Themis Medicare Limited (“TML” or “Transferee Company”) is engaged in the business of manufacturing of finished formulations and synthetic Active Pharmaceutical Ingredients (“APIs”). The equity shares of TML are listed on the Stock Exchanges.

In 2022, TML decided to transfer its entire API business to its wholly owned subsidiary through slump sale which was pending due to pending approval from GIDC which was secured. However, with approval for the proposed merger with GTBL, TML terminated the business transfer agreement on account of change in the business environment and strategy re-alignment.

During 2007-09, TML acquired a direct stake in GTBL and stepped in as joint promoters of GTBL.

Gujarat Themis Biosyn Limited (“GTBL” or “Transferor Company”) is engaged in the business of manufacturing fermentation-based pharmaceutical intermediates and APIs. The equity shares of GTBL are listed on BSE. As on date, GTBL is an associate company of TML which held 23.19% equity stake in GTBL.

To date, GTBL has witnessed several ownership changes. Originally, GTBL was incorporated in 1981 as a joint sector company with GIIC Ltd. and Chemosyn (P) Ltd. It was subsequently taken over in June 1991 by Yuhan Group, South Korea and Pharmaceutical Business Group (India) Ltd. (PBG). It is being actively managed by Themis Medicare Ltd. since 2007 along with Yuhan Corporation. In 2021, Yuhan Corporation sold its entire circa 26% stake in GTBL to PBG.

On the production side, GTBL mainly focuses on 2 products, Rifa S is used as an input for Rifampicin and Rifapentine (used primarily to treat TB), while Rifa O is used for Rifaximin (used to treat Diarrheal). During the year 2020, the company changed its business model from contract manufacturing to own manufacturing and sales model. After fulfilling all the contractual obligations, GTBL was able to make the strategic shift which led to improved realisations and substantial improvement in margins. This change gave better access to markets and a competitive advantage.

Proposed Transaction:

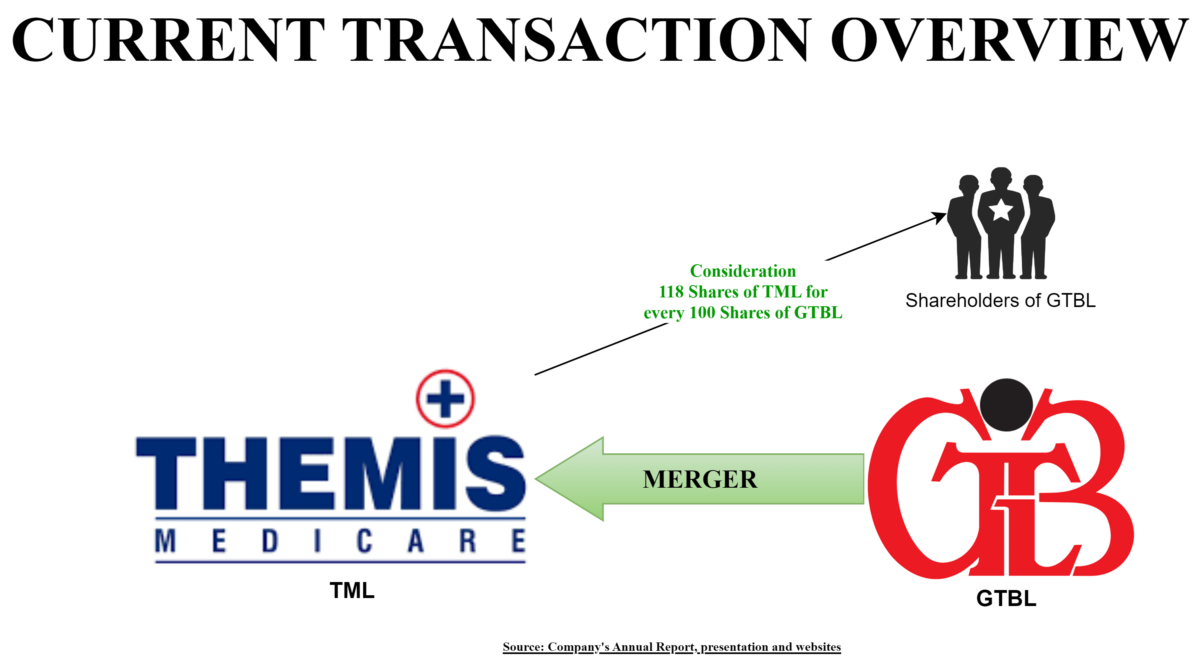

The board of directors of GTBL & TML at their respective board meetings approved a scheme of merger which proposes to merge GTBL with TML. The appointed date for the proposed merger will be April 1, 2025 or such other date as may be approved by the Boards of both companies.

Rationale for the scheme

As envisaged under the proposed scheme, the following are the rationale for the consolidation of GTBL with TML:

- Integration of the entire product value chain under a consolidated entity

- This consolidation will lead to synergies of operations and facilitate long-term sustainable growth to enhance value for all stakeholders concerned;

- Optimal utilisation of resources to derive operating efficiencies and business synergies;

- Ability to sell products through the expanded distribution channels;

- Efficient utilization of capital to drive growth of the consolidated business under a single entity;

Share Capital & Swap Ratio

Upon the merger becoming effective, Themis Medicare Limited will issue and allot 118 equity shares of the face value of Re. 1 each, credited as fully paid-up, for every 100 equity shares of the face value of Re. 1 each fully paid-up, held by shareholders in Gujarat Themis Biosyn Limited.

| Particulars | GTBL | TML-Pre | TML-Post |

| No. of paid up equity shares of INR 1 each | 10,89,65,265 | 9,20,40,120 | 19,07,98,129 |

| Promoter Holding | 70.86%* | 67.15% | 64.52% |

*: Including 23.19% stake held by TMLAs a result of the merger, TML’s existing holding in GTBL will get cancelled & new shares of TML will be issued to other shareholders excluding TML. Circa 9.87 crore equity shares will get issued by TML.

Financials

Please note:

- TML PAT is after considering its share in associate i.e. GTBL

- Core capital employed of TML is after deducting investment in associate which is recorded using equity method and GTBL after capital work in progress.

GTBL is a niche pharma company which focuses on specific products which gives them an edge on margins and overall returns. After a long gap, GTBL embarked on a capacity expansion plan which will significantly enhance its capacity in the next year. TML though having a larger presence, its return and even absolute profit is lower than GTBL. After merger, the consolidated numbers for TML will likely improve.

Assigned Valuation

| Particulars | TML | GTBL |

| Assigned market capitalisation in valuation report (INR in Crore) | 2590 | 3610 |

| EV/EBITDA | 48 | 44 |

| PE Ratio | 60 | 61 |

TML valuation is considering its 23.1% stake in GTBL.Interestingly, despite having superior margins and ratios, GTBL has been valued at almost par multiple with TML. There could be certain other reasons like product portfolio, TML stake in GTBL etc. for the same.

Conclusion

Currently, both TML & GTBL has been managed by the same set of promoters. Strategically, a merger is being announced post-buyout of its other longstanding strategic partner, Yuhan Corporation in GTBL.

On one hand, GTBL is engaged in niche products while TML has a diversified product base. Going forward, it will be interesting to see a return for minority shareholders.