Usha Martin Limited (“Usha Martin”) started with niche Wire & Wire Ropes (“WWR”) business. To create more value, did backward integration by starting a special steel business & mining operation. Commercially it was a good decision however, due to unviability of steel capacity and cyclical downturns aggravated due to family feud, backward integration instead of increasing contribution, resulted in significant losses.

Last decade was nothing short of a roller coaster ride for Usha Martin. The family run business stood witness to not only financial trauma but also family issues. Promoters of Usha Martin thus decided to revive itself first by divesting its core business i.e., WWR and later also ended up divesting the steel business. Post divestment the group was able to repay their significant debt and in the vein of restructuring has decided to set off the losses incurred on account of steel business against premium received from issuing equity to fund capex (for Special Steel business). The company filed a Scheme with the National Company Law Tribunal for Capital Reduction of its Equity Shares.

Is Capital Reduction final step towards reinventing its core business?

This article examines the last 10 years journey of Usha Martin, its strategy, rationale for divesting its core business, impact of family issues on its business, proposed capital reduction and post all the steps, whether ready for the new USHA MARTIN for its stakeholders.

Usha Martin started its journey as the first wire rope manufacturer in the country in 1960. It has traversed a long distance since its inception to become one of the largest Wire & Wire Rope (WWR) manufacturers in the world. The Company owns two wire and wire rope manufacturing facilities in India at Ranchi (Jharkhand) and Hoshiarpur (Punjab). It also has three wire rope facilities overseas in UK, Thailand and Dubai.

In its quest to have a fully integrated business model, the Company started its steel business in 1974 at Jamshedpur (Jharkhand) and also acquired Iron Ore mines which are at Barajamda (Jharkhand) and Coal mine.

The strategy was to place the Company distinctly in a unique position by combining both ends of value chain, from mining to high value wire ropes and further providing end use solutions on its key product applications. The decision was with aim of providing benefits of quality, consistency, and self-sufficiency in principal raw materials.

Later, the quest for having a fully integrated business model became the biggest worry for the company. Steel business of the company started facing turbulences due to severe downturn in the steel industry and debt started pilling on the balance sheet.

