Debt-laden Shapoorji Pallonji (SP) Group taking a step towards reducing debt, has announced a Scheme of Arrangement to separate its Hygiene product and water purifier maker Eureka Forbes Limited. The Scheme will not only pave the way for separation of the Hygiene product business but also list it separately.

Forbes & Company Limited (FCL) is engaged in the business of engineering (precision tools and coding) and residential project development. Further, through its subsidiaries, FCL also carries business of Health & Hygiene products, Shipping Business, and Information Technology. The Registered Office is situated at Mumbai.

Eureka Forbes Limited (EFL) is engaged in manufacturing, and servicing vacuum cleaners, water filter cum purifiers, water and wastewater treatment plant, trading in electronic air cleaning systems, small household appliances, digital security system and fire extinguishers, etc. It is a Wholly Owned Subsidiary (WoS) of FCL. EFL is in the process of shifting its registered office from the state of West Bengal to the state of Maharashtra.

Aquaignis Technologies Private Limited (ATPL) is engaged in manufacturing of electric water purifier₹ It is Wholly Owned Subsidiary (WoS) of EFL.

Euro Forbes Financial Services Limited (EFFSL) is Wholly Owned Subsidiary (WoS) of EFL. Currently, there are no operations being carried by EFFSL.

Forbes Enviro Solutions Limited (FESL) is in the business of manufacturing of RO systems, Water Treatment Plants (WTP), Sewage Treatment Plants (STP), Effluent Treatment Plant (ETP) and AMC Contracts, trading of spares and drinking water (PDW). It is Wholly Owned Subsidiary (WoS) of EFL.

All the companies are part of Shapoorji Pallonji Group (“SP Group”).

