IT sector is on the cusp of growth, driven by necessity in Automation, Digitalization, Cloud Computing, Security Surveillance, Data analytics and so on. This in turn brings a large opportunity for a niche software testing business. According to the NASSCOM report, the global software testing market is projected to expand to US$ 76 billion by 2022 and the banking financial services and insurance (BFSI) industry will remain at the forefront of leveraging these digital technologies. This has translated businesses to re-think/re-aligned their strategy to capture a higher share of the growing market.

The increasing regulatory requirements and need to present a company with multiple skills, products, services and domain has resulted in the consolidation of Indian business for Expleo group.

Background

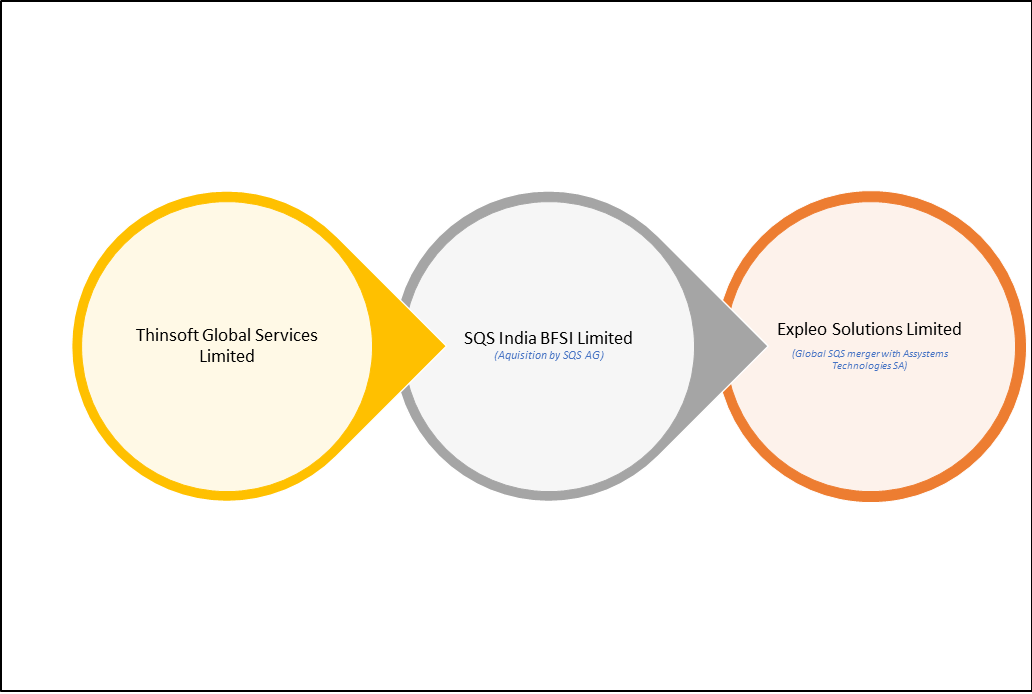

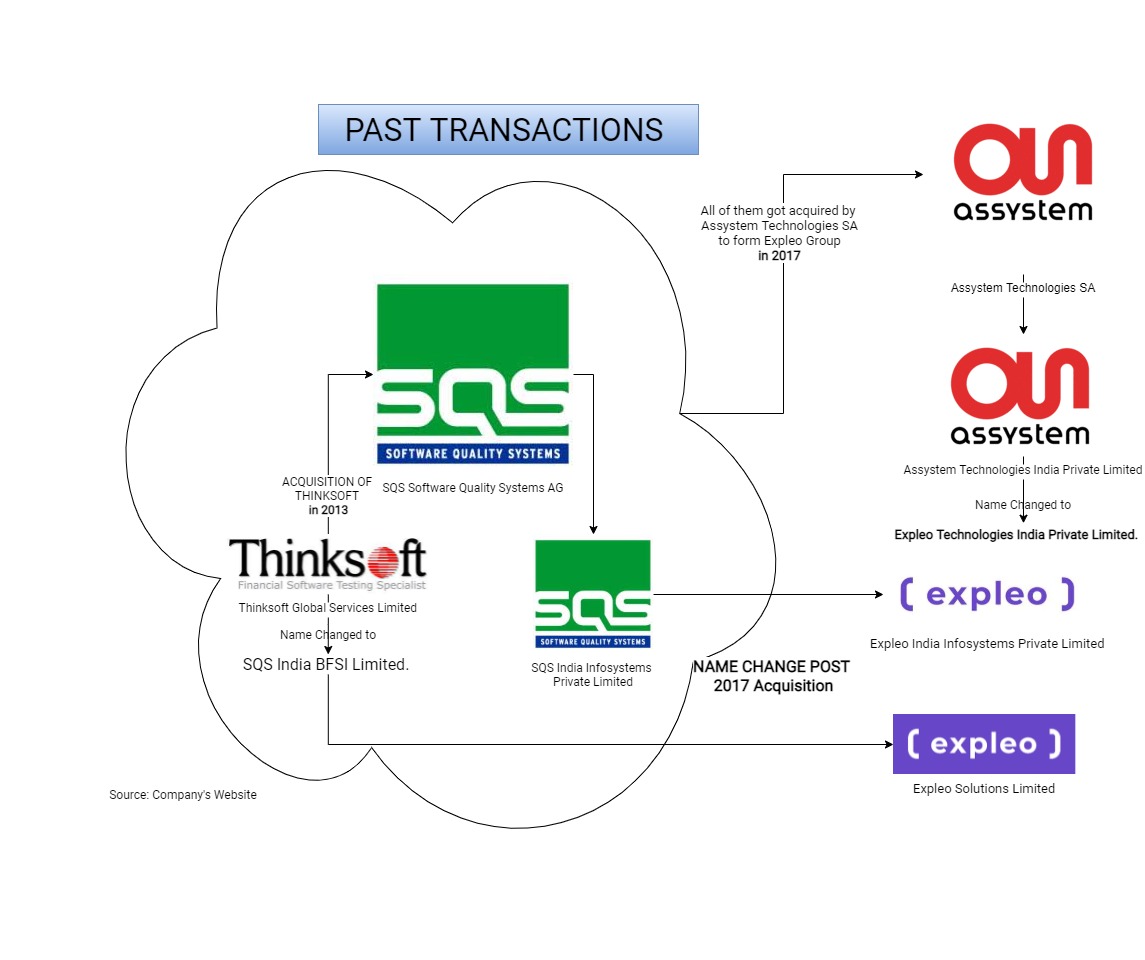

The present Indian structure of the Expleo group is not created, but it inherited due to M&A (Merger & Acquisition) deals. We summarize the series of events as follows:

In 2013, Thinksoft Global Services Limited, which was started by Indian promoters got acquired by SQS Software Quality Systems AG. At that time SQS AG already had a presence in India through SQS India Infosystems Private Limited having different products and services offering with little overlapping. SQS group decided to operate both entities separately. The name Thinksoft Global Services Limited got changed to SQS India BFSI Limited.

In 2017, SQS Software Quality Systems AG along with its Indian entities was acquired through a merger by Assystem Technologies SA to form “Expleo Group”. The acquisition not only led to the open offer but also change in the name of SQS India BFSI Limited and SQS India Infosystems Private Limited to Expleo Solutions Limited and Expleo India Infosystems Private Limited respectively. At that time, Assystems Group was having presence in India through Assystem Technologies India Private Limited which was renamed to Expleo Technologies India Private Limited.

Current Indian Business of Expleo Group Consists of:

Expleo Solutions Limited (ESL), a public listed company is a trusted partner for end-to-end integrated engineering, quality and management consulting services for digital transformation services to the banking, financial services and insurance industry worldwide.

The equity shares of the ESL are listed on the BSE Limited and National Stock Exchange of India Limited. Expleo Technology Germany, GmbH 56.17% shares of the ESL.

