Shriram Group announced the long-awaited re-jig of its group structure. The proposed re-jig entails consolidation of finance business under one listed company and its other businesses (insurance) continues to be placed outside the listed entity.

Shriram Group is India’s leading financial conglomerate with a dominant presence in commercial vehicle (CV) financing, retail financing, chit fund, equipment financing, housing finance, life insurance, general insurance, stockbroking, distribution of financial products, and wealth advisory services. Shriram Capital Limited (SCL) is the holding company for the Financial Services (Shriram City Union Finance Limited & Shriram Transport Finance Limited) and Insurance entities (Shriram General Insurance Company Limited & Shriram Life Insurance Company Limited) of the Shriram Group. Shriram Housing Finance Limited is a subsidiary of Shriram City Union Finance Limited.

Shriram Transport Finance Co Ltd. (STFCL) a part of the Shriram Group, is one of the largest asset financing Non-Banking Financial Companies in India. STFCL is a leader in the organized financing of pre-owned trucks.

Shriram City Union Finance Limited (SCUFL), a part of the Shriram Group, is one of India’s leading non-banking finance companies focused on the rural and semi-urban sector. The Company is a leading Two-wheeler financier, provides loans to SMEs, Gold loans and has a Housing Finance Subsidiary, Shriram Housing Finance Ltd.

