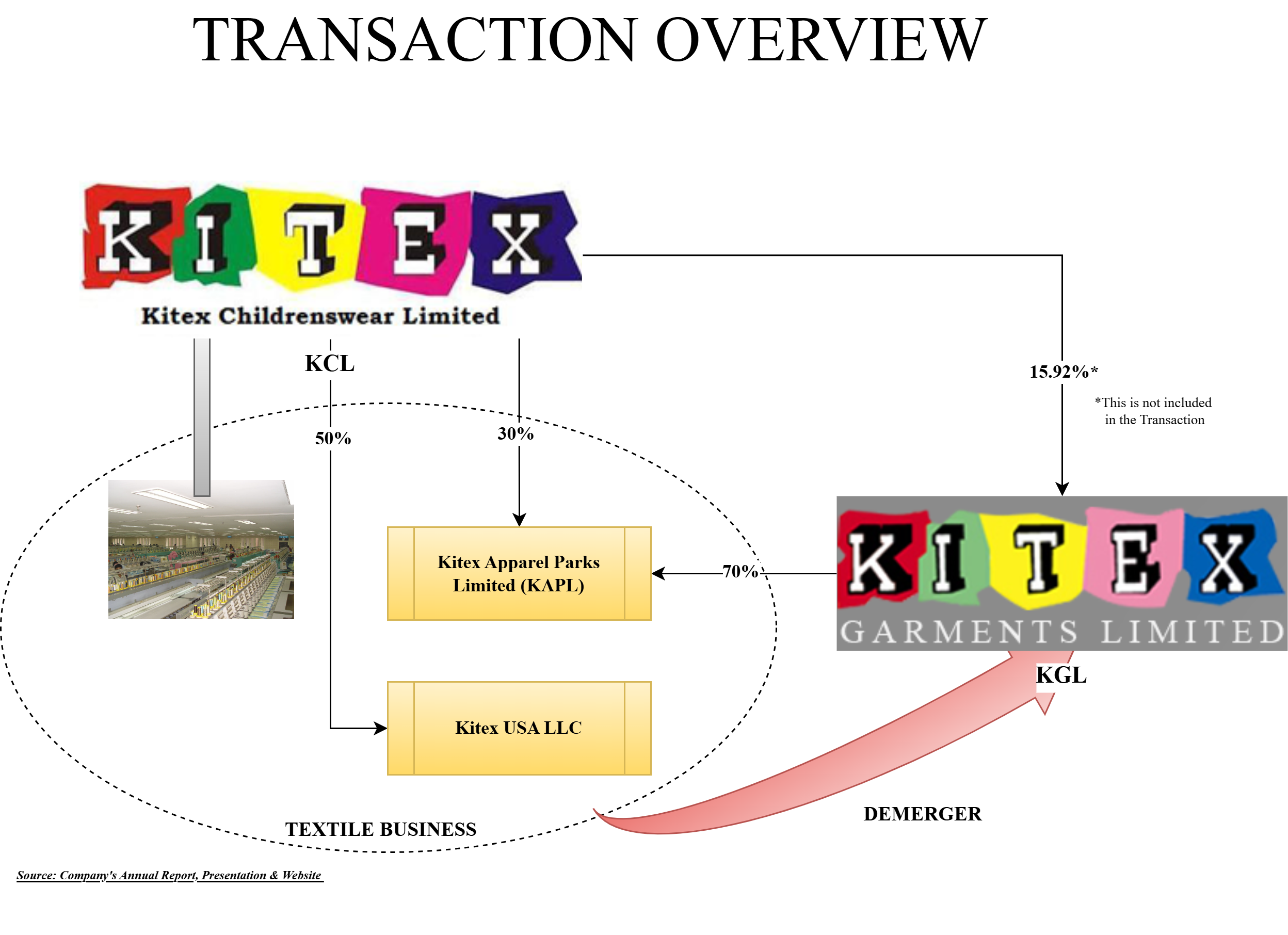

The Board of Directors of Kitex Garments Limited considered the Kitex Childrenswear Limited proposal and have approved a “Scheme of Arrangement between Kitex Childrenswear Limited and Kitex Garments Limited and their respective shareholders and creditors”, in compliance with Sections 230 to 232 and other applicable provisions of the Companies Act, 2013 (“Scheme”).

