“This scheme has been withdrawn from execution and the new composite scheme of arrangement was filed in 2023. Please read the article here.”

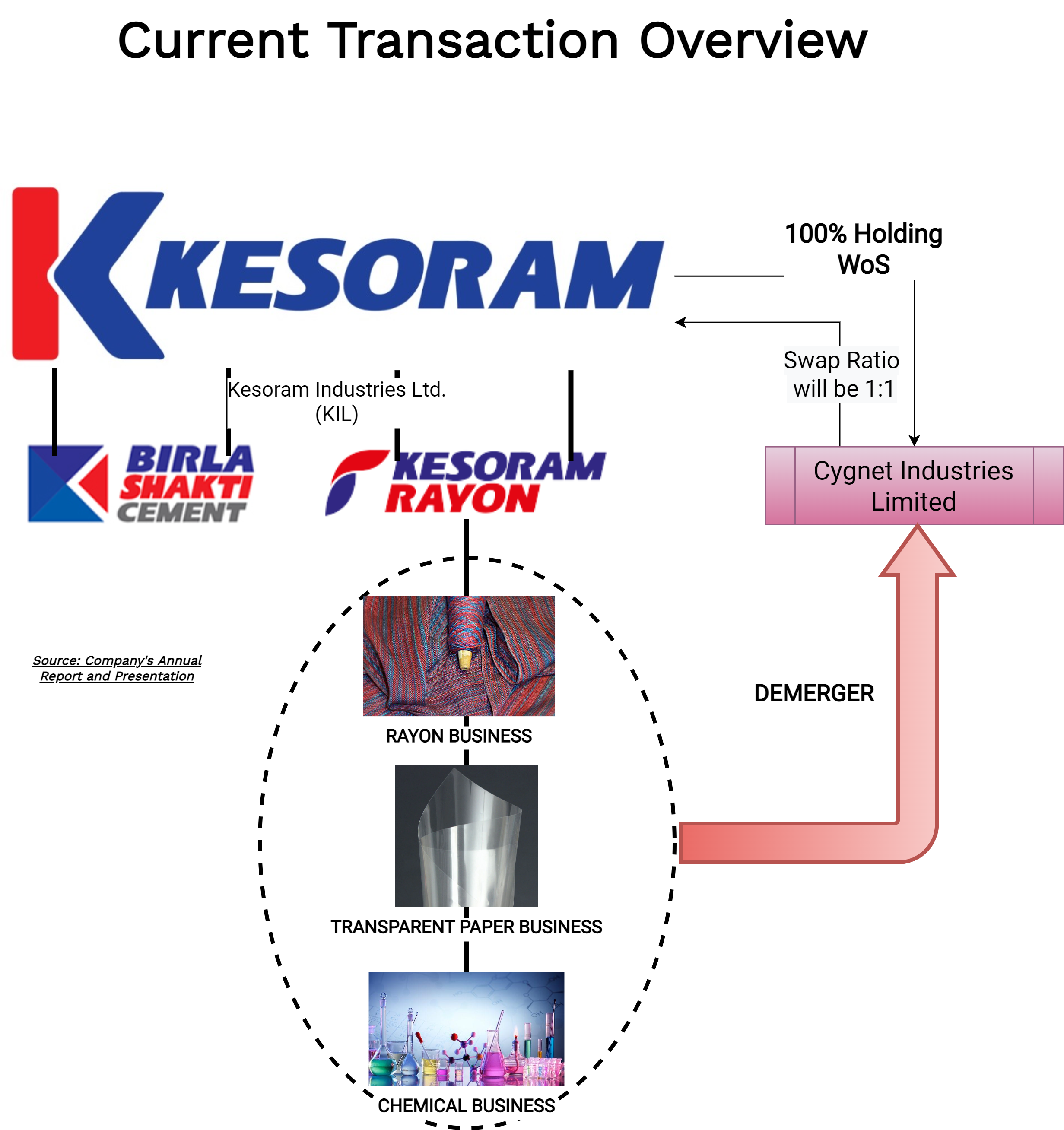

Demerger’s saga for Kesoram Industries Limited (KIL) seems to be a never-ending exercise. In the last few years, KIL (including companies formed out of KIL) did a couple of demergers & divestments pursuant to debt restructuring. In continuation to this, KIL announced the demerger of Rayon, Transparent Paper and Chemical business. Will this demerger solve the problems for KIL?

Kesoram Industries Limited (“KIL” or “Demerged Company”) is engaged in the business of manufacturing cement & chemical. It has 2 plants having a combined capacity of 7.25 MTPA. As mentioned in the Scheme of Arrangement, the business of manufacturing chemicals being directly carried by KIL is presently under suspension. However, in the standalone financials of KIL, there is no separate chemical segment. Even in consolidated financials, chemical business has been clubbed with Rayon & Transparent Paper business.

