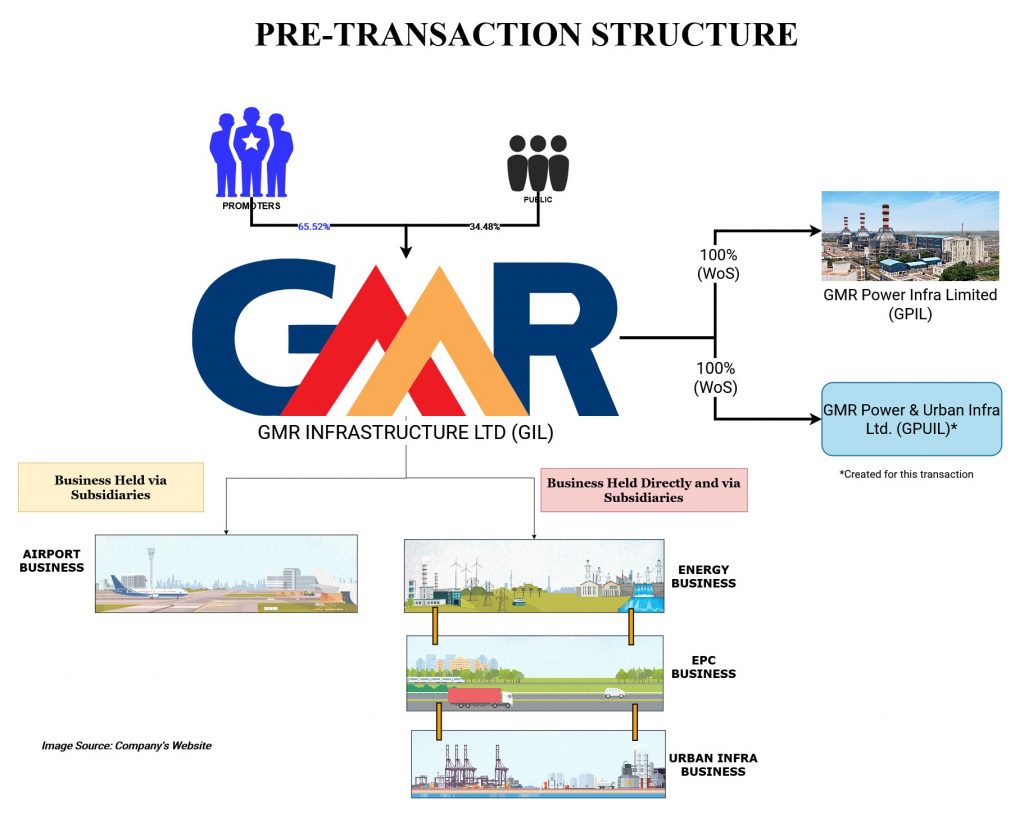

In August 2020, GMR Infrastructure Limited announced that its Board of Directors have approved the separation of its Airport Business from Non-Airport Business. As Airport business is quite different in terms of risk & rewards and skills sets and capital requirements, there was long-standing demand to house the other businesses in other listed company. It was the recent strategic investment which might have compelled management for separation. In this article, we have covered what forced the group to partially sell its crown jewel apart from the details of the transactions, its implications and the way ahead for both businesses.

