Starting as a Multimodal Transport Operator Company, Allcargo Logistics Limited diversified across various other ancillary businesses. Last year, with the acquisition of Gati Limited, Allcargo Logistics Limited’s vision to become an integrated logistics company seems to be fulfilled but ushered in the consolidation of various businesses having different risks and returns. To accelerate growth and to improve return on capital employed, Allcargo Logistics Limited has decided to split its logistic business into three verticals.

Allcargo Logistics Limited (“ALL”) part of The Avvashya Group is a global leader in multimodal logistics solutions. Allcargo Belgium NV., Operating ECU Worldwide network, is a global market leader in ocean freight consolidation. ALL along with its subsidiary companies is engaged in the business of:

- Multimodal Transport Operations

- Container Freight Stations/Inland Container Depots

- Project and Engineering Solutions

- Logistics Park

- Express Logistics business

- Contract Logistics

Allcargo Terminals Private Limited (“ATPL”) is incorporated in 2019 and has not engaged in any business operations. ATPL is a wholly-owned subsidiary of ALL.

TransIndia Realty & Logistic Parks Limited (TRLPL) is a wholly-owned subsidiary of ALL and has been incorporated to facilitate demerger transactions.

The Proposed Transaction

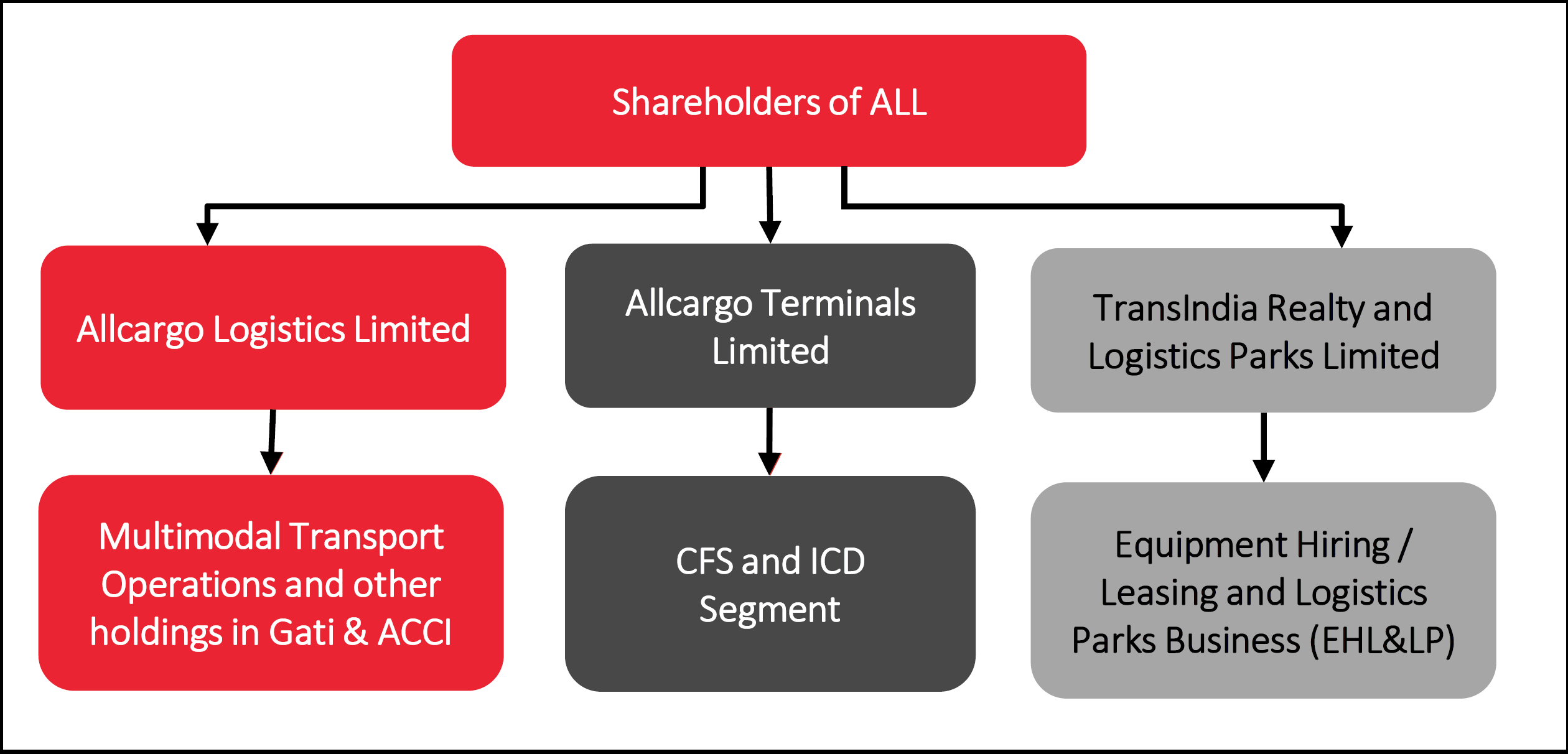

The Board of Directors of Allcargo Logistics Ltd approved the demerger of Container Freight Stations/Inland Container Depots business into Allcargo Terminals Limited and demerger of equipment rental, logistics parks and other real estate assets into TransIndia Realty & Logistics Parks Limited (TransIndia).

Container Freight Stations/Inland Container Depots business include operations related to CFS and ICD businesses across locations at JNPT, Mundra, Chennai and Kolkata. JV with CONCOR and planned ICD at Jhajjar under Allcargo Inland Terminal would also be a part of ATL. The land bank pertaining to usage for this business would be transferred to TRLPL and ATL would continue to be managed as an asset-light entity.

