In April 2016, Gammon India accepted a proposal from Thailand-based GP Group to invest Rs250 crore in its civil EPC business. The Board of Gammon India has approved the execution of the Investment Agreement. The entire transaction is expected to be completed in 12 months

Target Description

Gammon India is amongst the largest physical infrastructure construction companies in India. Gammon India’s business can be categorized into transmission and distribution (T&D), the Engineering, Procurement and Construction (EPC) unit and the third would comprise all Residual businesses. Headed by Mr. Abhijit Rajan ((Chairman & Managing Director).

The civil EPC business includes projects in roads, hydropower, nuclear power, tunnels, bridges, buildings, cooling towers, chimneys and other sectors.

Acquirer Description

GP Group is a 145-years old diversified group based out of Thailand and is headed by Kirit Shah. The group’s businesses include Constructions, Logistics, Aviation, Energy supply, Pharma, Agro products, Software, Mining etc. Operates across Europe, India, Middle East and South East Asia.

Transaction Purpose

The deal is part of Strategic debt restructuring (SDR) initiated by Gammon India’s Lenders who faced a daunting task of restructuring Rs 14,810 crore Debt of Gammon India.

SDR rules, seemingly gives lenders the ammunition to replace truant management of defaulting companies with credible investors.

In January 2016, Banks & Financial Institution acquired majority stake (52%) in Gammon India by converting Rs 14,810 crore debt into equity and agreed to segregate Gammon India’s businesses through a restructuring exercise & decided to sell majority stake in EPC & T&D businesses to credible strategic investors who can revive the struggling businesses.

The move comes at a time when Gammon is in the midst of a corporate debt restructuring (CDR) it embarked on in 2013 after falling into a crisis brought on by slower economic growth and project delays. It has been divesting assets as part of the exercise to repay debt.

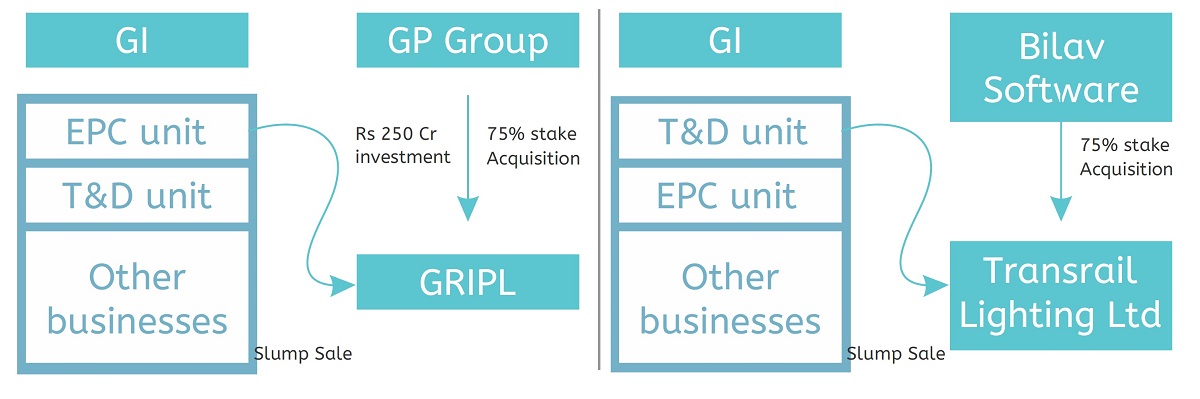

TRANSACTION STRUCTURE – Restructuring EPC & T&D Businesses

1. Gammon India is in the process of transferring its civil EPC business to subsidiary Gammon Retail Infrastructure Pvt. Ltd (GRIPL) on a slump sale basis, as part of a restructuring it announced in November 2015. On consumption of Scheme of Arrangement, GP Group to acquire 75% stake in GIPL.

The transfer is carried out through a combination of “Scheme of Arrangement” and “slump sale” subject to lenders and shareholders’ approval.

The company is in the process of transferring its Civil EPC projects along with all the properties, rights, powers, all debts, liabilities, duties and obligations to GRIPL, under the scheme of Arrangement.

The move will help Gammon India run the businesses independently of each other, bring in strategic investors and de-leverage its balance sheet. The Board has also approved the draft of the Investment cum Shareholders Agreement (“Investment Agreement”) to be entered into between the Company, GP Group and GRIPL.

Investment agreement – Key Terms

- GP Group shall invest a sum of Rs 250 crore, of which :

- Rs 26 crore will be invested on consummation of Business Transfer Agreement (BTA executed on February 12, 2016, between the company and GP Group

- Balance Rs 224 crore to be investment on consumption of Scheme of Arrangement

- GP Group will reconstitute the Board of GRIPL to control the Board composition

- GP group is not related to the promoter group

2. Gammon India restructured its power transmission and distribution (T&D) business by transferring part of its T&D unit to its subsidiary, Transrail Lighting Ltd (TLL) on a slump sale basis & later sold 75% stake in TLL to Bilav Software Pvt to revive the business.