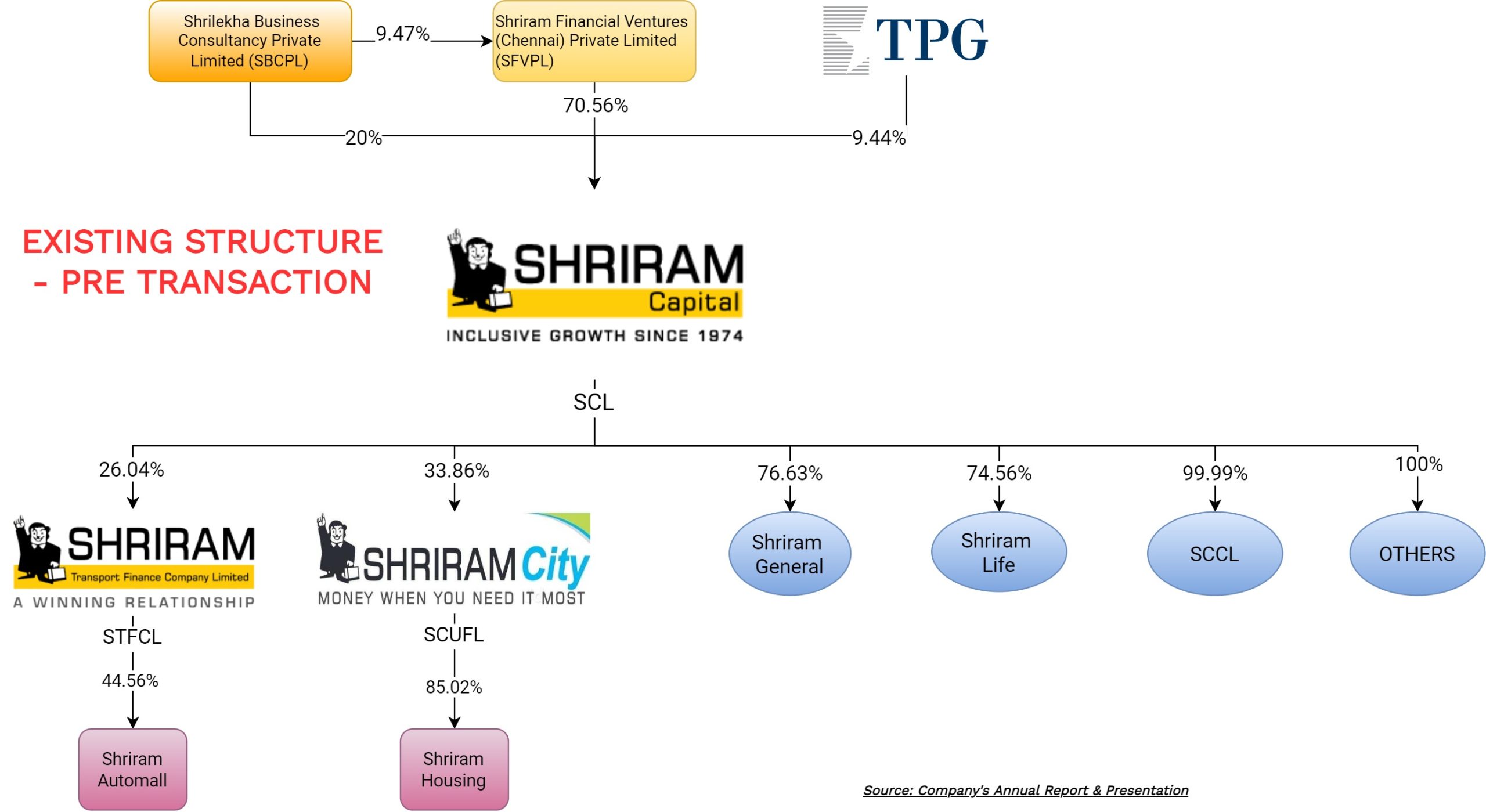

The Existing Structure of the group

Currently, equity shares of Shriram Capital Limited are held by Shrilekha Business Consultancy Private Limited (SBCPL), Shriram Financial Ventures (Chennai) Private Limited (SFVPL) and TPG group.

TPG Capital is a long-standing investor in Shriram Group. While, Piramal Enterprises Limited acquired ~10% equity stake in STFCL and later in 2014, acquired effective 20% equity stake (through SBCPL) in SCL and `10% equity stake in SCUFL. The total investment was pegged at around INR (India Rupees) 4440 crore. Mr. Ajay Piramal also appointed as a chairperson of SCL. Later in 2019, PEL offloaded its stake in STFCL. Apart from these two, South Africa based Sanlam Group also hold strategic investment in Shriram Group. Sanlam is also a joint venture partner in the two life and general insurance subsidiaries.

