In 2010, Ajay Piramal promoted Piramal Healthcare sold off its main formulation business to Abbott India for over INR 17,000 crore and announced a buy-back of up to 20% of outstanding share capital of the company at INR 600 per share.

The Healthcare business had sales of INR 1,970 crore in FY10. This was a landmark deal in the history of Indian pharmaceutical industry; with a premium valuation of ~9x FY10 sales.

The transaction was completed on September y, 2010 and PEL received INR 10,200 crore as initial consideration. The remaining consideration was paid in four installments each of four subsequent anniversaries of the closing, commencing in September 2011.

During the same year, PEL sold its shareholding in its subsidiary Piramal Diagnostic Services Private Limited (PDSL) to Super Religare Laboratories (SRL) for the total consideration of INR 600 crore. This deal valued Diagnostic services business at 3x FY2010 Sales.

-

Five years ago, Piramal Healthcare sold off its main formulation business to Abbott for INR 17,000 crore and also announced buy-back of up to 20% of the outstanding share capital at INR 600.

-

Whether the buy-back took place and after re-structuring, how PEL diversified their business?

-

Returns to the continuing shareholders and /shareholders who opted for buy-back.

JOURNEY POST-DIVESTMENT

Piramal Enterprises Limited (PEL) earlier known as Piramal Healthcare Limited, is the flagship company of Piramal Group.

After the divestments of Healthcare Solutions business and shareholding in subsidiary PDSL, the business portfolio of PEL had completely changed.

Three main businesses remained immediately after divestiture was:-

- Pharma Solution

- Critical Care

- Consumer Products Division

As quantum of funds was available that time for existing businesses, The company decided to diversify into new businesses.

In2010, after divestiture the company decided to foray into healthcare business. In the same year, Biosyntech, Inc., Canada was acquired by PEL.

.In 2011, Piramal Healthcare acquired Indiareit, a real estate focused investment trust with AUM of USD 760 Million and also acquired 11% stake in Vodafone India. However, in April 2014, PEL exited their investment in Vodafone for a consideration of INR 8900 crore at an IRR of 19%.

In 2012, Piramal Enterprises acquired the healthcare information management firm, Decision Resources Group, USA for USD 635 Million. In the same year, Piramal Enterprises started a non-banking financial company focused on lending to real estate, education, and hospitals. In 2013, Piramal Enterprises Ltd. consumer products’ division acquired the brand CALADRYL in India and acquired 10% equity stake in Shriram Transport Finance.

In 2014, Piramal Enterprises Limited agreed to acquire an effective 20% equity stake in Shriram Capital Limited, a financial services company, for an aggregate consideration of INR 20.14 billion. In the same year, Piramal Enterprises Limited acquired 9.99% equity stake in Shriram City Union Finance Limited.

In 2015, PEL acquired Kentucky-based Specialty Pharmaceutical CDMO, Coldstream Laboratories Inc.

Today,in healthcare, PEL is one of the leading players globally in CRAMS (custom research and manufacturing services) as well as in the critical care segment of inhalation and injectable anaesthetics. It also has a strong presence in the OTC segment in India.

PEL’s healthcare information management business, Decision Resources Group, is amongst the top 20 US market research organizations which provide information services to the healthcare industry.

In financial services, PEL, through its Piramal Fund Management Division, provides comprehensive financing solutions to real estate companies. Its Structured Investments Division invests in various sectors including infrastructure. The total funds under management under these businesses are around $ 2 billion. The company also has strategic alliances with top global pension funds like CPPIB Credit Investment Inc. and APG Asset Management.

UTILISATION OF FUNDS BY PEL

BUY-BACK

Through the two landmark deals done in FY2011, PEL had unlocked tremendous value for shareholders. Having created this value for the company, a part of it was distributed to the shareholders by the way of buyback of shares. PEL bought back 41.8 million shares which represented 20% of the equity share capital at a price of INR 600 per share. The buyback price represented a premium of 19% over the average share price for the last three months at the time of the announcement of buyback (October 22, 2010).

| Particulars | September, 2010 | March, 2011 | September, 2015 |

| Total Paid up share capital | 20,90,13,144 | 16,79,16,044 | 17,25,63,100 |

| Promoter | 10,86,81,936 | 8,95,15,400 | 9,11,68,023 |

| Promoter % | 52% | 53.31% | 52.83% |

| Public | 10,03,31,208 | 7,84,00,644 | 8,13,95,077 |

| Public % | 48% | 46.69% | 47.17% |

Buy-back was took place in two tranches: – 4.10 crore shares in FY 2011 & 7.05 lakh shares in FY12.

