SeQuent Scientific Limited announced a merger which is expected to create a unique & differentiated platform with leading market position in the Animal healthcare segment.

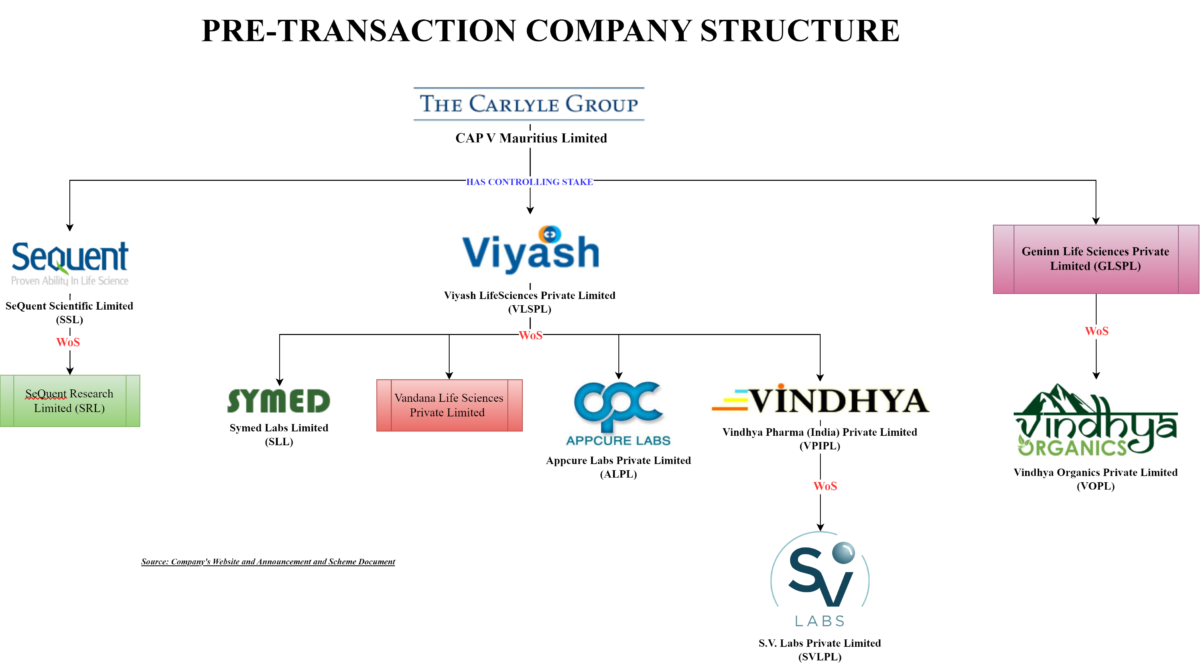

SeQuent Scientific Limited (“SEQUENT” or “SSL” or “Amalgamated Company”), headquartered in India, operates in Animal Health market with a global footprint. SeQuent has seven manufacturing facilities based in India, Spain, Brazil and Turkey with approvals from various international regulatory bodies. SeQuent currently produces API’s and Animal health formulations in over 100 countries and has more than 1,500 employees. SSL’s equity shares are listed on nationwide bourses. In 2020, The Carlyle Group acquired a controlling stake in SSL giving complete exit to erstwhile promoters.

Other company of SSL involved in the proposed transaction is SeQuent Research Limited (“SRL” or Amalgamating Company 2”) which is a wholly owned subsidiary of SSL.

