Context of merger and rising NPAs

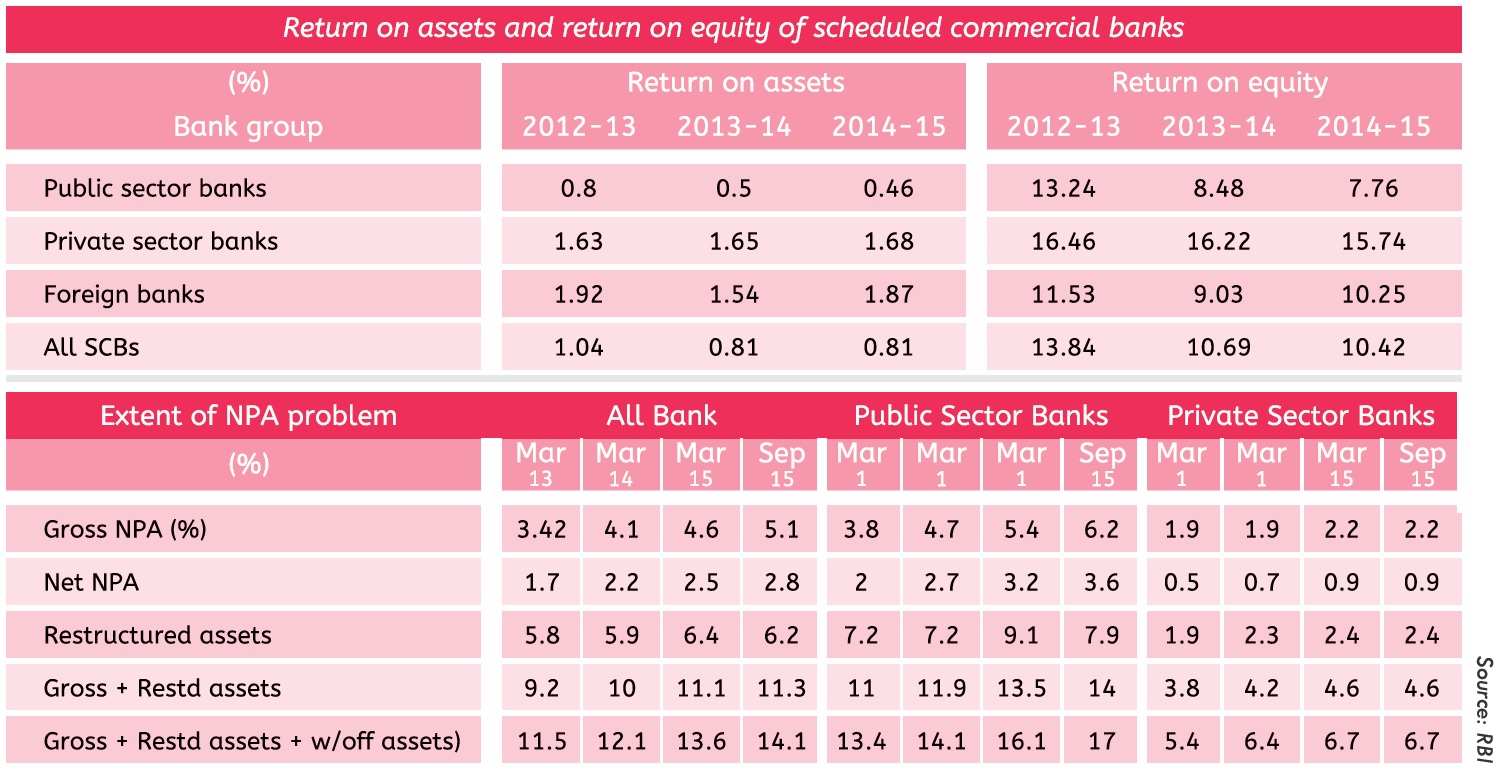

The steep rise in bad loans or non-performing assets (NPAs) of state-run banks has weighed on the economic development of the country as these banks hold more than two-thirds of deposits and advances in India’s banking industry. The 27 public sector banks hold about 85% of non-performing loans, which is affecting their profitability badly. The gross NPAs of the state-owned banks increased from 5.43% of advances as on March 2015 to 7.3% as on December 2015. The stressed assets (GNPA + restructured assets + written off accounts) for the banking system as a whole moved up to 14.5% at the end of December 2015 from 9.8% in March 2012. During the same period, the stressed assets of state-owned banks spiked to 17.7% from 11%.