The Proposed Transaction

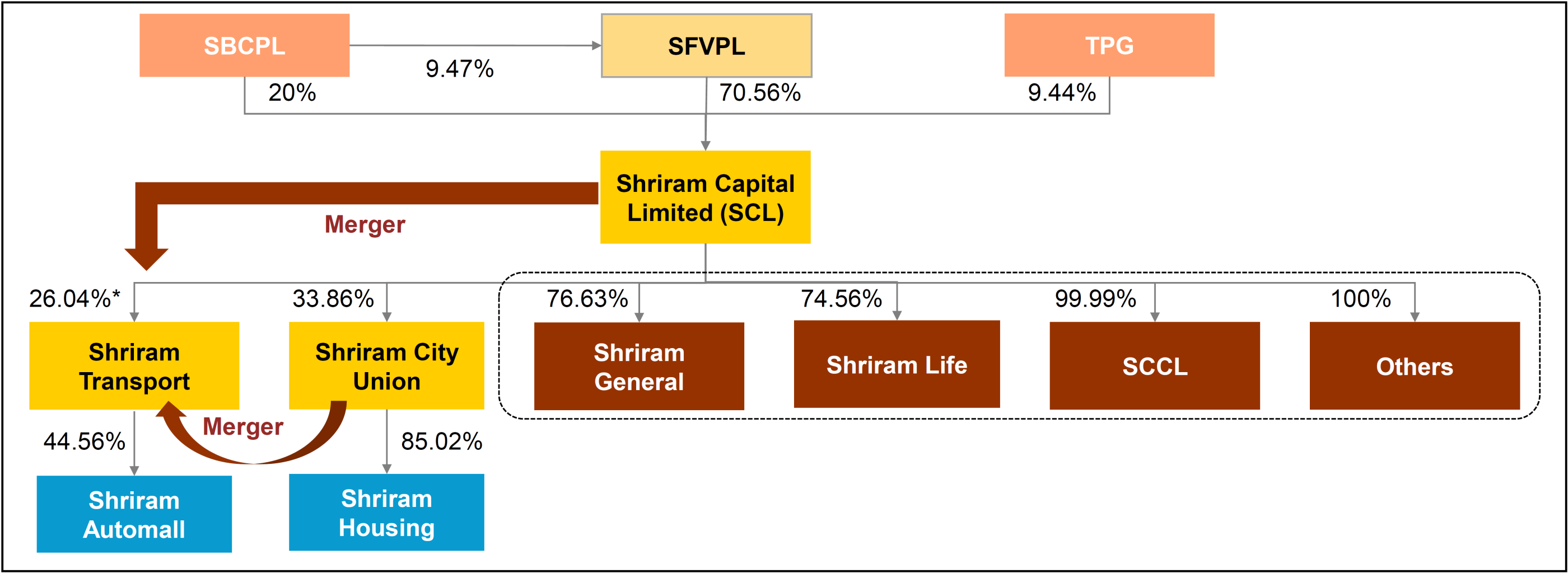

To streamline the group structure and facilitate exit to its investors, the proposed re-jig will be done in:

- Amalgamation of SBCPL with SCL

- Demerger of Insurance & Financial Services Undertakings into respective companies followed by merger of remaining SCL with STFCL

- Amalgamation of SCUFL with STFCL

Other Salient Features of the Scheme includes:

- The name of STFCL will be changed to Shriram Finance Limited

- Rejig-w.r.t the management

Rationale for the proposed re-jig

Apart from streamlining the structure of the group, the key reason for the proposed re-jig to facilitate exit for the financial investors like PEL and TPG group. Major part of their investment in Shriram Group is through SCL which is unlisted holding company of the group.

Apart from this, there are likely couple of business synergies that will arise:

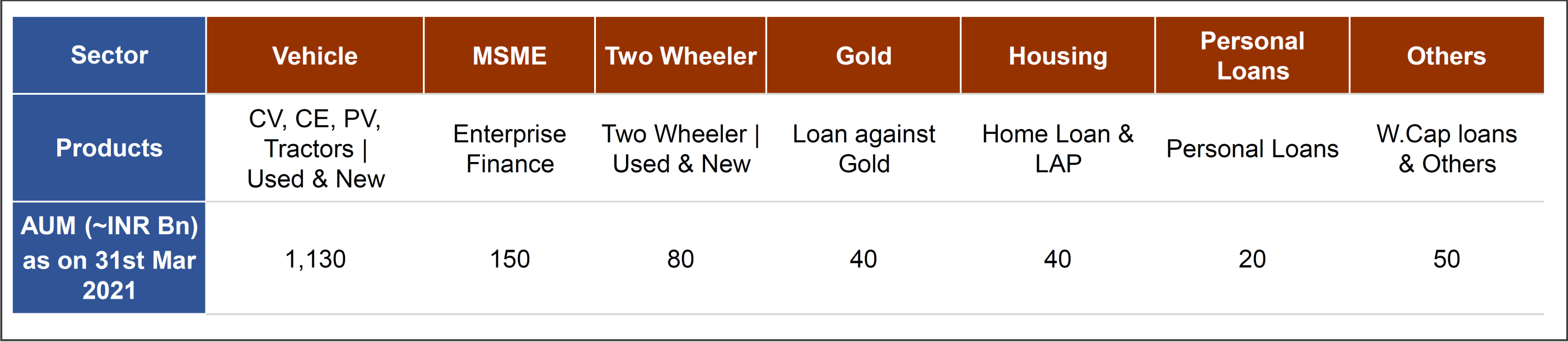

Largest NBFC

The move will result in making STFCL, largest retail NBFC in India. The combined entity will be having Assets under Management of circa 1,50,000 crore and a customer base of over 2.1 crore.