The Transaction

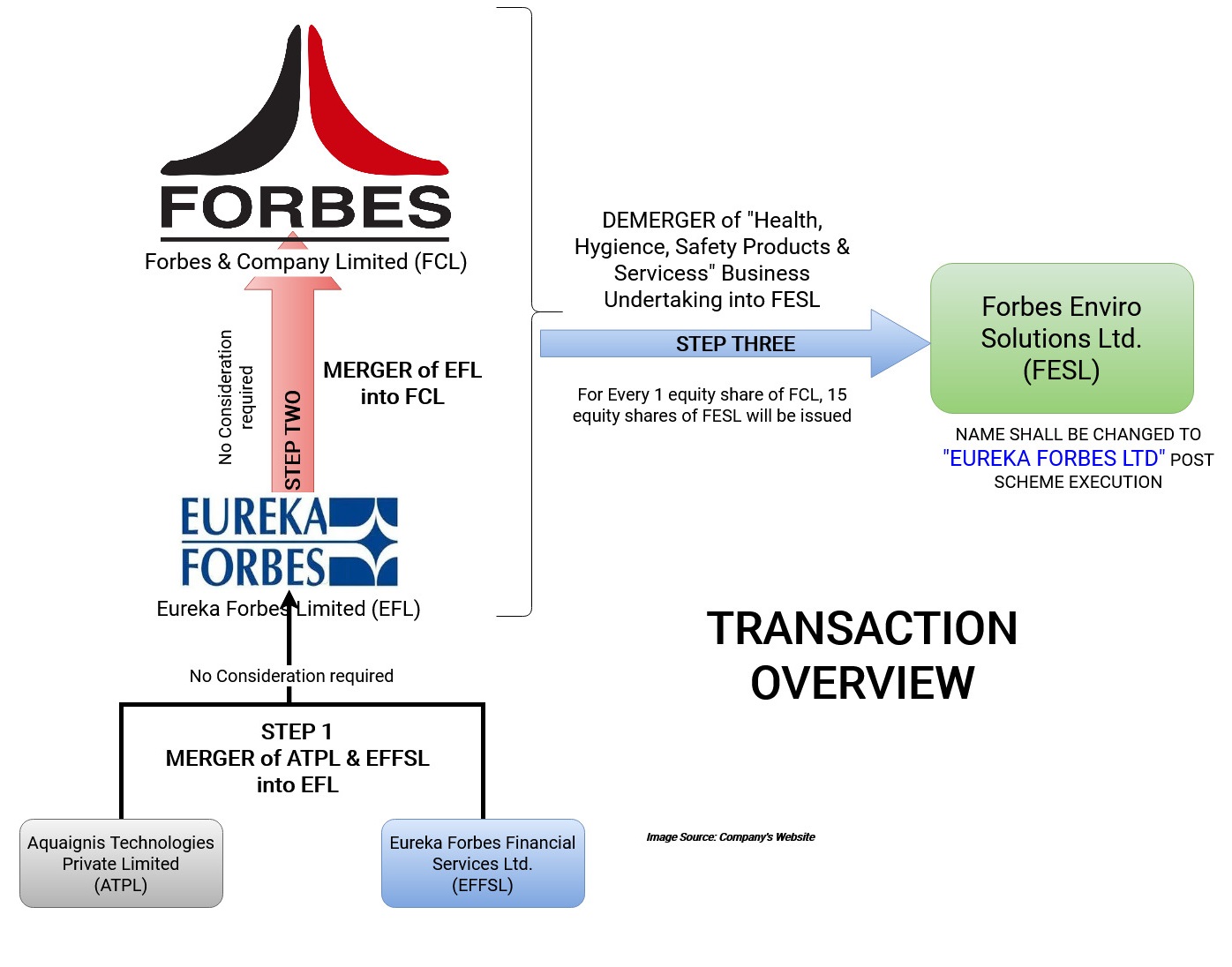

The Board of Directors of Eureka Forbes Limited at their Board Meeting held on September 08, 2020, have inter alia, approved the Composite Scheme of Arrangement (“the scheme”) which, inter alia, provides for amalgamation of Aquaignis Technologies Private Limited and Euro Forbes Financial Services Limited with Forbes and Company Limited. Further, upon the above part of the scheme becoming effective, Demerger and vesting of Demerged Undertaking (Health, Hygiene, Safety Products and Services Undertaking) of the FCL into Forbes Enviro Solutions Limited.

Steps:

- Merger of step down WoS’s (ATPL & EFFSL) with WoS EFL,

- Merger of EFL with ultimate listed holding company FCL, and

- Finally, Demerger of the main operating business of EFL along with its foreign subsidiaries into FESL, which will be listed.

“Appointed Date” for the transaction is 1st day of April 2020.”

Rational of scheme:

As mentioned in scheme:

- Unlock the value for the shareholders of FCL by listing of the ‘Health and Safety Solutions’ business of EFL.

- Enhanced focus to the operations of the business of EFL.

- Simplification and consolidation of group structure

- Facilitate management in achieving administrative efficiency

Based on our analysis, in our views, commercial reasons are:

EFL as on 31st March 2020 has negative net worth and the whole business getting financed by loans from parent company, deposits from Distributors and advance income for which actual expenditure to be incurred in future. In immediate future, SP group may dilute/ exit from ‘Health and Safety Solutions’ business, so the structure is designed in such way that it will transfer the necessary business to a separate company which will be listed later.

Demerged undertaking: the business of manufacturing, selling, renting and servicing of vacuum cleaners, water filter cum purifiers, water and wastewater treatment plant, trading in electronic air cleaning systems, small household appliances, digital security system, air-conditioners, and all kinds of electrical & non electrical appliances etc. which is being carried on by Eureka Forbes Limited at present as a going concern along with its loss-making foreign subsidiaries.

Consideration:

Consideration for the demerger transaction will be 15 equity shares of ₹10 each of FESL against 1 equity share of ₹10 each of FCL i.e., 15:1. It means paid up capital of newly listed company will be 15x (₹ 193.35 crore) of the current paid up capital of FCL i.e., ₹ 12.89 crore. How FESL will be able to service such a huge capital is not clear. There is no consideration for the merger of WoS with holdings companies (Step1 and Step 2).

Investment and JV with LUX Group

In 2007, Eureka Forbes and Lux International had entered in 50:50 joint venture to form Forbes Lux for global operations. Later in 2010, EFL had acquired 25 per cent stake in Lux International AG through its WoS EFL Mauritius Limited.

