Aarti Industries Limited (AIL) is a listed company and is a leading Indian manufacturer of speciality chemicals and pharmaceuticals with a global footprint. It manufactures chemicals used in downstream manufacturing of agrochemicals, polymers, additives, surfactants, pigments and dyes, etc (“Speciality Chemical Business” or “Speciality Chemical Division”).

The Pharma Business is divided into three verticals i.e.

- Manufacture of Active Pharmaceuticals Ingredients (“APls”)

- Manufacture of intermediates and

- Manufacture of xanthine derivatives.

The Pharma business of the Demerged Company has four APIs manufacturing plants, two of which are approved by the United States Food and Drug Administration (“USFDA”) and rest two are WHO/GMP certified. Additionally, it has two dedicated research and development facilities for pharmaceuticals API. (“Pharma Business” or “Pharma Division”)

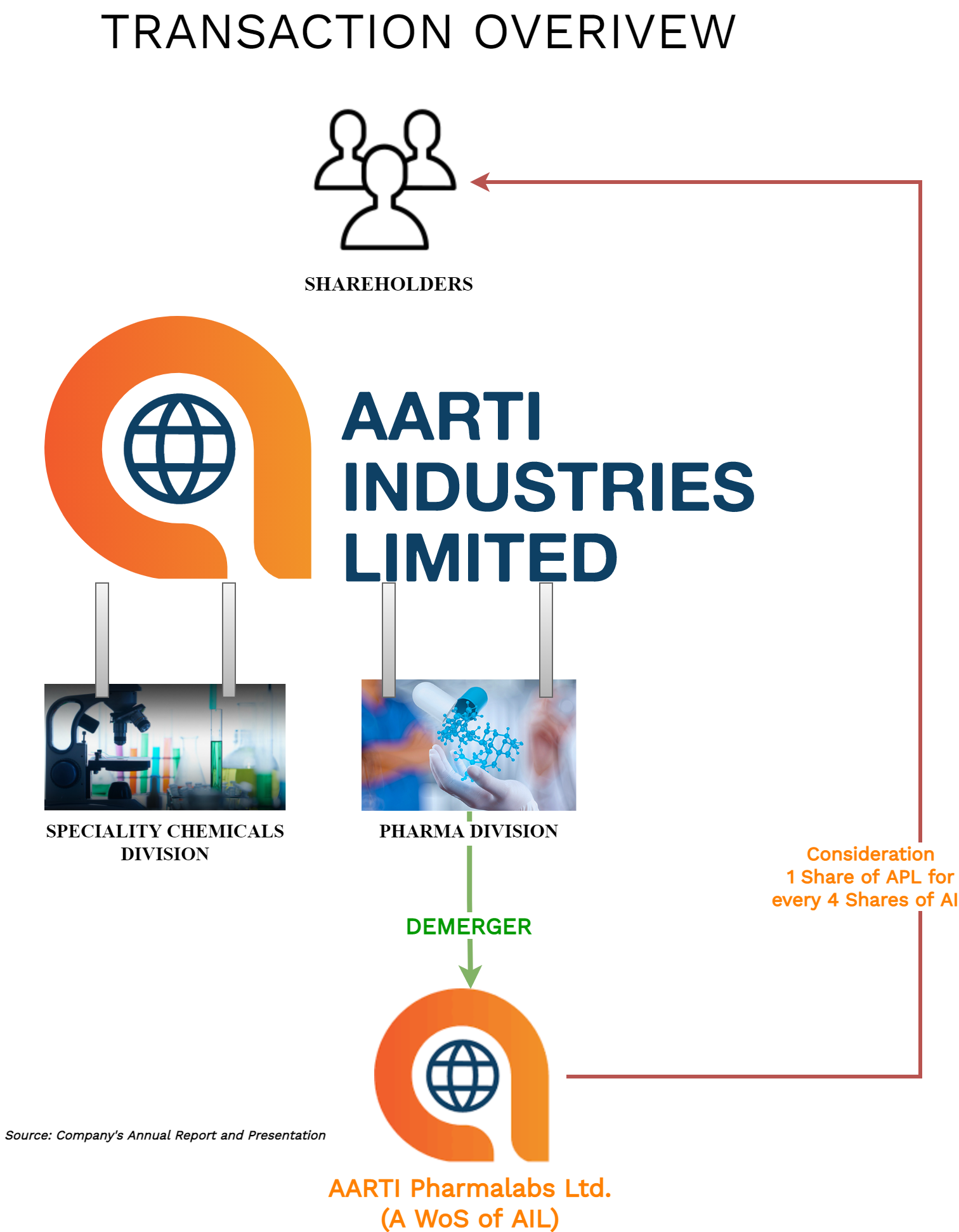

Aarti Pharmalabs Limited (APL) is Wholly Owned Subsidiary (WoS) of AIL having main object to engage in manufacturing and trading of Pharmaceuticals and allied products.

The Transaction:

Demerger of Pharma Business Undertaking of AIL into APL.

The appointed date for the transaction is 1st July 2021.

Rational for the transaction:

- To enable management of the Company to focus and adopt the relevant strategies necessary for promoting growth and expansion for demerged undertaking.

- To achieve operational efficiencies by streamlining of the relevant businesses.

- To expand its presence in the fast-moving Pharma Business in India and abroad.

- To Invite investor for separate business as per their willing.

Shareholding pattern:

The APL shall issue and allot on a proportionate basis to each member of AIL in the ratio of 1 (One) Equity Share of Rs 5 each fully paid up of APL for every 4 (Four) Equity Shares of Rs. 5 each fully paid-up held in AIL. So paid-up capital of the company will be 9.06 crores shares of Rs 5 each.

Financials

Brief consolidated financial statements of the last 5 years of AIL are as follow:

Table: Consolidated Segment Financial Statement of AIL.

INR in Crores

The demerged division’s turnover for FY 21 is 17.36% of consolidated revenue and PBT (Profit Before Tax) is 21.4% of total PBT. From the charts above, one can see that pharma toplines grew at more than 18% CAGR (Compound Annual Growth Rate) And PBT at more than 36% CAGR. So, management seems to believe that pharma business is now matured and ready to chart its own growth path.