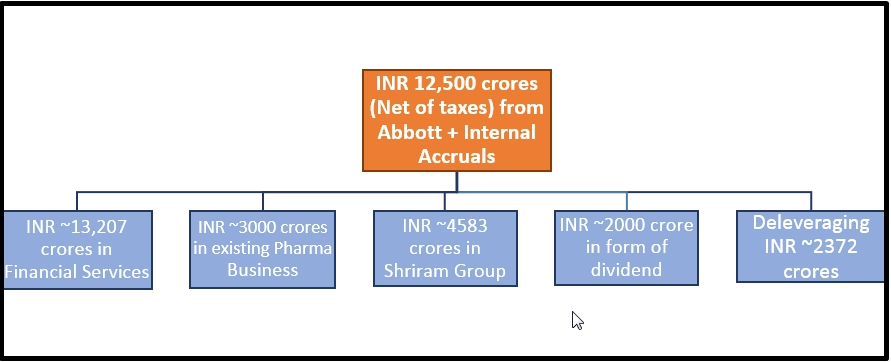

Allocation of funds by PEL

PEL received approximately INR 15,000 crore from Abbott deal. Out of which, INR 2,500 crore was used for buy-back of shares.

Today, its 10% stake in Shriram City Union Finance is worth over INR 1200 crore against an investment of INR 801 crore; while 10% stake in Shriram Transport Finance Company is worth INR 2,200 crore with an investment of INR 1,636 crore.

DIVERSIFICATION- SNAPSHOT

Revenue Diversification over years

Segment wise RoCE

| Segment | RoCE

as on 31st March 2015 |

| Healthcare+ | -5.63% |

| Financial Services+ | 6.60% |

| Information Management | 1.90% |

+:- RoCE calculated excluding exceptional gains/losses.

Financial Performance

In Rs crore

| Particular | PEL (Consolidated) | |

| FY2010-11 | FY 2014-15 | |

| Net worth | 11,856 | 11,736 |

| Total Revenue | 2,010 | 5,122 |

| EBITDA | 379 | 885 |

| EBITDA % | 18.9% | 17.3% |

| Capital Employed

(Net worth+ Long term borrowings) |

~12,184 | 15,522 |

| RoCE | ~3.63% | 3.83% |

| P/E Ratio*

(As on 31st March) |

54 | 33 |

| Market Cap | 7,400

As on 31st March |

17,080+ |

NOTE: – FY 11 financial of PEL includes the financial of Healthcare Business till 7th September 2010.

*:- Excluding Exceptional/Extraordinary items.

+:- As on date

For the FY 2014-15, its revenue from financial services was INR 1,096 crore against INR 82 crore in FY2011-12 at CAGR of ~137%. In FY 2012-13, PEL forayed into Information management business. Revenue from this business for FY 2014-15 was INR 1,020 crore against INR 651 crore in FY 2012-13. It pharma business is growing organically or inorganically at CAGR of 17%.

THE DIVESTMENT STRATEGY

Over the years, PEL grew their business through series of acquisitions & alliances. The divestment of domestic formulation business turned PEL from being the pharmaceutical company to a diversified entity. It entered into financial services focused on real estate. Today, it is growing at CAGR of ~137% vs. 17% CAGR of its pharma business. It takes a time to yield a return in real estate business. After incurring losses for two years, In FY 2015, PEL reported PAT of INR 421 crore.

From PEL’s shareholder point of view, suppose one had not opt for buyback option, today’s return on his investment:-

| Particulars | Amount |

| Value of INR 600; if invested somewhere else @12% | 1060 |

| Current Price of PEL | 983 |

| Dividend received in last 4 years

(Assuming reinvested @ 12%) |

125 |

| Total Gain for shareholder who had not opt for buyback | 108 |

It seems shareholder who had not opted for buyback in 2011, is in slightly better position but no brainer. However, if this INR 600 had invested in a benchmark index like Sensex/Nifty, he would have earned more returns. PEL’s financial sector has started yielding results. One can be optimistic about PEL’s future growth.