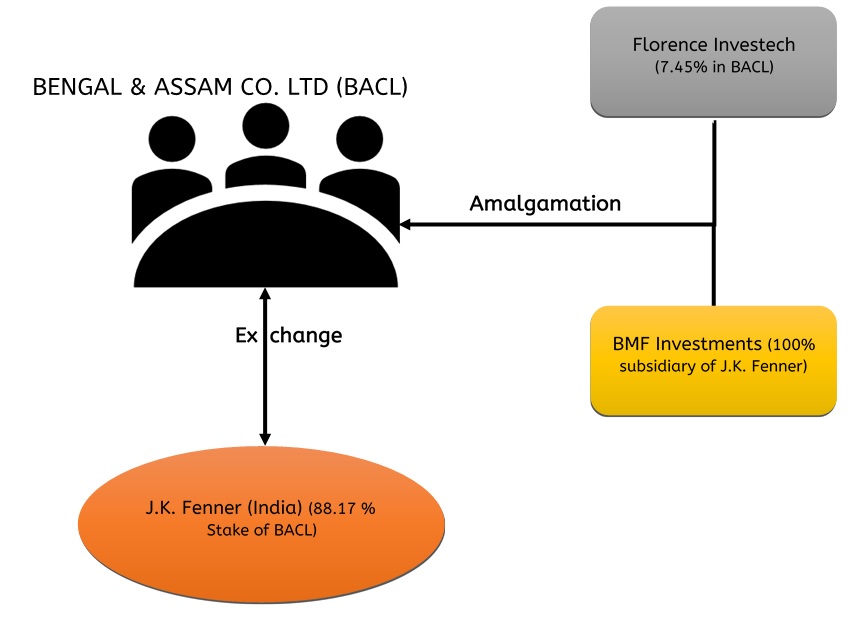

On June 12, 2017 Bengal and Assam Company Ltd announced the scheme of arrangement between Florence Investech Ltd., BMF Investments Ltd., J.K. Fenner (India) Ltd., and Bengal and Assam Company Ltd.

Bengal & Assam Company Ltd (BACL) is a public limited company incorporated in the year 1947. The company is engaged in the investment and finance business. It is an NBFC registered as a Non-Deposit taking Systematically Important Core Investment Company with RBI. The company operates in four segments: investment (shares/securities/funding), polymers, cotton yarn and dairy products. The equity shares of BACL are listed on BSE Ltd. and the current market cap of the company is Rs 1,488.80 crore.

Florence Investech Ltd (Florence) is a core investment company and is exempted from registrations with RBI. Equity shares of Florence Investech Ltd are listed on BSE. It is engaged in the business of investing in shares and securities. The market cap of this company is Rs 471.05Crores.

BMF Investments Ltd (BMF) is registered as NBFC with RBI. It is engaged in the business of investing in shares and securities. BMF is not listed on any stock exchange.

J.K. Fenner (India) Ltd (FIL) is an operating company engaged in the business of Power Transmission Products, Oil seals, Moulded Rubber Products and Rubber compounds, Rubber scrap, Engineering products and services. It has 7 manufacturing facilities spread over 5 geographical locations. FIL is not listed on any stock exchange.

Transaction

Appointed date is 1st April 2017.

Valuation

Table 1: Share Consideration

Consideration by Bengal and Assam Company to:

| Issue of shares (for every 100 shares): | |

| Flor ce | 89 shares |

| J.K. Fenner India Ltd (FIL) | 101 shares |

| Additional Consideration issued by BACL to other shareholders of J.K. Fenner India Ltd. | 51 shares |

In addition to the consideration received with amalgamation of BMF with BACL, the equity shareholders of Fenner (other than BACL) shall have the option to exchange all their Equity Shares in FIL for additional Equity Shares of BACL as mentioned above. And after exercising the option the shareholders of FIL will cease to, hold shares held by them in FIL.

The shares of Florence Investech Ltd are currently trading at a discount, the same can be explained with the following example:

Suppose Mr. A, holds 2000 shares in Florence Investech Ltd. at the current market price (dated 6th September 2017) of Rs 1445.00, his total holding value will be Rs 28,90,000. Post-amalgamation he will receive 1780 shares of BACL as per the share allotment ratio mentioned above, and his holding value will be Rs 30,68,453, as per the market price Rs 1723.85 (dated September 6, 2017). Hence Mr. A will cash in a profit of Rs 1,78,453 due to this merger.

