Last year, Bharti Airtel Limited announced an internal restructuring to facilitate the entry of a strategic investor/s into its Telecom Business. This internal restructuring was a combination of the merger of two indirect wholly-owned subsidiaries (WoS) along with the demerger of Telecom Business. However, in January 2022, they withdrew the scheme and proposed a new scheme containing only the amalgamation of wholly-owned subsidiaries. The reason stated by Bharti Airtel for withdrawal from the scheme was the seminal telecom sector reforms package announced by the Government of India & the management felt the existing structure is optimal to leverage those changes.

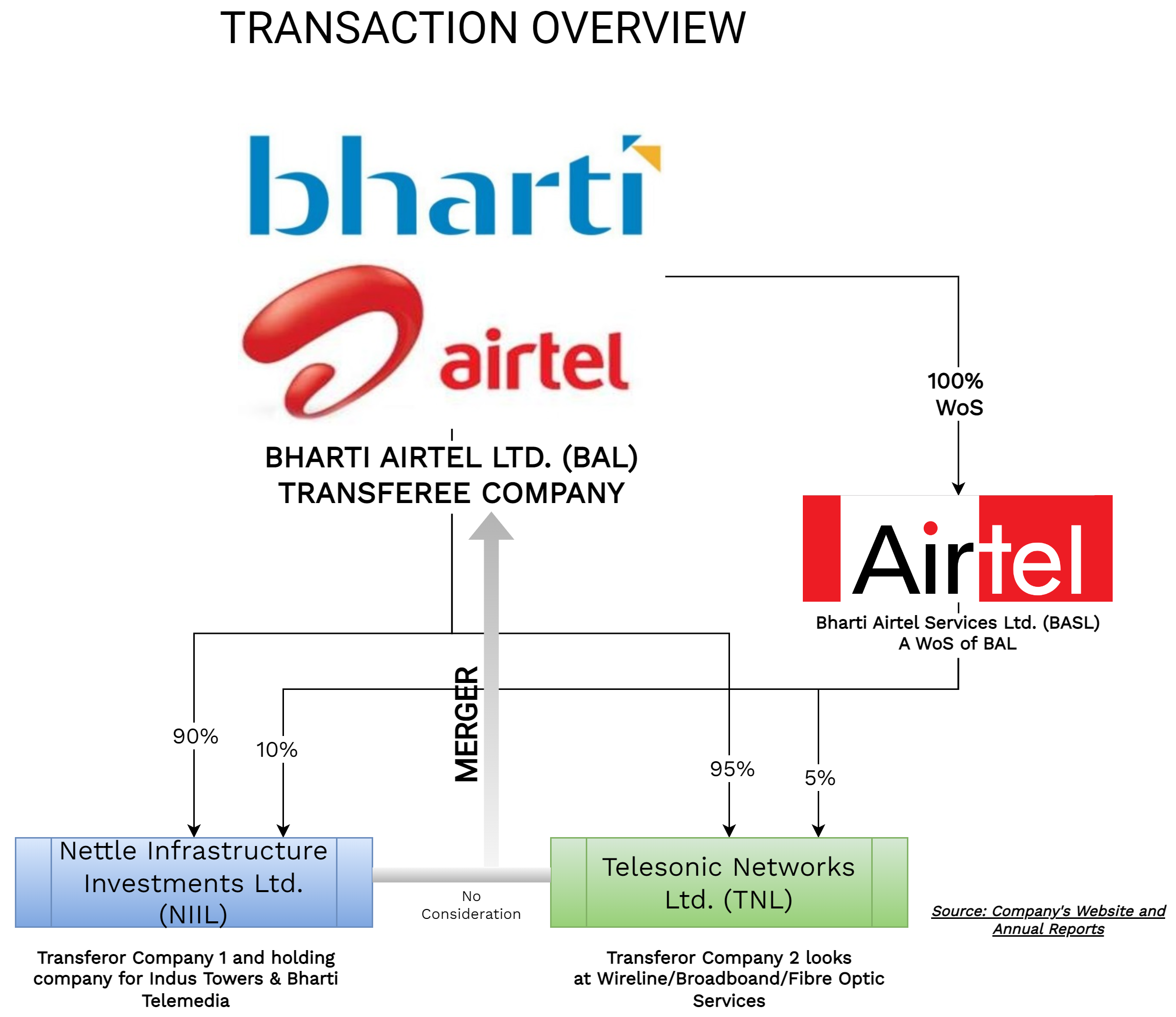

Bharti Airtel Limited (“BAL” or “Transferee Company”) is a global communications solutions provider and ranks amongst the top three mobile operators globally. The equity shares of BAL are listed on nationwide bourses.

