Cello World Limited (“CWL” or “Transferee Company”) is a company incorporated under the provisions of the Act. CWL is engaged in the business of trading of “Consumer Products” namely plastic and rubber products such as water bottles, storage containers and jars, tiffin and lunch carriers, glassware, steel flasks and jars. CWL holds 54.92% of the equity share capital of WPL. The equity shares of CWL are listed on nationwide bourses.

In 2023, CWL came out with an Initial Public Offer which was conducted through an offer for sale amounting to INR 1900 crore. The entire offer for sale was of shares held by promoters thus, the entire amount was received by the Rathod family (promoter). In 2024, to meet minimum public shareholding, CWL did qualified institutional placement and raised circa INR 737 crore.

Wim Plast Limited (“WPL” or “Transferor Company” or “Demerged Company”) is inter alia engaged in the businesses of manufacturing of plastic products such as plastic moulded furniture, extrusion sheets, air coolers, dustbins, industrial pallets and industrial and engineering moulds and investment business. WPL is a subsidiary of CWL. The equity shares of WPL are listed on BSE Limited since October 1994.

Cello Consumer Products Private Limited (“CCPPL” or “Resulting Company”) is a company incorporated under the provisions of the Act (as defined hereinafter). CCPPL carries on the Manufacturing Business (as defined hereinafter). CCPPL is a wholly owned subsidiary of CWL.

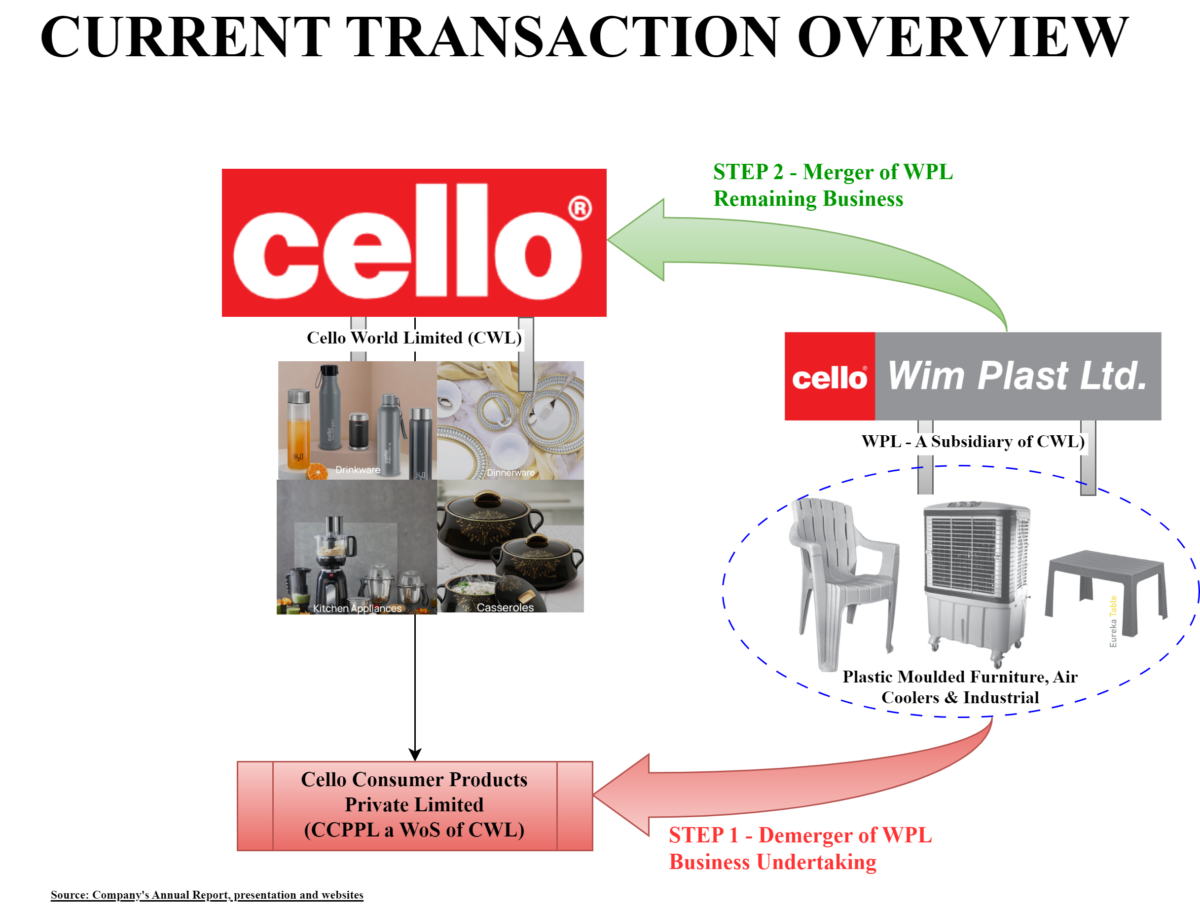

Proposed transaction

The Board of Directors of CWL, WPL and CCPPL at their respective board meetings, approved a composite scheme of arrangement which inter-alia provides for:

- Demerger of the Demerged Undertaking (as defined hereinafter) from WPL into CCPPL on a going concern basis, and issue of equity shares by CWL (being holding company of CCPPL) to the shareholders of WPL (other than the shares held by CWL), in consideration thereof and

- Merger of remaining WPL with CWL and the issue of equity shares by CWL to the shareholders of WPL in consideration thereof.