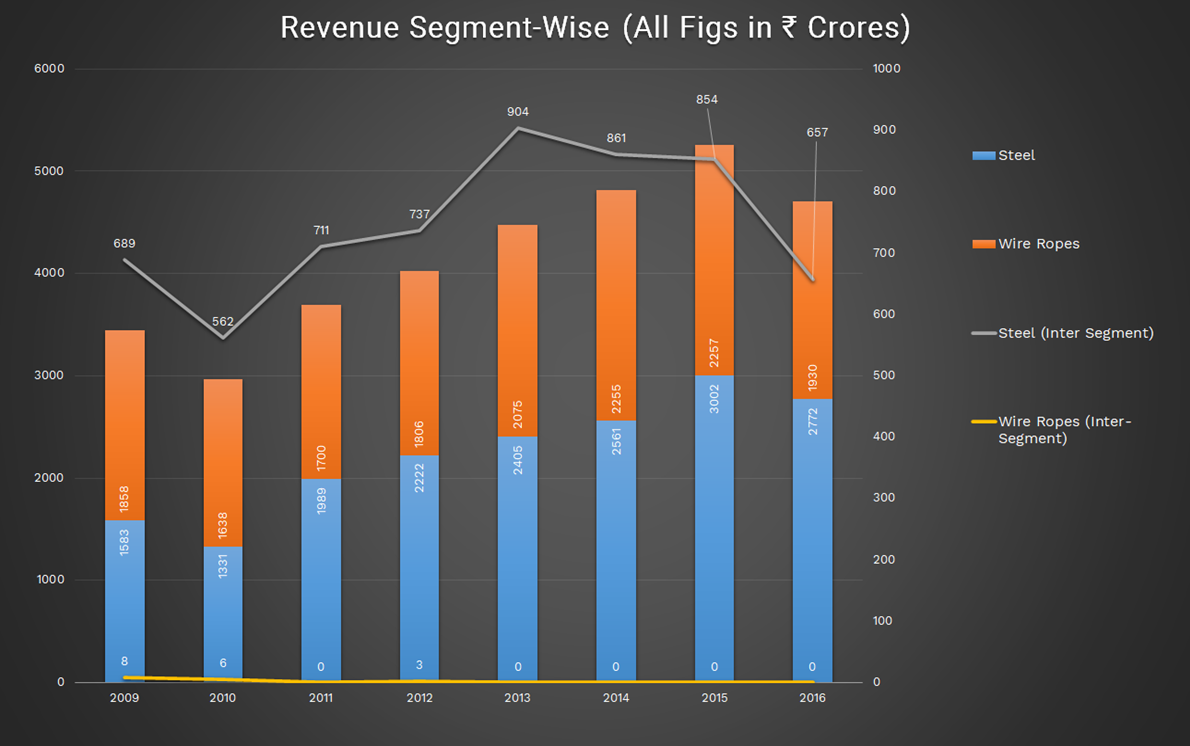

Financials of Usha Martin Limited for FY 2010 & 2016

INR in crore

| Particulars | 2010 | 2016 |

| Networth | 1,687 | 1,365 |

| Borrowings | 1,716 | 4,080 |

| Fixed Assets | 2,568 | 5,255 |

| Revenue | 2,539 | 4,147 |

| Profit After Tax | 168 | -480 |

Segment Financial in FY 2010 (without Inter-segment adjustment)

| Particulars | Steel | Wire & Wire Ropes | Others | Total |

| Segment Revenue | 1,331 | 1,638 | 134 | 3,103 |

| Segment Result | 81 | 274 | 11 | 366 |

| Capital Employed | 1,805 | 913 | 60 | 2,778 |

Segment Financial in FY 2016 (without Inter-segment adjustment)Revenue from the Steel business includes INR 562 crores of revenue from Wire & Wire Ropes business.

| Particulars | Steel | Wire & Wire Ropes | Others | Total |

| Revenue | 3421 | 2080 | 127 | 5628 |

| EBITDA | 99 | 234 | 7 | 340 |

| Capital Employed | 3244 | 1602 | -79 | 4767 |

Revenue from the Steel business includes INR 657 crores of revenue from Wire & Wire Ropes business.

Over a period, the size of its special alloy steel business was much bigger than what is required for captive consumption. In 2010, Half of the revenues from the Steel Business was from Wire & Wire Ropes Business which became 23% in 2016. During the period, the company was expanded its capacity through borrowing, internal accruals and raising equity.

The slowdown in steel prices turned fortune for the company. WWR business was stable & generating good profits. However, profits from WWR business was not enough to compensate interest payment on debt taken mainly for expansion of steel business. It started eroding its net worth due to losses in Steel Business. At the same time, its borrowing increased 4 folds. Raising debt levels & volatility in steel business became a nightmare for Usha Martin.

Interest Coverage Ratio:

INR in Crore

| Particulars | 2010 | 2016 |

| EBIT | 365 | 78 |

| Interest Cost | 125 | 558 |

| Interest Coverage Ratio | 2.92 | 0.14 |

With continuously building pressure due to increasing debt, in 2017, a reputed international consultant has been engaged to prepare and help in implementation of a sustainable improvement plan for the steel division. The company also started disposal of non-core assets to reduce its debt.

Divestment

In this instance, a similar thing happened when the specialty steel business become larger than what is required for captive consumption. The end customers for steel & WWR business were distinct. The company required to find more & more Auto Ancillaries/OEMs for its steel business vis-à-vis WWR caters significantly to oil & gas and infra projects. Downturn in both businesses at the same time ushered in significant challenges for Usha Martin.

What to Sell……?

