The Reserve Bank of India has merged capital-starved Lakshmi Vilas Bank (LVB) with the Indian subsidiary of Singapore’s DBS Bank. The central bank had to go ahead with the merger plan as there was no credible revival plan to revive the bank and protect depositors’ interest. After the scheme of amalgamation came into effect on November 27, DBS Bank India Limited (DBIL) has received capital infusion of Rs 2,500 crore fully funded from DBS’ existing resources. The amalgamation will provide stability and better prospects to LVB’s depositors, customers and employees after a long period of uncertainty.

This is the first time the RBI has allowed a foreign bank to rescue a struggling Indian bank. In fact, DBIL became lucky in the second attempt after in 2018 it had approached LVB to acquire about 50% of the stake for a much higher valuation of Rs 100-Rs 150 per share. According to the resolution plan, DBS India will invest $335 million in the equity of the LVB for a 51% stake even as the existing reserves and surplus of the bank will be extinguished. The merger is a very prudent step in order to save the depositors and to mitigate the systematic disruption associated with it. To be sure, the merger will be a template for the central bank to rescue other struggling banks in the future. In fact, the central bank had in October last year rejected a proposal for LVB to merge with Indiabulls Housing Finance Ltd.

Once the integration is complete, customers of LVB can access a wider range of products and services, including access to the full suite of DBS digital banking services. Moreover, DBIL is well-capitalised, and its capital adequacy ratio remains above regulatory requirements after the amalgamation. The bank’s Capital to Risk Weighted Assets Ratio (CRAR) was at 15.99%, against the regulatory requirement of 9%, and Common Equity Tier-1 (CET-1) capital at 12.84% was well above the requirement of 5.5%. The central bank had underlined that LVB’s losses would have continued in the absence of any feasible strategic plan, declining advances and scaling non-performing assets (NPAs).

Read: RBI rejects proposed Lakshmi Vilas Bank-Indiabulls Housing Finance merger

As part of the amalgamation, RBI had placed 94-year old LVB under one-month moratorium, superseded its board and capped withdrawals at Rs 25,000 per depositor. The RBI had put the bank under Prompt Corrective Action in September 2019. The central bank had placed Punjab and Maharashtra Co-operative Bank under its control and had placed Yes Bank under a moratorium before preparing a scheme led by State Bank of India and involving several other lenders to rescue the private-sector bank.

What went wrong with LVB?

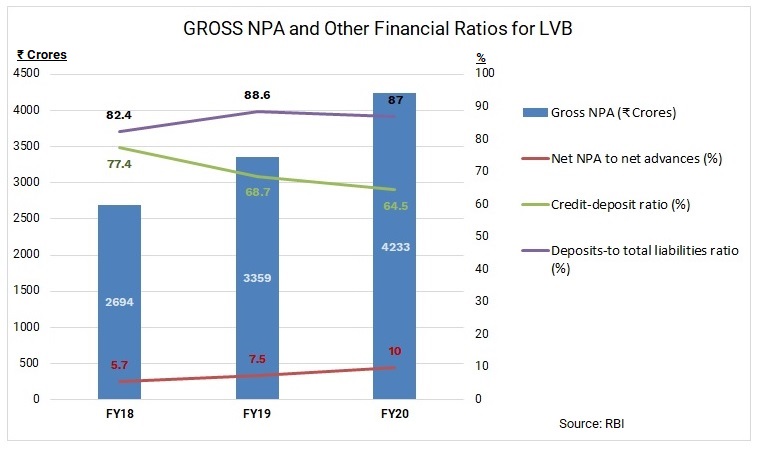

The governance standards of LVB started deteriorating over the last few years. The trouble started from 2016-17 when the bank changed its focus from SMEs to large businesses. The bank’s loan of Rs 720 crore to Malvinder Singh and Shivinder Singh, former promoters of Ranbaxy and Fortis Healthcare went bad. The gross NPA of the bank rose to 25% in 2020 from 10% in 2018 and the promoters have also pledged their shares. The bank’s losses jumped from Rs 585 crore in 2017-18 to Rs 836 crore in 2019-20. As the financial condition of the bank deteriorated, the bank started negotiating for merger with Indiabulls Housing Finance, an NBFC company in 2019. However, RBI did not approve the merger and LVB then started negotiating a merger with Clix Capital.

In the 93rd Annual General Meeting of the bank held in September 2020, shareholders voted against the seven out of a total of 11 members from the senior management including S Sunder, the bank’s interim MD & CEO. They raised alarm over the rise in bad loans and erosion of the market cap of the bank. The RBI appointed three members to look after the daily affairs of the bank along with the remaining four senior officials of the bank.

Shareholders of LVB got a raw deal after the merger. At the time of bank mergers, shareholders are usually given fresh share of the merged entity based on a pre-determined formula. But as LVB was cash-strapped with a negative net worth, the shareholders value was written off. The shares of the bank are going to be delisted as per the Scheme of Amalgamation. The bank’s shareholders challenged the scheme of amalgamation in Chennai High Court as their main concern was the provision in the scheme which cancelled their existing shares in the bank. However, in an interim order, the court, while declining a stay on the merger, directed DBS Bank India to create a reserve fund from which LVB’s shareholders will be compensated if the court so orders.

