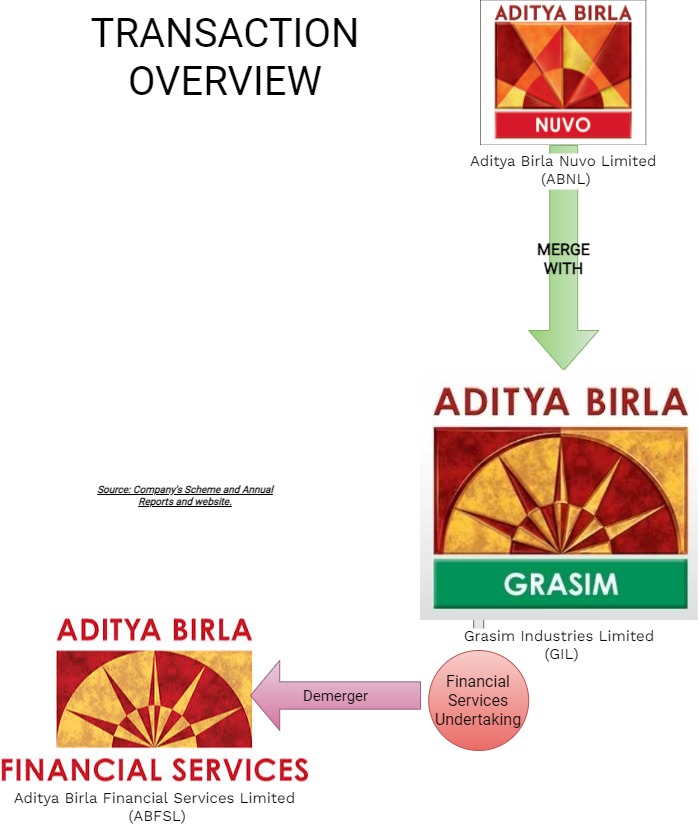

In 2016, the Board of Grasim Industries Limited (“GIL” or “Assessee”), Aditya Birla Nuvo Limited (“ABNL”) and Aditya Birla Financial Services Limited (“ABFSL” or “ABCL”) approved a composite scheme of arrangement of the merger of Aditya Birla Nuvo Limited with Grasim Industries Limited followed by transfer of “Financial Services Business” to Aditya Birla Financial Services Limited.

The scheme was approved by NCLT (National Company Law Tribunal) on 1st June 2017, and the merger became effective from 1st July 2017 and the Demerger of FSB (Financial Service Business) became effective from 4th July 2017.

As a result of the arrangement, consideration was issued by Grasim Industries Limited to the shareholders of Aditya Birla Nuvo Limited (for the merger) and by Aditya Birla Financial Services Limited to the shareholders of Grasim Industries Limited (for the demerger of Financial Services Business). Later, the name of Aditya Birla Financial Services Limited changed to Aditya Birla Capital Limited.

Orders by the Tax department

Any merger or demerger transactions are tax neutral provided the transaction comply with necessary provisions mentioned under the Income Tax Act, 1961. In above-mentioned transaction, the Income Tax Department issued a demand notice challenging the tax neutrality of the transaction.

The department earlier issued demand for DDT (Dividend Distribution Tax)

