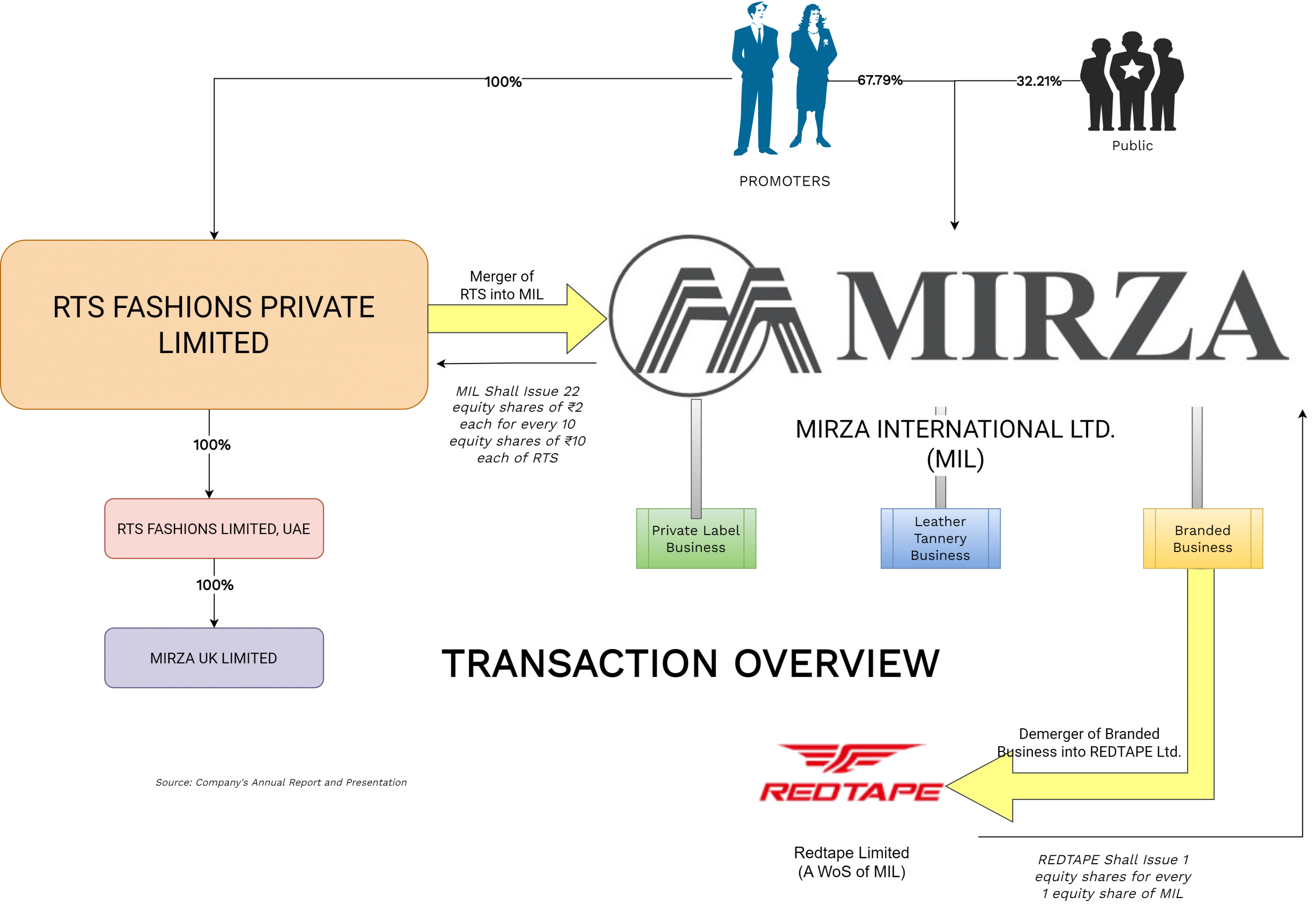

The Board of Directors of Mirza International Limited (“MIL”) has recently announced a consolidation of a promoter group entity i.e., RTS Fashions Private Limited which is predominantly engaged in selling goods manufactured by MIL in the international market. Through the same scheme, MIL will also demerge and separately list its branded business which is carried under the Redtape brand. The management believes these steps will unlock the value for shareholders. Let us examine whether the re-structuring will unlock the value, if yes, for whom?