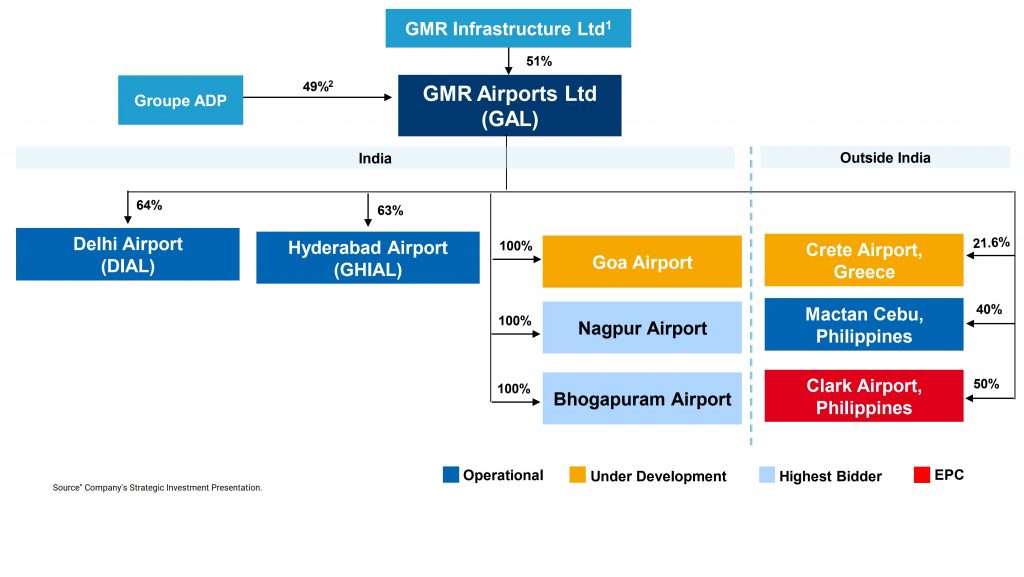

GMR Infrastructure Limited (GIL), a leading global infrastructure conglomerate with interests in Airport, Energy, Transportation and Urban Infrastructure, is listed on Indian Stock Exchanges. GMR Group’s Airport portfolio which is currently held under GMR Airports Limited (GAL) comprising of Airports in New Delhi, Hyderabad, Philippines, Goa and Greece. The Group’s Energy business has a diversified portfolio of around 4,995 MW, of which -3,040 MWs of Coal, Gas and Renewable power plants are operational and around – 1,955 MWs of power projects are under various stages of construction and development. The group also has coal mines in Indonesia, where it has partnered with a large local player. Transportation and Urban Infrastructure division of the Group has four operating highways project spanning over 1,820 lane km.

GMR Power Infra Limited (GPIL) is primarily engaged in the business of setting up, maintaining, operating all types of power plants, co-generation power plants, energy conservation projects, power houses, distribution systems for generation, distribution and supply of electrical energy, power generation by use of liquid, gaseous or solid fuels or through renewable energy sources, establishment and installation of all types of Infrastructure required.

GMR Power and Urban Infra Limited (GPUIL) is a wholly-owned subsidiary of GIL formed for the purpose of this transaction.