EFL acquires stake in Forbes Lux International AG in FY 2013-14 through its WoS Aquamall Water Solutions Limited (AWSL) total investment amount ₹228.99 crores (₹147.87 crores in 2013-14 and ₹81.12 Crores in 2015-16). In 2017-18 AWSL merged with EFL.

Financials

Table 1: Standalone Financials for FY 20 (All Figs in ₹ lacs)

| Particulars | FCL | EFL | ATPL | EFFSL | FESL |

| Revenue | 19,488 | 1,88,540 | 731 | – | 1,639 |

| Gross Profit | 10,978 | 1,07,501 | 151 | 301 | |

| Gross Profit% | 56% | 57% | 21% | 18% | |

| Operating Profit Before Exceptional Items and Taxes | -2059.67 | 599.60 | – | – | – |

| PBT | -2,578 | -39,668 | -36 | -0 | -57 |

| Depreciation | 1,210 | 2,740 | 47 | – | 14 |

| Finance Cost | 1,184 | 3,969 | 25 | – | 40 |

| EBIT | -183 | 7,308 | 36 | -0 | -2 |

| Net worth | 20,166 | -19,297 | 309 | 2 | 175 |

| Borrowings | 14,053 | 28,317 | 137 | – | 150 |

| Debt-Equity Ratio | 0.70 | -1.47 | 0.44 | – | 0.86 |

Net worth of EFL turns into negative due to impairment of investment of ₹40267.85 lakhs in EFL Mauritius Limited and Forbes Lux International AG.

As per the information given to BSE, total turnover of demerged undertaking is ₹1885.68 crores. However, consolidated turnover of ‘Health and Safety Solutions undertaking’ as per segment financial information is ₹2369.50 crores.

Non-current assets of EFL reduced to ₹433.49 crores from ₹776.47 crores because of major impairment in the value of investment. Over a period, total investment impaired by ₹778.32 crores. To expand globally company, invest huge amount in foreign subsidiary without analyzing potential market.

Table 2: Details of Impairment of Investment (All figs in ₹ Crores)

| Year | Amount |

| 2017-18 | 171.81 |

| 2018-19 | 341.13 |

| 2019-20 | 265.37 |

| Total | 778.31 |

As the current ratio of EFL is 0.61 which means EFL having negative working capital from this it looks like that company financing it short term requirement from long term borrowings. Further also note that EFL financing its fixed assets from current liability.

EFL having gross profit of 57% which was used mostly to pay employees and other expenses making Net profit of 0.32% which clearly indicates company is not being managed properly.

From the financial of EFL it looks that EFL pays interest by taking loan as the interest liability double in just 2 years.

EFL FY-20 Highlights

- ₹ 130 crores written-off as bed debts which is receivable from related party. Further also note that interest on loans given to related party not received.

- Having payable to employees ₹42.99 crores which means company does not pay to employee on times and finance from employee’s fund.

- Received advance from customer of ₹9.39 crores which is shown as other current liabilities this means company utilized this fund but expenses for that is also pending.

- From Note no. 30(b)(iv) of Financial statements of 2020 EFL committed to buy shares in JV Infinite Water Solutions for ₹21.24 crores.

- EFL also given a commitment to provide financial support for the continuing operation to its subsidiary Forbes Lux International AG and Forbes Enviro Solutions Limited.

- Freehold land and building admeasuring circa 40000 Sq. yard which was supposed to be transferred through scheme of merger is still not transferred in the name of EFL.

Change of Name of FESL:

After the effectiveness of scheme name of FESL changes to “Eureka Forbes Limited” to keep brand Eureka Forbes.

Conclusion:

Extraordinary business supported by the leading brand Eureka Forbes got destroyed by imprudent monetary management and related parties’ transactions and financing of sister concerns. It also looks like management seems to feel that its brand has substantial value and the transaction will enable it to unlock the value. The real question is whether any brand can create value without generating profits.

SP Group is facing crisis to raise funds and their attempt to sell their stake in Tata Group but are facing legal issues which has been not yet concluded. So, it seems that to overcome this crisis, SP group trying to sell Jewels from its crown. It will be interesting to see how and when shareholders of FCL will unlock value in loss making and negative cash flow business and FESL will create a growth opportunities/turnaround the business.

Add comment