Arvind Limited is engaged in the business textiles, fashions, engineering business and other business. The company is a leading fabric and apparel supplier to world’s top brands and a prominent technical textiles player. Arvind Fashions Limited (AFL) is a leading branded apparel and accessory platform. Branded apparels (comprising 30-40 percent of the total consolidated revenue) reported an impressive set of numbers in terms of turnover and operational efficiency. Engineering business has shown impressive revenue growth, is debt free and has good EBITDA margin in all segments of the company

TRANSACTION

Currently, branded business is carried out as a division of Arvind Limited including investment in Arvind Fashion Limited. The structuring branded apparel business including holding in AFL will be demerged into AFL. Other than Arvind Limited, Multiple PE, private equity investors, is holding approx. 10.31% stake in AFL. Appointed Date for the Demerger of Branded Apparel Business is Effective Date.

Before the demerger process, AFL will consolidate existing share capital with change from face value Rs 2 each to Rs 4 each. Swap ratio for demerger is one equity shares to be issued for every five equity shares held in Arvind Limited. Equity shares held by Arvind Limited in AFL will be cancelled as part of demerger process.

Currently, engineering business is carried as division of Arvind Limited including investment in Anup Engineering. Through this structuring engineering business including holding in Anup Engineering will be demerged into Anveshan and then merger of Anup Engineering into Anveshan. Other than Arvind Limited, banker and other public are holding approx. 6.46% stake in Anup Engineering. Appointed Date for Demerger of Engineering Business and then merger of Anup in Anveshan is 1st January 2018. Swap ratio for the demerger is one equity shares to be issued by Anveshan for every 20 equity shares held in Arvind Limited. Swap ratio for merger is seven equity shares to be issued by Anveshan for every 10 equity shares held in Anup Engineering.

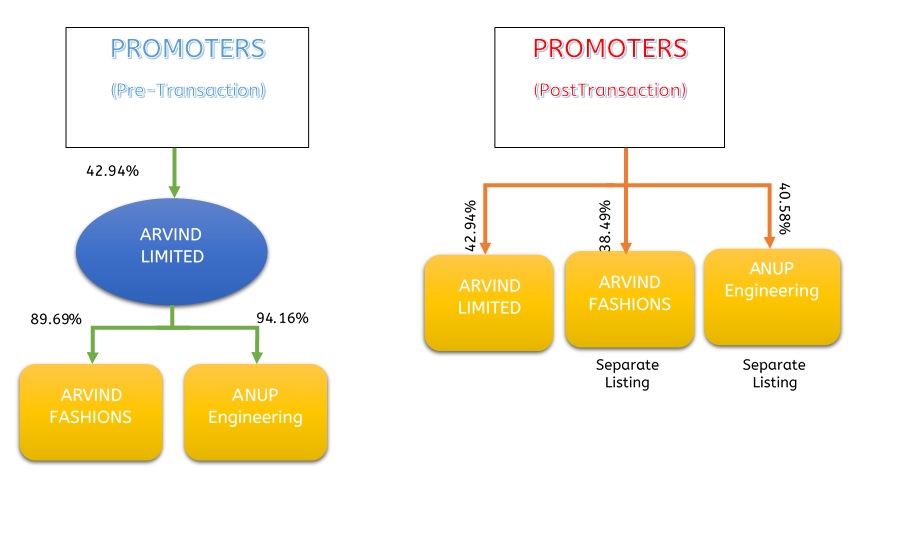

Pre & Post Transaction Promoters’ Holding

RATIONALE

RATIONALE

- Each separated business has attractive market opportunity

- Business are well established with solid independent momentum

- Demerger will create focused businesses, which will pursue independent growth trajectories.

- Arvind will transform into a customer-centric, IP driven player with global scale

ARVIND LIMITED

Post-demerger, Arvind will continue its core business of textile product manufacturing across categories such as

- Denim fabric,

- Woven fabric,

- Garments,

- Voiles,

- Knitwear,

- Other relatively smaller segments such as Arvind Internet and technical textiles (Acquired controlling stake in Arya Omnitalk wireless solutions private limited).

New asset-light business model policy will result into no investments in capital-intensive backward integration i.e. fibre and yarn manufacturing.

POST DEMERGER ARVIND LIMITED:

Post demerger, Arvind Fashions Limited will continue its core business with

- Long lasting brand relationships with 15 global brands for long tenure up to two-plus decades

- Strong distribution footprint (range of retail formats and state of art warehousing and logistics)

- Strong sourcing capabilities (global and local sourcing, multi-category)

- Digital and Omnichannel (seamless online and in store experience)

To capitalise on the high growth potential with minimum growth of 25% in this space, Arvind Fashions plans to invest Rs 150-200 crore primarily through internal accruals every year for network and digital expansion (the latter to be undertaken through the ‘NNNOW.com’ portal).