The Transaction

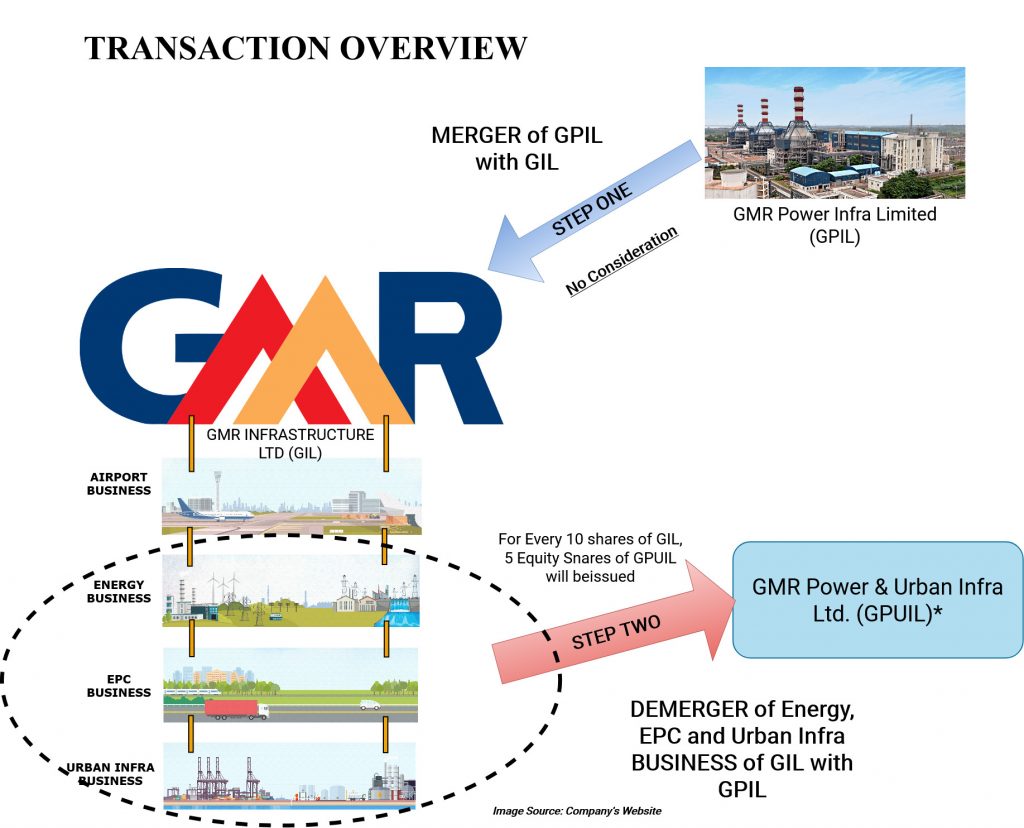

The board has given its approval for the Scheme of Arrangement, which will involve demerger of the Non-Airport businesses (Other Businesses), which includes Energy business, EPC business, Urban Infrastructure business. Post restructuring, GIL will have the airport business while GPUIL will have non-airport businesses.

The structuring will be executed in two steps:

- Amalgamation of GPIL with GIL

- Demerger of Non-Airport Business in GPUIL

The restructuring is a step in the direction towards delinking different businesses of the GIL and thereby attracting sector-specific global investors and unlocking value for the current shareholders of GIL. This will also pave the way for focused growth and sustained value creation for all stakeholders over a period.

The appointed date for the transaction is 1st April 2021.

Swap Ratio

As PCIL is a wholly-owned subsidiary of GIL, no consideration will be issued. For the demerger of Non-Airport business:

“For every 10 (Ten) Equity shares of face value of f 1/- (One) held in GIL, 1 (One) Equity shares of face value of 5/- (Five) in GPUIL to be issued to the equity shareholders of GIL.”

