In a move to broaden its business verticals, Adani Group announced acquisition of entire equity stake held by Holcim Group in Ambuja Cement Limited and ACC Limited. This marked foray of Adani Group into the cement business and directly placed them after Ultratech Cement, India’s largest cement manufacturer.

Ambuja Cements Limited (“Ambuja”) is incorporated in 1981. Ambuja is engaged in the business of manufacturing and marketing cement and cement related products. Equity shares of Ambuja are listed on the Stock Exchanges. Currently, Ambuja has a cement capacity of 31 million tonnes with 6 integrated cement manufacturing plants and 8 cement grinding units across the country

ACC Limited (“ACC”) is incorporated in 1936. ACC is engaged in the business of manufacturing and selling cement and ready-mix concrete. The equity shares of ACC are listed on the Stock Exchanges. It has cement capacity of 34.45 MTPA with 17 cement manufacturing units, 85 ready-mix concrete plants. Currently, Ambuja holds 50.96% equity stake in ACC.

History of Ambuja Cement

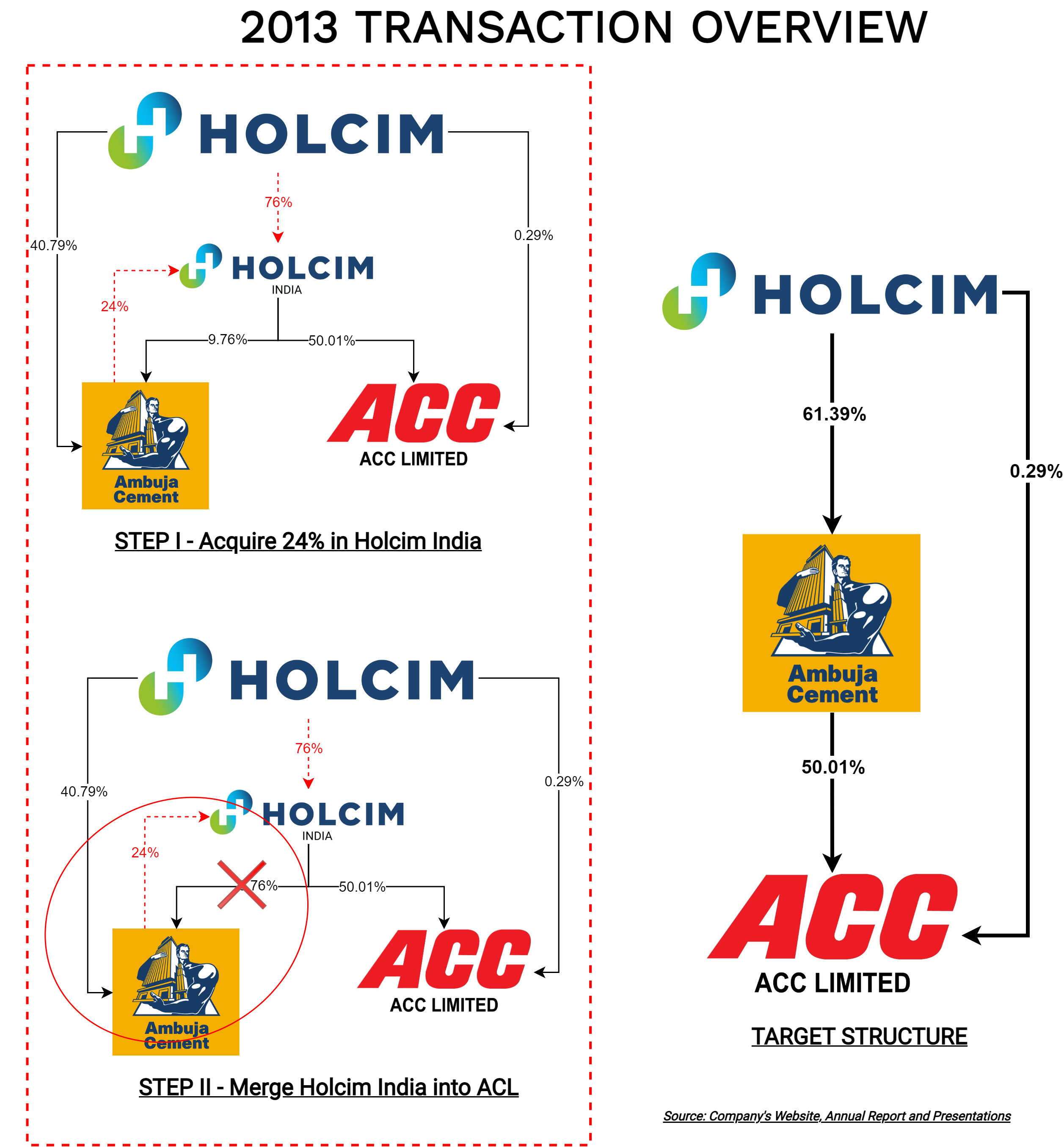

Early in decade after 2000, India witnessed couple of large M&A transactions in the Cement Sector. In 1999, Ambuja purchased circa 14% equity stake in ACC from Tata Group of Companies. One of the landmark transactions was Holcim group’s entry into Indian Market through a strategic partnership with Ambuja Group. They increased their holding in ACC to circa 35% and became promoter of ACC. In 2006, Holcim Group acquired control of Ambuja Cements through purchasing the equity shares held by previous Promoters of Ambuja followed by Open Offer.