Accounting Treatment:

In the Books of AIL:

AIL shall derecognise all the assets and liabilities relating to relating to demerged undertaking transferred to APL. Excess of book value of assets transferred over the liabilities transferred shall be adjusted first to Securities Premium & General Reserve in the ratio of values of business transfer. If thereafter any balance left will adjust against retained earnings/Profit & Loss Account.

In the books of APL:

APL shall record all the assets and liabilities at book value as appearing in the books of AIL. The excess of net assets over the face value of the new shares allotted shall be credited to the same reserves as debited in the books of AIL.

So, what is being done is to transfer reserves also in the same ratio of net assets as appearing in the books of AIL.

Past Scheme:

In FY 2018-19 Demerger of the Home and Personal Care (HPC) segment of the Company and merger of the manufacturing operations of Nascent Chemicals Industries Limited into the Company was carried out. You may like to read our article for the earlier scheme. HPC division was demerged into Aarti Surfactants Limited appointed date for this scheme is 1st April 2018. In fact, at that point of time, the size of that business was tiny with a turnover of Rs 264 crores and PBT of Rs2.75 crores - for FY17, till then though turnover grew less than 100% but PBT grew more than 1000%.

Conclusion

The management of Aarti nurtures businesses and then make them independent by demerging and creating focused separate listed entities. No doubt, earlier demerger created substantial value for all the stakeholders, and we hope that it will happen for this demerger also. Some expansion is proposed to the extent of Rs 300 to 500Cr in Pharma and around 3000 cores in speciality chemicals in next 3 years. The company made QIP (Qualified Institutional Placement) recently and at least the pharma business may not need further dilution for its future expansion. Like Adani Group many groups are de-risking and creating separate listed entities for various businesses and in the process, it results in the value creation for all the stakeholders in the most tax-efficient manner.

Add comment