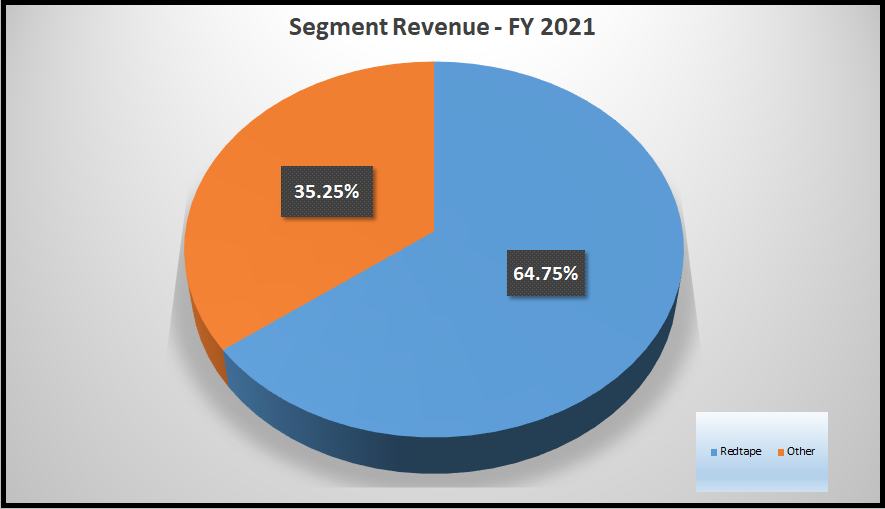

Mirza International Limited (“MIL” or the Transferee Company or Demerged Company) is engaged in designing, development, manufacturing, marketing, trading of leather footwear, sports shoes, garments & apparel, etc. The Company also owns and operates a leather tannery for captive consumption. Currently, MIL has three divisions:

Private Label Business: MIL designs, develops, manufactures and export and sells leather footwear to various private labels in the United Kingdom, United States of America, European & other countries. It is predominantly an export wholesale made-to-order business.

Leather Tannery Business: MIL owns & operates one of the most modern tanneries in India. Tannery is backward integration for captive consumption.

Branded Business: MIL designs, develops, trading, marketing, and retails leather shoes, sports shoes, garments & apparel, and other accessories under its own brand “Redtape”.

The equity shares of MIL are listed on BSE & NSE. The registered office of MIL is situated in the state of Uttar Pradesh.

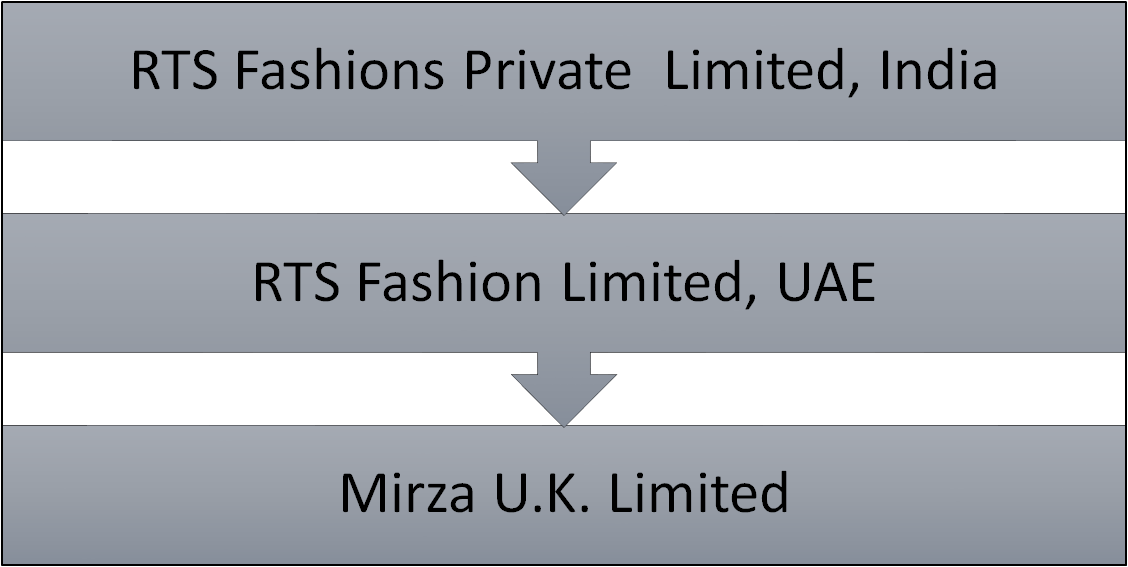

RTS Fashions Private Limited (“RTS Fashions” or the Transferor Company) through its step-down wholly-owned subsidiary, Mirza UK Limited is engaged in design, development, marketing and distribution of leather footwear, goods in the UK, USA and other European countries manufactured by MIL in India.

The equity shares of RTS Fashions are owned by the promoters of MIL and the registered office of RTS Fashion is situated in the state of Utter Pradesh.

RTS Fashions is a holding company of RTS Fashion Limited, UAE holding 100% of the share capital which in turn hold the entire share capital of Mirza (UK) Limited. Except for the small soling & packaging business, RTS Fashions and RTS Fashion Limited, UAE have no other major assets and independent business activities.

Redtape Limited (the Resulting Company) is a wholly-owned subsidiary of MIL and has been incorporated to facilitate the proposed transaction. Through the scheme, the branded business of MIL will get demerged into Redtape Limited.

The Proposed Transaction

The proposed Scheme envisages:

- Merger of RTS Fashions with MIL.

- Demerger of Branded Business into Redtape Limited

The Appointed Date for the transaction is 1st January 2022. Interestingly the Scheme envisages two different record dates for amalgamation and demerger. Record Date 1 will be for the amalgamation of RTS Fashions with MIL and Record Date-2 will be for the demerger. As a result, shareholders of RTS Fashions will become shareholders of both companies.

