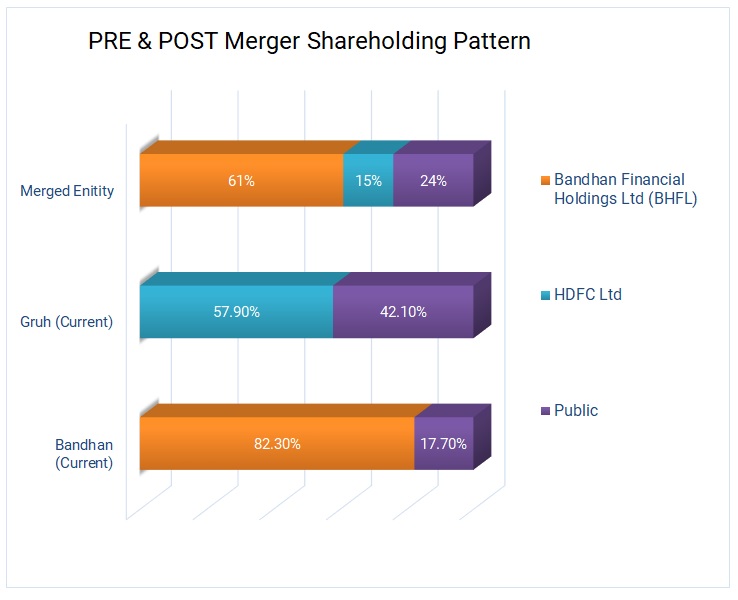

A new entrant in the banking space, Bandhan Bank has acquired HDFC Ltd-promoted Gruh Finance in an all-share deal. On January 7, 2019, the board of directors of Bandhan Bank and Gruh Finance approved the merger subject to regulatory and shareholder approvals. The merger will reduce the promoter stake in Bandhan Bank to 61%, from 82.3% as a first step towards finally reducing to 40% as directed by Reserve Bank of India (RBI) based on norms for holding of promotors in private sector bank. The RBI’s new licensing guidelines stipulates that Bandhan Bank’s promoter will have to reduce stake from 82% to 40% within three years, to 20% within 10 years and to 15% within 12 years of commencing its business. Post-merger, HDFC Ltd will hold 15% stake in the merged entity.

Gruh Finance was incorporated on July 21, as subsidiary of Housing Finance Development Finance Corporation (HDFC). Gruh Finance has reported strong financials. Gruh Finance has been growing well with 20% loan and profit CAGR over FY15 to FY18. The company’s return on equity growth is 30% along and gross non-performing loans of 1.3%, reflecting high stability. It has very low loan disbursement to developers and the stock has steadily risen. The biggest advantage for Gruh Finance is that it has access to a stable source of funding and ability to expand its presence in the eastern region on the back of Bandhan Bank’s branch network. Over the years, Gruh Finance has developed a very profitable and niche business franchisee. Both the entity will now cater to the bottom of the pyramid segment and the acquisition will be complementary from Bandhan’s standpoint. Gruh Finance is one of the few non-banking financial companies that have remained a AAA rated entity for the longest time and has high dividend payout ratio.