Similarly, the growth in net profits of public sector banks started declining from 2011-12 and turned negative in 2013-14, because of higher provisioning on banks’ delinquent loans. This impacted their return on assets and return on equity. As a result, the banks’ spread and net interest margin also witnessed a decline. With losses mounting because of a dodgy loan, the government wants to consolidate and improve their performance. Also, since it is not feasible to reduce the government’s share to below 51% in public sector banks (PSBs), consolidation in the only answer to creating strong banks. Moreover, these banks are in dire need for more funds to meet the new capital adequacy norms under the global Basel III norms.

In fact, some PSU banks have a very high susceptibility to their net worth getting eroded if a small increase in slippages happens. For instance, a report by brokerage firm India Nivesh shows that 30% slippages will lead to complete net worth erosion for United Bank and Indian Overseas Bank. A 40% slippages will add Central Bank and Bank of Maharashtra in negative net worth category, indicating the fact that the banks do not have any margin of error. It says on an average 20% of loans from restructured category eventually turn bad.

What are the options?

There are talks that government may merge over two dozen state-run banks because it wants to improve the asset quality and efficiency of some of the ailing lenders. The government will form an expert panel which will closely work with Banks Board Bureau to identify the right matches for consolidation. The panel will look into issues such as technology, asset base, regional strength and cultural match in chalking out strategies and identifying banks for mergers.

The panel will consider options such as making some banks subsidiaries under a holding company, merging a weaker bank with a stronger bank, or allowing banks that are stronger in a particular region to merge. By merging weaker banks with stronger banks, the government expects to create a protective ring for depositors and shareholders. However, many questions have been raised whether merging the weaker banks with the strong ones is the solution. In fact, RBI Governor Raghuram Rajan is himself against forcing a merger of banks as he has said that merging weak banks with a strong bank will make the merged entity unhealthy.

The government should look at the comprehensive approach to restructuring weak banks that can have a lasting effect on the cost, earnings, profits and assets and it should not be burdened with legacy and historical problems which again can be excused for not performing in future. The government should recapitalize the banks and set aside capital for the one-time write-off of the bad loans, which will enable banks to clean up their books and start afresh. The government should work to strengthen the bad loan recovery process at the banks. The Finance Ministry has estimated that the banking sector has Rs 8 lakh crore of stressed assets, out of the total outstanding loan book of Rs 69 lakh crore. Stressed assets include NPAs as well as loans that are written off by banks. Amendments to the SARFAESI Act (Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act), and expediting the Debts Recovery Tribunal process by some more amendments to the Act and enactment of New Bankruptcy Law can help in the recovery of the bad loans and help in the merger process. The progress on recovery of bad loans and the level of its recovery will determine the performance of banks going forward.

History of bank mergers

The history of bank mergers in the country is full of examples of weak banks being forced to merge with strong banks at the cost of the latter. Since 1961, under the Banking Regulation Act, 81 bank amalgamations took place. Of these, 47 took place before the first phase of bank nationalization in July 1969. Of the remaining, 34, in 26 cases private banks were merged with public sector banks and in the remaining eight cases, both the banks were private sector banks.

Post economic reforms, there were 31 bank mergers. Before 1999, amalgamations of banks under the Section 45 of Banking Regulation Act of 1949, took place because of weak financials. Under the said Act, Reserve Bank of India can make a scheme of amalgamation of a weak bank with a strong one if it is in the interest of the depositor and the overall banking system. In such a case, the operation of the weak bank is kept under a moratorium for a certain period to ensure smooth implementation of the scheme. The merger of Global Trust Bank with Oriental Bank of Commerce in 2004 was an example of such a merger. Later on, even business and commercial interest were evaluated which resulted in voluntary mergers like a merger of New Bank of India with Punjab National Bank in 1993 and the acquisition of State Bank of Saurashtra in 2008 and State Bank of Indore in 2010 by State Bank of India. The merger of its subsidiaries is a move to restructure within the group as SBI held majority equity stake in all its subsidiaries.

The second type of merger is the voluntary one under Section 44A of the Banking Regulation Act like ING Vysya Bank merging with Kotak Mahindra Bank in November 2014 which had the necessary synergies for a successful merger. ING Vysya Bank had a strong presence in South India while Kotak had an extended franchise in the West and North India which helped to create a large financial institution with a pan-India presence. Before the merger, 15% of the Kotak branches were in South India, which became 38% after the merger and Kotak had a balanced presence in different parts of the country. The merger increased Kotak’s branches and its ATM network by 47% and 35%, respectively. For Kotak, the deal was indeed strategic, accretive, and pushed it up from a niche to a more scaled player to become the fourth largest private bank in the country in terms of total business.

