The year 2017 will be known as the year of initial public offerings as record number of companies went for equity issuance. As many as 153 companies raised Rs 75,859 crore in the calendar year 2017, the largest in a single year in the history of Indian capital markets. In fact, the mop-up in 2017 is even larger than Rs 56,896 crore that companies raised from the primary markets between 2011 and 2016 cumulatively. A report by EY says India’s BSE, NSE and junior markets recorded a 74% increase in deal numbers in 2017 compared with 2016.

[rml_read_more]

Spurt in listing

Companies as diverse as Eris Life Sciences, Indian Energy Exchange, Bombay Stock Exchange, HUDCO, SBI Life Insurance, General Insurance Corporation of India sold shares in the market. Most IPOs and QIPs were in the nature of exit or sell-downs by existing investors or for balance sheet strengthening. The last 18 months have seen IPOs of companies from several new sectors such as life and general insurance, asset management companies, new-age banks, retailing and consumer.

| Amount raised (Rs 100 crore) | ||

| Year | Via IPOs | Via SME IPOs |

| 2000 | 2953 | – |

| 2001 | 296 | – |

| 2002 | 1981 | – |

| 2003 | 1700 | – |

| 2004 | 13121 | – |

| 2005 | 9890 | – |

| 2006 | 19852 | – |

| 2007 | 34179 | – |

| 2008 | 16904 | – |

| 2009 | 19544 | – |

| 2010 | 37535 | – |

| 2011 | 5966 | – |

| 2012 | 6835 | 103 |

| 2013 | 1284 | 335 |

| 2014 | 1201 | 267 |

| 2015 | 13614 | 260 |

| 2016 | 26494 | 537 |

| 2017* | 65923 | 1520 |

*All figures are till November 2017

So, why did so many companies go for IPOs in 2017?

Foremost, the stability in the political atmosphere in the country has given a lot of confidence to promoters of companies raise money through listing. The reform pushes by the government and the introduction of Goods and Services Tax (GST) have kindled the animal spirit of entrepreneurs in the country. Going forward, the EY report underlines that the Indian IPO market looks good for 2018 with the return of foreign institutional investors and strong investor sentiment creating a bullish investment climate. However, while the current market valuations offer a great opportunity to existing investors, sustenance of the bull run in the long-run will depend on the balance between offer for sale and fresh equity for growth.

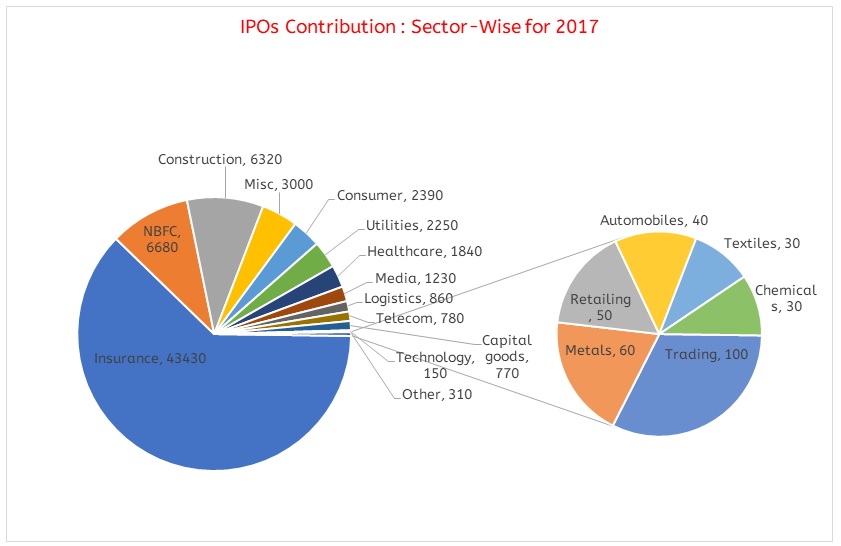

The three sectors by highest number of IPOs were insurance, non-banking financial companies and construction. The largest IPO by proceeds was General Insurance Corporation of India (GIC), the country’s largest state-owned reinsurance company, for Rs 11,300 crore. This was the largest public float by a company after October 2010 offer by Coal India which had garnered Rs 15,000 crore. The GIC offer was followed by New India Assurance Company, a state-owned non-life insurer, which mopped up Rs 9,600 crore. In fact, 72% of the funds raised through new offerings were accounted for by just 13 issuance and non-banking finance companies.

Also, the spurt in the number of IPOs was because over 130 small and medium enterprises went for listing and the issue size was less than Rs 100 crore. A report by Motilal Oswal says contribution of the new listings to Indian market cap is at a seven-year high, of 3%. The IPOs were not concentrated but spread across industries — companies from 18 different industries raised funds through IPOs this year. On average IPOs in 2017 were oversubscribed 13 times.

Even globally, IPOs were in rage with over 1,700 of them raising around $200 billion. In fact, globally, IPO volume in the first nine months of 2017 had exceeded the full-year total of 2016.