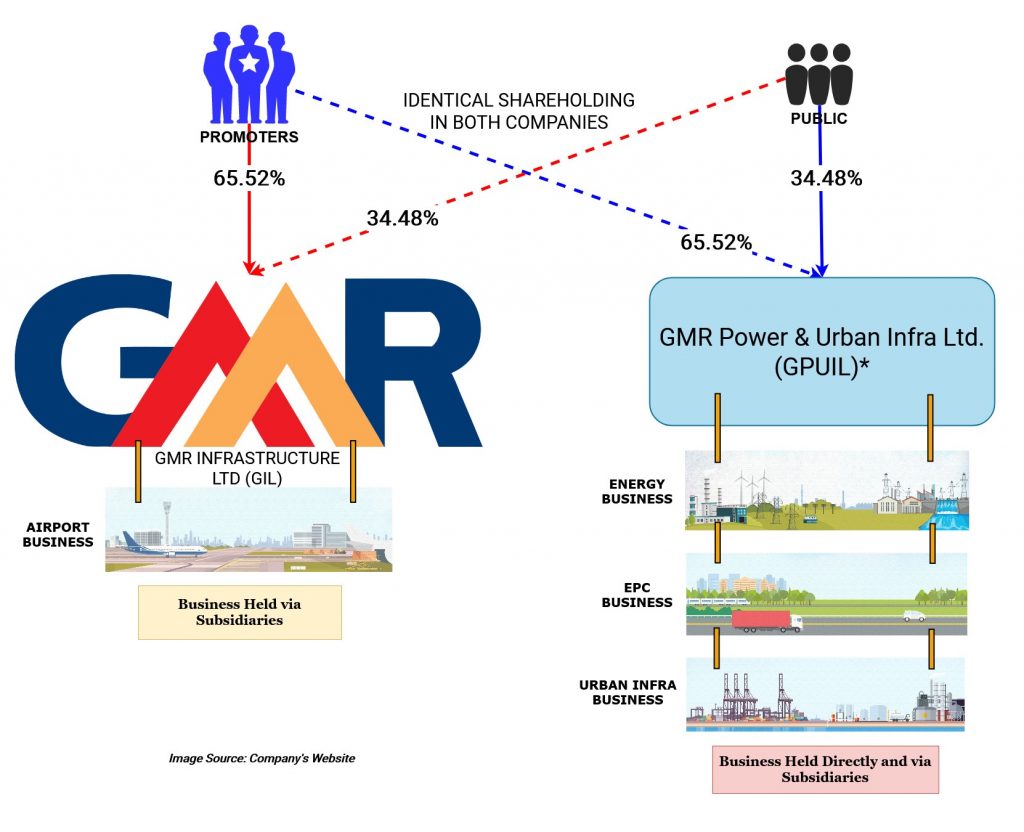

Post Demerger, the shareholding pattern of GPUIL will be identical to the shareholding pattern of GIL. The equity shares of GPUIL issued pursuant to the Scheme, shall be listed on BSE Limited and National Stock Exchange of India Limited.

Strategic Investment in Airport Business

In February 2020, GIL has announced a strategic partnership with Paris based Groupe ADP (ADP) for its Airports Business. GIL has signed a Share Purchase Agreement pursuant to which Groupe ADP decide to acquire 49% stake in GMR Airports Limited (GAL) for an equity consideration of ₹ 10,780 Crore. This equity consideration comprised of:

- ₹ 9,780 Crore towards secondary sale of shares by GMR group; and

- ₹ 1,000 Crore equity infusion in GAL

In addition, Groupe ADP has also pegged Earn-outs up to ₹ 4,475 Crore linked to achievement of certain agreed operating performance metrics as well as on receipt of certain regulatory clarifications over the next 5 years. If GMR achieves this, there stake in GAL will go to circa 59% from the current 51%.

The first tranche of Rs 5248 crores for 24.99% shares of GAL had been completed on February 24, 2020. Later, parties revised the agreement and as per the revised Share Purchase Agreement, the second tranche of the investment for 24.0 1% of GAL has been structured in two parts (which earlier was payment of ₹ 5532 crore):

- A fixed amount, immediately paid at Second closing, for a total of ₹ 4,565 crores (which received in July 2020), including ₹ 1,000 crore equity infusion in GAL.

- Additional Earn-outs amounting to Rs 1060 crore, subject to the achievement of certain performance related targets by GAL up to the financial year ended March 31, 2024.

Accordingly, ADP has increased earn-outs for GIL which are now pegged at up to ₹ 5,535 crore compared to the earlier ₹ 4,475 crores. These additional Earn-outs of ₹ 1060 crores are linked to the achievement of certain agreed EBITDA metrics/ levels.

The funds received from the deal have been used to primarily reduce debt, provide an exit to existing private equity investors and to improve overall liquidity at the Group level.

Financials & Valuations

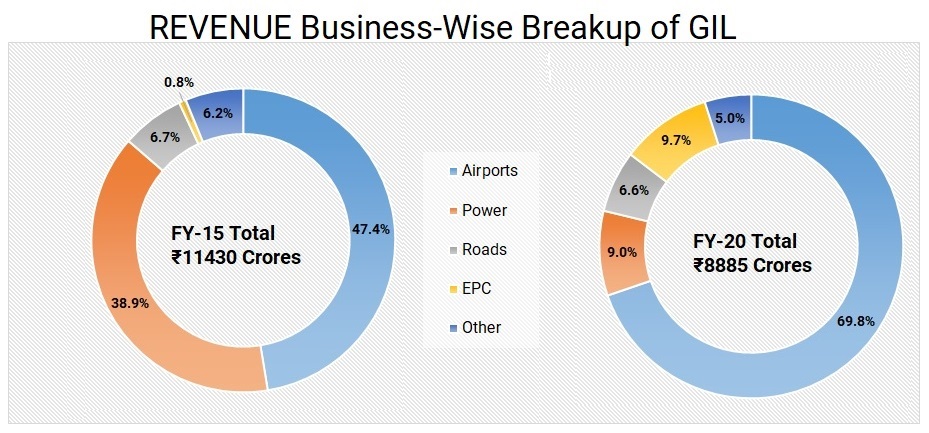

Please note that there were couple of divestments in Power Business between 2015 & 2020. Thus, in terms of top line, Airport business contributes 71.66%, in terms of EBIT, it is almost 100%

