Very Small Aperture Terminal (VSAT) provides satellite-based telecommunication and internet access to companies and individuals with applications from your our direct TV at our homes, ATMs, in-flight services to military usage in the remotest of the location. In India, although the VSAT services are regulated by the Department of Telecom (DoT), the operators can setup/install VSAT hubs and devices to communicate with the satellites.

In the past 10 years, only one out of the seven players, NELCO or previously known as Tatanet Services is able to grow and win market share. In 2009 NELCO had 8% of the market and after 10 years it has 24% market share* in the industry while others have seen contracting market share like Hughes (35.77%), HCL Comnet (5.96%), BSNL (5.31%) and Bharti Airtel (27.33%). This trend in market share exemplifies that the Industry is under constant pressure and faced head winds all last 10 years.

[rml_read_more]

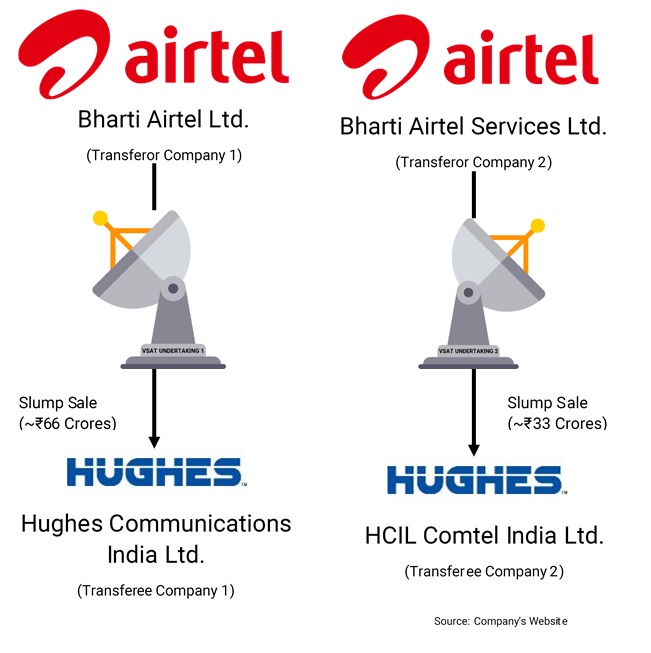

With high competition in the VSAT business and in the Telecom Business, Bharti Airtel announced that it will combine their VSAT operations with Hughes Communications India creating a leader in satellite communication with ~63% market share. The merger should bring in efficiencies in scale and operations.

*Source: Alpha Invesco Blog & TRAI Report

Bharti Airtel Limited (BAL) is a public limited company incorporated in 1995 and the equity shares of company listed on the Stock Exchanges. It engaged in the business of providing global telecommunication services with operations in 17 countries across Asia and Africa.

Bharti Airtel Service Limited (BASL) is an unlisted Bharti group public limited company incorporated in 1997. It engaged in the business of supplying hardware and related services for telecommunication networks including Very Small Aperture Terminal (VSAT) related communication services in India. It is wholly owned subsidiary (WoS) of BAL.

Hughes Communication India Limited (HCIL) is an unlisted public limited company incorporated in 1992. It is one of India’s premier networking companies and is India’s largest satellite service operator, offering broadband services under the “Hughes” brand. Its customers include large enterprise and small and medium business across various verticals and consumers.

HCIL Comtel Limited (HCL) is an unlisted public limited company incorporated in 2007. It is engaged in the business of supplying hardware and related services for telecommunications networks including very small aperture terminal (VSAT) related telecommunication services in India. It is Wholly Owned Subsidiary (WoS) of HCIL.

The Transaction

In a move to consolidate VSAT Businesses of both, BAL & BASL will transfer their VSAT business to HCIL & HCL on Slump Sale basis. Before transaction, BAL is likely to buy significant stake in HCIL.

The transaction is divided into two parts:

- Transfer of VSAT undertaking 1 of the BAL to HCIL ongoing concern basis by way of slump sale

- Transfer of VSAT undertaking 2 of the BASL to HCL ongoing concern basis by way of slump sale.

Rationale of Scheme

- Expanding the businesses in the growing market of India, thereby creating greater value for the shareholders.

- Consolidation of the VSAT businesses of the Transferor Companies with those of the Transferee Companies;

- Availability of increased resources and assets which can utilized for strengthening the customer base of the transferee company.

- The combination of the VSAT Undertakings with the Transferee Companies is a strategic fit for serving existing markets and for catering to additional volume linked to new consumers;

- Merged entity to increase scale, improve operational efficiency & target new segment, customers and market

Appointed date for the scheme is the commencement of the calendar day falling immediately after the effective date. Appointed date taken as this because scheme requires regulatory approvals.