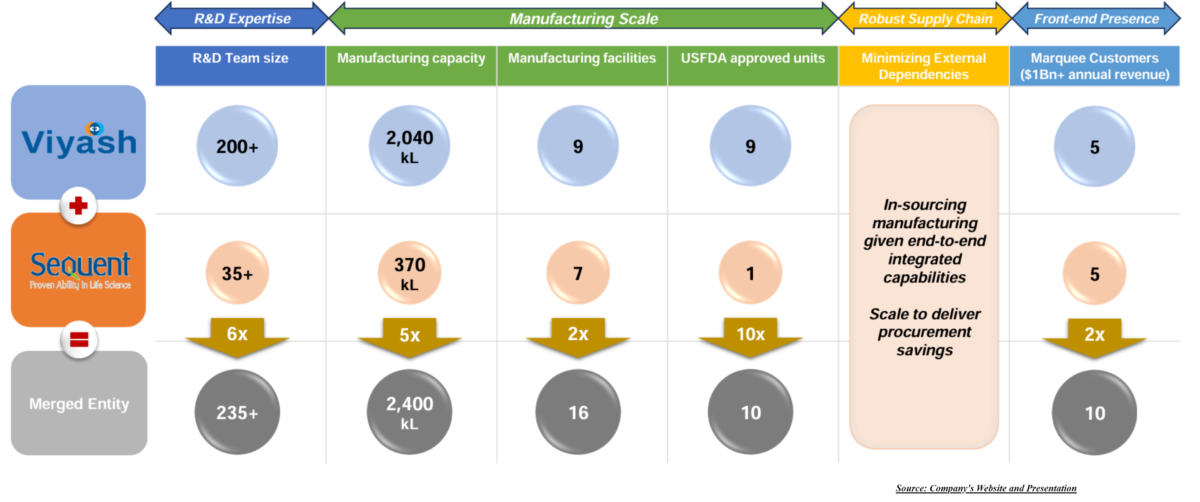

Viyash Lifesciences (together with various companies as mentioned hereinafter) is an integrated end-to-end pharmaceutical company with a presence across niche formulations, APIs and advanced intermediates. Viyash has an R&D team of 200+ scientists and has 9 USFDA approved plants, signifying strong R&D and manufacturing capabilities. Viyash serves customers across 150+ countries. The list of companies pertaining to Viyash Lifesciences involved in the transaction is as follows:

- Viyash Life Sciences Private Limited (“VLSPL” or Transferee Company 1” or Amalgamating Company 1). The company is engaged in the business of development, manufacture and marketing of active pharmaceutical ingredients. The Company is a holding company for all other Viyash group companies.

- Symed Labs Limited (“SLL” or Transferor Company 1”) is a wholly owned subsidiary of VLSPL. The company is engaged in the manufacturing of bulk drugs and intermediates.

- Vandana Life Sciences Private Limited (“Transferor Company2) is a wholly owned subsidiary of VLSPL. The company is engaged in the business of development, manufacture and marketing of active pharmaceutical ingredients. In prior years, operations of Vandana have been scaled down its facility including employees are transferred to other Viyash group companies.

- Appcure Labs Private Limited (“ALPL” or Transferor Company 3”) is a wholly owned subsidiary of VLSPL. The company is engaged in Research & Development of drugs & Pharmaceuticals & Technology transfer as formula service provider.

- Vindhya Pharma (India) Private Limited (“VPIPL” or “Transferor Company 4) is a wholly owned subsidiary of VLSPL. The company is engaged in the business of development, manufacture and marketing of active pharmaceutical ingredients.

- S.V.Labs Private Limited (“SVLPL” or “Transferor Company 5”) is a wholly owned subsidiary of VPIPL and thereby indirect wholly owned subsidiary of VLSPL. The company is engaged in the business of development, manufacture and marketing of active pharmaceutical ingredients

- Geninn Life Sciences Private Limited (“GLSPL” or Transferee Company 2” or “Transferor Company 7”). GLSPL is not carrying any active operations and is purely holding company of VOPL.

- Vindhya Organics Private Limited (“VOPL” or “Transferor Company 6”) is a wholly owned subsidiary of GLSPL. The company is engaged in the business of development, manufacture and marketing of active pharmaceutical ingredients.