Expleo India Infosystems Private Limited (EIIPL), an unlisted private company of Expleo group in India. EIIPL is on it owns and through its subsidiaries engaged in end-to-end, integrated quality services and management consulting for Automotive, Manufacturing, Gaming & Gambling, Energy & Utilities, Commodity Trading industries. EIIPL is Wholly Owned Subsidiary (WoS) of Expleo Technology Germany GmbH.

EIIPL holds 100% of shares in Expleo Technologies India Private Limited (ETIPL) which provides software development, validation, verification, certification and engineering design services in the field of Aerospace, Automotive, Defence and Rail Transportation Domains.

EIIPL also holds 100% of shares in Expleo Engineering India Private Limited (EEIPL). Silver Software Development Centre Private Limited (SSDCPL) is wholly owned subsidiary of ETIPL. Both EEIPL & SSDCPL do not have any business operations.

The Proposed Transaction:

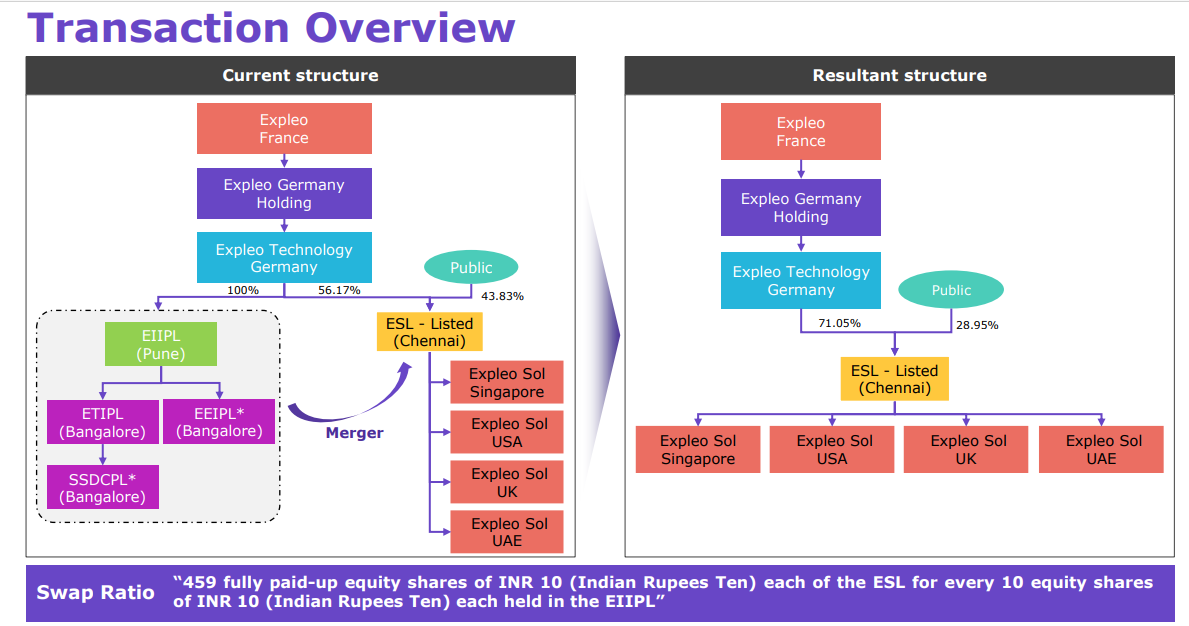

The proposed consolidation of group entities of Expleo Group will be executed in two parts:

PART I: Acquisition of Equity Shares

On 28th June 2021, EIIPL entered into a Share Purchase Agreement (SPA) to acquire 100% stake of EEIPL and ETIPL for ₹ 1.61 crores and ₹ 132 crore respectively. This was likely to be done with an intention of simplifying the transaction & approval process as well as certain commercials like upstreaming the cash available with the private company.

PART II: Merger

Immediately after the acquisition, the group announced a composite Scheme of Amalgamation (“Scheme”) pursuant to Sections 230 to 232 of the Companies Act, 2013, providing for the merger of various other group entities with ESL.

