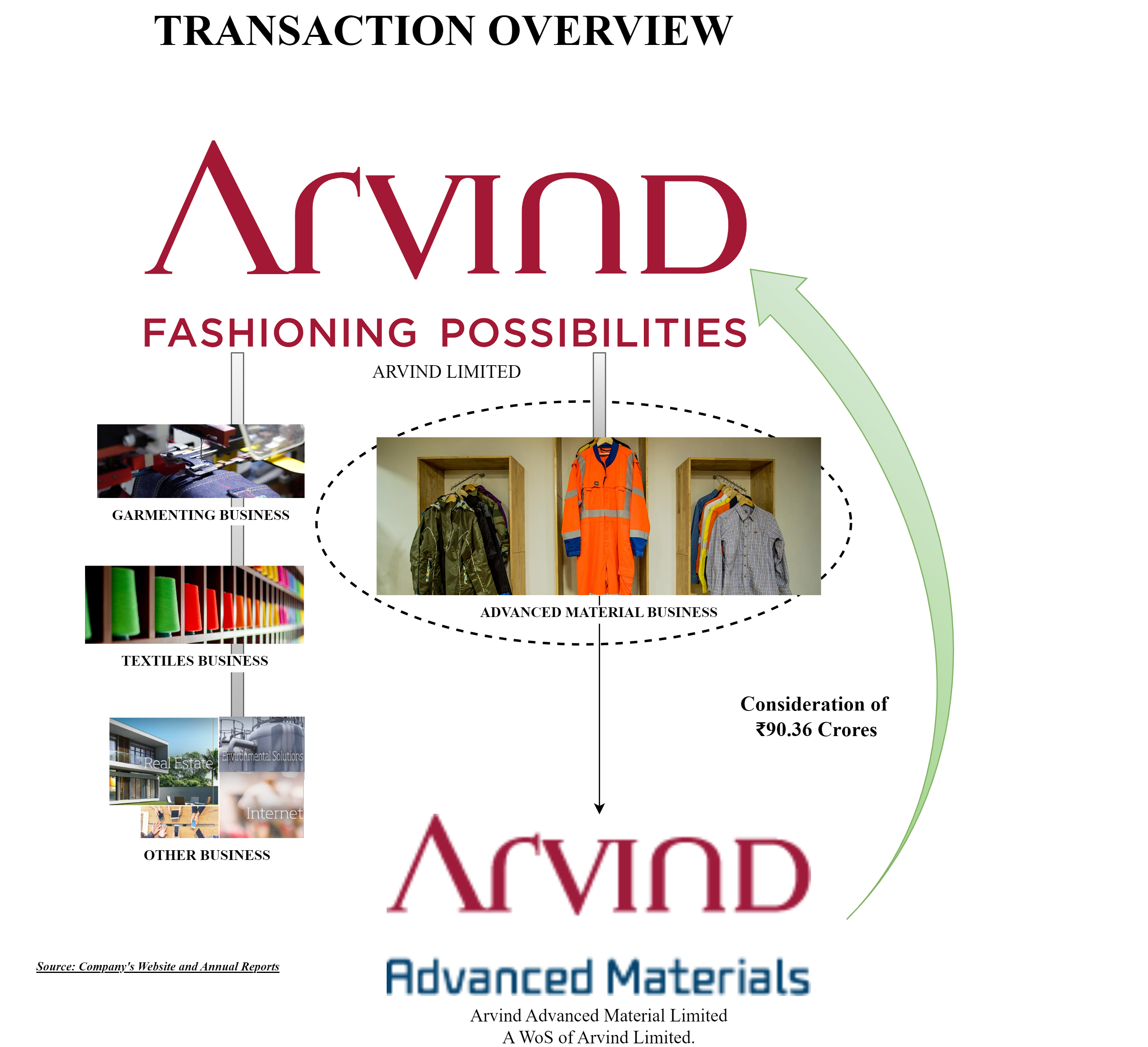

Advanced Material Business (AMD) of Arvind Limited focuses on advanced materials and caters to customer needs across the textile value chain, including specialty yarns, fabrics, and ready-made products. It has shown growth in revenue with profitably while also able to expand its product portfolio. Recently, Arvind Limited announced the transfer of its Advanced Material Business to its wholly-owned subsidiary on a slump sale basis. Arvind Limited (“Transferor Company”) is inter-alia engaged in the business of the entire textile value chain either directly or through its subsidiaries/Joint Ventures. The equity shares of Arvind Limited are listed on nationwide bourses. Over the years, the structure of the company has undergone several changes through various schemes of arrangements. Currently, the broader business segments of Arvind Limited include:

- Textile business comprising of manufacturing and supply of woven, denim and garment products and

- Advanced material business

Arvind Advanced Material Limited (“Transferee Company”) is inter-alia engaged in the business of manufacturing and supply of advanced materials. The company is a wholly owned subsidiary of Arvind Limited. It is pertinent to note that the Transferee Company made significant revenue only in FY 2024 aggregating to circa INR 95 crore.

