Emami Infrastructure Limited (EIL) is one of the flagship companies of the Rs 3,050 Cr diversified Emami Group. It was incorporated on January 4, 2008, and is in the business of real estate. Its footprints are spanning across Chennai, Kolkata, Mumbai, Jhansi, Bhubaneshwar, Hyderabad, Coimbatore and Indore. The company is presently engaged in various projects through their subsidiaries and associates. The company has one material non-listed subsidiary company, namely Emami Realty Ltd and six non-material, non-listed subsidiary companies, namely Delta PV Pvt Ltd, Emami Constructions Pvt Ltd, Emami Ashiana Pvt Ltd, Octagon BPO Pvt Ltd, New Age Realty Pvt Ltd and Emami Rainbow Niketan Pvt Ltd. The Company is listed on BSE and NSE respectively and is enjoying a market cap of Rs 412 Crores. Its operations include identification and acquisition of land, planning, execution and marketing, of the projects including management of projects owned by other Landlords. EIL has also entered Joint Development Agreements (“JDA”) with other land owners, wherein EIL will get share in constructed area as part of consideration.

Zandu Realty Ltd (ZRL) is listed with BSE and NSE, having a market cap of Rs 111 Crores respectively. Emami Group acquired Zandu Pharmaceuticals Works Ltd in 2008. Post-acquisition, the pharma division was de-merged and vested with Emami-Limited. Thereafter, it was renamed as Zandu Realty Ltd. ZRL has emerged into Development agreement with Seth Corp Private Limited for construction of buildings for commercial use on its land at Dadar, Mumbai. As on 1st April 2017, ZRL has certain unsold units as inventory. ZRL has also made investments in securities of listed/unlisted companies.

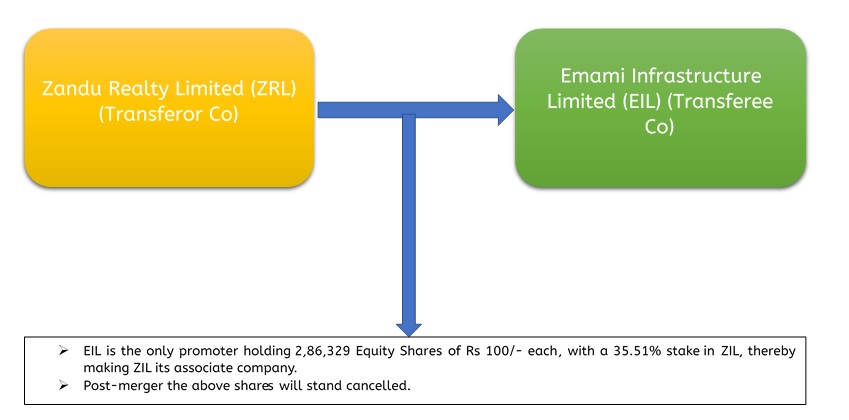

Transaction

ZRL is an associate company of EIL and both the companies are under the same management.

Consideration for Amalgamation of ZRL into and with EIL.

The consideration is fixed as EIL will issue and allot 7 equity shares of Rs 2/- each, to equity shareholders of ZRL, credited as fully paid-up, for every 1 equity share held by such shareholder in ZRL. Appointed date fixed is 1st April 2017.

Shareholding Pattern

Table 1: Shareholding Pattern (Pre-Merger)

| Emami Infrastructure Limited | Zandu Realty Limited | ||||

| Promoters | 1,41,07,511 | 58.06% | Promoter (EIL) | 2,86,329 | 35.51% |

| Public | 1,01,90,881 | 41.94% | Public | 5,20,071 | 64.49% |

| Total | 2,42,98,392 | 100.00% | Total | 8,06,400 | 100.00% |

Table 2: Shareholding Pattern (Post-Merger)

| Particulars | Nos of shares | Holding % |

| Promoters | 1,41,07,511 | 50.49% |

| Public | 1,38,31,378 | 49.51% |

| Total | 2,79,38,889 | 100% |

Observations:

- There is a dilution in promoter’s stake, as the promoters’ share in the merged entity will fall to 50.49 per cent, from the current 58.06 per cent in EIL.