Currently, ETIPL & EEIPL are directly wholly-owned subsidiaries of EIIPL and SSDCPL is a step down wholly owned subsidiary of EIIPL. Further, EEIPL & SSDCPL does not have any operations and are getting consolidated just for simplifying ESL structure.

The chronology of the transaction (merger) with ESL as provided in the Scheme is as follow:

(1) Merger of Expleo India Infosystems Private Limited

(2) Merger of Expleo Technologies India Private Limited and Expleo Engineering India Private Limited

(3) Silver Software Development Centre Private Limited with Expleo Solutions Limited.

As the registered office of the entities involved in the transaction is in different states, separate applications will be filled with Chennai, Mumbai and Bengaluru Bench of National Company Law Tribunal (NCLT) for approval.

Though the Appointed Date for all the parts of the merger scheme will be the same, the transactions have been structured in such a way that at the time of execution of each part, the transferor company/ies will be direct wholly-owned subsidiaries of ESL (immediately after the merger of EIIPL with ESL). This augurs in simplifying approval process and de-linking impact of approval of any particular part from the scheme as a whole as it is mentioned in the Scheme that each such parts shall be severable from the remainder of the Scheme thus, even in case of any reasons, the merger of ETIPL & EEIPL or SSDCPL doesn’t get approval, the scheme shall be modified and the remainder company/ies will continue to operate as a wholly-owned subsidiary of ESL(as they become WoS of ESL post-merger of EIIPL with ESL).

ESL has its operation located in Chennai while EIIPL operates in Automotive & Aerospace sector through Bengaluru Center and Pune Center caters to Automotive as well as other sectors.

The Appointed Date for all the transactions is 1st April 2022. The probable reason for having a prospective Appointed Date.

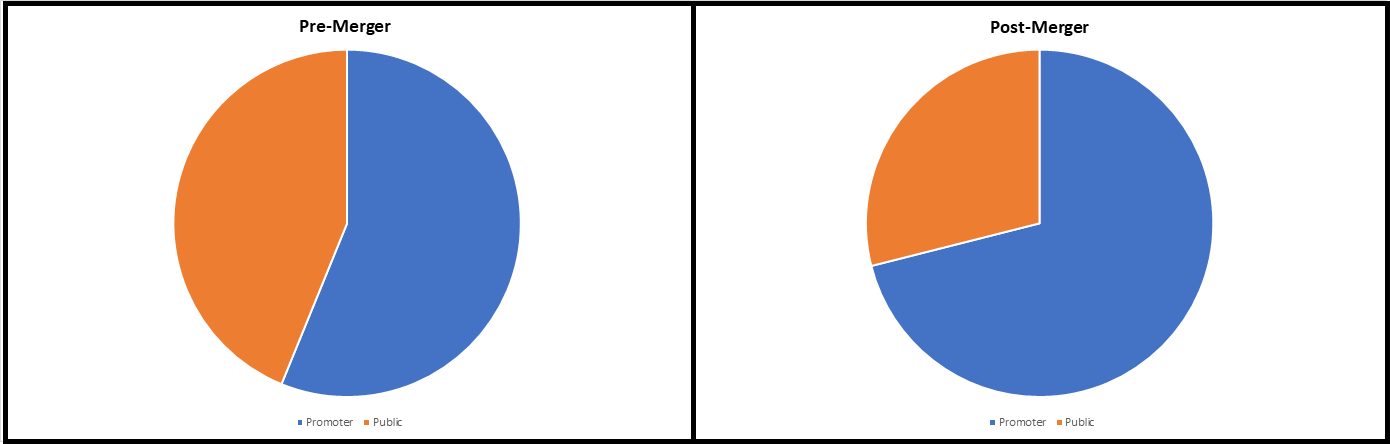

Shareholding pattern Pre and Post:

Pursuant to the above restructuring, ESL shall issue 459 fully paid-up equity shares of INR 10 each of ESL for every 10 equity shares of INR 10 each held in EIIPL.