Viyash group was founded in 2019 by Mr. Hari Babu Bodepudi & Mr. Srihari Raju Kalidindi joined him as co-founder. Later, Viyash acquired VPIPL, Vandana Lifesciences, Mylan’s certain units, Synmed Labs and Appcure Labs till date. In 2021, Carlyle joined the board with a controlling stake.

Both SeQuent & Viyash group belong to the group of entities doing business globally as, ‘The Carlyle Group’. Basically, the proposed transaction is a merger between portfolio companies pertaining to “The Carlyle Group” initiated to make its investments as 1+1=11.

The Proposed Transaction

The Board of Directors of respective companies, at their respective meetings have inter alia approved a composite scheme of amalgamation (“Scheme”) for the merger of Viyash Life Sciences Private Limited and its group companies and SRL with SSL under Sections 230 to 232 and other applicable provisions of the Companies Act, 2013, and approved the execution of an implementation agreement to set out the manner of implementation of the Scheme.

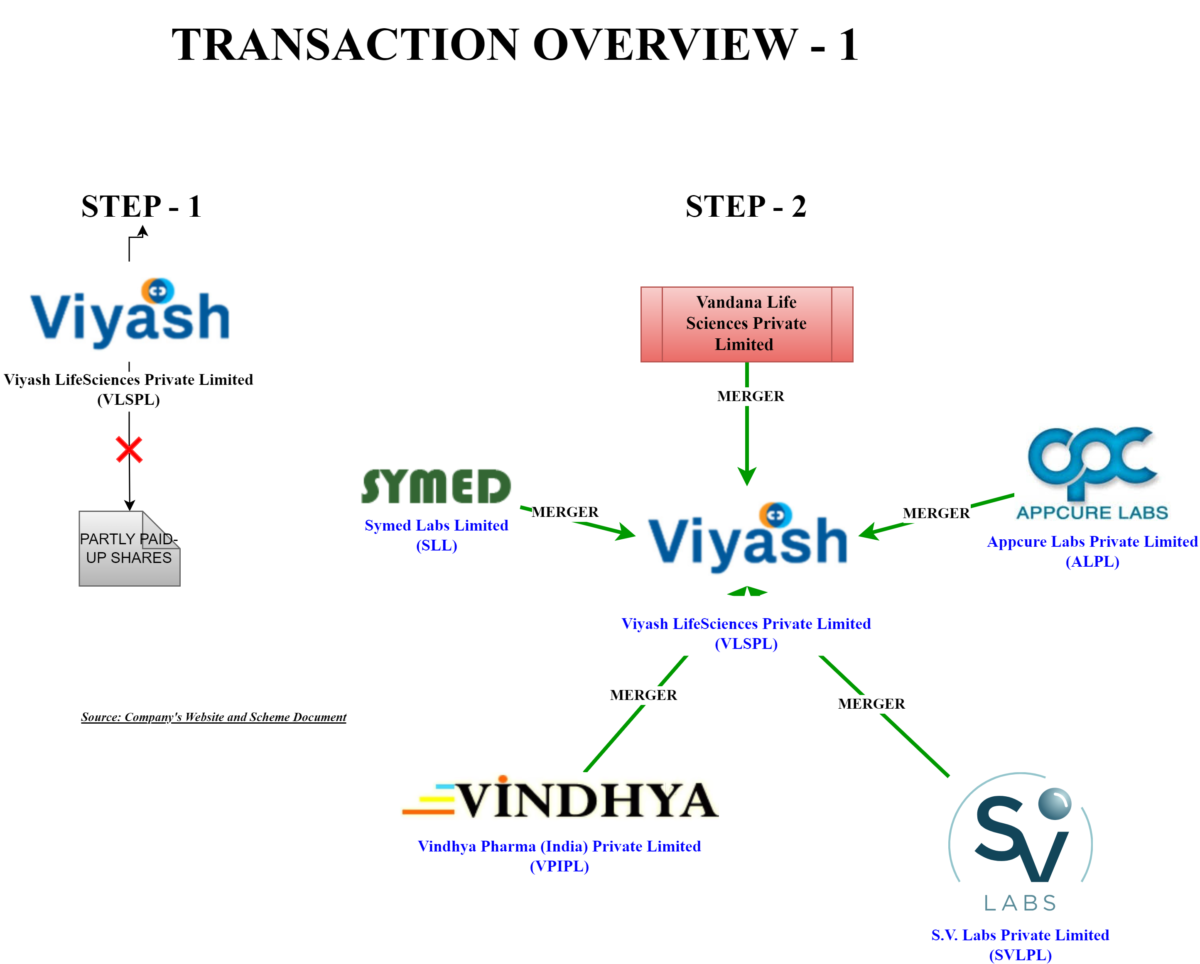

The chronological steps of the transaction:

- Reduction of the share capital of VLSPL by cancelling partly paid-up shares;

- Merger of Transferor Company 1, Transferor Company 2, Transferor Company 3, Transferor Company 4 and Transferor Company 5 (Directly and indirectly wholly owned subsidiaries of VLSPL) with VLSPL;

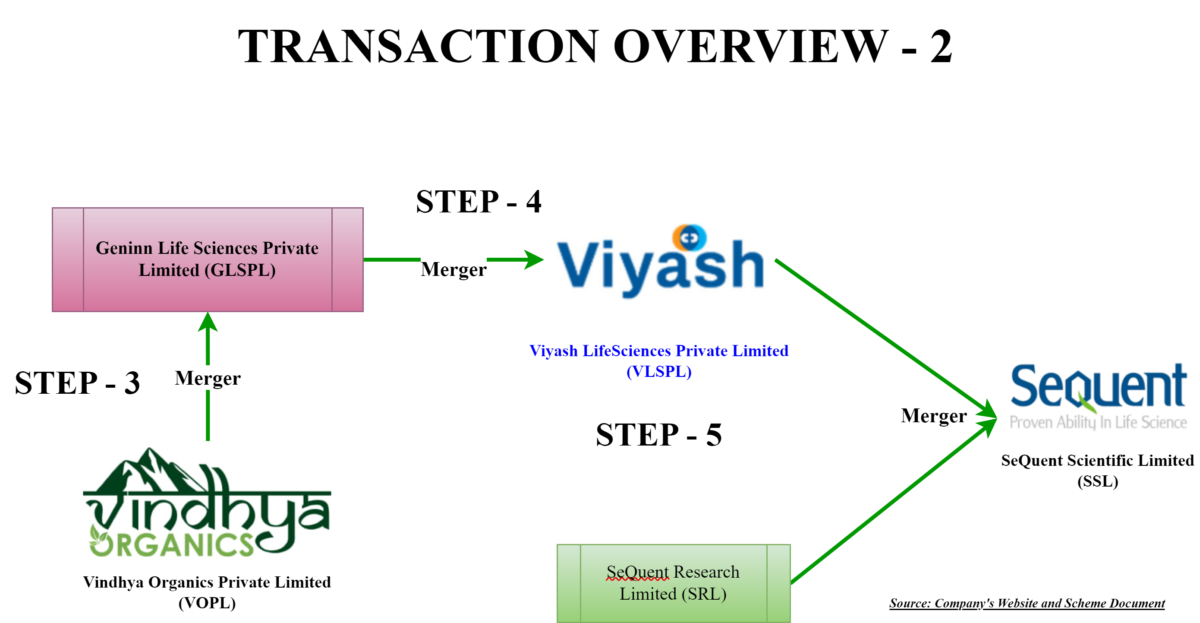

- Merger of the Transferor Company 6 with the Transferee Company 2/GLSPL;

- Merger of GLSPL with VLSPL;

- Merger of VLSPL and SRL with SSL.

