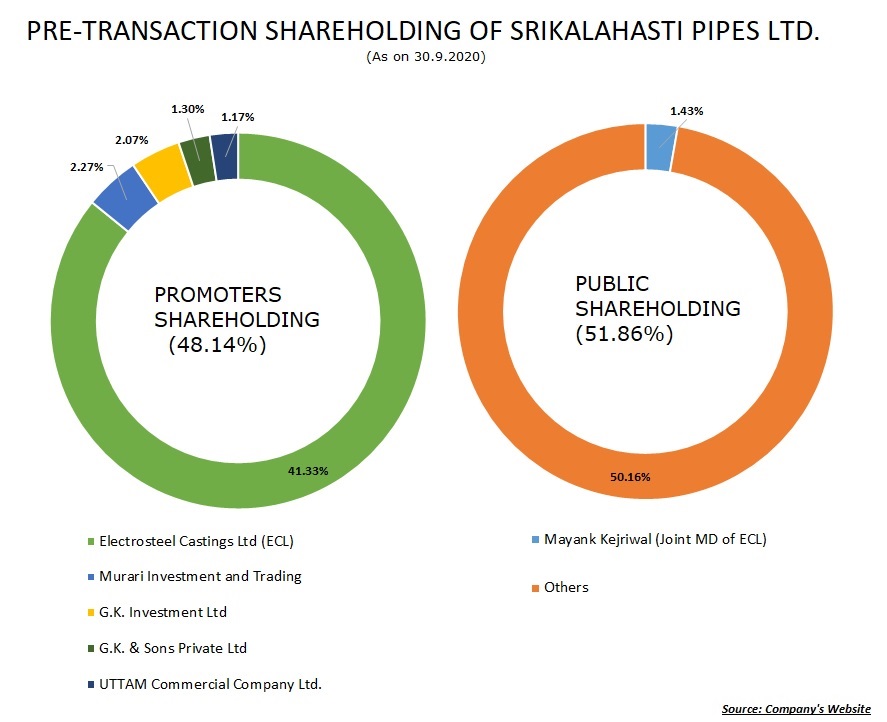

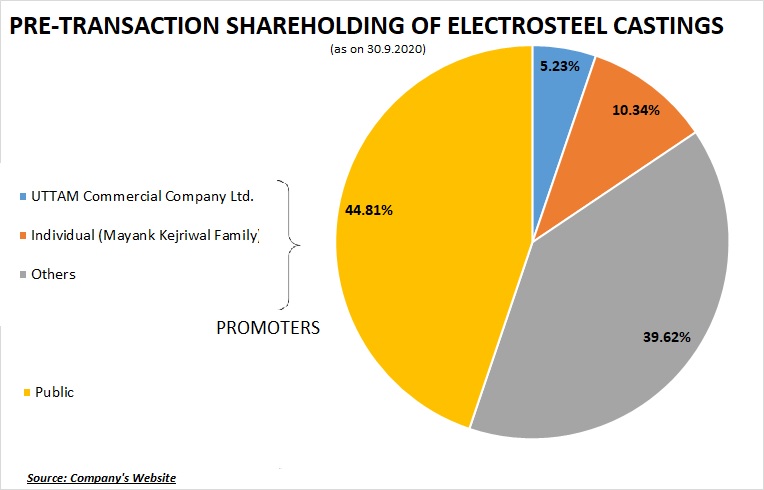

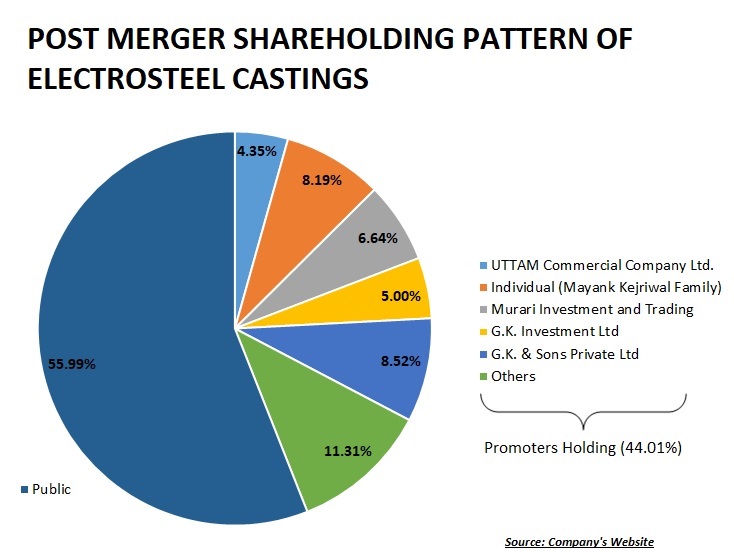

Shareholding pattern (Pre & Post Merger)

ANDHRA PRADESH INDUSTRIAL DEVELOPMENT CORPORATION LIMITED holds 0.52% shares in SPL and has one nominee director on the board.