Similarly, in the private sector, the merger of Bank of Madura and Sangli Bank with ICICI Bank in 2001 and 2007 and also the merger of Centurion Bank of Punjab with HDFC Bank in 2008 are appropriate examples of synergies working in tandem. The Reserve Bank of India has been supportive of voluntary mergers, which create value for banks and customers in general.

Benefits of mergers

To get a perspective on consolidation of state-owned banks, the Narasimham Committee Report in 1991 recommended a three-tier banking structure: establishment of three large banks with an international presence, eight to 10 national banks and a large number of regional and local banks.

Bigger banks or merger of weak state-owned banks with bigger banks will enable Indian banks to catch up with global peers. In fact, the country’s largest lender State Bank of India does not feature in the top 50 banks in the global ranking. In contrast, four Chinese banks were listed among the top 25 lenders in the world based on the profits and asset size. Consolidation will also increase capital efficiency and large banks can finance bigger infrastructure projects as it will have more leg room to raise capital. Also, a larger bank may be less risky than a smaller bank as the former will have a more diversified portfolio which will result in less volatility in its earnings. Also, a large bank will command higher credit rating than a smaller bank.

Cost rationalization will be the key to making the mergers successful. This would result in reducing inefficient branches, especially in urban areas, where there are quite a lot of branches of various banks. Shared infrastructure will give customers a wider we of ATM network, charges on cross-bank ATM usage will reduce and customers of smaller banks will get access to wider use of financial instruments like insurance and mutual funds. Also, the recent proposal of the central bank on large exposure norms which limit banks’ exposure to a group by 25% of their common equity will further limit their capacity to fund large credit demands. So, consolidation among state-owned banks can support the growth potential of the economy.

Some issue with bank mergers

Weak banks can instead become stronger by focusing on their core areas like corporate or retail lending in a particular part of the country instead of full presence across the country. These banks must put in place a strong mechanism for recovery of bad loans at an early stage before the matter goes out of hand. Weaker banks can streamline by redeploying capital out of non-strategic and sub-optimal business, review their branch and other networks and pare down losses by introducing technology and efficiency and operating control of these banks should be handed over to professionals.

Merging weaker state-owned banks is a complicated task and difficult to execute. Sensitive issues like staffing, branch integration, and priority sector lending will have to be handled carefully. The treatment of legacy issues, closure of redundant branches, redeployment of human resources and efficient allocation of capital will have to be looked into before merger. Also, the government will face the wrath of nearly eight lakh employees as the employees of state-owned banks are highly unionized. For instance, employees of associate banks of State Bank of India like State Bank of Hyderabad, State Bank of Mysore and State Bank of Travancore have made it clear that they will not agree to any merger with SBI.

Bank merger: The way ahead

There is ample room for consolidation in the state-owned banking space without creating issues of moral hazard or concerns of too big to fail. The banking system is too fragmented at present and consolidation will help in the working of the banks. In spite of issues with the mergers and not very successful history of bank mergers, the government should go ahead with mergers. To have successful and sustainable post-merger banking entity, it is advisable that weak banks are restructured either by hiving off of certain assets, capital restructuring or closing some branches etc. and hence legacy issues are taken care of before the merger. It may be advisable to see that cultural differences are given priority so that merged entity is able to grow or survive and does not underperform. One must look at to achieve to the extent possible, how each new large bank has exposure to each cyclical and capital intensive industries and retail loan portfolio.

State-owned banks have not been performing well in the last few years as is seen with the rising non-performing assets. As a part of managing large NPAs, a consolidation of state-owned banks or mergers of banks can make them more capable and strong of managing challenges ahead. A large bank will be adequately capitalized, will have a deeper expertise to handle large credits and large NPAs and can ride off troughs with relative ease. Cost rationalization will be a key to making mergers a success. Banks from different geographies must be chosen for merger like the acquisition by Kotak Mahindra Bank of ING Vysya Bank.

The merger of weak state-owned banks will be useful if the strategic vision is driven by synergy and create value for both the banks. The expert committee must examine every aspect of the business of each bank, their business plans, bad assets, and core area of work and find out opportunities for consolidation based on sound business strategy and synergy in the operations of the banks. The focus of synergies should be properly identified which must look into the broader gambit of compatibility of business, treasury, IT, HR, and other issues. The expert panel must seek suggestions from all stakeholders to make the merger process work and make it a win-win situation for all. The interest of all stakeholders like the government, depositors, borrowers, employees must be well balanced. Ideally, the process of mergers should evolve on the basis of profitability of the bank with whom it is merging and taking the support of the officers and staff. Voluntary mergers could be a way out in state-owned banks like the way it happened in private-sector banks.