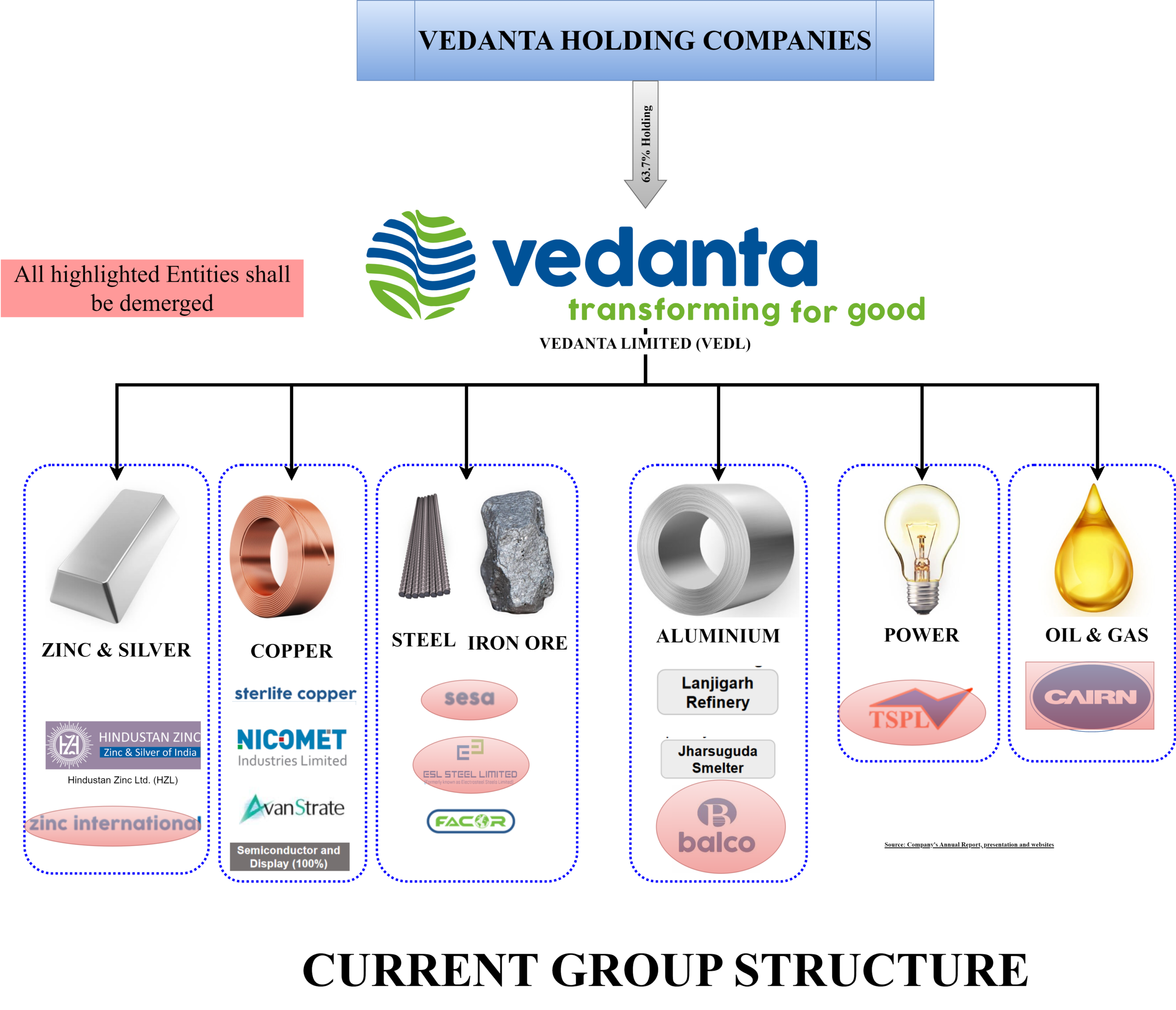

Vedanta Limited (“Demerged Company” or “VEDL”) is a diversified natural resources company engaged in the business of extraction, refining, manufacturing and sale of various metals and minerals, generation and sale of power and other businesses. The equity shares of VEDL are listed on nationwide bourses. The listed debt securities of VEDL are listed on BSE Limited. VEDL is a subsidiary of Vedanta Resources Limited listed on the Luxemburg exchange.