Thereafter couple of steps were taken by Holcim to increase the capacity & efficiencies of both companies.

Growth in Financials of Ambuja & ACC

Both Ambuja & ACC have significant Cash & Cash Equivalent available with them.

In the last decade, compared to other key cement companies who at least did double their capacity, Holcim did not increase ACC capacity as aggressively as its competitors and as a result, ACC lost its leadership position. Though Ambuja increases their capacity, it was not as aggressive as key competitors.

Current Transaction

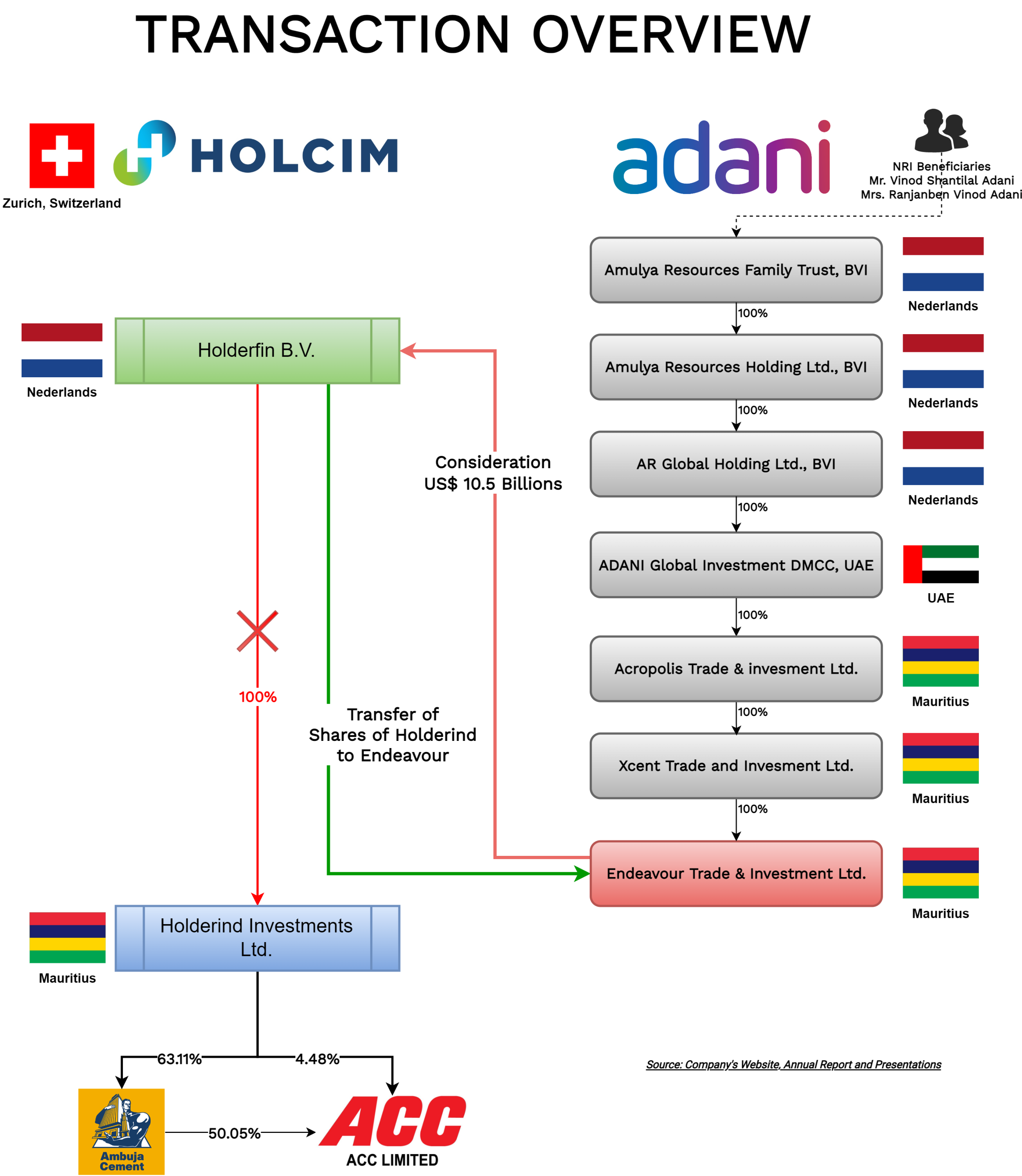

In May 2022, Holcim group announced that it has signed a definitive agreement with Adani Group to acquire its business in India comprising its 63.11% stake in Ambuja Cement as well as its direct stake in ACC for Circa ₹53,000 crore. This was followed by the Open offer in both Ambuja & ACC.