The “Demerged Undertaking” means entire undertaking of WPL, including all assets and liabilities pertaining to the Manufacturing Business i.e., manufacturing of plastic products such as plastic moulded furniture, extrusion sheets, air coolers, dustbins, industrial pallets, and industrial and engineering moulds.

The turnover of the Manufacturing Business is 89.39% to the total turnover of WPL for six months period ended September 30, 2024, and for the financial year 2023 – 24 is 93.28%. Thus, the entire manufacturing business will house under CCPPL through demerger and surplus assets which include mutual fund investments, cash & cash equivalents etc. will get merged with CWL.

The appointed date for both transactions is 1st April 2025, or such other date as may be mutually agreed by the respective Board of the Companies. It is clarified in the scheme that the demerger will be given effect first followed by the immediate merger of remaining WPL with CWL.

Rationale as envisaged in the scheme:

- CWL is currently engaged in the business of trading of Consumer Products which is manufactured by its subsidiaries and others. WPL is a subsidiary of CWL which is engaged in the manufacturing of various products. The Scheme is being proposed with a view to simplifying the management and operational structures of the Parties to increase efficiencies and generate synergies by demerging Manufacturing Business from WPL to CCPPL, the other subsidiary which is also engaged in the manufacturing activities.

- Creating a dedicated manufacturing vertical pursuant to demerger will enable a focused attention on the Manufacturing Business, which will lead to increased efficiencies and generate synergies amongst the various manufacturing businesses owned by CWL and better resource allocation, resulting in enhancement of shareholders’ value;

- The shareholders of WPL (other than CWL) will be allotted shares of CWL and therefore, they will become shareholders of a larger branded consumer products business with multiple growth avenues and at the same time, will continue to participate in the Manufacturing Business.

Essentially, the group is consolidating the two listed companies owned by the same group engaged in similar business which shall streamline the organisation structure at the same time eliminate confusion between minority shareholders on having two different listed companies engaged in the business which is not much different.

Capital Structure & Swap Ratio

| Particulars | WPL | CWL-Pre | CWL-Post |

| No. of Paid-up equity shares | 1,20,03,360 | 22,08,85,034 | 22,38,60,943 |

| Promoters Stake | 56%* | 75% | 74.03% |

*Including CWL’s stake of 54.92%.CWL existing share in WPL will be cancelled and new shares will be issued to the remaining shareholders of WPL. As the relative size of WPL is circa 5% of CWL and half of the existing holding of WPL is already held by CWL, there will be less than 1% dilution in the promoters holding for in the merged CWL. As CWL will issue shares (being the holding company of CCPPL), CCPPL will continue to be a wholly owned subsidiary of CWL post-demerger.

Effectively, CWL will issue 86 equity shares for 100 equity shares of WPL.

Consideration for Demerger:

Fifty-five (55 Only) equity shares of Cello World Limited of INR 5/- each fully paid up for every Hundred (100 Only) equity shares of Wim Plast Limited’s Manufacturing Business of INR 10/- each fully paid up.

Consideration for merger of remaining merger of WPL:

Thirty-one (31 Only) equity shares of Cello World Limited of INR 5/- each fully paid up for every Hundred (100 Only) equity shares of Wim Plast Limited’s Remaining Business of INR 10/- each fully paid up.

Through the designed structure, CWL will house the WPL business in a separate subsidiary and the remaining WPL which will have only investments will get merged with CWL.

Financials

Please note that the Consolidated CWL financials includes WPL financials as well.Though, in terms of market capitalisation, WPL is much smaller than CWL, it constitutes a good amount in the consolidated financials of CWL. Going ahead, CWL can effectively use the surplus assets of WPL for its future development which may result in some improvement at consolidated levels.

Valuation

Valuation split of WPL

| Particulars | WPL-Manufacturing Business | WPL-Remaining Business | Total WPL |

| Relative Value per share assigned | 480 | 271 | 751 |

| Total assigned value (In Crore) | 575 | 325 | 900 |

| % | 64% | 36% | 100% |

As mentioned in the valuation report, the appointed valuer has used a mix of income & market approach to value the manufacturing business of WPL and the NAV approach to value WPL's Remaining Business which primarily includes Mutual Fund Investments, Cash and Cash equivalents.

To meet the minimum public shareholding percentage (25% from circa 22%), CWL did a qualified institutional placement whereby it raised INR 737 crore at a price of INR 852 per share. From the money, it returned loan of circa INR 100 crore taken from WPL.

Valuation matrix for WPL & CWL

| Particulars | WPL-total | CWL |

| Assigned value | 900 | 19,438 |

| MCAP/EBITDA | 10.6 | 36.5 |

| PE Ratio | 16 | 54.6 |

CWL valuation is including its stake in WPL.Conclusion

WPL was started under the umbrella company and got listed much earlier than CWL. In 2023, when the parent got listed on nationwide bourses, it became inevitable to consolidate both businesses for the group due to similar products.

It appears the entire journey has been well crafted by Cello Group as promoters got substantial money at the time of IPO which was followed by QIP to meet minimum public shareholding and having cash reserve with the company. Immediately thereafter, the proposed merger was announced.