Equipment rental, logistics parks and other real estate assets business include a portfolio of high yielding rental assets. Some entity assets which will get transferred as a result of demerger which are required for running related-party businesses will be leased back to the group (land bank at JNPT and Chennai, corporate office, etc.). Also, certain asset classes which could be leased/constructed with other JV partners (Logistics Parks, etc.) would also be a part of TRL.

In Project & Engineering Business, Project Logistics is a service business and therefore would continue to form part of the Allcargo Logistics. The equipment business is more rental business, and which is why it will strategically fit in with the lease and rental business of TRLPL.

Allcargo Logistics Limited would continue to be operating Multimodal transport Operations, express logistics and contract logistics businesses etc.

The Appointed Date for the transaction is 1st April 2022.

All three companies will have mirror shareholding, resulting in no change in the entitlement of shareholders for each entity. After the demerger, shareholders will get 1 share each of Allcargo Terminals and TransIndia Realty & Logistics Parks for every 1 share held of Allcargo Logistics Limited. The equity shares issued by Allcargo Terminals and TransIndia Realty & Logistics Parks will be listed on bourses.

The Scheme also covers the list of assets & liabilities (not amount) getting transferred along with list of some of the common assets.

Some of the rationales as envisaged in the Scheme of Arrangement:

- Some of the ALL’s businesses have gained the scale and require strategic independence to operate with greater flexibility both financially and operationally, so that they can be more efficient and drive the next phase of growth.

- Sharper management focus.

- To provide much needed strategic independence and be able to attract the right pool of capitals and investors for sustained growth opportunities.

Through demerger, CFS & ICD business will be completely asset-light and will be housed under a different listed entity. CFS & ICD business is stable & generating free cash flow for the business. Asset Heavy and rent yielding business will be transferred to TRLPL.

ALL’s core business along with the newly acquired express delivery business will be housed under ALL only. Recently, ALL strengthened its core business with multiple acquisitions.

Deal with Blackstone

ALL entered a definitive transaction with the Blackstone Group on 13th January 2020, wherein Blackstone would acquire 90% stake in All cargo's warehousing subsidiaries set up as (Special Purpose Vehicle) at Telangana, Tamil Nadu, Karnataka, Gujarat, Goa, and Maharashtra for an equity consideration of over ₹ 380 Crores and taking over debt of the SPVs holding these assets. In some SPVs 90% shares have already been transferred, while the remaining are expected to be transferred upon full consummation of transaction with Blackstone Group. Allcargo would remain a strategic minority stakeholder in these warehousing subsidiaries at 10% post the transfer. These ALL’s warehousing subsidiaries forms part of the undertaking getting transferred to TRLPL.

Delisting

ALL vide its letter dated August 24, 2020 has intimated BSE Limited and National Stock Exchange of India Limited that it has received delisting proposal letter from Promoter and the Promoter group company, wherein they have expressed the intention to, either individually/collectively or together with other members of the Promoter group, to acquire all the equity shares of the Company held by the public shareholders of the Company and voluntarily delist the equity shares of the Company from the Stock Exchanges. However, later during shareholder’s meeting as the vote casted in favour was not enough, the proposal did not sail through.

Other Internal Restructuring & Acquisition

Recently, ALL informed exchanges that it has hired bankers to evaluate potential fundraising opportunities in global business i.e., ECU worldwide (subsidiary of ALL). Further, to facilitate the separation of CFS & ICD business from logistic, ALL also did a demerger of its Jhajjar Logistic Park company (wholly owned subsidiary of ALL).

Further, after the acquisition of Gati Limited last year, ALL announced turnaround project for Gati which includes divestment of non-core business along with strengthening core operations.

The Board of directors of ALL approved the scheme of demerger whereby the contract logistics business of its joint venture entity namely Avvashya CCI Logistics Private Limited will get transferred to Avvashya Supply Chain Private Limited a wholly-owned subsidiary of ALL with mirror shareholding.

Recently, to strengthen operations in Nordicon region, Allcargo Belgium N V (WoS of ALL) acquired 65% stake in ECU Worldwide (Nordicon ) AB for a consideration of USD 28 million.

Financials and Valuation

In all, CFS business has been steady and free cash flow generating business. Going ahead, it will be further asset light as land in JNPT & Chennai CFS will be transferred to TRLPL. Further, as told by the management, CFS business will not be requiring any significant capital expenditure in near future. ALL in strengthening its core business MTO with a couple of acquisitions in last year. Express Distribution business i.e., Gati Limited is on the verge of turnaround. Logistic Business is new business and true potential will be achieved in a year or two.

Over the last couple of years, there has been a continuous effort from ALL to re-aligned capital employed across the various segments. The focus was on divesting non-core assets and expanding into newer growth areas. This can be evident from the changes in capital employed across various divisions as envisaged below:

Post-demerger Logistic business may witness re-rating as the presence of Blackstone in the business. For CFS business, the key will be growth. Despite an asset light and cash flow generating business, the growth was mutant for the last couple of years. For ALL, Multimodal Transport Operations & Express Logistics will be the core business and interestingly both businesses are looking for turnaround.

Conclusion

ALL tried to build entire logistic value chain on the cash flow of the core business. The scheme likely to be proposed considering the belief that the future growth of these businesses will be required large capital and focus management. Post-demerger, promotors may exit Logistic Park and CFS&ICD business. Cash generated from such sales will go to fund further acquisitions for its core business or promoters may again discover options to delist core business. Core business growth will depend on the success of this restructuring and acquisition strategy. Management is aware of this and hence recently onboarded Mr Parthasarathy on the board.

Add comment