The value for the Holcim stake and open offer consideration for Ambuja Cements and ACC was estimated around US$ 10.5 billion, which made this the largest ever acquisition by Adani, and India’s largest-ever M&A transaction in the infrastructure and materials space.

Structuring the Transaction

Holcim group’s entire holding in Ambuja & ACC is through a Mauritius-based company, Holdering Investments Limited which indeed owned by Netherland-based Hölderlin B.V.

Adani Group structured this acquisition by purchasing the entire ownership of Holdering Investments Limited through its Mauritius-based entity Endeavour Trade and Investment Limited. This facilitated transfer between two Non-Resident Indian Entities.

Interestingly, Endeavour Trade and Investment Limited is owned by long trail of non-resident Indian entities/Special Purpose Vehicles. Out of three Mauritius-based entities, only Acropolis Trade and Investment Limited has significant assets and revenues rest are nominal entities.

Initial Funding for the Transaction:

Majority of the consideration payable for this transaction is financed through debt in series of the Adani group entities mentioned above. This debt will be used as equity in the drop-down Special Purpose Vehicles (SPV).

| Particulars | Borrowing (USD in Billions) |

| Endeavour Trade & Investments Limited | 3.50 |

| Xcent Trade and Investment Ltd | 1.035 (notes) |

| Acropolis Trade and Investment Limited | 1.075 |

The balance amount for the acquisition will be funded by combination of equity, offshore debt, liquid equity investment and available cash. The above funds are been arranged with various mortgages including equity shares of the respective companies. Recently, as additional security, Adani group also created pledge against equity shares of Ambuja & ACC.

Open Offer

The acquisition of shares of Hollerind Investments Limited ushered in an indirect change of control which triggered open offer as per regulation 3 of. Adani Group came up with an open offer for up to 26% equity shares held by public shareholders in both Ambuja and ACC. As the price for Open offer was lower than the market price prevailing that time (prices shot up immediately post announcement of the acquisition), the Open offer did not garner a good response. Adani Group acquired 0.03% & 2.157% in Ambuja & ACC, respectively. respectively.

Immediately after completion of Open Offer, Adani group announced preferential allotment to Harmonia Trade and Investment Limited for ₹20,000 crore in Ambuja. This increased Adani Group’s holding by circa 19.39% in the listed entity. Effectively, Promoters stake will go beyond maximum permissible promoter holding of 75%. Within threshold period, promoters must bring down their stake to 75%. This is likely to be done through a merger of ACC with Ambuja or inviting some strategic partner like Adani did in its other multiple businesses.

Tax & Regulatory Effect of the Deal:

If the shares held in the Target Entities by the Offshore promoter entity were transferred directly to an Adani Group Indian resident entity, the transaction would then be a transfer of shares in Indian listed entities by a non-resident seller to a resident acquirer and the pricing and regulatory compliances requirements set out under the FEMA Regulations would need to be adhered to.

Further, though the transaction is between two foreign entities Netherland based Hölderlin B.V. and Mauritius-based Endeavour Trade and Investment Limited, provisions of section 9 (Income Deemed to accrue or arise in India) of the Income Tax Act, 1961 needs to be considered. Further, if any tax is arising, Holcim group may take benefits of India-Netherland Tax Treaty and accordingly, taxes will be paid. Overall, it looks structuring the transaction, Holcim group will end up paying minimal taxes of the mammoth gain on the transaction.

Reason for Holcim Exit and Why Adani?

Holcim recently announced a “Strategy 2025 – Accelerating Green Growth”, which indicated a commitment to move away from sectors and operations responsible for significant environmental pollution, such as cement production. The principle idea is to shift to innovative building solutions that are sustainable in the long term. For instance, they plan to decarbonize cement for their future cement operations

Key reasons for signing agreement with Adani could be two folds, better consideration & less regulatory approvals by CCI as Adani does not have any prior presence in the cement business.

Conclusion

Like most of the Adani group expansion and entry into new businesses are debt funded and kind of leverage buyouts. The whole transaction is executed by Acquisition of holding outside India by the non-resident family members by taking temporary Acquisition financing and then replacing financing based on the security of Ambuja cements Ltd and ACC Ltd shares. No doubt, valuation of these companies is getting still industry multiple and not getting the fancy multiple other Adani group companies have as on date. This may be because how funds raised for buyout will be serviced.