Synergies for DBS India

DBS was the first foreign bank to receive a banking licence after the central bank allowed foreign banks to set up a wholly-owned subsidiary. DBS Bank opened its first office in Mumbai in 1994. The subsidiary structure brings the lender on a par with local banks, allowing them to open branches anywhere in the country. Most foreign banks in India operate as wholesale banks and have niche retail customers. After acquiring LVB, DBIL can now have a pan-India footprint to compete with big private sector banks such as HDFC Bank, ICICI Bank and Axis Bank. DBS has been named by Forbes in its 2020 list of the World’s Best Banks. Based on a global survey of 40,000 banking customers, DBS was ranked No 1 in India out of 29 domestic and international banks present in India.

Read: Marriage of convenience: Indiabulls Housing Finance to acquire Lakshmi Vilas Bank

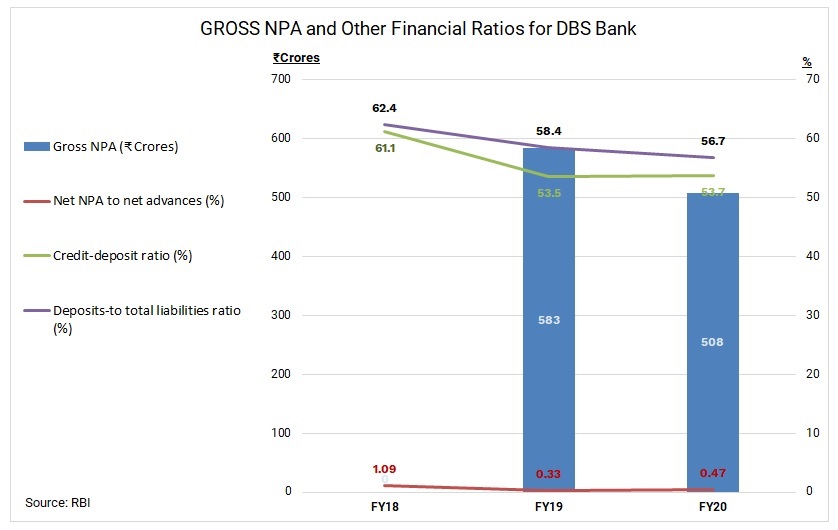

DBS provides an entire range of banking services for large, medium and small enterprises and to individual consumers in India. In 2016, DBS launched India’s first, mobile-only bank – digibank, which now has over 2.6 million customers. The merger will help DBS India to expand its reach in India and the bank’s growth curve in Singapore is now saturated. At present, DBS India has just about 30 branches in India. The bank has a healthy balance sheet, with strong capital support. As on June 30, 2020, its gross NPAs and net NPAs were low at 2.7% and 0.5% respectively, according to data from RBI.

The merger will strengthen DBS Bank’s position in the country by adding new retail and small and medium-sized customers. It will complement traditional physical branch banking with its digital strategy in India. In fact, Moody’s Investor Service estimates that DBS India’s customer deposits and net loans will increase by about 50 to 70% after the merger. At present, DBS has 2.5 million customers in India spread across 24 cities in 13 states. The merger will give it access to LVB’s 570 branches in 16 states and three Union Territories. So, to set up such a large bank network, it would have taken a long time for DBS. As the bank was trying to expand its presence all over India, the merger was a great opportunity.

Integrating issues

While LVB is saddled with an old legacy of systems, processes and products, DBS Bank comes with a foreign banking culture. It is more aggressive and focussed on productivity and return on investments. Regarding employees of LVB, the scheme of merger has no mention of rationalization. The cultural divide between a traditionally run bank and a foreign bank will be process and technology. Integrating the two will be a key challenge and DBS India will have to spend on training and upskilling of employees of LVB for digital banking, data analytics and cyber security.

By allowing deep-pocketed foreign banks to take over weak Indian ones will pave the way for more mergers of weak banks in the country. While RBI’s decisive and swift move will help protect depositors’ interests, it has to closely monitor the merger integration process of the two banks and ensure that all the check boxes are ticked. A proper integration and seamless functioning of the merged entity will open new doors for new bank mergers and resolve the bad loan problem that is crippling the banking sector in the country.

This merger seems like a significant move for the banking sector in India. I’m curious to see how DBS Bank integrates Lakshmi Vilas Bank’s operations and what it means for customers in terms of service improvement and product offerings. It could be a game-changer in boosting financial inclusion!

This merger is a significant move in the banking sector, especially for the legacy of Lakshmi Vilas Bank. It will be interesting to see how the integration with DBS Bank India unfolds and what it means for customers and employees alike. Hopefully, this brings better services and stability in the long run.

This merger could bring significant changes to the banking landscape in India. I’m curious to see how DBS Bank will integrate Lakshmi Vilas Bank’s operations and what it means for existing customers of both banks. It’s a bold step by RBI, and I hope it leads to more stability and innovation in the sector!

This merger marks a significant shift in the banking landscape! It’s interesting to see how RBI is consolidating smaller banks to strengthen the sector. I wonder how this will impact customer services and the overall banking experience moving forward.