Promotors increased stake by about 3% in the last six months including some shares bought as late as in the last week of September 2020. that also leads to insider trading allegations. Due to these transactions, this scheme may get glitches from regulators.

Combined Capacity

| Installed Capacity (MTPA) | |||

| Particulars | SPL | ECL | Total |

| DI Pipes | 3,00,000 | 2,80,000 | 5,80,000 |

| Pig Iron | 2,75,000 | – | 2,75,000 |

| Coke Oven Plant | 2,70,000 | 2,25,000 | 4,95,000 |

| Power | 14.5MW | 5MW | 19.5MW |

| Cement | 90,000 | – | 90,000 |

| Sinter Plant | 5,00,000 | – | 5,00,000 |

| CI Pipes | – | 90,000 | 90,000 |

| DI fittings & Accessories | – | 12,667 | 12,667 |

| Ferro alloy Plant | – | 6,277 | 6,277 |

Pig Iron, Coke Oven Plant, Cement and Ferro alloy Plant are used captively to produce DI Pipes and CI Pipes.

The merger will give a cutting edge to ECL as it will result in backward integration for ECL. After the merger ECL will get access to its raw material i.e., Pig Iron, which is used in the manufacturing of CI Pipes, it currently buys from the domestic market including 127 crores from SPL the transferor company. Because of now the large capacity of about 30% market share, it will be able to bid for larger contracts in Di Pipes.

Financials

(₹ in Lakhs)

| Particulars | SPL | ECL | Consolidated |

| Revenue* | 1,72,659* | 2,74,425 | 4,32,434** |

| PAT | 18,768 | 8,630 | 27,397 |

| Finance Cost | 4,620 | 22,758 | 27,379 |

| Depreciation and Amortisation Expense | 4,117 | 5,715 | 9,831 |

| EBITDA% | 18.76% | 14.5% | 16.72% |

| Borrowings | 53,332 | 1,71,813 | 2,25,145 |

| Advances given to KMP of ECL for Supply of Goods | 2,275 | – | 2,275 |

| Net Worth | 1,41,615 | 2,88,137 | 3,57,205 |

| Debt equity ratio | 0.38 | 0.60 | 0.63 |

*SPL sold ₹ 127.94 crores of material to ECL and ECL sold ₹ 18.56 crores of material to SPL.

**After adjustment of related party transaction.

After the merger EBITDA of ECL increase from 14.5% to 16.72%. due to the low finance cost of SPL. Average finance cost of ECL is 13.08% whereas 10.06% for SPL. After merger, the Debt equity ratio of the ECL decreases slightly. In December 2017 SPL raise ₹. 250 crores capital through QIP (Qualified Institutions Placement). Further, ECL will get free access to significant cash & Cash equivalent available with SPL.

Reverse merger

As both companies are in new tax regime, merged entity will not be able to utilise carry forward losses. Reasons for reverse merger seems to be mining rights and litigation related to mines, higher value of immovable properties, large government contracts and difficulties in transfer and registration with government authorities of a new entity, and number of JVs (Joint Venture) and subsidiaries of ECL, and manufacturing facilities of ECL in Two states (West Bengal and Tamil Nadu). However, if loss-making ECL would have merged with profit-making SPL, then the resulting capital base post amalgamation would have been much lower because of that it will be easier to service shareholders.

Not required working capital for GST payment on captive consumption amounting to Rs. ~26 crores.

Conclusion

After merger, the debt-equity ratio of the ECL improves which may enable them to raise finance at a cheaper rate. It also saves on GST and working capital due to captive consumption of many intermediate products.it will unlock value for shareholders of ECL by combining profitable operation of its subsidiary. It is possible that dividend yield for the present shareholders of SPL will get reduced substantially but they may get compensated by way of higher share price.

Add comment