Following assumptions were made in the above example:

- In arriving the total holding value, brokerage was excluded.

- Market price as on September 6, 2017 is taken to show the immediate effect of discount.

- Seeing the past three months’ trend, it is assumed that market prices of both the companies will remain in the same range up till effective date i.e. for Florence between Rs 1445 to Rs 1700. And for BACL Rs 1700 to Rs 1900.

Shareholding Pattern

Table 2: Pre-& Post Restructuring Shareholding of Bengal & Assam Co.

| Particulars | Pre-Restructuring (% Holding) | Post-Restructuring (% Holding) |

| Promoters Holding | 73.96% | 71.76% |

| Non-Promoters Holding | 26.04% | 28.24% |

| Total | 100% | 100% |

Table 3: Share Exchange Options for J.K. Fenner

| Option I: Suppose equity shareholders of Fenner (other than BACL) doesn’t exercise the option to exchange all their Equity Shares in FIL for additional Equity Shares of BACL | Option II: Suppose all the equity shareholders of Fenner (other than BACL) exercises the option to exchange all their Equity Shares in FIL for additional Equity Shares of BACL. | ||||||||||||||||||

|

|

Under option II, total shareholding of BACL post-scheme of arrangement will be 1,14,46,005 shares. (86,83,553 Shares+27,62,452 shares)

Accounting Treatment

Table 4: Share Prices

| Particulars | Shares | Value per share | Amount in INR |

| Face value of equity shares of BACL held by Florence | 6,46,811 | 10 | 64,68,110 |

| Carrying amount in the books of Florence | 6,46,811 | 99.81 | 6,45,59,000 |

| Amount to be adjusted against Reserves. | 6,46,811 | 89.81 | 5,80,90,890 |

Note: Florence is having Book Value per Share as Rs 488.97 on September 6, 2017.

Note: On March 30, 2016 MCA came up with amendment, so as to increase the scope of applicability of Ind-AS to certain entities by way of Companies (Indian Accounting Standard) Amendment Rules, 2016. Pursuant to the same, sub-rule (1) in rule (4) has been inserted to include NBFCs as well within the fold of Ind-AS. Hence Ind-AS will be applicable to BACL from the accounting periods beginning on or after April 1, 2018 with comparatives for the periods ending on March 31, 2018.

Tax consequences

The amalgamation in this scheme is carried out as per Sec 2(1B) and the said transactions are covered under Section 47(vi), hence thereunder no tax liability will arise.

Rationale

- The true value of the investments in the operating companies are not adequately reflected inter alia, due to the same being spread in three separate holding companies (Florence, BMF and Transferee Company) and BMF being itself held by the said FIL, which is an operating company, as aforesaid. Florence, BMF and BACL are all engaged in the same activity. The business and interests of the transferor companies and the transferee company are alike and to better reflect the value of the shareholders can be combined and carried on under one entity efficiently.

- The amalgamation will enable appropriate consolidation of the undertakings and investments of the transferor companies and the transferee company in a single holding company in which all the said investments in the operating companies are held. The amalgamation will lead to the formation of a larger and stronger entity with a wider capital and asset base and having greater capacity for conducting its operations more efficiently and competitively.

- Whilst the Transferee Company is a listed Company FIL is unlisted company. As such the shares of FIL are not as liquid and marketable as the shares of the transferee company. As part of the Scheme, it is thus also considered desirable and expedient to provide suitable options to the members of FIL to exchange their entire holding in FIL for Equity Shares of the transferee company.

- Lastly, the amalgamation will simplify and rationalise the holding structure of the said operating companies, unlock value and enhance the capacity of the Transferee Company to raise and access funds for making further strategic investments, including for further growth and development of the business of the said operating companies.

Conclusion

This amalgamation is nothing but two group holding companies amalgamating into one to obtain the benefits as stated above. An offbeat flavour in this scheme is that the equity shareholders Fenner (other than BACL) instead of retaining their equity shares in Fenner shall have the option to exchange shares of Fenner for additional shares in BACL. This move will eventually make Fenner a 100% subsidiary of BACL.