Rationale

Mirza UK has an experienced and dedicated team engaged in the design and development of leather footwear, leather goods and accessories for the UK and other Overseas Markets. Mirza UK does the design and development of shoes which are finally manufactured in India in the factories of Mirza International Limited and sold to various overseas customers. The merger will achieve consolidation of the entire value change being owned by the listed entity.

Redtape Business is a completely independent business than that of the Private Label Business. Redtape division buys an entire quantity of garments/apparel and a significant quantity of footwear from various third-party manufacturers. The company retails the same pan India through its own channels.

Consideration

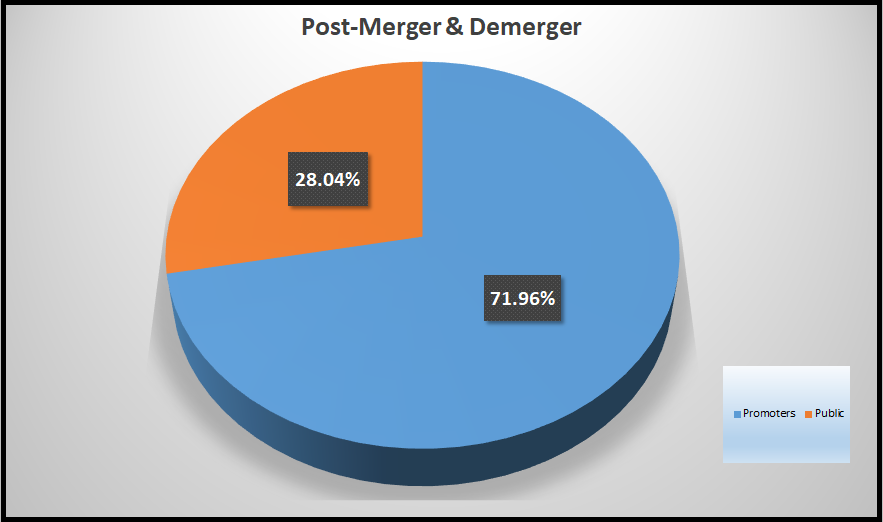

For the proposed amalgamation of RTS Fashion with MIL, MIL shall issue 22 equity shares of INR 2 each for every 10 equity shares of INR 10 each of RTS. As a result of the amalgamation, the paid-up 12,03,06,000 equity shares of INR 2 each shall stand increased to 13,82,01,900 equity shares of INR 2 each.

For the proposed demerger, Resulting Company i.e., Redtape Limited will issue one equity share for one equity share held in MIL. The resulting company will have mirror equity shareholding as that of MIL (Post-Amalgamation)

Changes in Shareholding Pattern

Redtape Limited’s shareholding pattern will be similar to the MIL’s (post-merger & demerger) shareholding pattern.

Re-organization of the Share Capital of Redtape Limited:

The paid-up equity share capital of Redtape Limited is INR 100,000. In most similar schemes, the said capital is cancelled so there is a mirror image of shareholding. Interestingly, the scheme proposes to issue to MIL in Redtape Limited, an equal number of 9% compulsorily Redeemable Preference Shares. The preference shares shall be redeemed at par within a period of 5 years with a put and call option available with the shareholder and issuer company for early redemption.

Financials

INR in crore

For H1 FY 2022, the leather business (part of other undertakings) has grown significantly. Branded/Redtape business is stable & growing and has better Return on Investment. Going ahead, the group may invite some of the investors /strategic tie-ups in Redtape which may improve its potential. The remaining Business, especially the Private Labelling business, can cater to other brands without any conflict of interest.

Brief Consolidated Financials of RTS Fashions for Half year ended on 30th September 2021 are:

INR in crore

| Particulars | Amount |

| Total Income | 64.02 |

| Profit After Tax | 1.85 |

| Net-Worth | 88.23 |

RTS Fashion on a standalone basis is engaged in the business of sale of products-soling & packaging material. It had a revenue of INR 71 lacs for half year ended on 30th September 2021.

Valuation

As per the valuation report given by the registered valuer, the assigned valuation to RTS Fashions (which is derived using a valuation of Mirza UK Limited) is circa INR 180 crore. Further, Mirza UK has also invested in a resort company, Genesis Riverview Resorts Private Limited which will become part of MIL.

Comparison of MIL with recently listed Metro Brands Limited:

Conclusion

The separation of private label business and branded business will facilitate raising necessary funds, invite strategic investors Promoters move to bring its privately held export business under listed entity & simultaneously demerging branded division can be with an intention of improving corporate governance as well as valuations. Recently, Metro Brands Limited got listed at a significantly higher valuation multiple than what MIL is trading at. A lot of related party transactions, significant international business through promoter entity and presence of Private Label and Branded business under one roof can be some of the attributes for subdued valuations. The proposed move may usher in reducing some of these concerns, still, the group will have other private companies into similar businesses and transactions between two listed entities.

Add comment