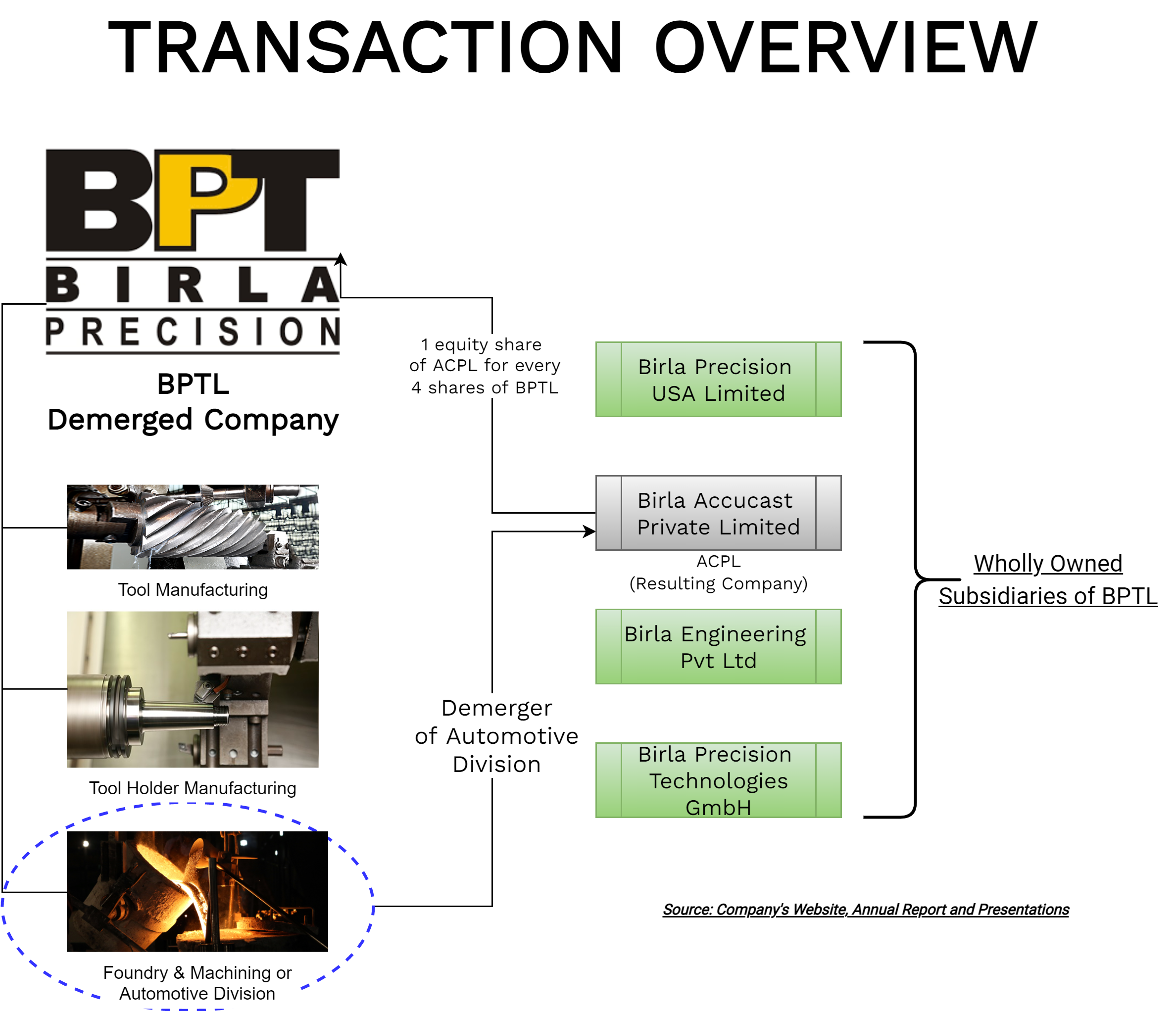

Incorporated in 1937, Birla Group started with manufacturing of tools and eventually with JV with Perucchini SpA and Kennametal started its foundry business and tool holder businesses respectively in their company Birla Precision Technologies Ltd. In recent years, the Foundry business which the company terms an Automotive Business Division isn’t doing that well and the management of the company has decided to demerge the division into a wholly owned subsidiary of theirs.