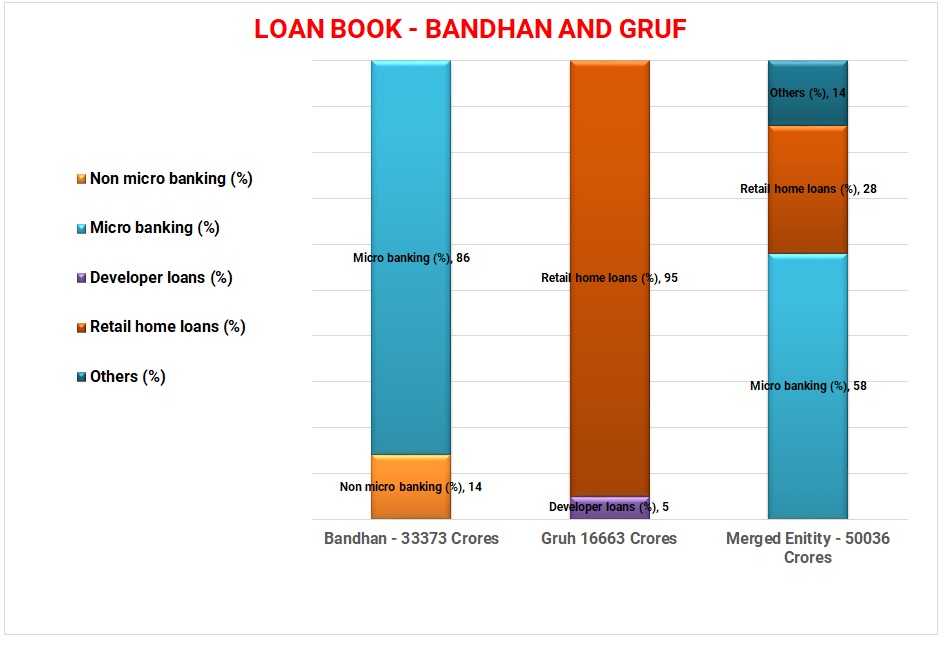

Bandhan Bank was incorporated on December 23, 2014 to provide banking services. In FY18, it had reported total income of Rs 55,084.8 million and profit of Rs 13,455.5 million. It has a distribution network of 4,182 banking outlets, 476 ATMs across 34 states. The bank has garnered sizeable retail liabilities within three years of its operations which is the key strength of the bank. Its asset quality is impeccable, has a low-cost micro distribution model, strong and loyal micro-loan borrower base. After the merger, Bandhan Bank would have outstanding loan book of Rs 50,036 crore based on financials of September 2018. Bandhan Bank, being a micro finance entity, enjoys high spread and return on assets of 4.25% trailing compared to 2.5% for Gruh Finance. Post merger, the return on assets of the merged entity is expected to compress.

Transaction

Under the merger agreement, shareholders of Gruh Finance will receive 568 shares of Bandhan Bank for every 1,000 shares held. This is at an 8% discount to the closing stock price of Gruh Finance as of January 7 and at a 2.5% premium to the last six months average stock price. The share swap ratio is in line with six-month weighted average stock price of the two companies. Post-merger, the entity’s market cap would be Rs 84,000 crore and a customer base of 1.5 crore. The deal will need approval from RBI, National Housing Bank and Securities and Exchange Board of India.

Although the acquisition gives Bandhan Bank a readymade home finance company to diversify business, it was the premium offered to HDFC by Bandhan Bank that swung the deal.

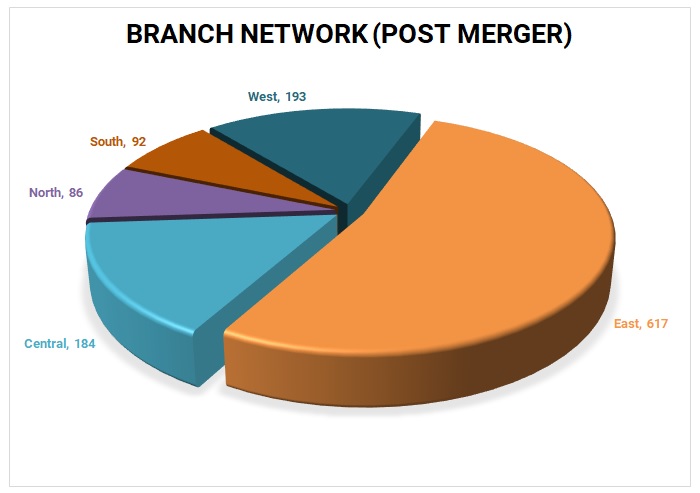

The business models of Gruh Finance and Bandhan Bank are not very different and there are a lot of synergies. It is widely believed that the merger will create one of the largest rural and semi-urban lending platforms in the country, increase shareholders’ value, expand new branches as Kolkata-based Bandhan Bank is primarily based in east India and Gruh has wide presence in western India and enable integration of technology. Bandhan Bank has 51% of its distribution network in eastern India and only 8.5% in western India. In contrast, Gruh Finance has dominant presence in western India. The loan book of the combined lending entity will have 58% micro loans, 28% retail home loans and 14% other loans. The merged entity will be best placed to reap benefits of growing income of rural and semi-urban population and also their changing habits

What it means for Bandhan Bank’s Promoters

It enables them to dilute their stake without actually selling any shares and get strong housing finance portfolio though at premium. Though they are still supposed to dilute stake further but may be when they dilute now can get better price for their sale. they will be able to scale up the business both in east and west by cross selling the products. They get HDFC as a very strong partner/promoter. The acquisition will help Bandhan Bank diversify its product basket and de-risk portfolio by addition of secured loan products. Though the acquisition may look pricy in the short term, if scale-up of business continues to remain profitable then it can provide benefits in the long run to all stakeholders.