KIL carries its Rayon, Transparent Paper and Chemical business through its wholly-owned subsidiary Cygnet Industries Limited (“CIL” or “Resulting Company”). CIL has temporarily suspended its entire operations since June 2021. Under the proposed transaction, KIL will demerge Rayon, Transparent Paper and Chemical Business (Carried through CIL) to CIL & CIL will be listed on nationwide bourses separately.

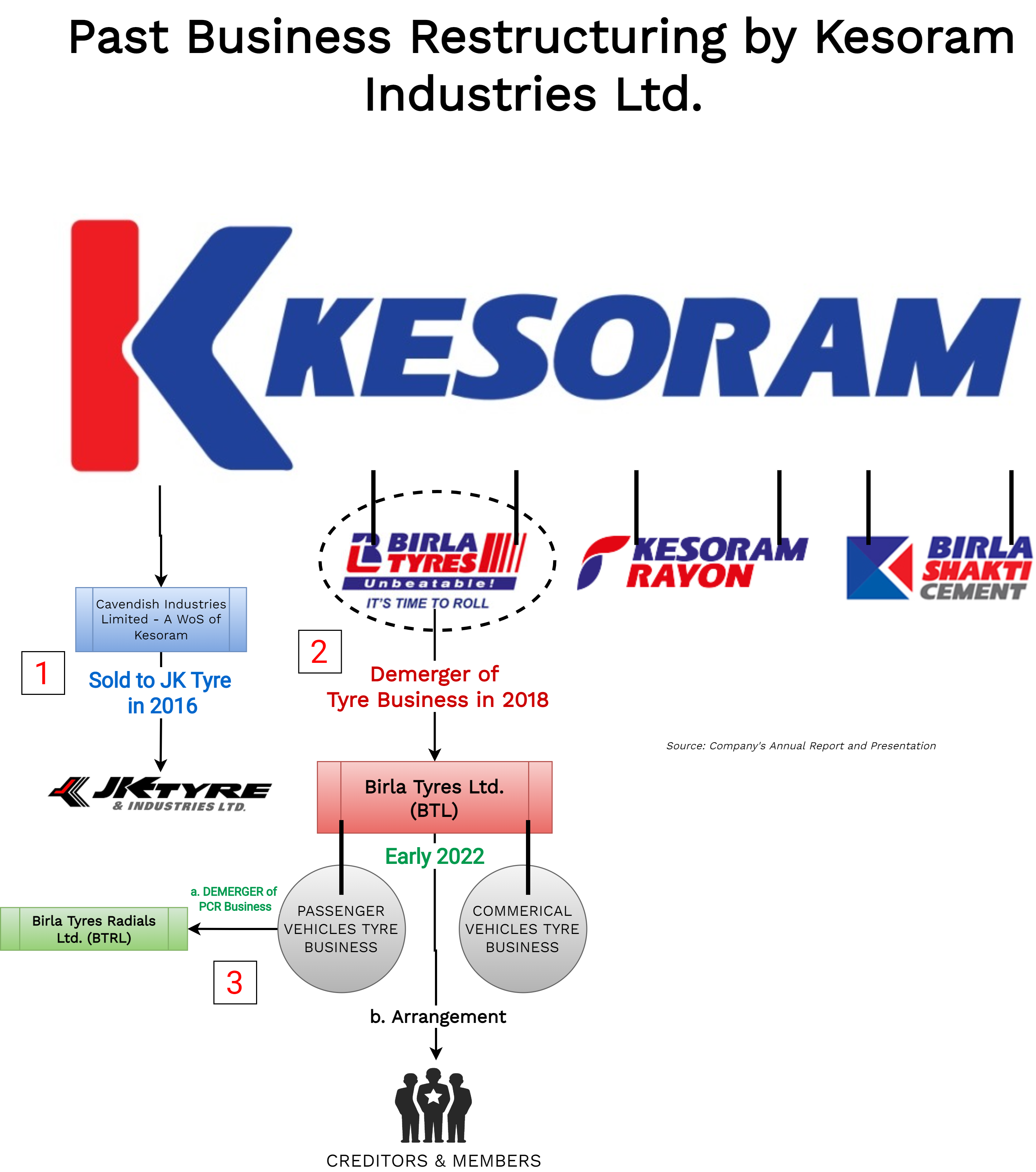

Past Corporate Re-structuring:

The last five years have been a roller-coaster ride for KIL. In 2015, sold its one of the two tyre facilities to JK Tyres for a consideration of INR 2195 crore. In 2019, KIL demerged its remaining tyre business to Birla Tyres Limited (BTL) and pawed the way for its separate listing. Thereafter, recently, BTL further announced the demerger of its Passenger Car Radial Tyre facility.

Apart from this, couple of times KIL raised money through debt & equity infusion latest being issue of rights shares last year for INR 40 crore. In 2021, Resolution Plan was approved by the lenders of KIL, pursuant to which KIL had entered into a settlement agreement with lenders which entailed settlement of existing gross debt aggregating to INR 2181 crore (as on 31st January 2021) into three phases:

- Issuance of equity shares for INR 144.5 crore.