The Proposed Transaction

The Board of Directors of Arvind Limited and Arvind Advanced Material Limited in their respective board meeting approved a Scheme of Arrangement which inter alia provides for the transfer of advanced material business of Arvind Limited to Arvind Advanced Material Limited through a Slump Sale.

Advanced material Business includes all business units located in various locations engaged in the business of Human Protection fabric & garments, Industrial Products, Advanced Composites and Automotive Fiber.

Some of the key rationale for internal restructuring are:

- Consolidation of advanced material business

- Getting ready for opportunities in advanced material business both organic and inorganic

- Allow raising of debt /equity in businesses whenever required

- Enabling strategic partnership/JV’s

The Appointed Date for the transaction is 1st April 2024. The consideration for slump sale will be INR 90.36 crore which shall be discharged by the transferee company to transferor company. Further, the scheme also provides for the conversion of consideration into interest bearing loan or debt securities. This essential provides deferment of consideration in case enough cash flow not available with the transferee company to discharge the consideration.

Slump Sale: National Company Law Tribunal Approval vs Agreement

The proposed transfer through slump sale will be through a Scheme of Arrangement which will require approval from the Hon’ble National Company Law Tribunal which will at least require 6-8 months. The Slump Sale can also be given effect through a Business Transfer Agreement which can be executed within a few days and can be given effect without any regulator’s approval

The key reason for going ahead with NCLT approval instead of an agreement could be the single window approval process and in certain cases saving on duties and taxes, mainly stamp duty. In particular cases, there could be some accounting and/tax advantages for going through an NCLT approval. Undoubtedly, there is a commercial advantage due to the structure of raising funds/inviting partners in one particular business.

Financials

Advanced Material Business of Arvind Group is continuously showing good growth and has better margins and returns than the textile business.

Capital Employed for both businesses as on 31st March 2024

| Particulars | Garments | Advanced Material |

| Assets | 4659 | 889 |

| Liabilities | 1460 | 239 |

| Net Capital Employed | 3199 | 650 |

Apart from the above, there are unallocated & other asset worth INR 1710 crore & liabilities of INR 614 crores. It is not clear on the bifurcation of the same. Please note that the slump sale is an internal reorganization that will have no effect on the business and reported financials of Arvind Limited on a consolidated basis.

Consideration vs Capital Employed

The consideration for the proposed slump sale will be INR 90.36 crore. As per the presentation shared by the company, the net capital employed of the Advanced material business of Arvind Limited is circa INR 565 crore. The difference between the consideration & net capital employed as mentioned in the Audit Committee Report is pertaining to the adjustment on account of retained earnings. Thus, by transferring the retained earnings, the lump sum consideration payable decreased. The consideration could be the incremental value of fair value as computed in accordance with rule 11UAE read with Section 50B of the Income Tax Act, 1961 over net worth of business getting transferred.

One needs to understand the impact of the above adjustment, if any, on direct tax applicable on slump sale transaction to Arvind Limited. Further, one must evaluate any tax challenges on proposed transactions if financial/strategic investment happens in Transferee Company at a much higher valuation.

Conclusion

Arvind Group has undergone some restructuring in the past. We have covered a couple of articles in our past issues where it had demerged the better performing retail and engineering businesses. The group strategy is to house and nurture new businesses in the main holding company Arvind Limited and if required for independent growth separate it into its subsidiary.

Advanced Material business has tailwinds and is all set for growth with the base already created in the last couple of years. The proposed restructuring will be to be ready for opportunities, both organic and inorganic for AMD business. The transferee company is getting ready to invite financial/strategic partner in near future.

Immediately, the structure will have no impact on shareholders or consolidated financials of Arvind Limited. It may also happen minority shareholders may not be able to gain because of the increased profitability of AMD's business.