PE player taking advantage of market rally

A large number of companies that went for listing were looking to take advantage of a rally in the stock market. The buoyancy in the primary market is likely to continue till the markets are flushed with liquidity. Interestingly, a large chunk of the money raised through IPOs has gone to the promoters and other existing shareholders such as private equity firms for the shares sold by them for partial or full exit from the firm. When companies raise funds through the offer for sale route, the proceeds are used to pay existing shareholders who are looking to dilute their holdings or exit the company. Also, a lot of private equity investors who had put in money between 2004 and 2008 have seen their investments mature and companies gaining scale. As a result, private equity investors are exiting by selling their stakes. As investors are able to monetize their investments, it keeps the cycle of funding and fresh investment, especially in start-ups, going. It has been the biggest and best year for PE exit.

Given the fact that private equity investors have limited investment period, the opening up of the primary markets in the last one year has resulted in several of them bringing their portfolio companies to the market. The quality of companies that went to the markets to raise equity capital is an indication that many of them have good track record of managing outside funds well. The assorted menu of companies in the primary market serves well for larger investors which will be able to diversify their best outside of the select stocks in the secondary market. When there is a scarcity of good paper in the secondary market, or there is a need to diversify, a strong pipeline of IPOs is always positive.

Government’s Offer for Sale

As a part of Central government’s disinvestment process this fiscal, offers for sale from public sector undertakings saw a significant rise. About 80% of the amount raised through OFS was accounted for by the government’s disinvestment. The largest one was that of NTPC in August 2017 for Rs 9,700 crore followed by PNB Housing in November and NALCO in April 2017. Of the nine issues, five have delivered 105 plus returns over the issue price. Seven stocks have outperformed the index and only two stocks are trading at a discount to the issue price.

Insurance sector lists the most

There was a strong activity in the insurance sector due to regulatory changes and a number of major insurance companies, both government and private, went for listing. Sponsors of five insurance companies tapped the capital market to scale down holdings and align with regulations. In the private insurance space, SBI Life Insurance and ICICI Lombard Insurance raised Rs 8,400 crore and Rs 5,700 crore, respectively through IPOs. State-owned General Insurance Corporation of India (GIC) raised Rs 11,300 crore and New India Assurance Company raised Rs 9,600 crore. Listing of insurance companies started with ICICI Prudential Life insurance going to the bourses in 2016. The IPO had a fantastic outcome and reiterated the fact that size is not a constraint for good assets and investors have appetite for good quality public issuances.

| Year | Indian market cap (Rs lakh crore) | Contribution through new listing (%) |

| FY12 | 62.1 | 0.4 |

| FY13 | 63.9 | 0.7 |

| FY14 | 74.3 | 0.2 |

| FY15 | 101.1 | 0.1 |

| FY16 | 94.6 | 0.1 |

| FY17 | 121.7 | 1.9 |

| FY18* | 144.9 | 3 |

Note: All in Figures in Crores. 122 total IPOs.

In 2016, the insurance regulator, Insurance Regulatory Development Authority of India allowed all non-life insurance companies including standalone health insurers with over 10 years of existence (for life insurance companies, it is 8 years) to mop up money through listing from the primary market. The regulator had also underlined that all companies meeting the stipulation on minimum years of existence for listing should initiate steps to get listed by 2020.

The Finance Minister in his 2017 Budget speech had announced the listing of four state-owned non-life insurers and also the only reinsurance company to make them financially strong and enable them to expand business. The listing of insurers will help in improving the quality of disclosures and make companies answerable to investors. It will also help customers to make informed decision regarding their policies, claims and other products-related features.

The listing will help analysts understand the business of non-life insurance companies better. Overall, listing of companies will help focus on profitable growth and consequently enhance their ability to raise capital in the future. The money raised through listing of PSU non-life companies will also help reduce the Central government’s fiscal deficit. The government has set an ambitious target to raise Rs 72,500 crore in 2017-18 from disinvestment, of which it expects to get 15% from the listing of state-owned general insurance companies.

Returns from the listings in 2017

Of the total number of IPOs in 2017, 75 of them were able to beat the 31% return of the broader benchmark Nifty-50 while 42 IPOs failed to earn returns over their respective offer prices (returns calculated till December 25). Stock-wise, Apex Frozen Foods was the biggest gainer as the stock of the shrimp manufacturer has risen almost five times since the listing on September 4. Next in the top gainers were Shankara Building Products and Avenue Supermarts. In terms of losers, CL Educate (brand name Career Launcher) gave a negative return of 43% since its listing on March 31. Others like S Chand and Company and New India Assurance flopped since listing.

*Till Nov 2017. Source: Prime Database, Motilal Oswal Research

Radhakishan Damani’s Avenue Supermarts saw mammoth interest from investors as the Rs 1870-crore IPO was subscribed over 100 times, with most applications coming from HNIs and institutional buyers. The share of Avenue Supermarts was offered at Rs 299 a share and was listed at Rs 600 and is currently trading at Rs 1153.

Conclusion

IPO enables various businesses to raise risk capital for growth and gives exit to PE/VC through listing. The domestic capital pool has been strongly investing in IPOs. IPO in a way also enable promotors to have shares of listed company as currency for acquisition and further expansion. In fact, in a lot of IPOs domestic investors have bet more than their foreign counterparts. So far, we have not seen the capex-heavy industries come to the market to raise equity capital. As the economy improves and the woes of these sectors are removed through policy interventions, such sectors, too, will start approaching the market. Though the market appears to be buoyant, given the recent super subscriptions and strong listing gains, it has to be seen if the same buoyancy continues even in 2018 and beyond.