The paid-up share capital of the entity will be increased for the existing 1.02 crore equity shares of INR 10 each to 1.55 crore equity shares of INR 10 each.

Other Aspects of the Transaction:

Accounting Treatment:

As the proposed restructuring is between entities having common control i.e., controlled by Expleo Technology Germany, GmbH, the transaction will be accounted for in accordance with Appendix C of IND AS 103.

The difference between the consideration/value of investments as the case may after adjusting assets, liabilities and reserves of the Transferor Companies will be adjusted against the Capital Reserve.

Currently, ESL does not have a Capital Reserve and significant part of its reserve’s consist of Retained Earning.

We summarise below the likely Capital Reserve and other significant accounting entries as a result of each of the parts of the merger below:

| Transaction Part | Accounting Impact (based on financials as on 31st March 2021) |

| Merger of Expleo India Infosystems Private Limited | 1. The existing reserves of EIIPL amounting to INR 224 crore will be added to the existing reserves of ESL.

|

| Merger of Expleo Technologies India Private Limited and Expleo Engineering India Private Limited | 1. The existing reserve’s ETIPL amounting to INR 18.49 crore will be added to the existing reserves of ESL.

|

| Silver Software Development Centre Private Limited with Expleo Solutions Limited | No significant reserve will be created/adjusted as a result of merger of SSDCPL. |

Please note due to the prospective appointed date and availability of limited data, the actual amount may change significantly.

Other Aspects of the Scheme:

The scheme also provides for the transfer of various credits relating to direct tax & indirect tax along with transfer of relevant licenses and benefits pertaining to Special Economic Zone, statutory licenses issued by Software Technology Park of India etc.

Considering the applicable Indian laws, the merger will be tax neutral for the companies and Indian shareholders.

The shareholders of the Transferor Companies shall indemnify and hold harmless the Transferee Company and its directors, officers, representatives, partners, employees and agents for any losses, liabilities (including but not limited to tax liabilities), costs, charges, expenses including interests and penalties discharged by the Indemnified Persons which may devolve on Indemnified Persons on account of the merger.

How Merger Came on Cards

It was a long-standing demand from shareholders of ESL for consolidation of Indian entities and the perceived conflict of interest or the focus of the Group on the India business per see.

Expleo Group has two strong heritages, Engineering services with a strong presence in Europe, and due to SQS acquisition, strong Quality and Consulting capabilities. Last year, Expleo Group’s Board of Directors appointed Mr. Rajesh Krishnamurthy as Expleo’s new group CEO who later unveiled a strategy to harness Expleo’s capabilities to steer it into a fast-growing digital transformation journey. Within a period of 7 months, he visited India twice and announced that going ahead India will be part ~75-80% of the future global Expleo Project.

Engineering Division was strong in Automotive and Aerospace, but as part of the strategy, Expleo have in an aggressive fashion diversified into Healthcare, Construction and Manufacturing industries, etc. At the same time, on the Quality side, the group expanding into newer industries like Energy, Utilities and Services etc. Simultaneously, the group decided to have India as a significant base over the next three, four years and getting Indian setups simplified and have a single go-to entity is a critical part of the strategy to target larger deals.

The merger paved the way for Expleo group to cater to multiple sectors through the same entities. From having circa 1500 ESL employees, the merged entity will have strong 3,200-plus people company in India with close to around Rs. 600 crores of annual revenues. The merged entity will also look at consolidating some parts of the operation to Pune location among other shared services.

Going ahead, ESL will be classified into two segments, one is the engineering capability, and the other is the quality capability. Existing Managing Director & Chief Executive Officer of ESL, Balaji Viswanathan will be the CEO of the merged entity and Prashanth who is the Managing Director of EIIPL will become Chief Operating Officer (COO). Balaji Viswanathan will continue to be the leader for everything related to Quality and Financial services and Prashant will continue to be the overall lead for delivering the Engineering services business.