Companies Involved:

Kitex Garments Limited (“KGL” or “Resulting Company”) is engaged in the manufacturing and export of knitted garments for infants and kids. The equity shares of KGL are listed on nationwide bourses.

Kitex Childrenswear Limited (“KCL” or “Demerged Company”) is a promoter group company of KGL, which is also engaged in the manufacturing of babywear garment products. It also undertakes job work assignments for KGL. As on date, KCL holds 15.92% equity stake in KGL. The equity shares of KCL are not listed anywhere.

The Proposed Transaction

The approved Scheme, inter alia, provides for the demerger of the Textile Business Division of the KCL into KGL (“Proposed Transaction”).

“The Textile Business Division of KCL” is engaged in the manufacturing, selling, exporting, etc, of children’s garments and apparel and related services, activities, operations as a going concern. Further, the textile business also includes KCL’s 30% stake in Kitex Apparel Parks Limited (KAPL) and 50% holding in Kitex USA LLC.

KAPL is incorporated to engage in the same business and is a subsidiary of KGL (70%) and an associate company of KCL. Post-consolidation of KCL with KGL, KAPL will become wholly owned subsidiary of KGL. Currently, KAPL is in the process of establishing its plant which is announced for a massive expansion of INR 2890 crore through a mix of debt & equity in the state of Telangana.

It is pertinent to note that the stake held by KCL in KGL (15.92%) shall not form part of the textile business division and shall continue with KCL.

Initial funding plan for capex to be done by KAPL

| Particulars | Amount in crore |

| Circa project cost | 2890 |

| Equity funding (30%) | 867 |

| KCL: KGL% split for equity contribution | 30:70 |

| Expected equity infusion by KCL | 260 |

| Infusion by KCL in KAPL till 31st March 2024 | 123 |

Kitex USA LLC’s net worth has eroded however, the management expects revival on account of its new big customer in the USA.

The appointed date for the proposed demerger is 1st April 2025 or such other date as may be approved by the Hon’ble National Company Law Tribunal.

Rationale for the proposed transaction:

The segregation of the Textile Business Division of the Demerged Company would allow the management to effectively cater to the independent growth plans (both through organic and inorganic means) by enabling access to the availability of increased resources. Moreover, the Resulting Company is engaged in a similar business and is a pioneer in the said field.

- The demerger would facilitate focused growth, operational efficiencies, business synergies and increased customer focus in relation to the Textile Business Division.

- Each business would be able to address independent business opportunities, pursue efficient capital allocation and attract a different set of investors, strategic partners, lenders and other stakeholders.

- Combining similar business activities under a single entity shall optimize business operations, achieve economies of scale, create operational efficiency, a common pool of production and better utilization of resources

- Facilitating the pursuit of scale and independent growth plans (organically and inorganically) with more focused management, flexibility and liquidity for the shareholders;

- Insulating and de-risking the businesses from one another;

- providing scope for mitigation of overlapping services and enhancing the focus on independent business growth strategies and expansion for each of the business undertakings.

Swap Ratio & Share Capital

For the proposed demerger, for every 100 equity shares of face and paid-up value of Rs 100/- each held in KCL/the Demerged Company, 9,706 (Nine Thousand Seven Hundred and Six) equity shares of face and paid-up value of Re. 1/- each in KGL/the Resulting Company to be issued to the equity shareholders of the Demerged Company, whose name is recorded in the register of members and records of the depository as a member of the Demerged Company as on the Record Date.

Existing paid-up capital of KGL is 19,95,00,000 equity shares of INR 1 each. Pursuant to the demerger, KGL will issue 9,23,97,779 equity shares to the shareholders of KCL, i.e. to the promoters and their stake will increase by circa 13.70% in KGL.

Accounting Treatment

In the books of the Demerged Company

- The Demerged Company shall give effect to the Scheme in its books of accounts in accordance with the accounting standards specified under Section 133 of the Act, read with the Companies (Indian Accounting Standards) Rules, 2015 and the generally accepted accounting principles in India.