STFCL has total 1825 branches while SCUFL has 971 branches across India. Most of the branches of SCUFL are concentrated in South India while STFCL has a balance distribution of branches compared to SCUFL. There is limited overlapping of branches between STFCL and SCUFL.

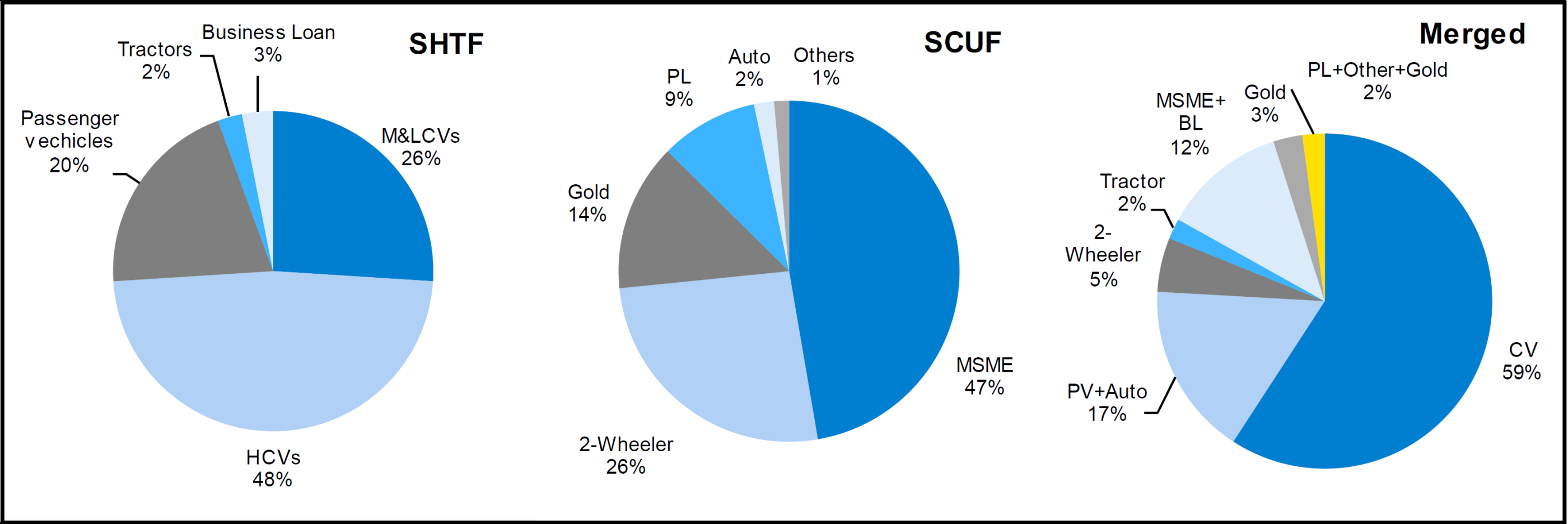

Diversification

STFCL is engaged in the financing of used vehicles (mainly commercial) while SCUFL is a leading Two-wheeler financier, provides loans to SMEs, Gold loans and has a Housing Finance Subsidiary, Shriram Housing Finance Ltd. Financing of used vehicles is a monoline business and highly cyclical. While SCUFL is concentrated in south India. With the merger, product portfolio will be much wider and provide balance spread across India.

The group is also developing a super app Shirom One, the merger will help in consolidating various business portfolios under one roof.

Ticket size & tenure of the finance provided by SCUFL is low while that of STFCL is high.

Cross-Selling

Currently, the cross-selling for the group is limited to the insurance business only. There is no cross-selling between STFCL and SCUFL. Going ahead, the management will focus on cross-selling between STFCL and SCUFL business. Further, being a wider portfolio, the cost of borrowing will come down. In all, the management has guided for incremental ~10% bottom line due to the merger.