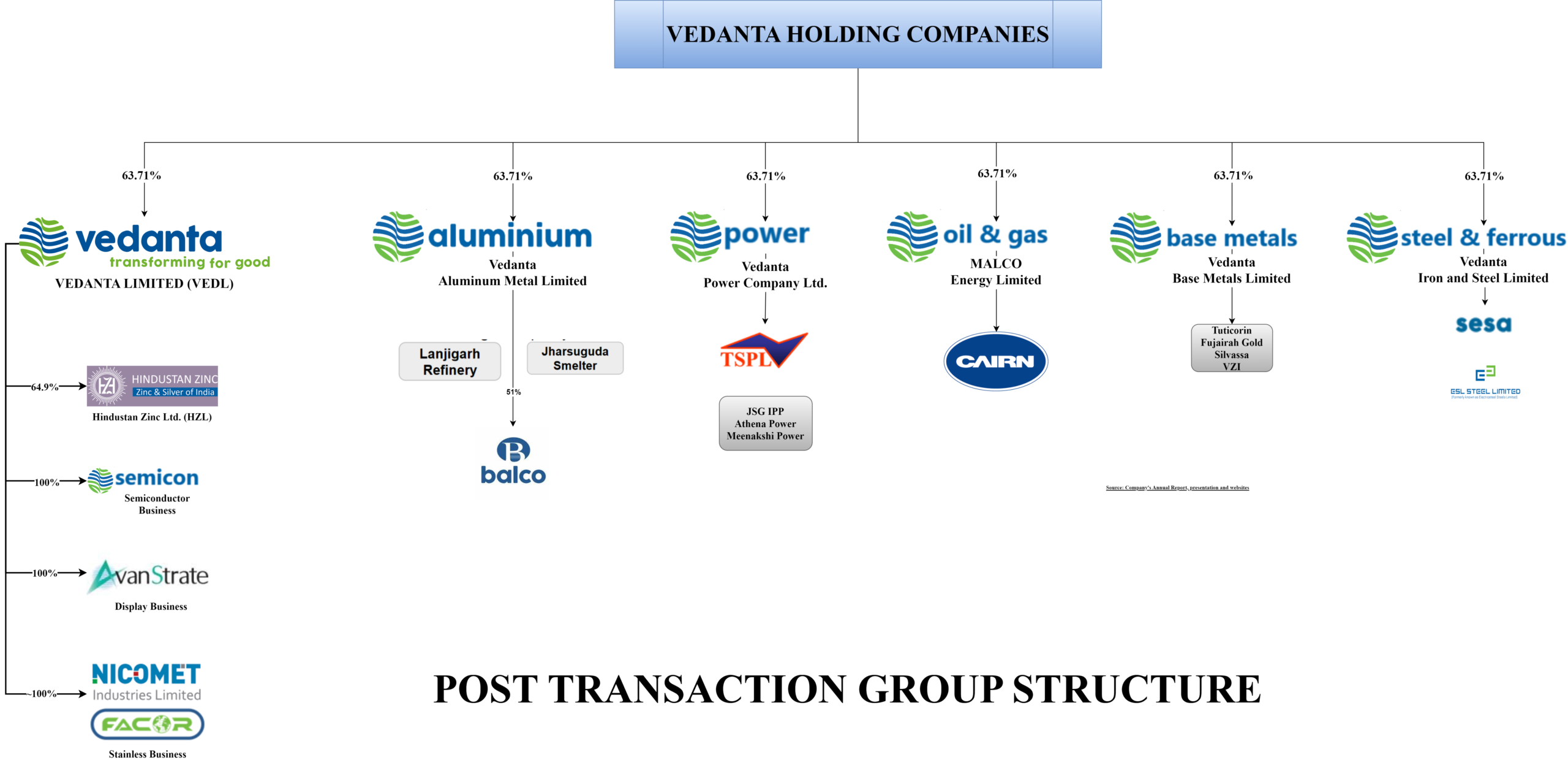

Vedanta Aluminum Metal Limited (“Resulting Company 1” or VAML”), Talwandi Sabo Power Limited (“Resulting Company 2” or TSPL”), MALCO Energy Limited (“Resulting Company 3” or MEL”), Vedanta Base Metals Limited (“Resulting Company 4” or VBML”) and Vedanta Iron and Steel Limited (“Resulting Company 5” or VISL”) are wholly owned subsidiaries of VEDL.

Transaction:

The Board of Directors of VEDL have approved a Composite Scheme of Arrangement which inter-alia provides for:

- Demerger of Aluminum Undertaking of VEDL to Vedanta Aluminum Metal Limited

- Demerger of merchant Power Undertaking of VEDL to Talwandi Sabo Power Limited

- Demerger of Oil & GAS Undertaking of VEDL to MALCO Energy Limited

- Demerger of Base Metal Undertaking of VEDL to Vedanta Base Metals Limited

- Demerger of Iron ore Undertaking of VEDL to Vedanta Iron and Steel Limited

VEDL will continue to hold strategic investment in Hindustan Zinc Limited, Vedanta stainless business, its proposed semiconductor business and display glass manufacturing.

Effectively, the existing VEDL will be split into 6 different companies (including existing VEDL) which will house different businesses.

Rationale for the demerger:

- Allow investors great choice to invest in either or all businesses.

- Better align strategy to each vertical with customers, investment cycles and end markets

- Simplifies Vedanta’s corporate structure.

- Drives value across the asset base.

The Appointed Date will be the Effective Date and the Appointed Date for each of the demergers may be a different date.