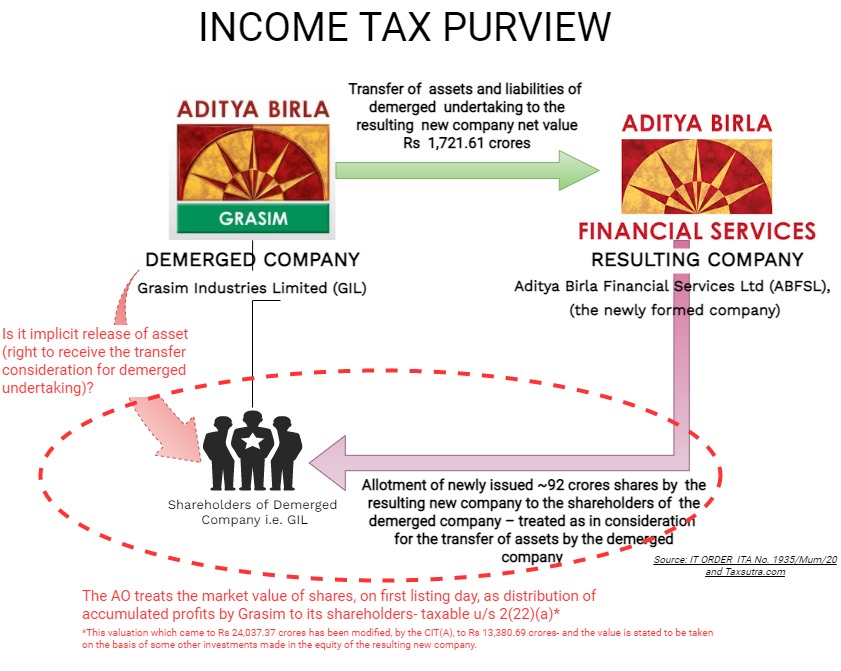

The assessing officer considered that this composite scheme of arrangement was not in accordance with the provision of section 2(19AA) of the Income Tax Act 1961, and ABCL merely transferred 92 Cr. shares to an assessee under the guise of consideration for combination of assets and liabilities with the net book value of Rs. 1,721 Cr.

Order under Sec 115-O

The assessing officer considered the non-qualified demerger as deemed dividend as distribution of assets under Section 2(22)(a). The Assessing officer-imposed tax on above transaction under Section 115-O of ₹ 5,872 crores including interest (DDT 4,893.44 and Interest 978.68) considering the market value of 92 crores shares on the listing date as the fair value of shares issued i.e. ₹ 261.20 per share. CIT(A) confirmed and agreed to the assessment order but gave relief in terms of the fair value of shares reduced to ₹ 145 per share based on a recent transaction.

The DCIT (Deputy Commissioner of Income Tax) has in the course of regular assessment confirmed the transaction as disqualified demerger and considered issue of same shares as part of purported disqualified demerger as transfer of assets by GIL to its shareholders as liable to capital gains tax even though no consideration was received by the Company, The Learned DCIT has valued the shares issued by the Resulting Company (Aditya Birla Capital Limited i.e. ABFSL) at Rs. 24,037 Crore as the sale consideration for transfer of undertaking and has made the addition of capital gains of Rs. 22,772 Crore to the income of the Company as part of scrutiny assessment for the AY 2018-19 and has passed draft assessment order on 30th September 2021. Based on the draft Order, the demand for the AY 2018-19 is estimated at Rs. 8,334 Crore, including interest but excluding any penalty proceedings.

Analysis

The tax department has not considered underlying large and flourishing business as good enough for the definition of an undertaking as envisaged under Section 2(19AA) and levied first DDT on GIL and now a capital gain tax on the same transaction of issue of shares of ABFSL and interestingly both are based on different valuation.

Various points for consideration and debate are:

- Whether department can raise the demand now even though National Company Law Tribunal gave reasonable opportunity to object or raise its concerns before sanctioning the scheme of arrangement?

- Whether ‘UNDERTAKING’ underlying the shares of operational subsidiary company shall not be qualified as valid undertaking on a going concern basis?

- Whether department stand would have been different if the demerger would have been of the undertaking consisting small/minuscule similar business carried by GIL itself and along with shares of ABIFL are transferred?

- Whether levy of DDT and capital gain tax both is justified?

- In current scenario where dividend is taxable in the hands of shareholders, How the department would have levied and recovered dividend Tax?

- Whether department can value same shares differently while working out tax liability under Section 115-O and Section 143(3)?

- Whether in a genuine business transaction without any monetary gain and just different structure to hold the same business without any cash inflow can be made liable to tax?

Section 2(22)(a) deems release of assets out of accumulated profits in lieu of dividends. In the present case that is not the purpose and in fact, major shareholders including promoters continued to hold the shares and the purpose is only to manage the business more efficiently and hence in commercial parlance cannot be equated as a return given to shareholders by way of dividend.

As regards capital gain tax, GIL did not receive any consideration for transfer and not only that transfer is to the shareholders of GIL who already had a similar beneficial interest in the shares of ABFSL shares even before the scheme of arrangement.

May be on strict interpretation of tax statute, the transaction may attract tax for GIL. However, commercially the transaction was necessity for the growth of businesses and invite foreign capital, thus, in our opinion provisions of the act needs to be streamlined.

Add comment