Started with WWR business, over a period, Steel business become a major business for the company. It can be witnessed from its Annual Reports that the company’s major focus was on steel business. Between FY 2009-16, the company invested circa ₹ 4600 crores in steel business vis-à-vis circa ₹1000 crore in wire & wire ropes business. As a result, the gross debt of the company increased from ₹1716 crores in FY 2010 to ₹4080 crores in FY 2016.

Usha Martin was left with no other option than selling one of the businesses to pare its debt. In February 2017, despite having meagre 1 MTPA capacity steel plant, the Company announced that it is evaluating divestment of its original Wire & Wire Ropes Business. The Company also appointed a consultant for the same.

The reason for announcing divestment of its original business i.e., WWR business instead of steel business could be focus on steel business, stable revenue & profitability of the WWR business, heavy capex already done in steel business etc. Company’s endeavour to address the debt burden by looking for a buyer for Wire and Wire Ropes business was not met with success. With no other option left, the company announced that it has also started evaluating divesting its steel business.

Divestment of Steel Business

In 2018, the Company announced that it has entered an arrangement with Tata Sponge Iron Limited, a subsidiary of Tata Steel Limited to sell the 1 MTPA capacity steel business along with the mines by way of slump sale as a going concern. The amount of consideration for the transfer was decided in the range of ₹ 4300 – 4700 crores, subject to adjustments as per the signed agreement. After adjustments, actual Consideration worked out was INR 4525 crores (including negative working capital). The entire consideration was utilised to pare its debt.

Table 1: Financial Snapshot of Steel Business transferred for FY 2019 (All figs in ₹ Crores)

| Particulars | Amount

(Continuing Operations) |

Amount

(Discontinued-/Steel Operations) |

| Revenue | 2509 | 4009 |

| EBIT | 273 | 151 |

| Finance Cost | 113 | 490 |

| Fixed Assets | 860 | 3677 |

| Borrowings | 3158 | 115 |

| Net Assets | 814 | 2321 |

Please note that all borrowings, though significantly related to steel business, Tata Sponge Iron Limited decided not to take over.

Table 2: Profit on Transaction

| Particulars | Amount (INR in Crore) |

| Consideration (Net of acceptance of INR 980 crore directly by purchaser & after adjusting negative working capital) | 3083 |

| Net Assets Transferred | 2356 |

| Expenses Relating to Transaction | 171 |

| Profit from the Transaction | 556 |

The profits so realised from divesting steel business has been recognised in profit & Loss Account. The amount realised from the transaction has been utilised to pare its debt. In FY 2020, consolidate debt of Usha Martin improved substantially.

Table 3: Financials of Usha Martin for FY 2021 (All Figs in ₹ Crores)

| Particulars | Amount |

| Revenue | 2130 |

| EBIT | 244 |

| Net-worth | 1403 |

| Fixed Assets | 816 |

| Borrowings | 486 |

| Debt: Equity Ratio | 0.34 |

| Interest Coverage Ratio | 4.28 |

The things have started improving for Usha Martin. It has repaid substantial debt pertaining to the steel business and thereby improved its credit rating. The company also secured contract with other steel manufacturers. The Company has also signed a five-year supply contract with Tata Steel at fair market price.

Family Fiasco

The Business of Usha martin was handled by Basant Kumar Jhawar, his brother Brij Kishore Jhawar and his son Prasant Jhawar along with the company’s MD and his Nephew Rajeev Jhawar. Till 2017, Mr. BK Jhawar was acting as Chairman Emeritus, Prashant Jhawar was Chairman, Brij Kishore Jhawar was Director & Rajeev Jhawar was Managing Director.

Usha Martin board passed a resolution on April 25, 2017 removing Basant Jhawar as chairman emeritus and Prashant Jhawar as non-executive chairman. A row between two branches of the Jhawar family intensified, with one side (BK Jhawar & Prashant Jhawar) accusing the other side of financial irregularities. Basant and Prashant Jhawar–formerly chairman emeritus and non-executive chairman, respectively–have asked the NCLT to reinstate them on the board of Usha Martin in their previous capacities.