- The public shareholding will go from 41.94 per cent to 49.51 per cent.

Accounting Treatment

The amalgamation is in the nature of common control transactions as defined in the scope of Ind AS 103. The accounting treatment shall be on the basis of “Pooling of Interests” method.

| Assets and Liabilities | On and from appointed date i.e. 1st April 2017, all assets and liabilities of ZRL shall be recorded in the Books of Accounts of EIL at their existing carrying amount and in the same form as they appear in the Books of Accounts of ZRL as on the effective date. |

| Retained earnings | The balance of retained earnings appearing in the financial statements of ZRL is added to the corresponding balance appearing in the financial statements of EIL. Further in the absence of any retained earnings in the books of EIL, the retained earnings of ZRL should be transferred to General reserve, if any. |

Please note: The excess, if any, between the amounts recorded as share capital issued as consideration and the amount of share capital of ZRL is recognised as goodwill in the financial statements of EIL and in case of any deficiency, the same shall be treated as Capital Reserve.

Financials

Table 3: Standalone Financials (All Figs. in Rs. Lacs)

| Particulars | EIL | ZRL |

| Paid up Capital | 4.86 | 8.06 |

| Turnover | 118.35 | 16.81 |

| Net Worth | 26.07 | 187.81 |

| Secured and unsecured loans | 1,545.36 | 11.40 |

| PAT | 15.45 | 5.18 |

| Cash Profit | 19.24 | 6.54 |

Table 4: Share Price (Before & After)

| Particulars | Pre-announcement (Market price on 30th June 2017) | Post-announcement (Market price on 24th July 2017) | % change in the share price |

| EIL | 147.9 | 169.4 | 15% |

| ZRL | 1242.3 | 1348.8 | 9% |

Rationale of the Scheme

- The complications of construction industry coupled with volatility and uncertainty in market, emphasises the need for highly efficient and competent managers to steer them. With many emerging players, procurement of skilled and efficient managers is one of the major concerns for the real estate industry.

- EIL and ZRL are both engaged in real estate business and are listed companies. ZRL is an associate of EIL and both the companies are under the same management.

- The amalgamation will ensure focused management in a single combined entity thereby resulting in efficiency of management and maximising over shareholder value.

- The proposed amalgamation will bring in advantages of synergy in operations and economies of scale. The pooling of resources of companies will create strong financial structure and facilitate resource mobilisation and achieve better cash flows.

- The combined net worth in a single entity shall facilitate in attracting funds from strategic investors and/or financial institutions at competitive rates.

- The synergies created by the horizontal merger will increase the operational efficiency and integrate business functions of the amalgamated company and help to pursue organic and inorganic opportunities of such business.

- It will also lead to more efficient utilisation of capital and create a consolidated base for future growth of the amalgamated entity.

Conclusion

The indebtedness of EIL and ZRL is Rs 1545.36 Crores and Rs 11.40 Crores. The merger will imply ZRL’s debts being taken over by EIL, but also simultaneously increasing EIL’s net worth to Rs 214 crore from Rs 26 crore. The merged entity will have better debt equity ratio and in the process lower cost of funds. As mentioned, there are various other benefits which the merged entity will have due to merger. EIL was until recently in losses, on account of inability to complete projects in time, leading to rise in administrative overheads. It is now targeting to complete at least one project every year, which will help it maintain a profit margin.

Zandu Realty (ZRL) is being merged into Emami Infrastructure (EIL). Over the years, while ZRL, its subsidiary, had stagnated in implementation of new construction, EIL has been on a project construction track and is currently implementing as many as eight projects, entailing an investment of Rs 4,500 crore. ZRL had stagnated over the years, with inventory of Rs 10-12 crore and no land reserve. The merger will imply a flow of funds from ZRL into the former, helping project funding. While, EIL has land parcels of around 800 acres, sufficing for new constructions in the next seven-eight years.

Therefore, this is a smart move done at the right time by Emami group to steer ahead the business smoothly in times of lull in real estate sector.