| Particulars | Airports | Power | Roads | EPC | Other | |||||

| FY-15 | FY-20 | FY-15 | FY-20 | FY-15 | FY-20 | FY-15 | FY-20 | FY-15 | FY-20 | |

| Revenue | 5,421 | 6198 | 4,450 | 801 | 766 | 585 | 86 | 860 | 707 | 441 |

| EBIT | 909 | 695 | -378 | -486 | 208 | 229 | -3 | 166 | 234 | -70 |

| Assets | 16,184 | 27683 | 36,487 | 6583 | 6,966 | 3586 | 814 | 1338 | 18,448 | 7272 |

| Liabilities | 1,752 | 24189 | 7,772 | 2563 | 1,718 | 1042 | 536 | 691 | 51,111 | 17752 |

| Capital Employed | 14,432 | 3494 | 28,715 | 4020 | 5,248 | 2544 | 278 | 647 | -32,663 | -10480 |

Clearly, over a period, GIL’s focus turned from Power to Airport business. Over a period, they did couple of divestments, some of them failed to sail through. It is an Airport business which has had been generating cash flow for the group. This cashflow was used by other segments, however, with an entry of an investor, GMR compelled to do a demerger.

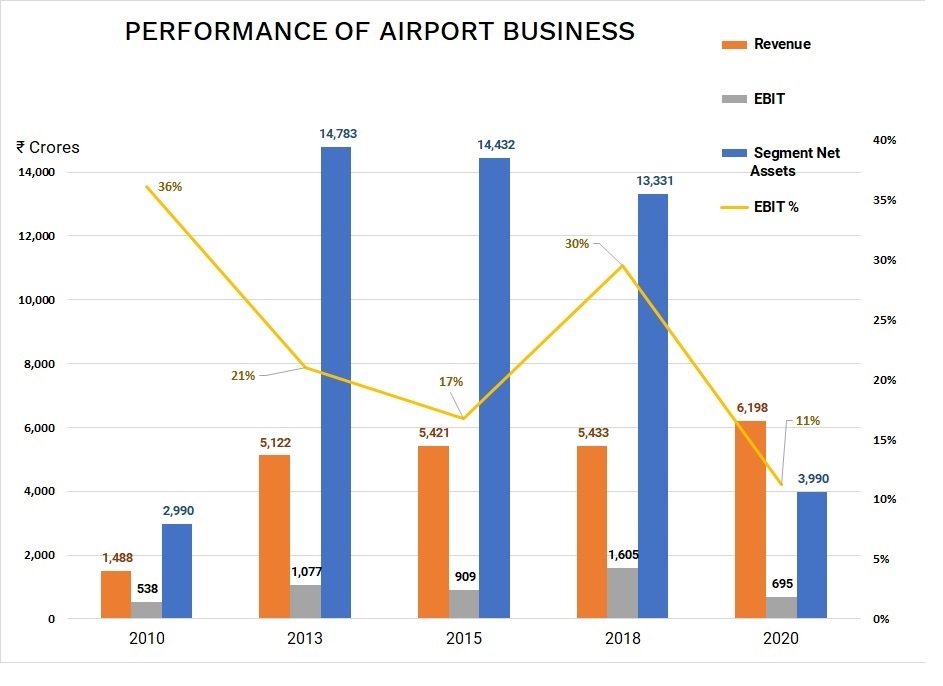

Performance of Airport Business in last decade

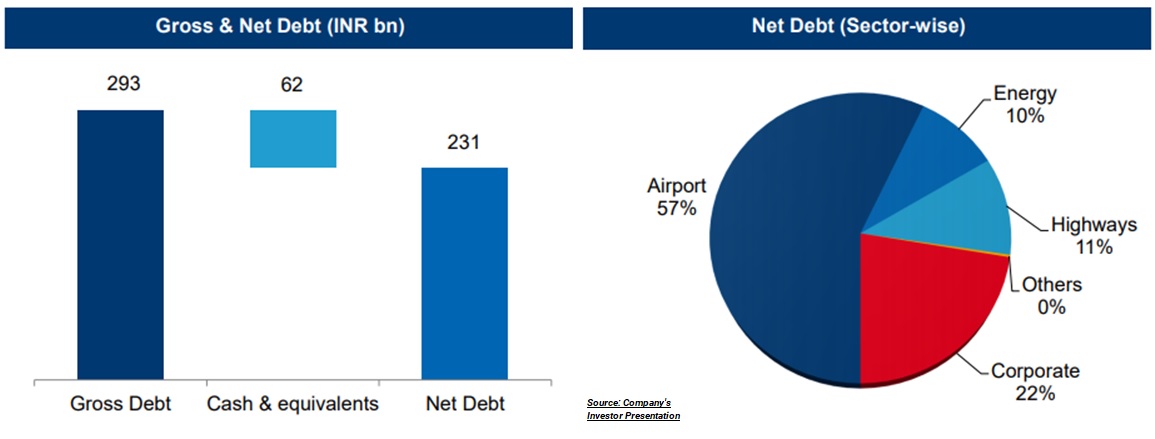

Over the years, though airport business is consistently generating operating profits for the group, its revenue & margins are fluctuating mainly due to regulatory flip-flops. Further, as a result, the share of Airport Business net debt in overall net debt increased from 28% in June 2017 to 57% in September 2020.

Debt position for September 2020

As on 30th September 2020, circa 20% of the gross debt has been taken/raised in the GIL’s standalone books.

Table 1: Loans & Cash over the years (All Figs in ₹ crores)

| Particulars | 2010 | 2015 | 2020 |

| Total Loans | 20,837 | 42,201 | 34,324 |

| Cash & Cash Equivalent | 1,682 | 3,904 | 4,448 |