The Rationale Behind Marriage

True intention of “Carlyle Group” is to create large platform which will enhance its value on investment and facilitate ease exit whenever it wants to. However, there are certain key advantages for all other stakeholders. The inherent capabilities of Viyash and SeQuent to create a platform with leadership in animal pharmaceuticals, end-to-end integrated capabilities across the larger global pharmaceuticals market with a strong operating and R&D backbone. The combined entity will leverage the individual businesses’ strengths through the following ways:

- Access to global innovators & big pharmaceuticals customers:

- Leverage technical skills:

- Expanded marketing presence across geographies

- Backward integration

- Enhanced R&D and new product pipeline

- Procurement synergies & Other cost benefits

Overall, it appears that SeQuent has strong front-end operations in animal healthcare while Viyash has a domain in R&D and patenting along with manufacturing facilities for human health. It will be interesting to see how each business will complement others and create value.

The appointed date for the proposed merger (all steps) is 1st April 2025. However, the transaction will be given effect in above-mentioned (Stepwise as mentioned above). Further, the transaction will have two different record dates & effective dates.

The Equity Share Capital & Swap Ratio

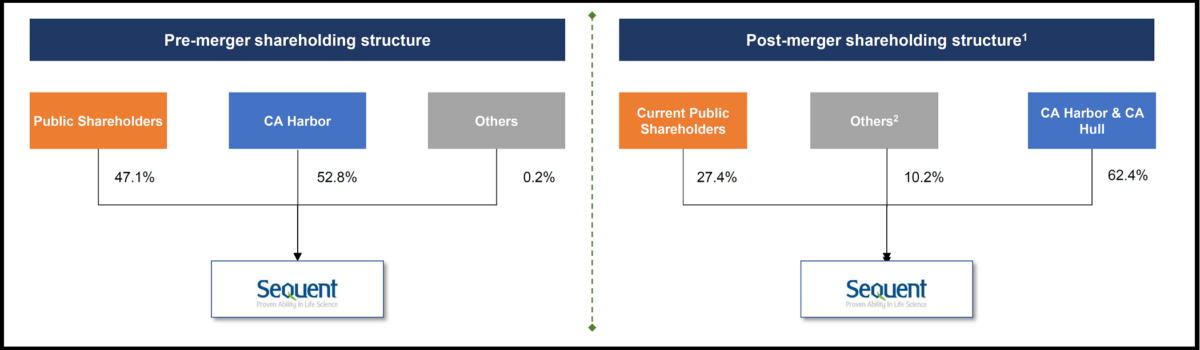

Currently, SSL is entirely promoted by the Carlyle Group while VLSPL & GLSPL is jointly promoted by the Carlyle Group and the founders of Viyash Group.

Effectively, SSL shall issue Circa 18 crore shares to the Carlyle Group, founders of Viyash Group and some other small shareholders. This will further increase if warrants are exercised & partly paid shares are been fully paid by the founders. Essentially, it gives sort of flexibility to adjust their stake in the merged entity for optimum consideration.

Further please note:

- SSL is promoted by The Carlyle Group only.

- Promoter holding of VLSPL means Hari Bapu Bodepaudi and related individual persons (Founders of Viyash) plus The Carlyle Group. The Carlyle Group owns 77% while remaining by the founder group.

- Promoter holding of GLSPL means Hari Bapu Bodepaudi and related individual persons only however, through Contractual arrangement, VLSPL effectively controls GLSPL without holding any shares.

- Current co-promoters of VLSPL & GLSPL will be classified as public shareholders and hold circa 10% in the merged entity. Further, upon conversion of the warrant, their stake will go up by circa 5%.

In 2022, VLSPL transferred the legal ownership of GLSPL to individual shareholders of the VLSPL. As per the same agreement, VPPL transferred its entire stake in VOPL to GLSPL for which consideration of INR 57 crore is yet to be paid by GLSPL. However, through various clauses of the said agreement, GLSPL is still controlled by VLSPL and GLSPL was fully consolidated with VLSPL.