- Issuance of 0% Optionally Convertible preference Shares of value INR 100 each for INR 449 crore.

- Upfront repayment of INR 1670 crore.

Despite several re-structuring, KIL failed to facilitate deleveraging of its balance sheet.

KIL has also given a loan to CIL which partly was converted into equity. Further, during the demerger of tyre business it also advance INR 519 crore (balance as on 31st March 2022) as a loan to BTL which has been entirely provided for impairment. Further, recently BTL also announced debt restructuring and it is evaluating an investor for its passenger car radial tyre business.

| Particulars | Amount (INR in Crore) |

| Total Financial Support provided by KIL to CIL | 650 |

| Conversion to Equity | 496 |

| Outstanding Loan | 154 |

| Loan provided to Birla Tyres Limited | 519* |

*: Entire amount has been provided impairment. Further, pursuant to the recently announced debt restructuring scheme by BTL, the amount shall be converted to equity plus preference shares.The Transaction

As approved by the Board of Directors of KIL & CIL, KIL will transfer its “Rayon, Transparent Paper & Chemical Business” to CIL through a demerger. The Appointed Date for the transaction is 1st April 2022.

As the main Rayon & Transparent paper business is carried by KIL through its subsidiary CIL. Apparently, it looks like the Demerged Undertaking shall constitute mainly “Kesoram Brand”, suspended chemical business and equity shares of CIL.

The operations of chemical business carried by KIL & Rayon, Transparent paper and chemical business carried by CIL are suspended. The reason stated for the suspension of CIL’s operations was a restriction in logistics activities due to covid-19. Further, CIL has also launched a Workman Separation Scheme during FY 2021-22.

Swap Ratio:

CIL shall issue 1 equity share of INR 10 each fully paid-up for every 1 share of INR 10 each fully paid up of KIL. Further, currently KIL also have some partly paid-up shares issued as right shares. As mentioned in the Scheme, till the record date, such shares will be either fully paid-up or forfeited.

There will be no change in the shareholding pattern of the KIL and CIL shareholding pattern shall be mirror image of KIL.

Shareholding Pattern:

Currently, the paid-up capital of CIL is more than 3 times the paid-up capital of KIL. Significant high paid-up capital of CIL is due to the conversion of loan given by KIL into equity. After demerger, though the paid-up capital of CIL will get reduce substantially, it may not commensurate with the operations it has, since entire operations have been suspended.

Accounting Aspect:

The Accounting Treatment to be followed by the Demerged Company has not been given under the proposed Scheme. As CIL is controlled by KIL, the transaction will be a common control transaction and will be accounted as per the Annexure C of IndAS:103 Business Combination.

As a significant part of the demerged undertaking shall likely constitute the equity investment in CIL & Loan given to it, the same shall get cancelled and adjusted against the reserves of the demerged company.

Table stating invest/loan given by KIL to CIL:

As on 31st March 2022

| Particulars | Amount (INR in Crore) |

| Equity Investment | 306* |

| Loan given to CIL | 154 |

| Net-worth of KIL | 606 |

*: After providing an impairment of INR 620 crore.As per the consolidated segmental information published by KIL: for the year ended as of 31st March 2022; no/miniscule borrowings of KIL likely to get transferred as a part of the demerged undertaking.

Income Tax Aspect:

Section 47(vi b) & 47(vi d) of the Income Tax Act, 1961 (ITA) provides any demerger shall be tax exempted if it is in compliance with the provisions of section 2(19AA) of ITA. One of the requirements under section 2(19AA) is the business shall constitute an “Undertaking” & transfer of the undertaking is on a going concern basis. Considering the operations have been suspended, can the condition of “Going Concern” be complied? Though, the Statutory Auditors of both KIL & CIL in their Auditor Report for FY 2022 have not given an adverse opinion on going concern.

Financials:

Financials of CIL for FY 2022:

INR in crore

Segmental Financials (Consolidated) for FY 2022:

CIL revenue for Q1 FY 2022 (till the date of suspension). Despite the highest cement sales & EBITDA for KIL in FY 2022, cash flows are barely sufficient to serve the finance cost. The cash flows from the cement business are not sufficient to fund the operations of other businesses.

Conclusion

In an effort to come out of piling debts, KIL did multiple re-structuring including settlements with lenders. However, none of the restructuring seems to have facilitated the desired objective of deleveraging. Under the proposed transaction, CIL will become another listed company for the group housing Rayon, Transparent Paper & Chemical business which is currently being suspended. Considering the size & nature of the operations with the capital CIL will have, it will be difficult for CIL to create any value for minority shareholders. KIL will continue with its crown & cash cow cement business along with huge debt. In future, it may evaluate the option to sell some of the businesses. For now, the value creation journey for KIL or its other group entities looks a fairy tale.