Ador Group forayed into welding & cutting products by starting Ador Welding Limited in 1951. Later, in 1974 the group started Ador Fontech Limited to manufacture products relating to the life enhancement of industrial components. The two companies got listed on exchange separately. In addition to these two companies, the group have other entities present in different business. In a move to create the best welding company and consolidate its market position, Ador Group announced consolidation of both entities. In this article, we have studied various aspects relating to this merger including whether the merger creates value for public shareholders of both companies.

Ador Fontech Limited (“AFL” or “Transferor Company”) is engaged in the business of ‘Life enhancement of Industrial Components’ which inter-alia includes providing products, services and solutions for reclamation, repairs and maintenance. The registered office of the company is situated in Bengaluru and its equity shares are listed on BSE Limited.

Ador welding Limited (“AWL” or “Transferee Company”) is engaged in the business of manufacturing & selling various products such as welding and cutting equipment, CNC machines, welding automation products as well as welding accessories. The Transferee Company is also engaged in the business of Flares & Process Equipment. The registered office of the company is situated in Mumbai and its equity shares are listed on BSE Limited and National Stock Exchange of India Limited.

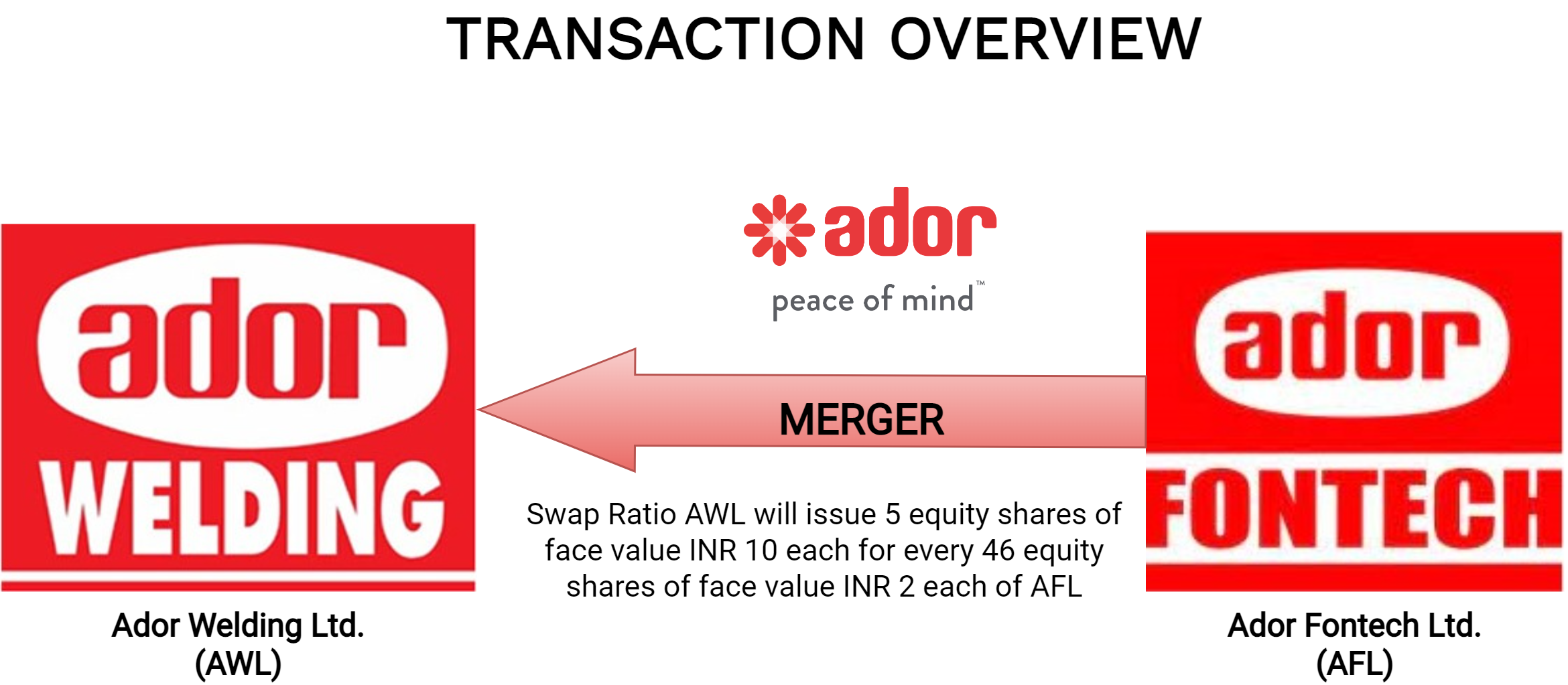

The Transaction:

The Board of Directors of AWL & AFL approved a Scheme of Amalgamation which inter-alia provides for the merger of AFL with AWL. The Appointed Date for the transaction is 1st April 2022 or such other date, as may be fixed or approved by Hon’ble National Company Law Tribunal or such other competent authority / Appropriate Authority. As the registered office of both companies is situated in different states, AWL will file an application with the Mumbai Bench of NCLT while AFL will file with the Bengaluru Bench of NCLT.

Some of the Rationale for the merger as envisaged under the scheme:

- Transferor Company and the Transferee Company are engaged in similar lines of business and complement each other. The merger will assist in expanding the business and achieve larger product portfolio, economies of scale, efficiency, optimization of logistics and distribution network and other related economies.

- Creation of one of the largest welding and cutting product manufacturer and refurbishment player in the industry

- Greater synergies between businesses and optimum use of manufacturing facilities, marketing strength, R & D facilities, optimized production, streamlining of supply chains, enhancing customer delight, brand strengthening and certifications resulting in productivity gains.

Shareholding Pattern & Swap Ratio:

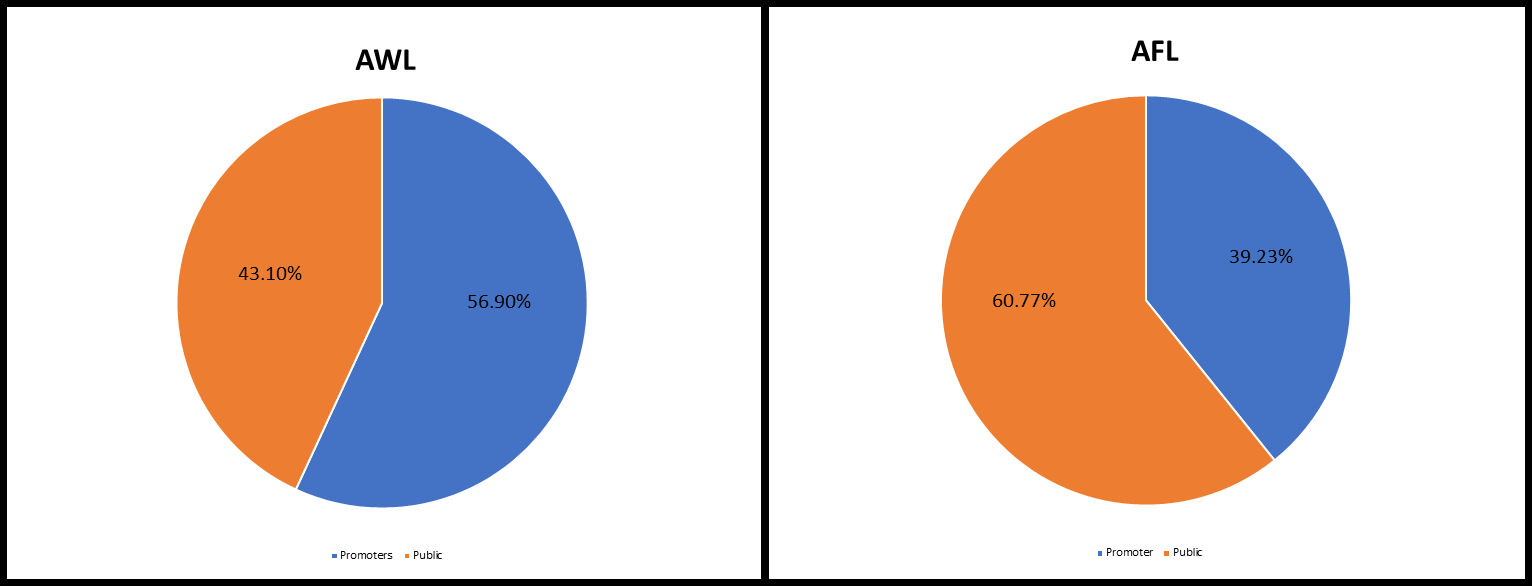

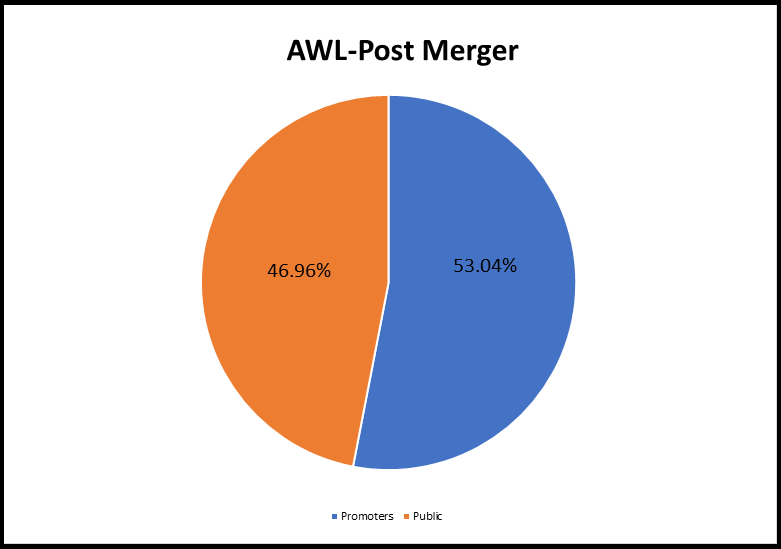

The existing shareholding pattern of the Company:

The swap ratio for the merger is AWL will issue 5 equity shares of face value INR 10 each of AWL for every 46 equity shares of face value INR 2 each of AFL.

| Particulars | AWL | AFL | AWL-Post Merger |

| No. of Paid-Up you Shares | 1,35,98,467 | 3,50,00,000 | 1,74,02,815 |

| Face Value | 10 | 2 | 10 |

Accounting & Tax Implications

As both AWL & AFL are under common control i.e., Ador Group, the merger will be accounted in the books of AWL in accordance with the pooling of interest method as laid down in Appendix C of Indian Accounting Standard (Ind As) 103- Business Combinations. As the merger will be in compliance with section 2(1B) of the Income Tax Act, 1961 there would not be any direct tax implications.

Financials

Tentative Financials for FY 2022

INR in crore

Overall, the business carried by AFL have better margins and efficiency. The merger will help AWL to improve its ratios and efficiency immediately after the merger. AFL have significant cash & cash equivalent (some given to group entities as inter-corporate deposits) which can be used to expand business or can be given to shareholders.

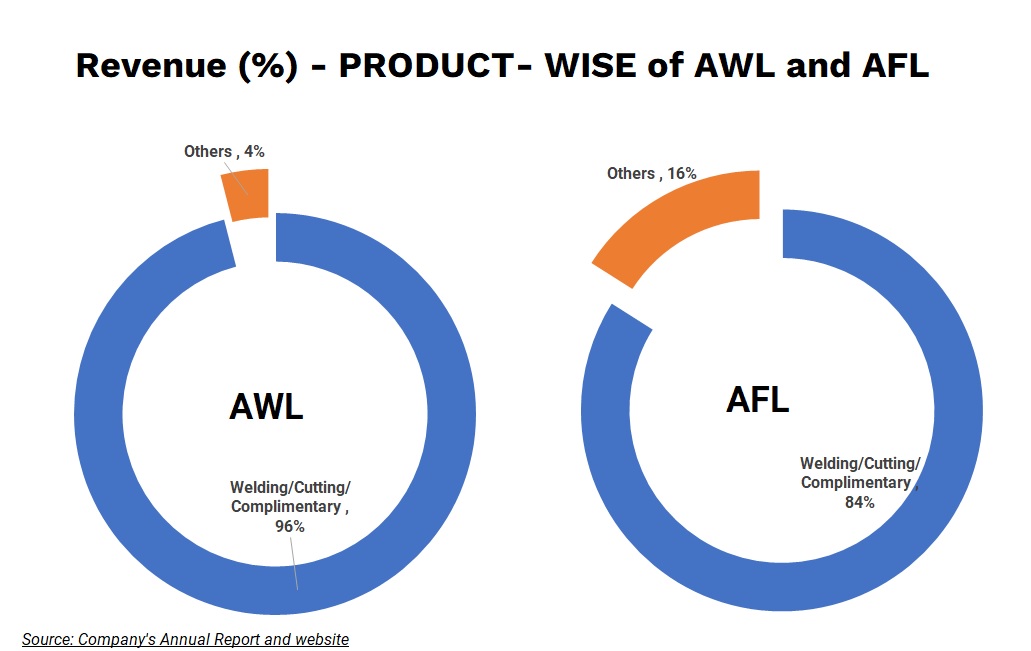

Product portfolio (revenue-wise) of both companies:

Snapshot of financials of AWL for the last 10 years:

INR in Crore

Snapshot of financials of AFL for last 10 years:

INR in Crore

In last 11 years, AWL revenue has compounded at 7.6% while profit after tax has compounded at 5.2% while that of AFL is 3.1% and 3.0% respectively. As mentioned in the annual reports for these periods, AWL has launched several products during that time span while no such information available for AFL.

AFL had also formed a joint venture in Malaysia, Dualrank Fontech (M) Sdn. Bhd. Which was discontinued/exited in 2017. In 2016, AFL formed a wholly owned subsidiary 3D Future Technologies Private Limited engaged in the production of dental range of 3D printed products. To date, AFL has infused INR 9.75 crore as equity contribution in the company. However, the subsidiary is yet to perform as per expectation and revenue in FY 2022 was a meagre INR 5 crore with loss of INR 4.19 crore.

In last 10 years, AFL has regularly given inter-corporate deposits to its group companies mainly Ador Powertrain Limited instead of rewarding its shareholders/utilisation in growing its own business. Apart from ICD’s, there are regular sales & purchases with group entities including AWL. Even for FY 2022, AFL has given circa INR 7 crore to group company Ador Powertron Limited and circa INR 5 crore to its subsidiary as inter-company deposits.

In contrast to this practice, AWL does not give /have meagre inter-corporate deposits to group entities however, it does regularly undertake sales & purchases with related parties.

During the same period, both companies regularly paid dividends to their shareholders:

| Particulars | AWL | AFL |

| Circa Profit after Tax from FY-2011 to FY 2021 | 190 | 147 |

| Circa Dividend Paid from FY 2011 to FY 2021 | 76 | 64 |

| % of Profit distributed as dividend | 40.0% | 43.6% |

Valuation

As equity shares of both companies are listed, the registered valuer has used Market price Method to arrive at fair value of both companies. As no financial projections have been provided to the valuer, discounted cash flow method which essential captures the future growth earning capability of the company has not been used to arrive at fair value of both companies.

| Particulars | AWL | AFL |

| Assigned Per Share Value (₹) | 677.8 | 73.7 |

| Derived Market Capitalisation of the Company (₹ Crores) | 922 | 257.95 |

| EV/EBITDA | 14.04 | 4.88 |

| PE Multiple | 20.40 | 10.14 |

Despite having better ratios & efficiency, during the period 2011-2022 the Market Capitalisation for AFL has compounded at meagre 4.3% while that of AWL compounded at 13.0%. Interestingly, the market capitalisation of AFL was higher in June 2011 than what is assigned while arriving at the swap ratio.

The valuation has been done in accordance with the prescribed framework as given by the Securities and Exchange Board of India (SEBI). The valuation multiple fetched by AFL is significantly at discount to AWL despite of same management and huge surplus cash on the balance sheet. The current valuation doesn’t seem to consider the highest ever revenue by AFL and AWL and one-of-it-kind approval of robotic welding systems for Indian Railways received by AFL.

Conclusion

The timing of the merger is when India is on the cusp of multi-year capex cycle which ultimately benefits AWL & AFL. After almost more than 25 years since listing of AWL & AFL, the Ador group is consolidating entities. During the last decade, lot of new products has been launched by AWL while there is no such announcement done by AFL, though it generated large free cash flow. Instead of returning cash to shareholders or use for expanding business, AFL used cash to fund growth of its group companies or expanding unrelated business. Now there will be an opportunity to use surplus cash and free cash flow to fund merged business.

Though the swap ratio has been arrived within framework prescribed by the SEBI, for better corporate governance & benefit to the public shareholders, the management should consider the fact that AFL shares are trading at significant discount to the multiple fetches by AWL especially as both AWL & AFL have achieved highest ever revenues in FY 2022, better margins of AFL and future opportunities available with AFL. It also points to ponder whether SEBI guidelines for valuation method to be used need to be accommodative for other methods in appropriate cases to be fair to the minority shareholders.