Further, as provided in the scheme, 1,86,15,406 partly paid-up shares of VLSPL which if remain partly paid up till Effective Date 1 shall get cancelled & shall payback the partly paid amount so received from respective shareholders. without any payment. These partly paid up shares are mainly owned by Viyash employee benefit trust & Founders. Shares issued to founders are mainly converted from time linked warrants (as discussed hereinafter). The total uncalled amount is circa INR 148 crore.

VLSPL recently (July 24) came up with right issue in which 6,49,66,430 equity shares were issued at INR 45 each to existing shareholders.

Further, pursuant to the investment agreement with Carlyle Group, VLSPL is required to issue warrants to two founders after each of the investment rounds done by VLSPL without any initial consideration. These warrants are split into time linked warrants, performance linked warrants and environmental, health and safety linked warrants with each having its own vesting conditions. The exercise price of all warrants is INR 90 each which has conversion ratio of 1:1. Later, Time linked warrants are cancelled & converted into founder’s incentive shares. As on date, VLSPL has issued 4,07,10,139 warrants for which circa INR 228 crore needs to be bought by founders/warrant holders.

During the merger, every warrant holder of VLSPL will receive 56 warrants of SSL for every 100 warrants of VLSPL held by them. Each of the warrants shall be entitled to get converted into 1 equity share of SSL.

| Name of warrant holder | No of warrants allotted by SSL |

| Hari Babu Bodepudi | 2,03,41,257 |

| Kalidindi Srihari Raju | 24,56,420 |

| Total | 2,27,97,677 |

warrants represent 5.0% of the company’s total outstanding shareholding on a fully converted basis.Equity Share Consideration:

For merger of GLSPL with VLSPL:

- Each shareholder of GLSPL will receive 47 (forty-seven) equity shares of VLSPL for every 1 (one) equity share of GLSPL held by them, for the merger of GLSPL with VLSPL.

For merger of VLSPL with SSL:

- Each shareholder of VLSPL will receive 56 equity shares of SSL for every 100 equity shares of VLSPL held by them.

Financials & Valuations

Key financials of Viyash Group:

Please note that GLSPL is purely holding company of VOPL thus, its revenue & other details are not covered above.

Please note that there are multiple transactions between aforesaid entities including purchases, sales, loans and transfers of businesses/shareholding.These financials are for FY 2024 and without considering the further issue made /amount if any received in future for warrants & partly paid up share. If VLSPL received circa INR 376 crore (from warrants & partly paid up shares) it becomes debt-free & can improve returns further.

Valuations

Considering the valuation report, following the assigned valuation & revenue & EBITDA multiple assigned to companies:

| Particulars | Shares considered in valuation report | Assigned value | Revenue Multiple | Tentative EV/EBITDA |

| SSL | 26,51,93,745 | 4823 | 3.5 | 73 |

| VLSPL | 35,66,36,465 | 3612 | 2.6 | 20 |

Please note that the above share considered by the valuer for working the swap ratio. VLSPL shares are after considering the warrants & ESOP (not partly paid-up shares). Comparatively, it appears that VLSPL has been valued at a discount to SSL. The valuation of VLSPL may undergo change if the warrants are not converted into equity and requisite cash is not brought into the company.Conclusion

The proposed step taken to create a unique company which shall provide an opportunity for shareholders mainly for the Carlyle Group to create some value in its acquisition. Sequent was acquired by Carlyle Group in 2020 and in the last 4 years, no substantial value has been created for shareholders. The merger will provide liquidity for Viyash group shareholders which may take exit after merger becomes effective. Further, warrants/partly paid-up shares structure has been designed carefully in VLSPL to protect interest of Viyash founders and at same time compensate them appropriately. Only time will tell whether the move to diversify creates any value for SSL minority shareholders.