The case filed with the Enforcement Directorate brought the spotlight on INR 190 crores worth of immovable property. Following this, the case was transferred to the CBI, which immediately filed a case against Usha Martin and its MD Rajeev Jhawar. The FIR was filed under the prevention of corruption act in October 2020. The result of these cases is still pending.

Capital Reduction

In order to right size the balance sheet & capital structure of the company, the Board of Directors of the Company approved the Scheme of Arrangement between the Company and its shareholders under Section 230 and other applicable provisions of the Companies Act, 2013 which provides for reduction and reorganization of capital of the Company. There will be no outflow/payout of funds to shareholders or realignment of equity share capital but set-off of negative retained earning balance with other positive capital reserves available with the company.

The major part of Steel expansion of the company was supported through raising loans and some part through issuing equity shares/warrants at a premium. The company’s operational profits were not sufficient to repay interest thus, the company incurred losses. Due to this, its retained earnings turned negative. Later, the company sold its Steel business on a slump sale basis. However, all negative retained earnings pertaining to steel business continued to be a part of WWR business i.e. Usha Martin. Even the profits from selling Steel Business were not sufficient to set off losses incurred. To set-off the security premium on account of raising funds to expand steel business with losses incurred from steel business operations, the company announced a Scheme of Capital Reduction.

The Appointed Date for the Capital Reduction is 1st April 2021. As on 31st March 2021, reserve of the company is as follow:

| Particular | Amount in crore |

| Retained Earnings/Profit & loss Account | (808) |

| Capital Redemption Reserve | 23 |

| Other Reserve | 63 |

| Capital Reserve | 4 |

| Security Premium Reserve | 856 |

| General Reserve | 545 |

| Total | 683 |

The company decided to set off positive capital reserve (major part pertains to steel business) against negative retained earnings (mainly consisting of losses pertaining to steel business) than setting off against General Reserve (which may be created due to profits from WWR business). Upon the Scheme becoming effective, the credit balance of following reserves as appearing in books of accounts of the Company as on the Appointed Date, shall be adjusted against the entire negative balance of the Retained Earnings of the Company, to the extent permissible under law, in the following chronological order:

- Entire credit balance appearing under the capital redemption reserve;

- Entire credit balance appearing under the other reserves;

- Entire balance appearing under the capital reserve; and

Securities premium, to the extent of remaining Retained Earnings.

Strategy for Tata Sponge Iron Limited

To ensure sustainable long-term value creation for all its stakeholders, Tata Sponge was evaluating various strategic options beyond the manufacturing of sponge iron. Their focus was on long products, with an emphasis on special and alloy steels. UML’s steel business was the rich product mix of carbon steel and alloy steel which caters to automotive customers as well as produces high-end wire rods. The company funded the acquisition through a mix of issue of equity shares & borrowings.

In order to align the name of the Company with the newly acquired steel business, which became one of the main business activities of the Company, Tata Sponge Iron Limited changed its name to Tata Steel Long Products Limited.

To further strengthen its product portfolio, after the acquisition of Steel Business from Usha Martin, Tata Steel Long Products Limited announced multiple internal restructurings including the merger of The Indian Steel & Wire Products Limited.

Conclusion

Usha Martin has begun its “Usha Martin 2.0” journey towards becoming “Resilient & Sustainable” by divesting Steel Business. It needs to get rid of historical baggage in terms of losses pertaining to the divested business. Divestment of steel business was the first step followed by the capital reduction by adjusting losses against capital raised for starting & expanding the said business to become “Sustainable”. As divestment was through Slump Sale, losses & capital reserve pertaining to Steel business remained in the books of Usha Martin 2.0 as accounting standard does not permit set-off losses against capital reserve even after selling the business.

Now, the company, with focus and better balance sheet, poised to give better returns to all its stakeholders.

Add comment