Birla Precision Technologies Limited (“BPTL” or “Demerged Company”) belonging to Yash Birla group has three business divisions:

- Tool Manufacturing

- Tool Holder

- Foundry & Machining (Automotive Division)

The equity shares of the Company are listed on BSE (Bombay Stock Exchange) Limited.

Birla Accu-Cast Private Limited (“ACPL” or “Resulting Company”) is a wholly-owned subsidiary of the demerged company incorporated to facilitate the demerger of Foundry Division.

Demerged Undertaking includes Foundry Division constituting all assets and liabilities pertaining to Company located at MIDC Waluj (Aurangabad) along with such unit’s business on a going concern basis, including the Raw Castings manufacturing plant having capacity of 23 MT per day.

The turnover of the demerged undertaking for FY 2022 constitutes ₹39 crore amounting to 15.62% of the total turnover of the demerged company.

The Transaction:

To segregate management and ownership of different businesses of BPTL, it is proposed to demerge the Foundry business of demerged company into Resulting Company. The Appointed Date for the transaction will be 1st April 2022. The Birla brand will be co-owned by both companies.

Consideration & Exit Opportunity:

As part of the consideration, the resulting company shall issue 1 equity share of INR 2 each for every 4 equity shares held in demerged company. The equity shares issued by ACPL will not be listed on BSE Limited. The resulting company shall be converted into a Public Company.

The paid-up share capital of the Companies:

| Particulars | BTPL | ACPL: Post Demerger |

| No. of Equity Shares | 6,52,71,137 | 1,63,17,784 |

| Face Value | 2 | 2 |

| Pai-up Capital | 13,05,42,274 | 3,26,35,568 |

Reorganisation of Capital of both Companies:

Pursuant to clause 12 of the Scheme, the authorised capital of the demerged company to the tune of 1,62,68,000 equity shares of INR 2 each shall get reduced and transferred to the resulting company. Further, the authorised capital of the resulting company shall be reclassified from face value 10 each to 2 each.

Exit option to shareholders:

The dissenting shareholders shall have an opportunity to take exit from the Resulting Company in accordance with SEBI (Securities and Exchange Board of India) Regulations, by receiving fair compensation. All the shareholders of BPTL shall have an option to sell the equity shares of the resulting company to Birla Infrastructure & Construction Private Limited, a promoter group company at decided exit price. The Exit price for the per equity share of ACPL will be INR 2 per share.

Taxation on Sell of Share

As provided in Clause 11 of the Scheme, shareholders who want to exercise sell option shall do so on or before 30 days from the date of allotment of Shares. Upon receipt of such notice, Birla Infrastructure & Construction Private Limited shall execute the transfer transaction and discharge consideration to shareholder who have opted to sell the shares of the resulting Company.

Selling of shares will be a transfer as per section 2(47) of the Income Tax Act, 1961 and capital gains will be applicable. Further, as the transaction likely to be not through exchange, as shares of the resultant company is not going to be listed special rates as applicable pursuant to section 112A of ITA (Income Tax Act,) may not be available to selling shareholders. Further, if the transfer happens before the listing of equity shares of the resulting company, deeming section like 50CA of ITA will also be applicable.

Financials

The Demerged Undertaking has negative net worth and its incurring continuous losses. Pursuant to the demerger, the net worth of the demerged company shall increase from INR 118.27 crore to INR 173.47 crore. Further, the return ratio will also improve significantly.

Thus, the resulting company shall house a loss-making foundry business. Going forward the group may look to divest the business.

Conclusion

During the financial year FY 22, The Company Incorporated three wholly owned Subsidiary Companies in the name and style of “Birla Accu-Cast Private Limited“, "Birla Engineering Private Limited" and a foreign subsidiary in the name and style of “Birla Precision Technologies GmbH" incorporated in Germany. The purpose seems to be reorganisation of the business of the company i.e., to place different SBUs in separate companies. It may be looking for a buyer or strategic investor in each of the businesses. Through demerger route, i) there is no cash outflow in terms of duty and taxes, ii) it makes easier to give complete control to strategic buyer/investor without burdening them with the listing compliances and iii) it also gives some cash in the hands to promotor when they exit the business.

The company has more than 50,000 public shareholders hence it has given exit opportunities to them if they want to sell shares of the resultant company to the promotor. Most demerger unlocks value for all the stakeholders, but in the present case considering the situation and size of the business, it is really going to be difficult to create value for the stakeholders. In fact, it seems transaction cost is likely to be more than benefits stakeholders may derive from demerger as value unlocking.