Valuation:

EIIPL entered into Share Purchase Agreement (SPA) on 28th June 2021 to acquire 100% stake of EEIPL and ETIPL for ₹ 1.61 crores and ₹ 132 crore respectively.

The valuation of EIIPL has arrived by giving 50:50 weight to Discounted Cash Flow (DCF) and Comparable Companies Multiple (CCM) while ESL has been arrived by giving 50:50 weight to Discounted Cash Flow (DCF) and Market Price. Based on this, the valuation arrived is as follows:

Table 1: Valuation of Involved Entities (All Figs in ₹ Crores)

| Particulars | EIIPL (consolidated) | EPL |

| Weighted Equity Value | 426 | 858 |

The equity value of EIIPL was evaluated after appropriate discounting for illiquidity and adjustment for the investment made by EIIPL in EEIPL and ETIPL.

Financial

Table 2: Financial breakup of Consolidated EIIPL as on 31st March 2021 – All Figs in ₹ Crores

| Particulars | EIIPL-Pune Operations | ETIPL-Bengaluru Operations |

| Revenue | 137 | 130 |

| Profit After Tax | 25 | 13 |

| Networth | 224 | 32 |

As the parent entity is focused on Engineering, EIIPL & ETIPL have a considerable chunk of business coming from the parent entity. After the merger, the group business share for the combined entity will be approximately equal to 33% to 34%, and the direct business is approximately 66% odd. The management expects that over the next two to three years, the group business contribution would probably be in the range of around 42% to 45%.

Earlier Transaction

SQS Software Quality Systems AG, entered into an agreement, on November 8, 2013, with the promoters of Thinksoft Global Services Limited, to acquire majority stakes in Thinksoft Global Services Limited. SQS Software Quality Systems AG, gave an open offer for acquiring equity shares constituting at least 26% of the paid-up equity share capital of the Company, of that time Thinksoft Global Services Limited, in accordance with the terms of the Securities and Exchange Board of India (Substantial Acquisition of Shares and Takeovers) Regulations, 2011. The aggregate shareholding of SQS after the completion of the Open Offer and the Acquisition was less than 51% of the paid equity Share Capital of the Company thus in accordance with the Share Purchase Agreement, the erstwhile promoters have sold their balance equity shares in the Company to make up for the shortfall, resulting in SQS acquiring a 53.35% controlling interest in the company.

After acquisition, the name of the company changes to SQS India BFSI Limited. Thinksoft at that time was India’s only listed entity in the pure play independent software testing space, provides software validation and verification services to the Banking and Financial Services Industry (BFSI) worldwide.

In a move to create an opportunity to deliver a “best in class” offerings to customers based on a shared culture of technical excellence across geographies and sectors (especially in BFSI, automotive and aerospace), In 2018, the parent company, Software Quality Systems (SQS) AG took a strategic decision and agreed a merger with Assystem Services Deutschland GmbH, a subsidiary of Assystem Technologies.

As a result, Assystem becomes the majority shareholder and it gave mandatory open offer for acquiring 26% of paid-up capital of ESL as per regulations of the Securities and Exchange Board of India (Substantial Acquisition of Shares and Takeovers) Regulations, 2011. later name of the company changed to Expleo Solution Limited.

Conclusion

Multiple M&As ushered in multiple entities in India for the Expleo group. Though the business carried through each of the entities was not similar, to some extent it was overlapping. Expleo India derives a considerable chunk of its business through parent/group level entities which was amounting to a kind of confusion at the parent level too for assigning the global business to Indian entities. This was becoming a concern for minority shareholders. Similarly, for small companies, it creates difficulties in retaining and acquiring right talent. The move will create significant value for other stakeholders like Parent Entity, Employees, customers etc.

While designing the merger, management appropriately planned the activities which will lead to a simple and cost-effective transaction. With the merger, ESL is well poised to scale the business and maximise the value for all the stakeholders. After the merger, ESL may distribute the surplus cash to its shareholders.

Add comment