KKR’s roads platform Highways Infrastructure Trust is in talks to acquire a portfolio of 12 road projects from Agra-based construction firm PNC Infratech for an enterprise value of about ₹9,000 crore (about $1.1 billion), said two people aware of the development If the deal materialises, it would be the biggest acquisition of road projects by the US-headquartered private equity (PE) firm in India.

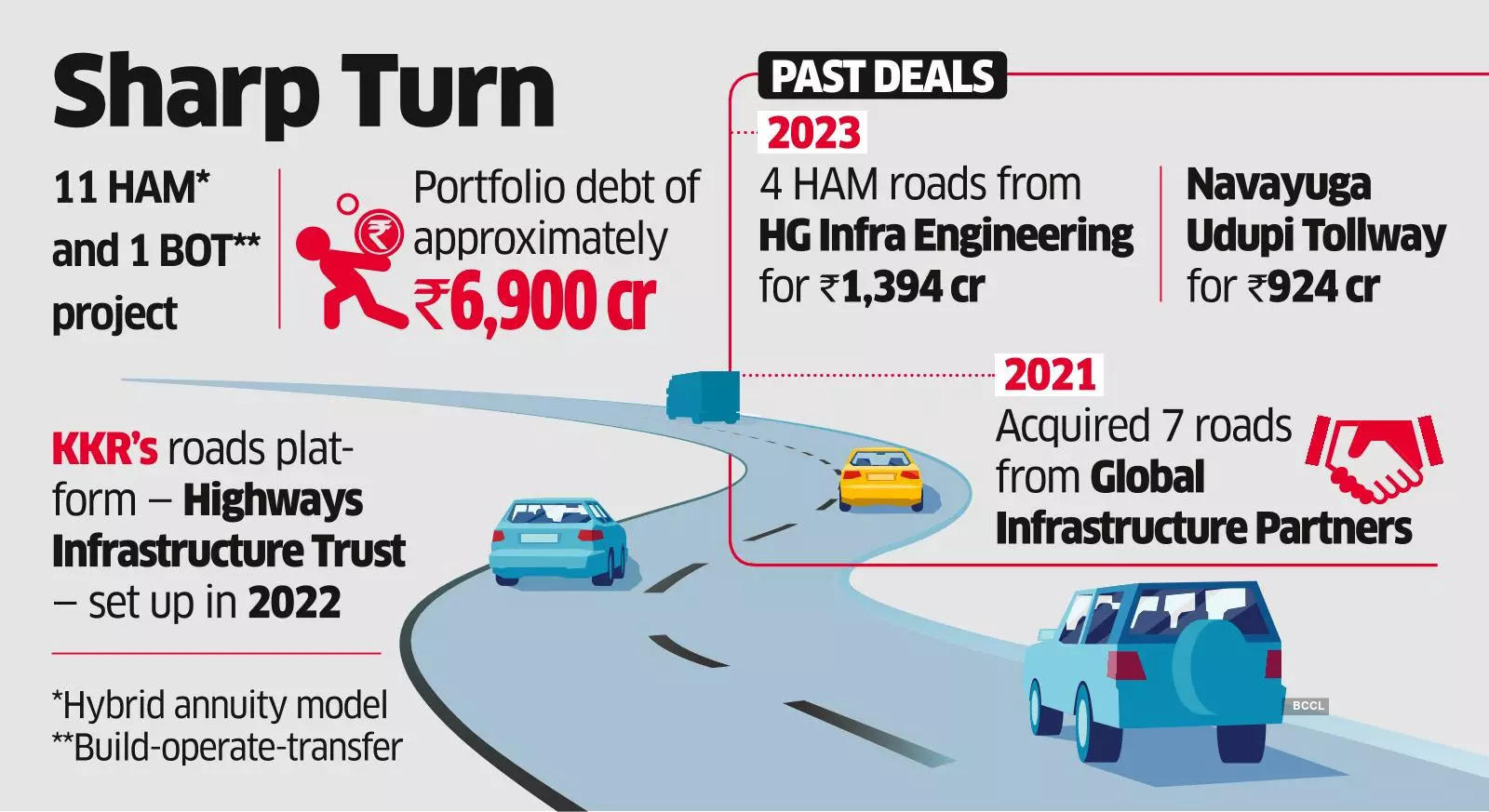

The portfolio on sale comprises 11 hybrid annuity model (HAM) roads and one build-operate-transfer (BOT) road. These projects are located across Uttar Pradesh, Madhya Pradesh and Rajasthan. “There were four bidders for the PNC portfolio. The company has gone ahead with KKR and the PE firm has recently started due diligence on the assets. The portfolio has an enterprise value of around ₹9,000 crore, with debt of around ₹6,900 crore,” said one of the persons, who did not wish to be identified.

Seven of the 12 road projects are already operational while the remaining are expected to become operational in the next three-four months, the person said, adding, “This is one of the biggest portfolio of roads on sale in the market currently.”

ET’s queries emailed to PNC Infratech and KKR did not elicit a response till press time. KKR is among the most active seekers of road projects in the country.

Last month, Highways Infrastructure Trust, an infrastructure investment trust (InvIT), signed agreements to acquire four HAM projects from construction firm HG Infra Engineering for an enterprise value of ₹1,394 crore. In April, ET reported that KKR had signed agreements to acquire 100% equity stake in Hyderabad-based Navayuga group’s toll road, Navayuga Udupi Tollway, for an enterprise value of ₹924 crore.

KKR began investing in Indian roads in 2021 when it acquired Global Infrastructure Partners’ entire stake in Highway Concessions One (HC1) highway assets totalling 487 km. The HC1 road portfolio is spread across seven states – Gujarat, Karnataka, Madhya Pradesh, Meghalaya, Rajasthan, Tamil Nadu and Telangana. The portfolio comprised 5 toll roads and 2 annuity roads.

The assets housed under the KKR roads InvIT are Jodhpur Pali Expressway, Godhra Expressways, Dewas Bhopal Corridor, Ulundurpet Expressways, Normal BOT and Shillong Expressway. The Indian roads sector has been seeing a flurry of deal activity as developers look to monetise their operating road projects to pare down debt and reinvest capital in new projects, and foreign investors seek long-term yield-generating infrastructure assets.