As told by the management in recent con calls, most of the corporate borrowings are related to the non-airport business. The sale proceeds from the stake sale to ADP was utilised for reduction in the borrowing mostly related to a non-airport business and giving exit to PE funds.

From the valuation perspective, considering the current market cap, valuation given by ADP & profitability of airport business, one can assign significant part of existing market capitalisation of GIL towards an Airport business and Non-Airport Business likely to get minuscule valuation compared to the airport business.

Failed/aborted Deal with Tata Sons & Others

GMR Airports Limited (“GAL”) had executed a definitive agreement on July 04, 2019 with TRIL Urban Transport Private Limited a subsidiary of Tata Sons, Solis Capital (Singapore) Pte. Limited and Valkyrie Investment Pte. Limited whereby they decided to acquire equity stake in GMR Airport Limited’s assets for a consideration of Rs 8,000 crore through issuance of equity shares of GAL of ₹ 1,000 crore and purchase of GAL’s equity shares held by GIL of Rs 7,000 crore. However, later, due to regulatory hurdles, the transaction didn’t sail through.

Valuation difference between both deals

Table 2: Valuation done for Fund-Raising

| Particulars | Transaction with TATA | Transaction with ADP |

| Investment | ₹ 8000 cr | ₹ 10,780 cr |

| Proposed Stake | 44.4% | 49% |

| Primary Infusion | ₹ 1000 cr | ₹ 1000 cr |

| Secondary Infusion | ₹ 7000 cr | ₹ 9780 cr |

| Base Pre Money valuation | ₹ 17,000 cr | ₹ 21,000 cr |

| Earnouts Up to | ₹ 4480 cr | ₹ 5535cr |

Immediately after the cancellation of deal with Tata & others, GIL announced a deal with ADP with increased valuation. ADP being a strategic player and foreign investor (through in earlier transaction Government of Singapore was present), must have given higher valuation to the Airport business.