Shareholding pattern of the Entity

- Shareholders of SCL for every 1 share of Re 1 each of SCL will receive 0.097 share of Rs 10 each of STFCL

- Shareholders of SCUFL for every 1 share of Rs 10 each of SCUFL will receive 1.55 shares of Rs 10 each of STFCL

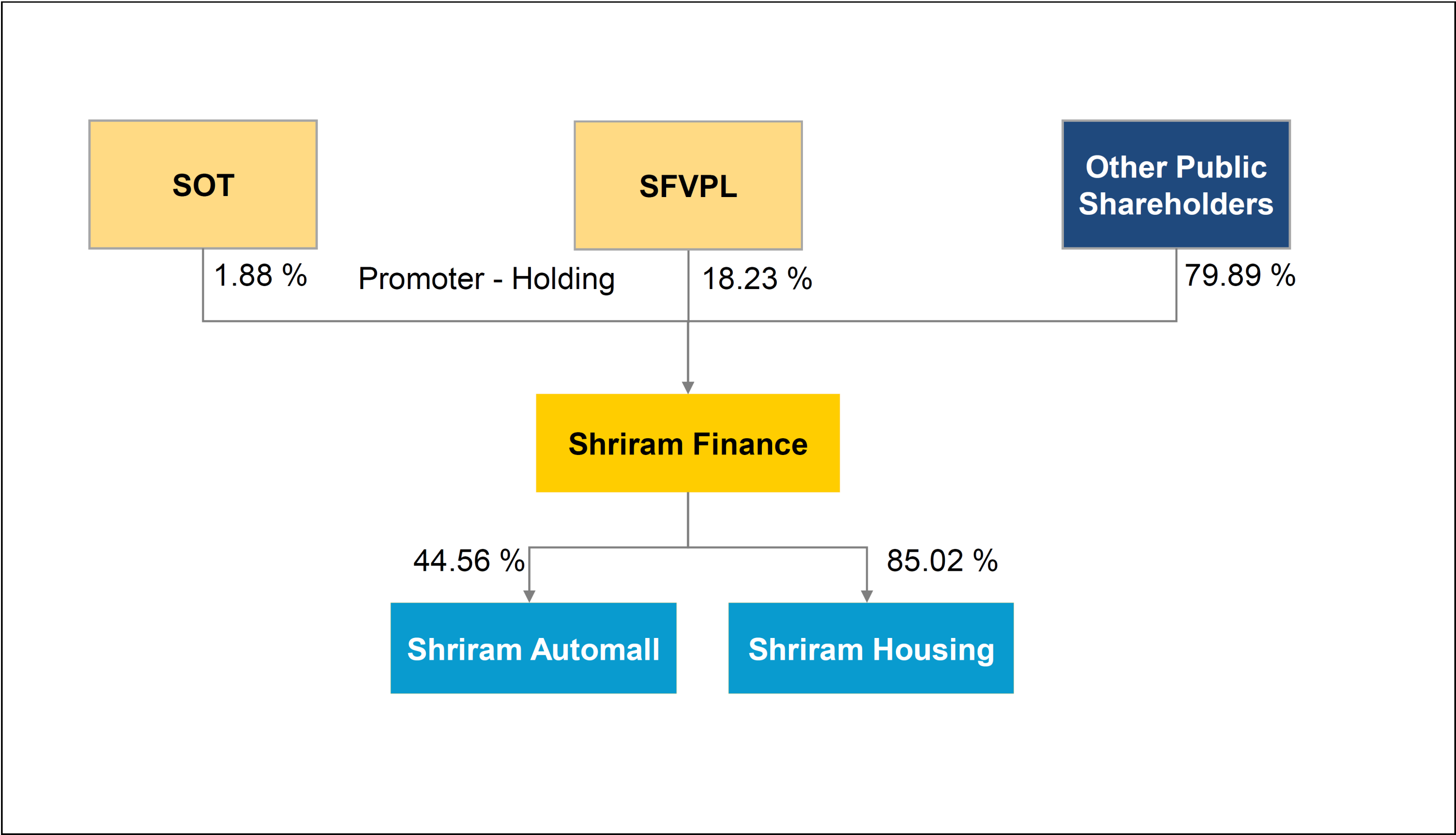

After completion of the re-jig, STFCL shareholding pattern will be:

| Particulars | Pre | Post | |||

| No. of Shares | % | No. of Shares | % | ||

| Promoters | 704,94,053 | 26.06 | 7,49,85,867 | 20.11 | |

| Public | 2000,25,660 | 73.94 | 2979,30,459 | 79.89 | |

| Total | 2705,19,713 | 100 | 3729,16,326 | 100 | |

Promoter holding in the merged entity i.e., Shriram Finance Limited will be 20.11% cumulatively held by Shriram Ownership Trust (SOT) & SFVPL. PEL will own circa 8.5% while TPG will own circa 2.6% in the merged entity. These two investors are classified as public shareholders. Apart from this, they will continue to hold a stake in Insurance and other Finance Business.

Shriram Finally Providing an Exit

The proposed re-jig is not the first attempt made by the Shriram group to provide an exit to financial investors. In 2017, the group entered into an exclusive agreement with IDFC group to evaluate the potential combination of certain businesses and subsidiaries with IDFC group. However, later the mega-merger plan was called off due to valuation and structure differences between groups.

Later in 2019, many of the newspapers reported news that Shriram Group considering consolidation of finance business with Piramal’s finance business. Meanwhile, PEL and TPG took part exit from Shriram Group. However, their major investment being in unlisted holding company, collapsing holding company was inevitable for the exit.

| Particulars | Amount |

| Total Amount invested by PEL in Shriram Group in 2013 & 2014 | INR 4583 crore |

| Sale of investment in STFCL in June-19 | INR 2300 crore |

| Existing Market Cap of STFCL* | INR 32,700 crore |

| Existing Market Cap of SCUFL* | INR 11,550 crore |

| Merged Entity Market cap (excluding Insurance & others) | INR 44,250 crore |

| PEL Stake Value (8.5% in merged entity) | INR 3761 crore |

*: Market cap as on 21.12.2021.

In addition, PEL will have stake in Insurance as well as other businesses which will be demerged from SCL. Going ahead, PEL may also evaluate the possibility of consolidating part of Shriram Group business with itself.