Revenue growth for Arvind Fashions are not a cause of concern, the margins in businesses like these (where the company is a mere intermediary) are much lower than Arvind’s textile business, which combines textile manufacturing and selling activities. Two out of three brands, that are EBITDA negative at the moment, are expected to turn profitable from H1FY19. This, in turn, will ensure that Arvind Fashions gets off to a good start.

Since roughly 80-90 percent of the branded garments will be sourced directly from warehouses of the foreign brands or through manufacturers associated with them, Arvind Fashion’s procurement costs can be kept low. The company will have debt of approx. Rs 700 crore.

ANUP ENGINEERING

Post-demerger, Anup Engineering will continue its core business such as:

Manufacturing and supplying critical process equipment used by companies in the oil and gas, petrochemicals, fertilisers, and pharma sectors. The business, with zero debt in its books, is capable of continuing its trend of decent return ratios. Plan to become Rs 1,000-crore top-line business over next 5-6 years. Longstanding relationships of over 10 years. Team of 500 member led by industry veterans. However, the company’s cash flows are vulnerable to changes in the macro-economic environment and capex cycle slowdown.

FINANCIAL STATEMENT POST DEMERGER

Table 1: Financials as on 31.03.2017 (All Figs in Rs. Crores)

| Particulars | Arvind Limited | Arvind Fashions Limited | Anup Engineering |

| Revenue | 6,158 | 2,898 | 179 |

| EBITDA | 819 | 145 | 54 |

| EBITDA Margin | 13.30% | 5.00% | 30.17% |

| Net Worth | 2,600 | 1,108 | 179 |

| Debt | 2,792 | 696 | |

| Total | 5,392 | 1,804 | 179 |

| Book Value per share post demerger(Approx.) | INR 100 | INR 315 | INR 175 |

| Debt Equity Ratio | 1.07 | 0.63 | – |

SHAREHOLDING PRE & POST DEMERGER

Table 2: Pre & Post Shareholding

| Particulars | AFL | Anup Engineering | ||

| Pre | Post | Pre | Post | |

| Arvind Limited | 89.69% | – | 94.16% | – |

| Promoters Directly | – | 38.49% | – | 40.58% |

| Multiple PE (Private Equity) | 10.31% | 11.51% | – | 1.80% |

| Other Public | – | 49.44% | 5.84% | 57.61% |

| Total | 100.00% | 100.00% | 100.00% | 100.00% |

TAX IMPLICATION

Since it will be compliance demerger under section 2(19AA) and merger under Section 2(1B) of the Income Tax Act 1961, it will be tax neutral under Income Tax Act 1961.

ACCOUNTING

Arvind Fashions Demerger

Demerger to Anveshan and Anup merger

Anveshan will record assets and liabilities at book value with equity issue at premium and the difference will be treated as accounting standard. The Goodwill if any appearing in the books will be amortised/impaired/written off either as per applicable standards or will adjusted against the reserve as per decided by Board of directors

VALUATION

Based on the transaction for 10% stake sale in Arvind Fashion to Multiple PE, the value of balance Arvind can be considered as around Rs 5,000 crores based on EBITDA multiple of 9.51. Value of Arvind Fashion has been values based on CCM and Income Approach approx. Rs. 7,700 crores (AFL valuations is at 10% premium to last transaction with Multiple PE). Anup Engineering has valued based on CCM and Income Approach approx. 500 crores. The Valuation is as follows:

Table 3: All Figs in Rs. Crores

| Particulars | Arvind Limited | AFL | Anup | Total |

| Valuation (approx.) | *5,000 | **7,700 | **500 | 13,200 |

| Market Capitalisation on date of announcement i.e. 8th Nov 2017 | 10,677 | |||

| Approx. Gains unlocking due to restructuring | 24% | |||

* Based on Estimate EBITDA Multiple

** Based on Valuation report submitted to Stock Exchange

CONCLUSION

This demerger is expected to unlock value of the branded apparel business and engineering business which are growing at a faster rate than the Textile Business. As the remaining business of the company is mainly B2B and fashion business is mainly B2C, considering this it requires different skill sets and marketing focus. Post-demerger, it is possible for the strategic investor to come in Arvind Fashion which otherwise may not be interested in B2B business.

A key factor to watch out would be the increase in growth rate of apparel business which is currently around 25 percent. The Lal Bhai Group in past has created value for stakeholders of Arvind Limited with unlocking Arvind Smartspaces into a separate listed company and hope this demerger will also result in substantial value creation.