Nettle Infrastructure Investments Limited (“NIIL” or Transferor Company 1”) is holding company holding equity shares of Indus Towers Limited, a company engaged in building & managing telecom tower business and Bharti Telemedia Limited, a group company engaged in Direct-to-home(D2H) business. Apart from this, the company is not engaged in any other operations.

Telesonic Networks Limited (“TNL” or “Transferor Company 2”) is engaged in the business of designing, planning, deploying, optimizing, and managing broadband and fixed telephone networks across India. The Company is managing pan India fibre optic cable and wireline voice/ broadband services.

THE HISTORY & CURRENT POSITION

NIIL is purely a holding company holding an investment in Indus Towers Limited & Bharti Telemedia Limited. In 2017, 90% of the equity share capital of NIIL got transferred from Bharti Realty Limited (promoter group entity) to BAL and the remaining 10% to Bharati Airtel Services Limited (BASL). On the same day of transfer, NIIL bought 11.32% equity stake in Bharti Infratel Limited (now merged with Indus Towers Limited) from BAL using the funds infused by BAL in the form of borrowing. Thereafter, in the last couple of years, NIIL did purchase & sold entire/part of various group entities equity with BAL.

Key financials of NIIL as on 31st December 2021:

| Particulars | Amount (INR in Crore) |

| Investment | 11,108 |

| Borrowings (From BAL which got converted from Loan to Optionally Convertible Debentures in FY 2021) | 15,000 |

| Other Borrowings from BAL | 1446 |

| Net-worth | -2604 (negative) |

Over the last 3 years, NIIL is continuously buying additional shares of Indus Towers Limited. Funds required have been provided by BAL. Apart from that, there was an internal re-shuffling of equity shares of Bharti Telemedia Limited between NIIL & BAL.

| Date | No. of Shares Held | % Of total |

| March 2020 | 36,88,82,251 | 19.94% |

| March 2021 | 50,36,28,998 | 18.69%* |

| March 2022 | 57,95,30,375 | 21.50% |

*: Stake diluted as infusion by some other shareholders as well.

TNL was a joint venture incorporated in 2009 between Alcatel-Lucent India Limited and BAL formed to manage Bharti’s pan-India wireline voice and broadband services. Later in 2013, BAL purchased Alcatel-Lucent India Limited’s 74% equity stake in TNL and thus, TNL became WoS. TNL is continued to manage pan India fibre optic cable. The entire revenue of TNL comes from BAL.

Key financials of NIIL as on 31st December 2021:

| Particulars | Amount (INR in Crore) |

| Revenue (9 months) | 2000 |

| PAT (9 Months) | 178 |

| Net worth | 966 |

| Borrowings (most of the loans through group entities including holding company BAL) | Circa 4625 |

WHETHER WHOLLY OWNED SUBSIDIARIES (WoS) OF BAL?

The entire share capital of both Transferor Companies is not directly held by the Transferee Company.

- 90% Share capital of Transferor Company 1 is held by BAL and 10% Bharati Airtel Services Limited (BASL), another WoS of Transferee Company

- Similarly, 95 % Share Capital of Transferor Company 2/TNL is held by BAL and the remaining 5% Shareholding is hold by BASL.

As BASL is the direct WoS of BAL and thus the entire share capital of Transferor Companies is held by BAL (directly & indirectly), in the introduction part of the scheme, BAL has considered the NIIL and TNL as the wholly-owned subsidiaries of it.

It is pertinent to note that, though WoS is not defined under the Companies Act 2013, it provides certain exemptions from compliances in certain transactions involving WoS which are listed below: –

- No restriction under section 185 of the Companies Act, 2013 for providing loan or guarantee to the WoS provided that the same has been utilized for its principal business activities by WoS.

- No shareholders’ approval required for making further investment, providing loan, guarantee to its wholly-owned subsidiaries as mentioned under section 186 of the Companies Act, 2013. As per the Annual Report of March 2021, During FY 2020-21 BAL has given loan to NIIL and TNL amounting to Rs. 35,269 million.

- No Approval of shareholders is required as per the proviso given to section 188(1) of the Companies Act, 2013 (Related Party Transactions) even though the amount of transaction is exceeding the specified limit.

- Scheme of Merger can be executed without the approval of the National Company Law Tribunal (NCLT) pursuant to Section 233 of the Companies Act 2013. In the present case, BAL might not have opted for the merger under section 233 for the following reasons:

- Approval from majority creditors representing nine-tenths in value either at the meeting or otherwise in writing.

- Compulsory convening meeting of shareholders of both transferor and transferee company and obtaining approval from shareholders holding at least ninety per cent of the total number of shares.

- Single window approval/change of licenses in case of a merger through NCLT.