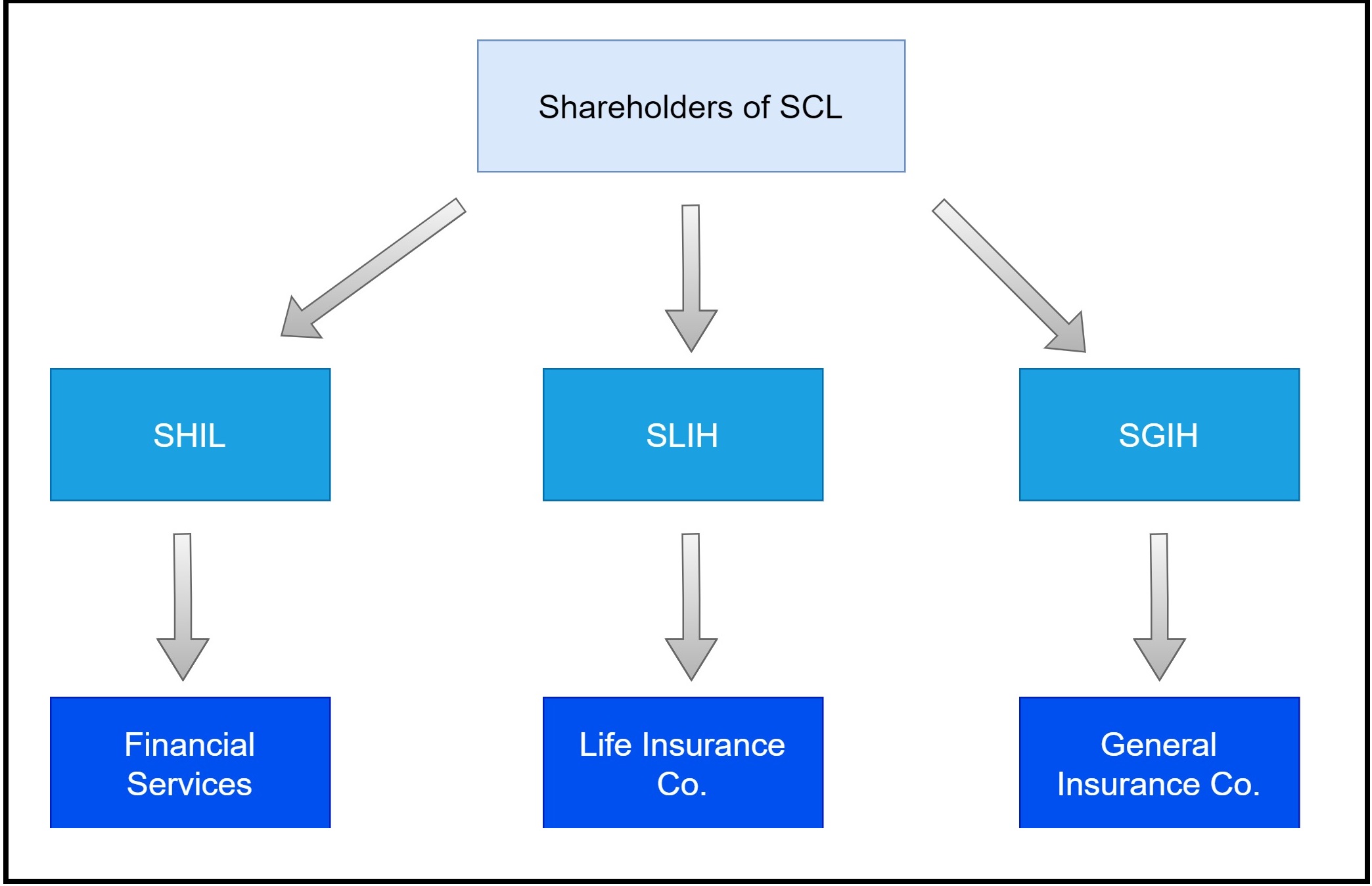

Demerger of Financial & Other Business

The Scheme proposes for demerger of Financial Services Undertaking of SCL into -Shriram Investment Holdings Limited (“SIHL”); demerger of Life Insurance and General Insurance Undertakings of SCL into Shriram LI Holdings Private Limited(“SLIH”) and Shriram GI Holdings Private Limited (“SGIH”) respectively.

Currently, the Life and General Insurance Business is being carried by Shriram Life Insurance Company Limited and Shriram General Insurance Company Limited, respectively. Through demerger, SLIH & SGIH will become holding companies holding investment in life as well as general insurance.

Before consolidation of finance business, the group’s insurance business will be carved out. The probable reason part from the commercials for demerging Insurance business could be regulatory challenges for consolidating insurance business with finance business.

Conclusion

Shriram group made multiple attempts to rejig its businesses so that it can streamline its corporate structure and provide an exit opportunity to its various investors. Let us hope the latest proposal will go through without any hurdle. The rejig on one hand will provide exit opportunity for some of the long-standing investors and simultaneously will also enable to invite strategic investors and go for IPO (Initial Public Offering) for insurance business.

Post-restructuring promoters holding of circa 20% will be continued to be housed under complex trust structure. If they want to continue to run the business, they might need to raise funds by exiting or selling a substantial stake in other businesses- like life insurance and general instance. So, it is a long way for the group to have a structure which will enable them to grow without any burden of giving exit to investors.

Add comment