Other Divestment & Fundraise Initiatives

Apart from divestment of stake in Airport business, GIL has also proposed to do some divestments in non-airport business:

- Signed Definitive Agreements for divestment of entire 51% stake in Kakinada SEZ to Aurobindo Realty and Infrastructure Pvt. Ltd

- Monetisation of Barge Plant

- To re-start the process of divestment once coal prices stabiles

Apart from above, recently

- GIL has sold its entire stake in GMR Chhattisgarh Energy Limited (GCEL) to Adani Power Limited in July 2019.

- GMR Energy Limited (subsidiary of GIL) entered into share purchase agreement with JSW Energy Limited for sale of its equity stake in GMR Kamalanga Energy Limited. However, after the year-end, the said transaction has been put on hold.

In the last few years, to strengthen its balance sheet, GIL did a couple of divestments. They did divest stake in an international airport, couple of power projects and highway projects. At the same time, GIL raised money in different businesses:

Table 3: Past Fundraising done by GMR Group

| Year | Form | Entity Which Raised | Amount |

| 2009-11 | PE Funding | GMR Airports Limited | $330 Mn |

| PE Funding | GMR Energy Limited | $300 Mn | |

| Post-2015 | QIP | GIL | ₹14.8 bn |

| Right Issue | GIL | ₹14 bn | |

| FCCB | GIL | ₹20 bn |

Despite so much fundraise and divestment initiatives, GIL unable to turnaround the businesses and its debt increased from ₹ 20,837 crores in 2010 to ₹ 34,324 crore in 2020.

Group Strategy

With the aim of builders and custodians of world-class infrastructure assets that every Indian would be proud of, GIL expanded into asset heavy business having a long gestation period under one roof. They also invited a couple of PE funds to fuel their growth strategy. However, things didn’t go as per expectation for the group. The non-Airport business started blighting by various issues. Overall debt started shooting up and the cash flows from Airport business weren’t enough to offset the losses. They even didn’t give an exit to its PE partners within time & later went to the courts to settle the issue. Somehow, they managed to settle the issues with a PE firm with a promised exit within a few years. Later, they change their strategy and moved their focus from the “Asset Growth to Cash Growth” and opted for “Asset light, Asset Right” strategy. The group did couple of divestments to reduce leverage but didn’t work well.

As a last resort, they decided to invite strategic partner in its cash cow business and announced a pure play airport company. The did sign agreement with Tata Sons & others, however, due to regulatory issues it didn’t sail through. Immediately after this, they got strategic investor ADP which has now crystallised.

The proposed transaction will not only help Airport business to grow to its potentials but also will give comfort to the ADP and other stakeholders. At the same time, the future journey of Non-Airport business will not be less than a roller-coaster ride. The group has somehow managed to minimise the debt for its Non-Airport business, generation of cash will become extremely critical for its survival.

Going ahead, GIL (Airport business) will focus on operations of two most crucial airports in India which it has in its portfolio (Delhi & Hyderabad) and some other airports. At a same time, it will along with its partner ADP, will try to expand operations in Asia region. For expansion of its airport business, significant cash flow will come through monetisation of huge land bank near airport and that too without dilution in equity. In non-airport business, the focus will be on divestments of non-core assets and then focusing on few profitable projects. Maybe in future, GIL will work either towards selling the entire Non-Airport Business or invite some strategic partner.

With entry of behemoth’s like Adani Enterprises Limited in airport business, GIL, essentially safeguarding its crown jewel through inviting a strategic partner. The strategic partnership with ADP will not only help them in reducing corporate debt but reduces its cost of funds due to better credit rating, will give a strong hand to sustain against the competition.

Conclusion

The scheme will enable GIL to delink Airport Business having high EBIT, cash generating and international presence business from other businesses with insignificant EBIT. Till date, Airport Business which is Kohinoor in GIL’s crown was not sparkling and generating light for its various stakeholders. Though it may have been advisable to start all businesses under one Umbrella to support and capture each other’s synergies, but now with different set of investors and their vision does not allow those businesses as a conglomerate and in no way, it will be the most efficient and value creation for the group and its old, new and prospective stakeholders. Let us hope that GIL’s Kohinoor sparkles now and generates bright light for its stakeholders long enough to compensate years of darkness.

Add comment