OVERCOMING LIQUIDITY CRISES

- In April 2016, Gammon India’s board approved divestment of up to 30% of its shareholding in Gammon Infrastructure (“GIPL”), held through its wholly owned subsidiary Gammon Power Limited (GPL). Gammon India currently holds 56% of the equity capital of GIPL through its wholly owned subsidiary GPL.The sale of shares shall be to the general public through the exchanges and no shares shall be sold/disposed off to the promoter/promoter group companies.The said shares have been pledged with lenders as security for the financial facilities extended by ICICI and IDBI Bank. The Company shall use the proceeds of the sale to repay ICICI and IDBI Bank. Expected date of completion of sale/disposal; within 6 to 12 month

- In March 2016, Gammon India’s board also approved further investment of up to Rs.675 crore in its GPL by subscribing up to 2.25 crore equity shares of GPL of Rs.10 each at a price of Rs.300 per equity share. The proceeds will be used to repay debt of GPL.

- In August 2015, Gammon India’s subsidiary GIPL sold six road and three power projects to BIF India Holdings Pte. Ltd for about Rs.563 crore. BIF is controlled by Canada-based Brookfield Asset Management Inc. and Core Infrastructure India Fund Pte. Ltd.

STRATEGIC DEBT RESTRUCTURING (SDR)

In Nov 2015, decided to convert part Gammon India’s Rs.14,810 crore debt into equity in a prelude to changing its management in a so-called strategic debt restructuring (SDR) exercise.

Gammon India is the sixth company in which bankers have decided to take majority control by converting debt into equity. Previously, lenders to Electrosteel Steels Ltd, Lanco Teesta Hydro Power Pvt. Ltd, VISA Steel Ltd, Jyoti Structures Ltd, and Monnet Ispat and Energy Ltd invoked SDR norms.

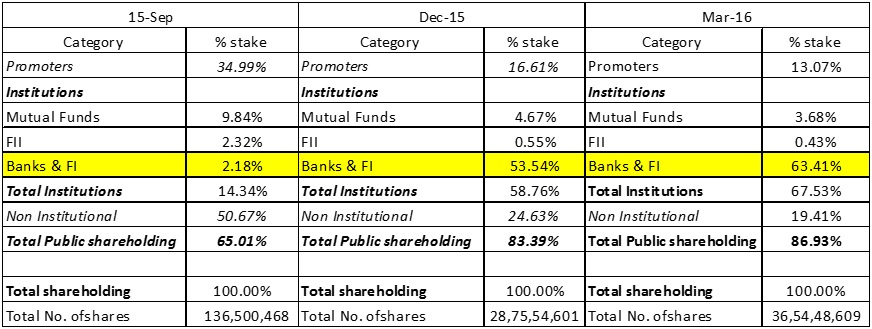

OWNERSHIP PATTERN AT GAMMON INDIA

Banks now control 63% stake in debt-laden Gammon India. The consortium of eight banks has become the largest shareholder of Gammon India.The shareholding under financial institutions/banks stood at 2.18% as on September 30, 2015.

In January 2016, a consortium of creditors to Gammon India Ltd kicked off a strategic debt restructuring (SDR) drive in Gammon India Ltd by swapping its outstanding Rs 14,800 crore debt including unpaid interest into equity.

According to the RBI norms, banks that decide to recast a company’s debt under the SDR scheme must hold 51% or more of the equity after the debt-for-share conversion.If lenders had not taken a decision to go for SDR, the account could have turned into default status. Moreover, RBI has given a provision to invoke the norms in cases where CDR is still going on.

CONCLUSION

The macro economic environment has faced a slow growth trend in the last 4-5 years and EPC companies have struggled to grow in this challenging environment with Gammon India being no exception. The company has continued to witness sluggish growth due to policy inaction, liquidity constraints, project delays, huge cost overruns, higher funding cost, etc. The backlog at stalled project sites created due to severe liquidity crisis continued to adversely affect project execution. Order intake remained sluggish, since many of the stalled projects are yet to be kick-started. Added to this, Delays in land acquisition, Govt approvals, regulatory hurdles were factors beyond the control of the company.

Given the above concerns, Gammon India’s lenders by invoking SDR have undertaken a major corporate restructuring exercise to unlock the value of Gammon India’s business units by transferring control in the hands of credible investors. The various sell-offs, fund infusion and restructuring moves will enable the company to deleverage its balance sheet, address its liquidity issues and repay the lenders.