Consideration

The de-merger is planned to be a simple vertical split and for every 1 share of Vedanta Limited, the shareholders will additionally receive 1 share of each of the 5 resulting companies.

| Particulars | VEDL | Resulting Companies (post demerger) |

| Paid-up no. of shares | 3,71,75,04,871 | 3,71,75,04,871 |

| Face Value | 1 | 1 |

| Promoters Stake | 63.71% | 63.71% |

Effectively, post demerger, each of the separate businesses shall have share capital equivalent to the existing share capital of combined VEDL. One needs to evaluate whether the post-transaction share capital is not substantially higher than the business operations it will house.

Other aspects relating to the scheme:

The Scheme inter-alia also provides for a change of name of the Resulting Companies. The resulting Company 2 name will change to Vedanta Power Company Limited. Resulting Company 3’s name will be changed to Vedanta Oil and Gas Limited.

Further clause 41A of the Scheme provides for any credit balance remaining in capital reserve of the respective resulting companies on the Effective Date to be transferred to the Securities Premium of the respective resulting company.

Restructuring at Hindustan Zinc Limited

On the same day of approval of the Scheme by Board of Directors of VEDL, the Board of Directors of Hindustan Zinc Limited (HZL, a subsidiary of Vedanta Limited), authorized Committee of Directors (CoD) to evaluate appropriate corporate restructuring exercise to unlock shareholder value.

The basic idea is to create separate legal entities for undertaking the Zinc & Lead, Silver, and Recycling business of the Company. HZL has appointed advisors to assist them.

Vedanta Resources Limited’s Debt trap

The holding company of VEDL, Vedanta Resources Limited is listed on Luxembourg exchange has consolidated total debt as on 31st March 2023 of circa US$ 1536 crore (INR 1,26,000 crore). VRL is taking several actions to reduce its significant debt on its books. Few of the initiatives includes large dividend payout from its subsidiaries, VEDL & HZL, charging brand fee and stake sale in VEDL of circa 6%.

The ultimate holding company Vedanta Incorporated which also owns stake in Sterlite Technologies Limited & Sterlite Power Transmission Limited are also on demerger spree. Overall, the entire operational companies of the group (VEDL, HZL, Sterlite Technologies Limited & Sterlite Power Transmission Limited) are demerging various businesses which will pave the way for group to divest some of the businesses which will help them in reducing the further debt.

Sizeable chunk of debt raised by Vedanta Resources will be due in coming years. VEDL & HZL have already distributed most of the cash through dividend. Further fat dividends may not be available options. Demerger will allow the group to divest stake in some of the businesses which will allow the group to reduce its debt and fund its ambitious future projects.

Dividends distributed by VEDL:

Financials

Segment Information:

Vedanta Aluminium

VEDL’s Jharsuguda facility is the largest single-location aluminium smelting facility outside of China, and recently saw its capacity ramp up to 1.8 MTPA. It is accompanied by Bharat Aluminium Company Ltd. (BALCO, a 51% owned subsidiary of Vedanta Limited, taking total Group capacity to 2.4 MTPA).

Vedanta Oil & Gas

Vedanta’s Oil & Gas is the largest private oil, gas and sweet crude exploration and production company in India, accounting for more than a quarter of India’s domestic crude oil production.

Vedanta Power

Vedanta Power will house the Independent Power Plants at Vedanta. Anchored by Talwandi Sabo Power Limited (TSPL, a wholly owned subsidiary of Vedanta Limited), a 1980 MW plant based in Punjab, India, the business will also include the 600 MW Jharsugada power plant, the recently acquired 1200 MW Athena plant and the 1000 MW Meenakshi plant which is in the process of being acquired. Total capacity will therefore near 5GW post completion.

Vedanta Iron Ore

Vedanta’s Iron Ore Business includes Iron Ore Goa, Iron Ore Karnataka, Liberia as well as VAB (Value Added Business). The company has aspirations to more than double annual iron ore production, from assets in India and Liberia to 13Mt by 2025. This vertical will also include, ESL Steel Limited (ESL, a 95.49% owned subsidiary of Vedanta Limited).

Vedanta Base Metal

The Zinc International assets continued to ramp up production at Gamsberg mine in South Africa and achieved record production of 208kt in 2023. Vedanta’s copper business is capable of producing more than a third of India’s copper, Vedanta Copper’s assets in India consist of custom smelter, a refinery, a phosphoric acid plant, a sulphuric acid plant and a copper rod plant.

Residual Vedanta

Residual Vedanta to hold strategic investment in Hindustan Zinc Limited, Vedanta stainless business, its proposed semiconductor business and display glass manufacturing.

"Please note that the above numbers include the numbers of HZL and the dividend etc. received from subsidiaries/associates companies"Conclusion:

Vedanta’s move to split itself into several parts is a result of the group’s overall strategy to divide its operations into several different companies. Considering the existing debt & its repayment schedule, the move is a compulsion rather than a step for value creation.

With numerous listed companies with the group, it is likely that they will divest their stake in some of the businesses which shall help them in repayment of debt & funding its aspirational projects.