What it means to HDFC

HDFC is able to get an exit from its subsidiary at good premium and is able to participate in the growth of the merged entity though as minority shareholder. HDFC has been able to monetize its investments in Gruh Finance at a very attractive valuation which is 13.3 times the trailing book value. The merger helps HDFC Ltd avoid a potential conflict of interest as both the parent and Gruh Finance are in mortgage financing and HDFC is trying to organically expand into the affordable housing segment. There has been an overlap in business of both Gruh Finance and HDFC Ltd, especially in the western region.

There is a regulatory hindrance for HDFC group in this deal. The deal means HDFC emerging as a co-promoter for Bandhan Bank, apart from being the promoter of HDFC Bank. The RBI’s rule does not allow a promoter of one bank to hold more than 10% stake in another bank. As HDFC will hold 15% stake in Bandhan Bank, it will have to reduce its stake in the future. Media reports suggest that HDFC is negotiating with institutional investors to offload around 5.5% stake in Bandhan Bank

Business Rational

For Bandhan Bank, it’s like getting ready made business and also in the process walk towards the compliance by getting reputed Company like HDFC as its shareholders. In terms of manufacturing business, it is not only geographical expansion but also product diversification and getting strong infrastructure and client base where there is enough opportunity for cross selling the products and also raising funds for deposits and improving gross and net interest margin. It is possible for the bank to increase its CASA deposit post-merger as existing clients of GRUH Finance may be attracted to shift its normal banking operations to Bandhan Bank.

From nil deposits in FY15, within three years Bandhan Bank has replaced all high cost borrowings with low cost deposits. Total retail liabilities and current account and savings account form 80% of total deposits, as robust mobilization of retail deposits is essential for a successful operation of a bank. The biggest advantage of the merger for Bandhan Bank will be a sharp increase in the secured loans. Post-merger, the share of unsecured loan book of Bandhan Bank will decline to 57% from 86%. Also, expertise of Gruh Finance can be utilized to cross-sell products. The merger will enable Bandhan Bank to reduce risk arising out of geographical concentration, diversify its product portfolio, and still target the underpenetrated market.

Table 1: Key Metrics (All Figs in ₹ Billion)

| Particulars | Bandhan Bank | Gruh Finance | Combined entity |

| Total asset | 456 | 185 | 641 |

| Loan book | 333.7 | 166.6 | 500.3 |

| Networth | 102.1 | 16.6 | 118.7 |

Table 2: Financials of FY 18 (All figs in ₹ Million)

| Particulars | Bandhan Bank | Gruh Finance |

| Net Interest Income | 30322 | 6409 |

| Profit after tax | 13456 | 3627 |

| GNPA | 3731 | 701 |

| GNPA (% of advances) | 1.25 | 0.45 |

Note: All data from Respective company’s Annual report.

A report by Goldman Sachs says that Bandhan Bank is well positioned to deliver a 23% CAGR in microfinance loan book over FY18 to FY25 (estimates), driven by continued growth in credit demand from existing customers, increasing penetration and expansion into new geographies and further market share gains from microfinance lending. The report also underlines that Bandhan’s strategy to diversify the geographic and lending mix will be helpful and its ability to collect deposits from its borrowers would also give it more information about the borrowers, thereby reducing the risk.

Conclusion

The merger looks like marriage done in heaven at least from the angle of promotors of both the companies but whether it will deliver superior value to public shareholders or not will depended how product and cost of funds synergies are captured post-merger. Cultural issues and methodologies also should not come in the way of capturing the full value of the merged entity. Some analysts are also of the view that the deal hurts public shareholders of Bandhan Bank and Gruh Finance because of overvaluation of Gruh Finance and removal of HDFC’s parentage from Gruh Finance.

Add comment