- Upon the Scheme becoming effective and from the Appointed Date, the Demerged Company shall reduce the carrying value of all the assets and liabilities pertaining to the Demerged Undertaking as appearing in the books of accounts of the Demerged Company, being transferred to and vested in the Resulting Company from the respective book value of assets and liabilities of the Demerged Company.

- The difference, being excess of carrying value of assets over the carrying value of liabilities of the Demerged Undertaking, if any, will he adjusted against Retained earnings under the head “Other Equity”.

In the books of the Resulting Company

- Resulting Company in accordance with Appendix C to Ind AS (103 – Business Combinations, shall record all the assets and liabilities pertaining to “Demerged Undertaking” vested in it pursuant to this Scheme, at their respective carrying values as appearing in the books of the Demerged Company.

- Resulting Company shall credit to its equity share capital, the aggregate of the face value of the New Equity Shares issued and allotted by it pursuant to the Scheme and excess, if any, of the fair value of the equity shares issued over the face value of the equity shares issued shall he classified as securities premium under the head “Other Equity”.

- The difference between the value of New Equity Shares issued by Resulting Company to the shareholders of the Demerged Company as consideration and the book value of the assets and liabilities of the Demerged Undertaking received from the Demerged Company will be credited or debited, as the case may be, to equity and classified as capital reserve in case of a credit or business reconstruction reserve, respectively in case of a debit under the head “other equity”.

- Post giving effect to the demerger above, the debit balance of “business reconstruction reserve”, if any, under the head “other equity” arising in shall be adjusted against the corresponding credit balance of Securities Premium Account.

Thus, technically, KGL will classify capital reserve/ business reconstruction reserve arising out of the proposed demerger to securities premium account.

Financials

Related party transaction between KGL & KCL

| Particulars | For 6M Ended 30th September 2024 (₹ Crores) | For FY 2024 (₹ Crores) |

| Sale of goods from KGL to KCL | 66.4 | 102 |

| Purchase of goods by KGL from KCL | 12.5 | 28 |

Apart from KCL, there are several other group entities present which may be engaged in similar business and there are regular transactions between group entities.

The increase in net worth of KCL & Remaining undertaking is mainly on account of the increase in share prices of KGL from 31st March 2024 to 31st December 2024. Apart from KGL investment, KCL will keep certain other investments in group companies and some liabilities with it. The clear bifurcation of liabilities is not available.

KGL special purpose interim financials for the period ending on 31st December 2024

| Particulars | Amount (₹ Crores) |

| Revenue | 682 |

| PAT | 104 |

| Net-worth | 1153 |

| Borrowings | 824 |

Post consolidation of the textile business of KCL, KGL revenue will strengthen significantly. Further, the proposed expansion in KAPL will provide good opportunity for KGL to expand. However, the debt for expansion will remain a key concern along with a couple of related parties engaged in similar business.

Assigned Valuation

| Particulars | KGL | KCL-Demerged Undertaking |

| Assigned value per share | 328.7 | 31,904 |

| No. of Paid up shares | 19,95,00,000 | 9,49,905 |

| Assigned valuation in crore | 6557 | 3030 |

| Loans | 824 | 10 |

| Expected EBITDA FY 25 | 210 | 80 |

| EV/EBITDA Multiple (FY 2025) | 35 | 38 |

Interestingly, the valuation of KGL as per the market price method was ₹213 per share. However, due to higher valuation & weightage assigned to the valuation derived through the discounted cash flow method & comparable companies’ multiple method, the assigned value per share of KGL increased significantly.

In terms of valuation, KCL’s demerged undertaking has been given a valuation which is circa 50% of the valuation fetched by KGL. One really needs to ponder why a tentative EV/EBIDTA multiple given to the unlisted undertaking higher than the listed company?

Conclusion

No doubt, this is a welcome step to consolidate promoters privately held similar business with a listed company. If KCL’s stake in KGL was also included as part of the demerged undertaking, promoters would have received an equivalent stake in KGL directly.

One may ponder upon the valuation given to the private business vis-à-vis a listed business. Let’s hope the consolidation will bring fortune for the Kitex Group and create value for its minority shareholders.