- SEBI (Listing Obligation and Disclosure Requirements), 2015 do not specifically provide any provisions for the merger under section 233 of the Companies Act 2013.

SEBI (Listing Obligation and Disclosure Requirements), 2015 (SEBI LODR) also does not defined WoS. Regulation 37(6) of SEBI LODR and SEBI Master Circular on Scheme of Arrangement Circular No.- SEBI/HO/CFD/DIL1/CIR/P/2021/0000000665 provides an exemption to Listed Holding Company from Obtaining Observation letter/No-objection Certificate only in the case of a scheme of merger of WoS with the Listed Holding Company.

Some companies have sought guidance from SEBI for clarification with respect to similar transactions. One of them is in case of Scheme of Amalgamation of Renaissance Jewellery Limited (RJL/Transferee Company) listed company and its unlisted WoS – N. Kumar Diamond Exports Limited (NKDEL/Transferor Company 1) and House Full International (HFIL/Transferor Company 2) in which NKDEL holds 55% and RJL holds 45%. RJL sought guidance from SEBI that whether the amalgamation of NKDEL and HFIL with RJL is exempted under regulation 37 of LODR on the ground that RJL is, directly and indirectly, holding 100% shares of HFIL.

SEBI stated that since the whole share capital of HFIL is held directly 45% and 55% (through NKDEL) by RJL, HFIL shall be considered as WoS of RJL for purpose of LODR. Only they will have to comply with regulation 37(6) of SEBI LODR – Filing of Scheme as part of Disclosure Requirement.

Amalgamation of NIIL and TNL with BAL is similar to the Scheme of RJL with NKDEL and HFIL. Based on such cases BAL might have considered claiming exemption from the requirement of obtaining an Observation letter/No-objection Certificate from stock exchange.

The Transaction

The Board of Directors of BAL on their meeting held on 4th January 2022 approved a Composite Scheme of Arrangement between Nettle Infrastructure Investments Limited, Telesonic Networks Limited and Bharti Airtel Limited which inter alia provides for the amalgamation of Nettle Infrastructure Investments Limited and Telesonic Networks Limited with Bharti Airtel Limited. The Appointed Date for the transaction is 1st April 2022.

NO CONSIDERATION/ISSUANCE OF SHARES TO BASL: –

Scheme do not provide issuance of shares to the shareholder (BASL) of the Transferor Companies since they are considered as WoS, and the further scheme provides for cancellation of investment in the books of shareholders of Transferor Companies.

Further, pursuant to Section 19 of the Companies Act, 2013 BAL is not allowed to issue shares to BASL since BASL is subsidiary of BAL.

ACCOUNTING TREATMENT

As both transferor companies are an indirectly wholly-owned subsidiary of Transferee Company, Transferee Company shall account for the merger in its book in accordance with the “Pooling of Interest method” as laid down in Appendix-C of Ind-AS 103 (Business Combination of entities under common control).

Further, though Bharti Airtel Services Limited is not a party to the scheme, it will also cancel its investment in Transferor Companies and the amount will get adjusted against reserves.

Tax Implications:

Pursuant to the provisions of sections 47(vi) & 47(vii) of the Income Tax Act, 1961 (ITA), any amalgamation will be tax exempted in the hands of the Transferee Company & shareholders of Transferor Company. Under section 47(vii) of ITA, one of the requirements for amalgamation to be tax exempted in the hands of shareholders of Transferor Company is that there must be a consideration in the form of allotment of shares of Transferee Company to shareholder.

In present scenario, Bharti Airtel Services Limited who holds some shares in Transferor Companies won’t receive any shares of the Transferee Company and its holding in Transferor Companies will get cancelled. Thus, the cancellation of equity shares of the Transferor Companies may be treated as a “Transfer” as per section 2(47) of ITA in the hands of Bharti Airtel Services Limited.

Further, Section 50CA of ITA, a deeming section, provides to tax the difference between the Fair Market Value (as computed in accordance with the provisions of prescribed rule) and the consideration received for the transfer of unquoted shares as capital gains in the hands of the transferor, if the consideration received pursuant to the transfer is less than FMV.

Considering this, one needs to evaluate if there will be any tax implications in the hands of Bharti Airtel Services Limited. One may argue on the applicability of section 50CA in the absence of consideration and consideration is not getting issued by virtue of provisions of the Companies Act (Section 19) and thus the transaction is not liable to tax.

CONCLUSION

As mentioned above, multiple transactions were carried out between BAL and those companies in terms of transfer of investments, providing loans and transfer of businesses as slump sales The scheme is internal restructuring of collapsing subsidiaries after its commercial, business and financial purposes are achieved.