ADANI Enterprises Ltd. (AEL) is primarily engaged in coal mining and trading, oil and gas exploration, ports and multi-modal logistics, power generation and transmission, gas distribution and edible oil and agro commodities businesses in India and globally.

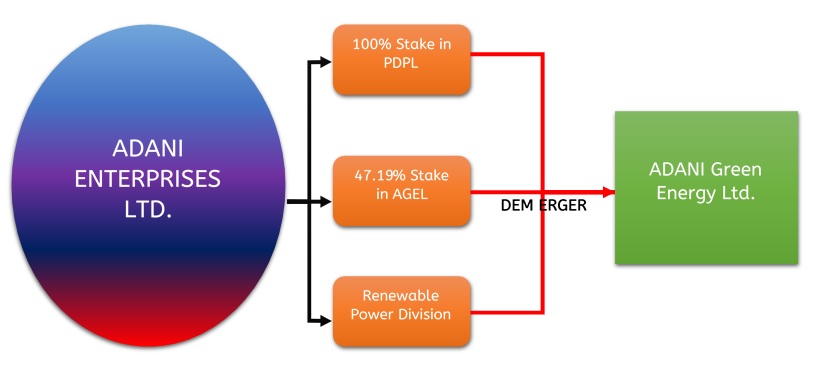

Further company owns and operates solar power plants with an installed capacity of about 1000MW in various parts of the country through its subsidiaries. Prayatna Developers Private Limited (PDPL) is developing 220 MW of solar power projects which are under various stages of implementation. PDPL is a 100% subsidiary of Adani Enterprises Limited.

Adani Green Energy Limited (AGEL) owns and operates solar and wind power plants through group of its subsidiaries. The company is associates of AEL holding 47.19%.

[rml_read_more]

TRANSACTION

In other words, it includes renewable trading undertaking PDPL (one of the wholly owned subsidiary of AEL), and approximately 47.19% of AEL in AGEL (one of the associate of AEL). AEL also held series of the unsecured compulsory convertible debentures in PDPL. The demerger will be effective from April 1, 2018. The equity share entitlement ratio for transfer of renewable power undertaking to AGEL is 761 equity shares of AGEL for every 1000 equity shares of AEL.

Please Note: The demerger‘s final approval is expected in April 2018.

RATIONALE

- Creation of separate renewable power listed company under one r

- Separation of renewable from the other business carried out by AEL will enable new set of investors to specially focus on renewable energy.

- Separation of renewable energy will enable management to focus on operation of the said business.

- Proposed demerger will enhance value for shareholders as it will allow focused strategy and specialisation for sustained growth.

- Proposed demerger will also provide scope of independent collaboration and expansion.

RENEWABLE BUSINESS

Adani group plans to be a leading renewable energy player in India. It is the country’s largest solar power developer with a portfolio of over 1,988 MWac (2.6 GWp) capacity and a total renewable portfolio of 2,148 MW (2.76 GWp) with current operational capacity of 1,118 MW currently. Adani would contribute around 10% of India’s solar generation by March 2018. The target is to achieve a portfolio of around 10 GW capacity by 2022. The company has diversified assets with pan India presence with 40 plants. It has strong and diversified sovereign off takers with long-term 25 year PPA at an average rate of Rs.5.12/kwh. Half of the capacity PPAs are with NTPC and Solar Energy Corporation of India Limited (SECI). The current renewable energy is majorly contributed by wind power 56.4% and then solar power 21.5%. But with changing scenario, by 2022 it will be 57% for solar power and 34% for wind power. Of Which, 60% will be ground mounted and 40% from rooftop Solar PV.

Operation status

| Split | MWAC | Solar | Wind |

| Operational | 1,118 | 1,058 | 60 |

| Under Implementation | 1,030 | 930 | 100 |

| Total | 2,148 | 1,988 | 160 |

INCOME TAX ACT 1961

The proposed demerger is in compliance of Section 2(19AA) of the Income Tax Act 1961. Therefore, it will be tax neutral in the hands of the involved companies and their shareholders.

VALUATION

PROMOTERS HOLDING AND CAPITAL BASE AND MARKET CAPTILASITION

| Particulars | AEL | AGEL |

| Paid Up capital | 1,09,98,10,083 | 13,76,74,78,070 |

| Face Value | 1 | 10 |

| No of Shares | 1,09,98,10,083 | 1,37,67,47,807 |

| Issued on Demerger Process | 83,69,55,473 | |

| Cancellation on holding by AEL in AGEL | – | -64,96,88,994 |

| Net Number of shares post transaction | 1,09,98,10,083 | 1,56,40,14,286 |

| Paid up Equity Capital post-merger (cr.) | 110.00 | 1,564 .00 |

| Promoters Holding | 74.92% | 86.58% |

| Value Per share based on valuation report (AGEL) & Market Value as on 27.10.2017 (AEL) | 130 | 33 |

| Market Capitalisation (Cr.) | 14,248 | 5,125 |

Please Note:

- Additional 18,72,66,479 Equity shares issued on demerger for 200MW of PDPL and Renewable business in AEL.

- Promoters holding in AGEL is exceeding 75% which will be reduced by liquidating in open market to comply with regulations within a period of one year from the listing. The promoters may end of getting approx. Rs 600 crore on sale of 18.11 crore shares at Rs 33 per share or the company get infusion of further funds by preferential allotment of approx. Rs 800 crore by allotting 24.14 crores shares at the same price.

MARKET PRICE MOVEMENT

Post announcement of demerger there is approx. 10% growth in the market price of AEL.

RENEWABLE BUSINESS OF AEL

| Particulars | Pre-demerger | Post- demerger | Renewable business of AEL |

| Total Revenue | 38,056 | 37,579 | 477 |

| EBIDTA | 3,090 | 2,764 | 326 |

| PBT | 905 | 1,133 | -228 |

| PAT | 988 | 1,021 | -33 |

| Diluted EPS | 8.98 | 9 | |

| Attributable Equity | 14,136 | 13,299 | (as worked above for total AGEL) |

| Total Debt | 20,783 | 16,442 | 4,341 |

| Cash and Investment | 1,093 | 974 | 119 |

CONCLUSION

AEL is the company having multiple businesses. It did demerger few years back of power business, transmission business and port business all the three companies are listed today as covered in our March 2015 and Feb 2016 issues. The demerger of renewable power business will create one more listed entity in the group and some cash out for the promoters. It will create value for all concerned though the promoters will be the main beneficiary.