Consideration

Valuation for VST Undertaking 1 of BAL is INR 663.21 million and for the VST Undertaking 2 of BASL is INR 334.29 million.

The valuation is done on the basis of assets approach and market approach and the weighted is given for Undertaking 1 is 55% to the assets approach and 45% to the market approach while the 85% and 15% weight respectively given for the Undertaking 2.

In Market Approach considered EV/Sales Multiple and EV/EBIDTA

Airtel-Hughes communication India deal to create No. 1 entity with 63% market shares. At present Hughes has 36% market share while Airtel business has 27%.

Table 1: Market Share of VSAT Providers as on Mar-2019

| Name of the Service Providers | Subscribers as on Mar-19 | Market Share (%) |

| Hughes Communications Ltd | 106407 | 35.77 |

| Bharti Airtel Ltd. | 81309 | 27.33 |

| Tatanet Services | 73627 | 24.75 |

| HCL Comnet | 17720 | 5.96 |

| BSNL | 15809 | 5.31 |

| Infotel Satcom | 2519 | 0.85 |

| Cloudcast Digital Ltd (eartwhile Planetcast Media Services Ltd) | 74 | 0.02 |

| Total | 297465 | 100 |

Source: TRAI Website

Shareholding Pattern

Table 2: Shareholding pattern of HCIL given in Regulation 31

| Particulars | Pre Arrangement | Post Arrangement | ||||

| No. of Equity Shares | % Holding | No. of Equity Shares | % Holding | |||

| Promoters | ||||||

| Indian Bodies Corporate | 0 | 0% | 7748900 | 33.33% | ||

| Foreign Bodies Corporate | 9424486 | 60.80% | 9424486 | 40.54% | ||

| Public | 6075514 | 39.20% | 6075514 | 26.13% | ||

| Total | 15500000 | 100.00% | 23248900 | 100.00% | ||

Note: The Shareholding pattern of HCL, BAL and BASL is not changed due to this transaction.

As per the agreement, Hughes will have majority ownership in the combined entity and Airtel will have a significant shareholding. The statement did not spell out the financial details of the transaction, which is subject to requisite approvals.

As per declaration given under regulation 31(1)(b) of SEBI (LODR) Regulation, 2015 HCIL will be issuing ~33% stake to Indian corporate entity as promoters.

- Hughes should hold 67% post transaction, remaining will be held by Bharti Airtel.

For Airtel, the move comes at a time when its telecom business is under immense financial pressure due to intense competition since Reliance Jio’s entry in September 2016.

Financials

Table 3: Financials of Bharti Airtel Services Ltd. (BASL) as on March 2019 (all figs in INR Millions)

| Particulars | Hardware & support Services | Resource Management Division | Unallocated | Total |

| Revenue | 3,694 | 55 | – | 3,749 |

| Results | 385 | -80 | – | 305 |

| Assets | 1,789 | 997 | 863 | 3,649 |

| Liabilities | 1,304 | 604 | 1,845 | 3,753 |

| Net Worth | 485 | 393 | -982 | -104 |

Accounting Treatment

In the books of BAL and BASL:

- Record all assets and liabilities of VSAT undertaking at their carrying amount.

- Record consideration received.

- Difference if any shall record in the ‘Statement of Profit and Loss account’.

In the books of HCIL and HCL:

- All the assets and liabilities vested pursuant to scheme is recorded at their fair value.

- Any difference between consideration paid or value of net assets vested, be adjusted in goodwill or capital reserve as the case may be.

In scheme is also mentioned that if scheme is not approved/sanctioned by DoT and/or NCLT and/or SEBI on or before 30 June 2020 or such other extended date as mutually agreed between parties, then this scheme shall become null and void. As per the scheme, either of the company also has a right to withdraw the scheme.

Opportunities for VSAT business in India

- Oil and gas companies because Govt. wants complete automation and real time monitoring of outlets of Oil Marketing Companies (OMCs) in the country.

- Digital India: as the Govt. plans to extends the reach of its services to the remote part of country also.

- Smart Cities: In smart cities required more connectivity of network

Conclusion

BAL and BASL may use these funds to buy the stake in HCIL as BAL said in press release that majority stake will be of HCIL and substantial stake of BAL, though at what valuation it is not disclosed. This merger deal sees No. 1 and No. 2 (as per market share) in the industry coming together as it seems neither of them are ready to take risks of further investment in technology and in the process minimise avoidable capital expenditure in creating infrastructure and even on marketing and customer acquisition.

Merged companies will have 63% market share hence will become dominant player ready to sustain and grow even against some new strong player like Jio or any foreign player. It seems there is no application is being made to CCI for its NOC despite assets/turnover at the group level is higher than threshold limit.

Add comment